To put it briefly, PAN is a ten-digit identification number assigned to individuals who have applied for it. The purpose of introducing PAN was to keep track of taxable financial transactions. PAN card acts as a form of identification and helps prevent tax evasion.

Companies, banks, and other business entities can verify an individual’s PAN details with the Income Tax Department (ITD). This not only allows verifying the accuracy of the PAN details but also helps detect any fraudulent PAN cards.

Individuals can use the PAN verification service on the IT department’s official e-filing portal to check the validity of their PAN card. However, it is essential to keep in mind that you will need your PAN number to avail of this service.

Who is Eligible to Utilise the Bulk PAN Verify Service?

The Verify Bulk TAN or PAN service is accessible to external government and non-government, such as the State Government Departments, Central Government, or entities, recognised autonomous organisations, and RBI-approved Banks or Financial Institutions that have registered as external agencies on the e-filing portal.

How Many Queries Can be Included in a Bulk Verification File?

A maximum of 100 queries can be included in a single bulk verification file.

How Does Gen TDS Software Prove to be a Suitable Choice for Bulk PAN Verification?

Gen TDS is top-notch TDS software with a straightforward and user-friendly interface, crafted for filing TDS and TCS returns online by TRACES and CPC, India’s norms and regulations. Our innovative tool enables users to calculate the TDS amounts in advance, determine interest, and prepare TDS returns, penalties, and late filing fees all in one place. This software is an authorised TDS solution and is listed on the Government of India’s official tax information network website.

The software also comes equipped with other important information such as all India PIN codes, TIN FC, MICR & IFSC codes, Service tax ranges, ISD codes, TAN/PAN AO codes, Bank BSR codes, etc.

Key Features of Gen TDS Return E-Filing Software that Enhance Productivity

- E-return Uploads for TDS or TCS Online.

- Direct Online Filing of TDS or TCS Statement (Regular or Correction) via the ITD Portal.

- Quarterly 15G or 15H Register.

- Facility for Quarterly Filing of 15G or 15H Forms and Maintenance of the Register.

- No Deduction or Lower Deduction Forms Generation

- Ability to Generate Lower Deduction and No Deduction Forms

- Filing of 15CA or 15CB Forms

Step-by-Step Procedure to Verify Bulk PAN Via Gen TDS Software

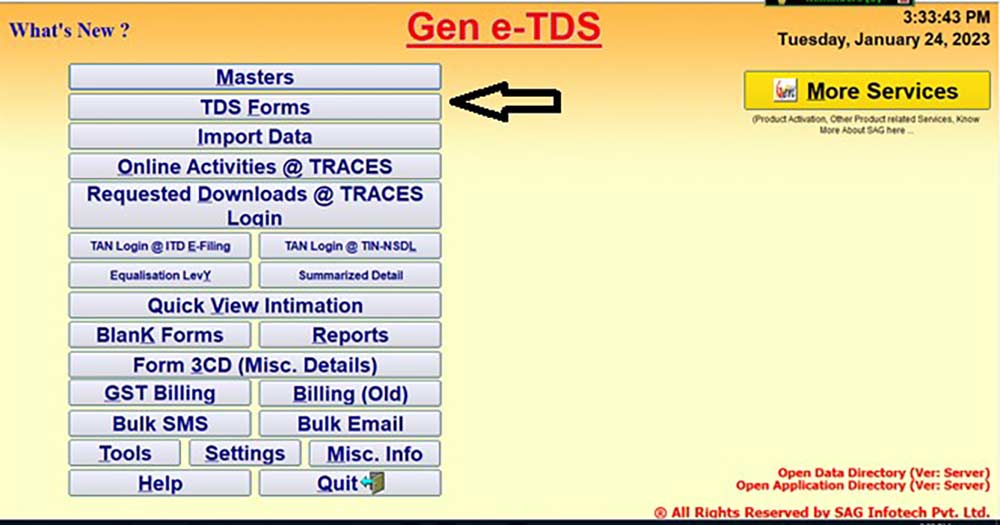

Step 1: First, install the Gen TDS Return Filing Software. After that, open the Software and go to the Tab ‘TDS Forms’.

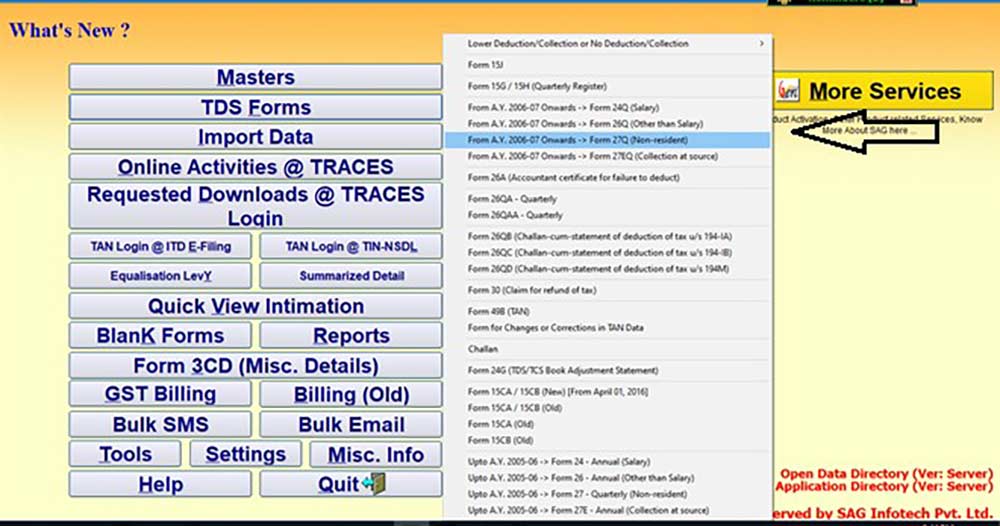

Step 2:- Select the Form in which you want to Bulk PAN Verify.

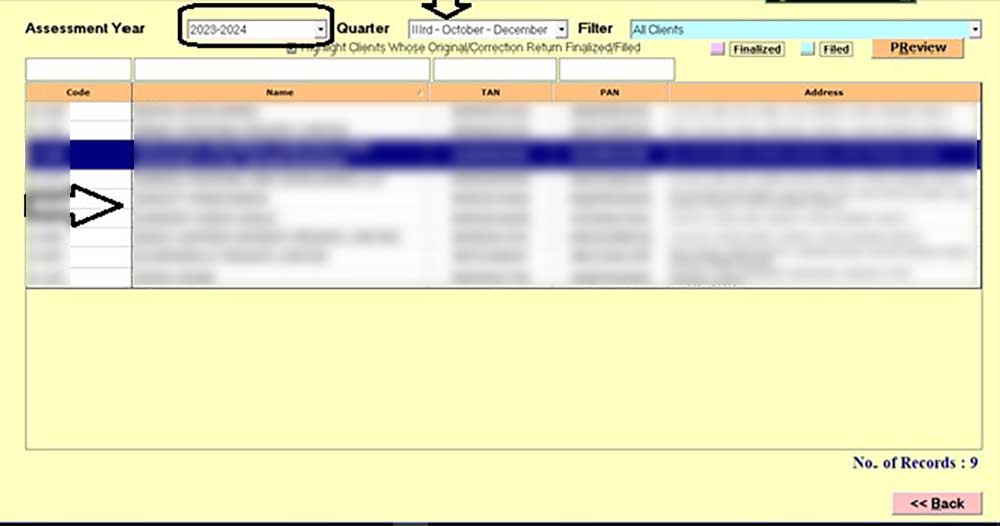

Step 3:- Select the Client, Assessment Year and the Quarter.

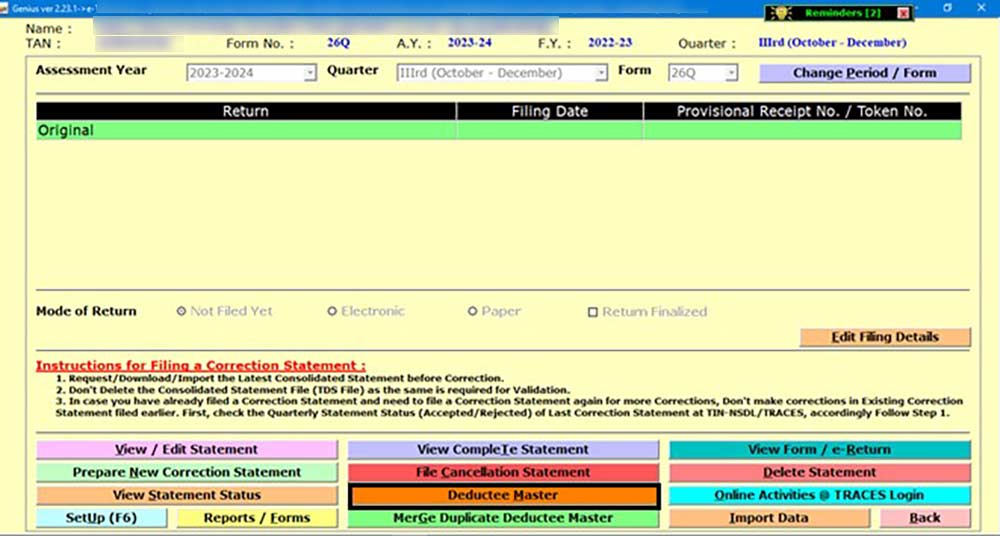

Step 4:- Click on the ‘Deductee Master’ for Bulk PAN Verification.

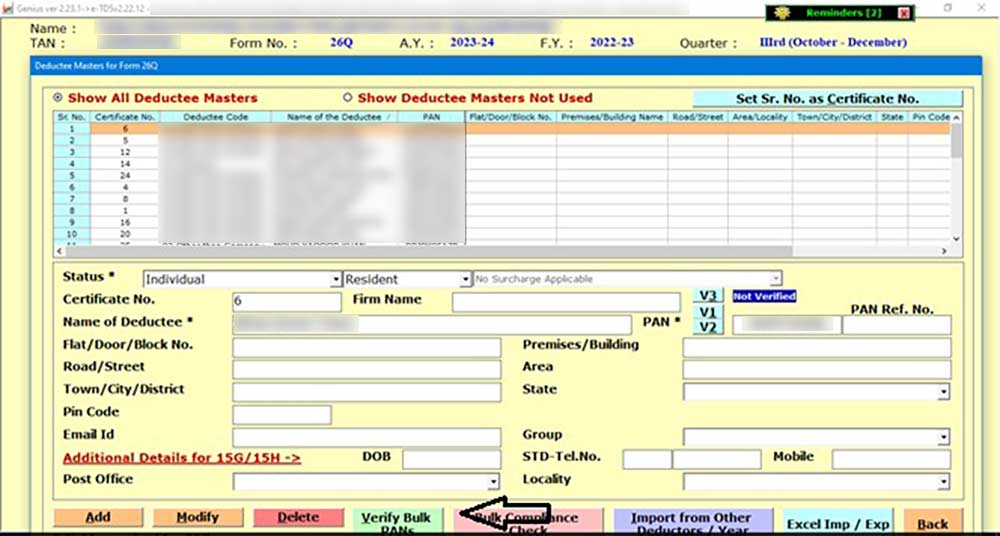

Step 5:- Click on ‘Verify Bulk PAN’.

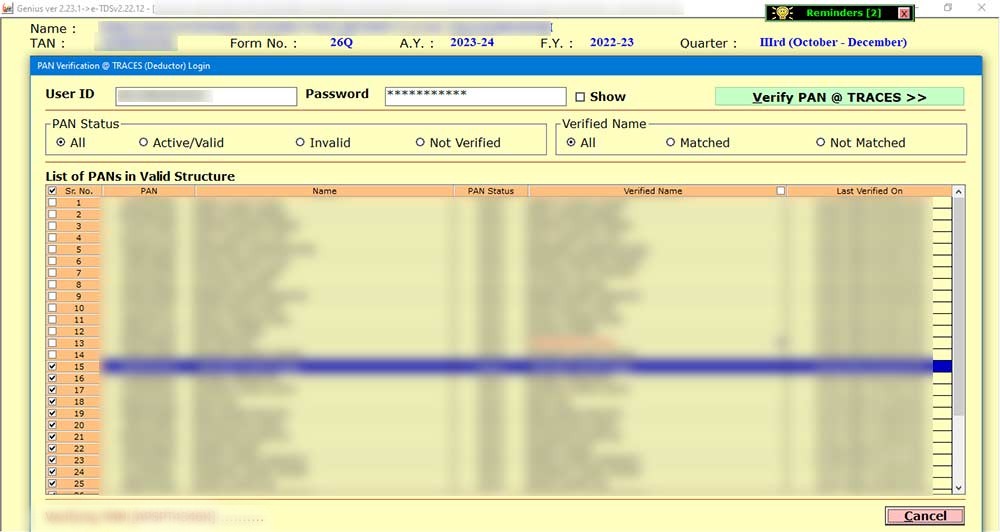

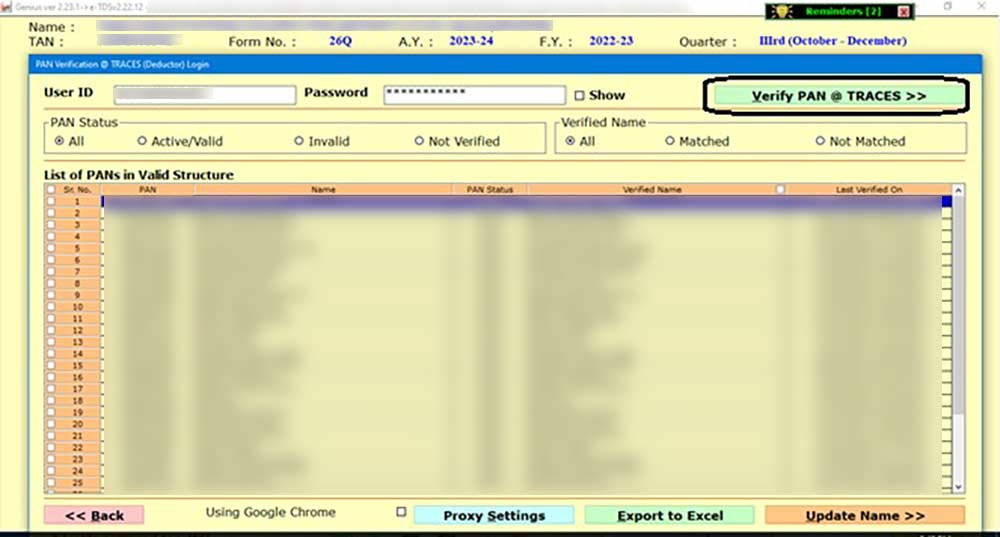

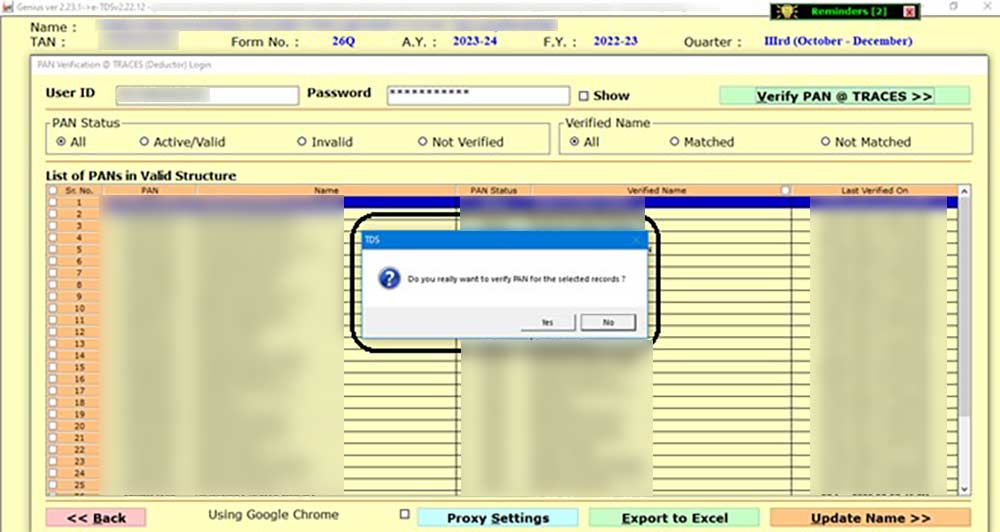

Step 6:- A Window will appear, and then click on the ‘Verify PAN @ Traces tab’.

Step 7:- A message will appear asking whether you want to verify PAN for selected Records, and then click on the Yes Button.

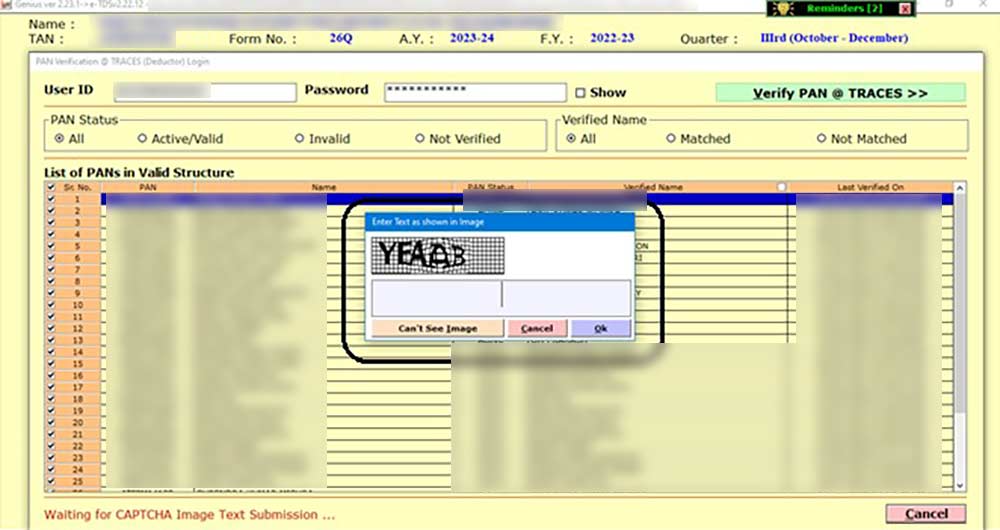

Step 8:- Enter the captcha as shown in the image and then click on the OK button.

Step 9: The software will start verifying the PAN. PAN that will not get verified with the Name mentioned in the software will be shown by the software in Red Colour.