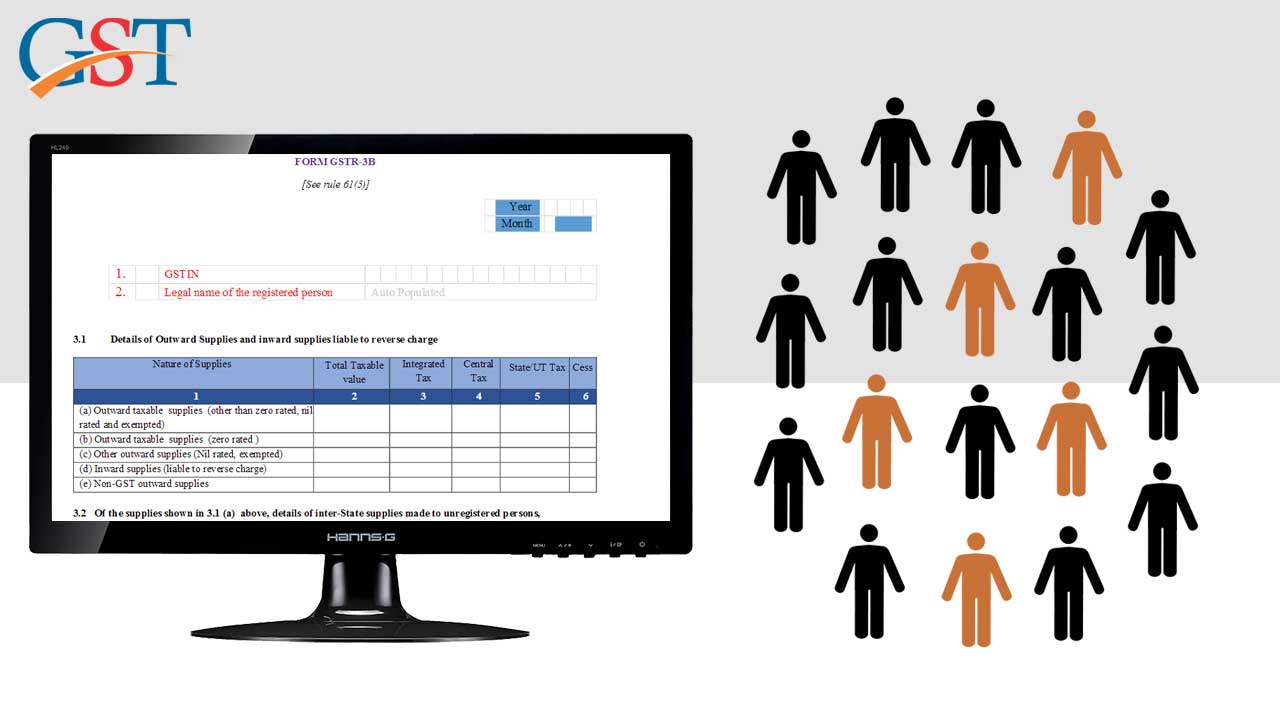

As the clock is ticking, the government’s concern is increasing that among 85 lakh registered taxpayers only 6.5 lakh have filed the GSTR-3B return for August month. The calculation shows the filed returns for July month was 46 lakh. If we just leave the 11 lakh composition scheme dealers, still 6.5 lakh is a very less amount.

Although GSTR-3B is a single page form and only requires detailing of sale and purchase in the given month, applicable input tax credit, and the tax payable/paid information. Apart from this, it is only filed by normal taxpayers and the taxpayers including non-resident taxpayer, input service distributor, composition dealers, tax deductor and tax collector are not required to file the form.

Revenue secretary, Hasmukh Adhia, has shown debacles over the last 2-day rush which system is going to face when most of the people will be filing the GSTR-3B in those days. He is sure about the deadline 20th September to file GSTR-3B for August month and in the last two remaining days, taxpayers will certainly rushing to file GSTR-3B because they are aware of the self-assessment form to be filed without any extension.

On the matter, Uday Pimprikar, tax partner at Ernst & Young said, “If 90 percent of the assessees are going to attempt filing returns in the last two days of the deadline then it is definitely going to test the system. To that extent it will test the GSTN portal. Having said so, we can’t really blame the tax payers because most of them very busy in getting GSTR-1 done. I think it’s only in the last three or four days they have started working on GSTR- 3B.”

GST council has already extended deadlines for GSTR-1, GSTR-2, and GSTR-3 by October 10, October 31, and November 10 respectively and filing of GSTR-3B should be done till six months by 20th of the next month for a given tax period. With the approaching deadline, the GST Council is expecting 65 lakh tax returns for August month which seems quite difficult considering the current scenario.

I make a mistake in GSTR-3B how can i rectify it

You can only make changes while filing GSTR-1 and 2 for the concerned period. No correction allowed in GSTR-3b.