Summary of 15G and 15H Forms

Form 15G and 15H are submitted to the bank by individuals requesting that their interest income not be subject to TDS.

In order to do so, you must provide your PAN. Online forms are available on some banks’ websites.

| Form 15G | Form 15H |

|---|---|

| Any HUF, resident individual, trust, or other taxpayer, but not a firm or company, less than the age 60 years age | A residential senior citizen age 60 or older. |

| No tax is calculated on your total income | Your total income is tax-free |

| The financial year 2023-24(AY 2024-25)’s total interest income is below the basic exemption limit, which is Rs 2.5 lakh. | |

| Note: Non-resident taxpayers cannot appropriate the benefits of Form 15G and 15H |

Submission Process of Forms 15G and 15H

Each Form 15G and 15H has a validity period of one financial year. As a consequence, these forms need to be submitted every year at the start of the financial year (F.Y.). Your interest income won’t be subject to TDS deductions by the bank.

Where Else Can Forms 15G and 15H be Submitted?

- TDS on the rent

- LIC premium receipts

- Tax is deducted on the EPF withdrawal

- Tax is deducted from insurance commissions

- TDS on the post office deposits

- Taxes on corporate bond income

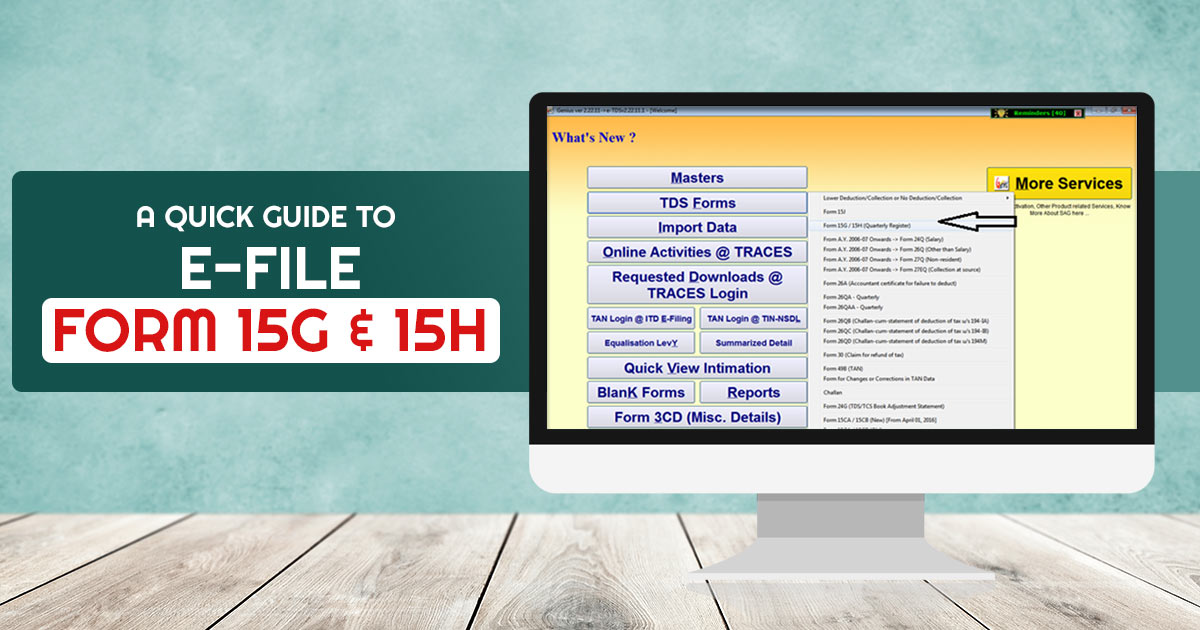

What Makes Gen TDS Software the Best Option for Forms 15 & 15H Filing?

Gen E-TDS is the best TDS software for filing online TDS and TCS returns according to the norms and regulations of TRACES and CPC, India. It provides an easy-to-use interface with a simple and intuitive interface. Our software is an innovative tool that allows users to predetermine the TDS amount, prepare the TDS returns, and calculate interest, penalty, and late filing fees all in one place.

This software is listed on the official website of the Indian government’s tax information network as an authorised TDS software. According to the Indian government’s list of authorised TDS filing software, it also earned the highest rank in 2012-13. The TDS return filing software allows professionals to directly log in to the TRACES CPC and NSDL, so they do not have to generate user ID each time.

Different Features of Gen TDS Return Filing Software

- The software supplies e-TDS returns and calculates taxes.

- Uploading TDS or TCS e-return online on the portal.

- Ensures proper validation of the returns 24Q, 27Q, 26Q, and 27EQ by generating e-filings.

- Online Correction Statement Filing and Uploading.

- Non-filing of returns or declarations for no TDS deduction.

- Certificates in Form 12BA, 16AA, 27D, 16, and 27A, 27B.

- Certificates in PDF format for forms 16, 16A, and 27D, along with the option of a digital signature (optional).

- After giving effect to the deduction under Chapter VI-A, calculate the annual taxable salary.

- A request can be downloaded easily from the TRACES website, such as consolidated files, the Justification Report, and 16 and 16A forms.

Step-by-Step Procedure to e-file Forms 15G & 15H Via Gen TDS Software

Mentioned below is a simple guide to e-file the forms 15G and 15H using Gen TDS Software:

Case 1: E-file Form 15G

Step 1:- First Install the Gen TDS Return Filing Software on your laptop and pc.

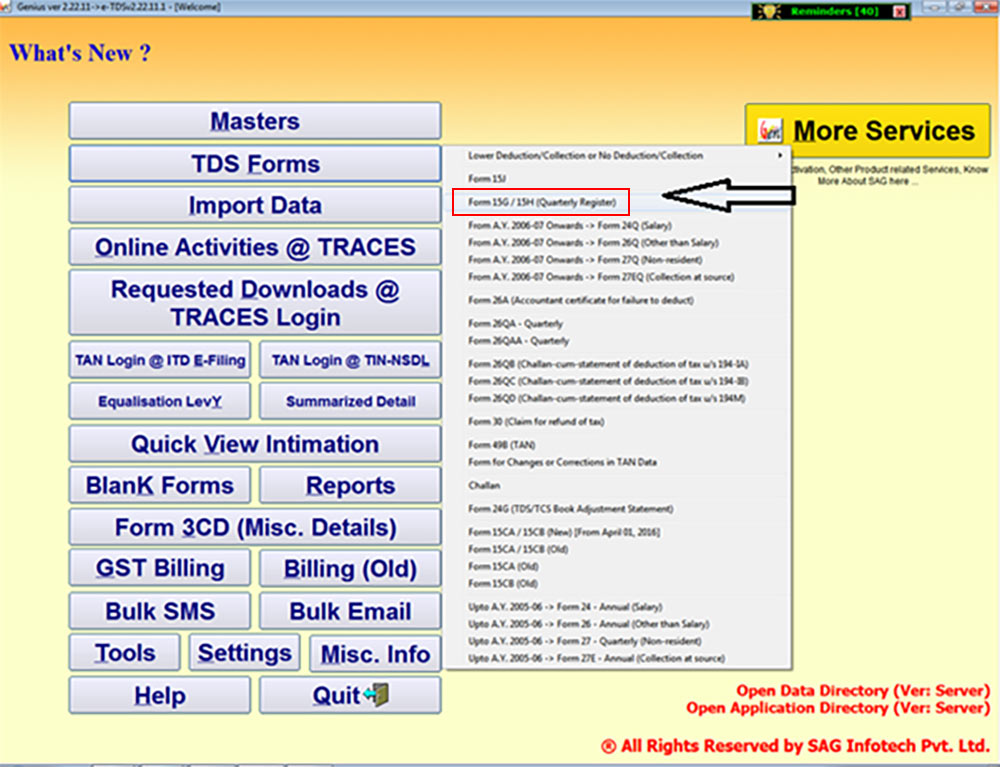

Step 2:- After that Open the TDS Software and Click on the 15G/15H Tab.

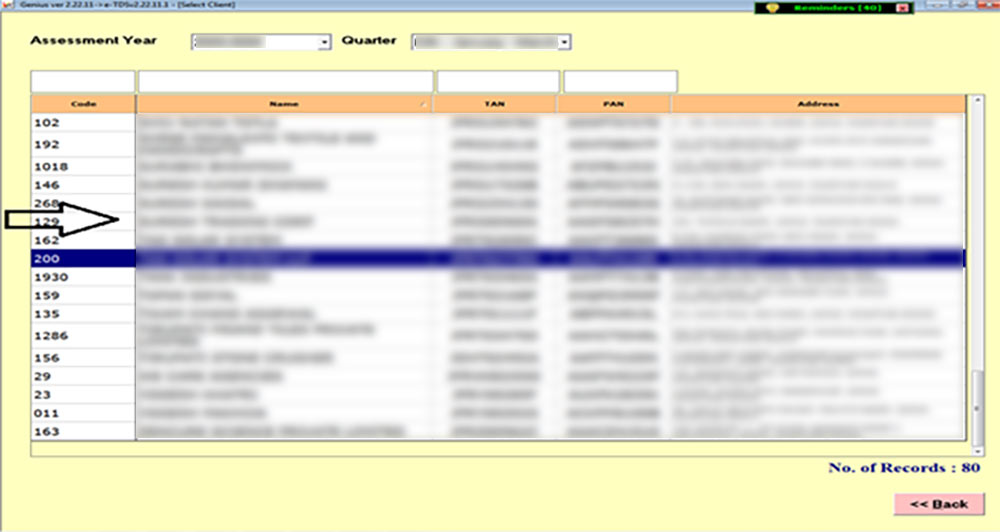

Step 3:- Now Select the Client to which you want to submit Form 15G.

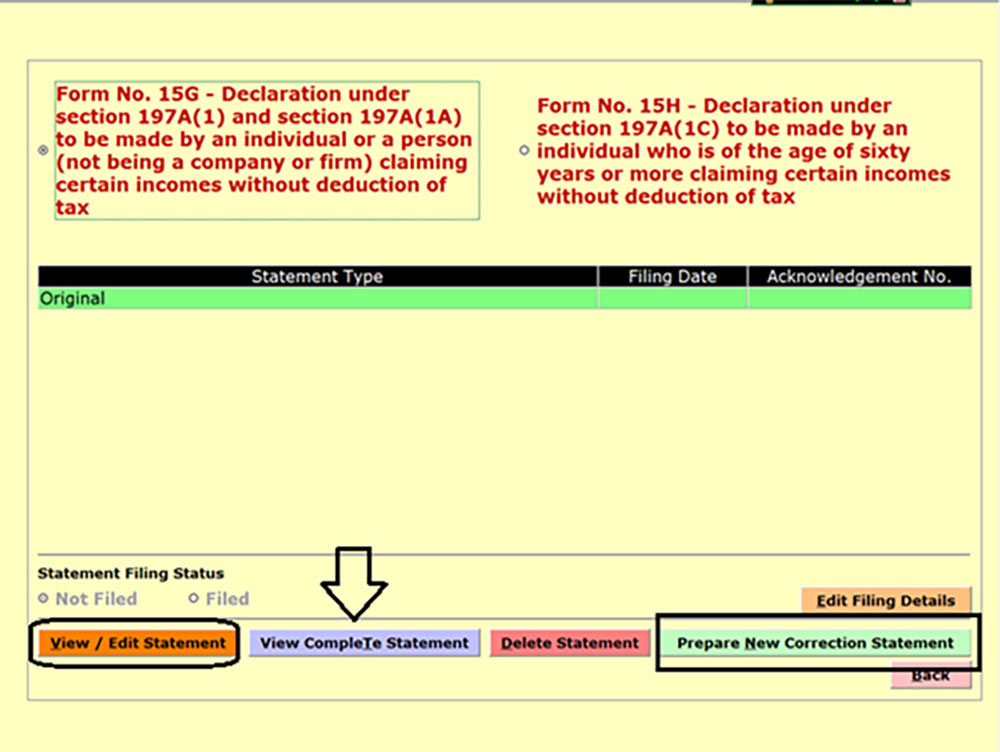

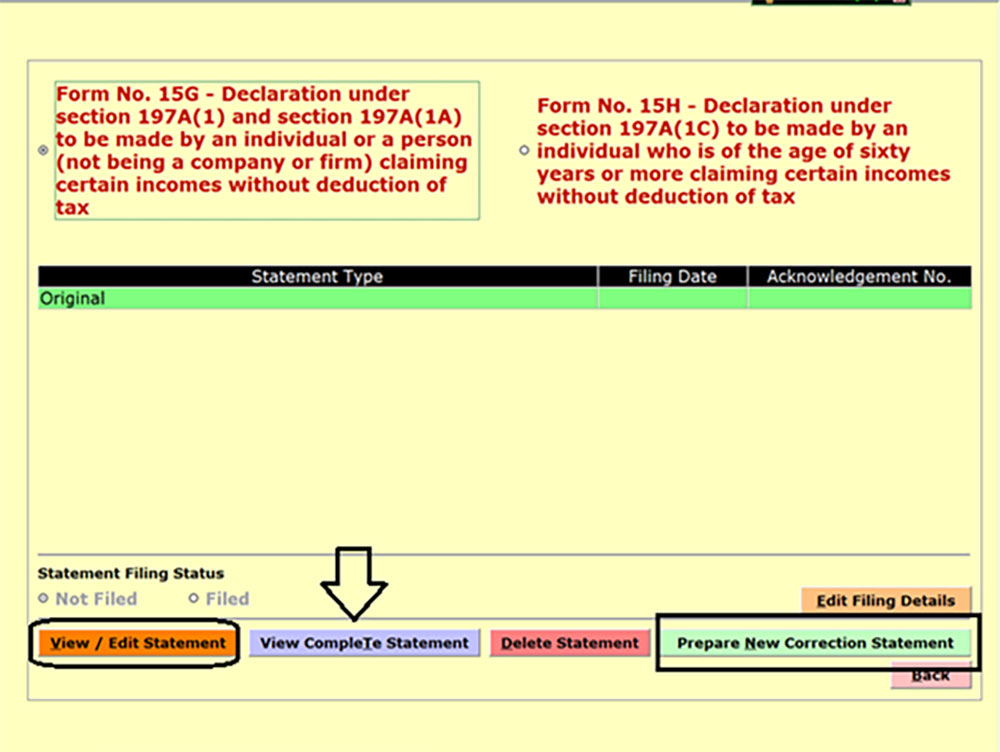

Step 4:- For preparing the statement click on View/Edit Statement. If there is more than one statement prepared by you then you can check those through View Complete Statement. For Prepare New Correction Statement click on the tab Prepare New Correction Statement.

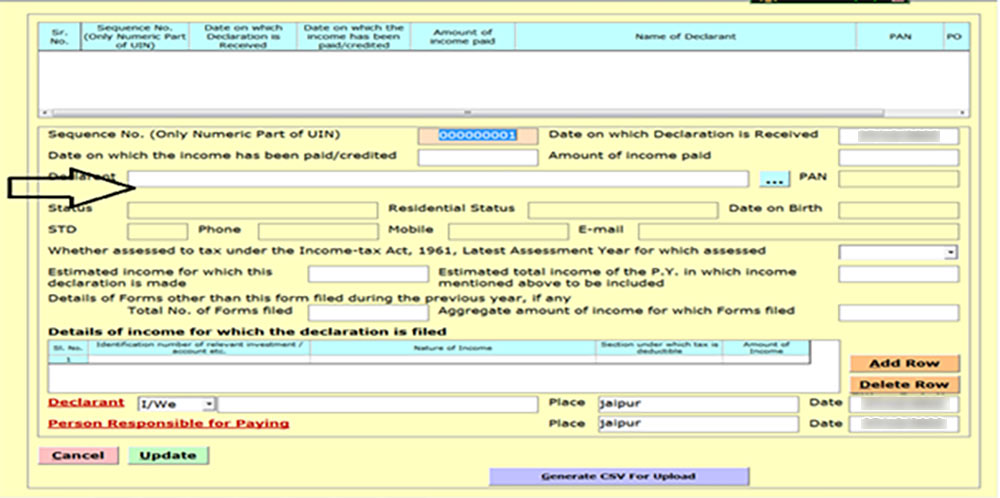

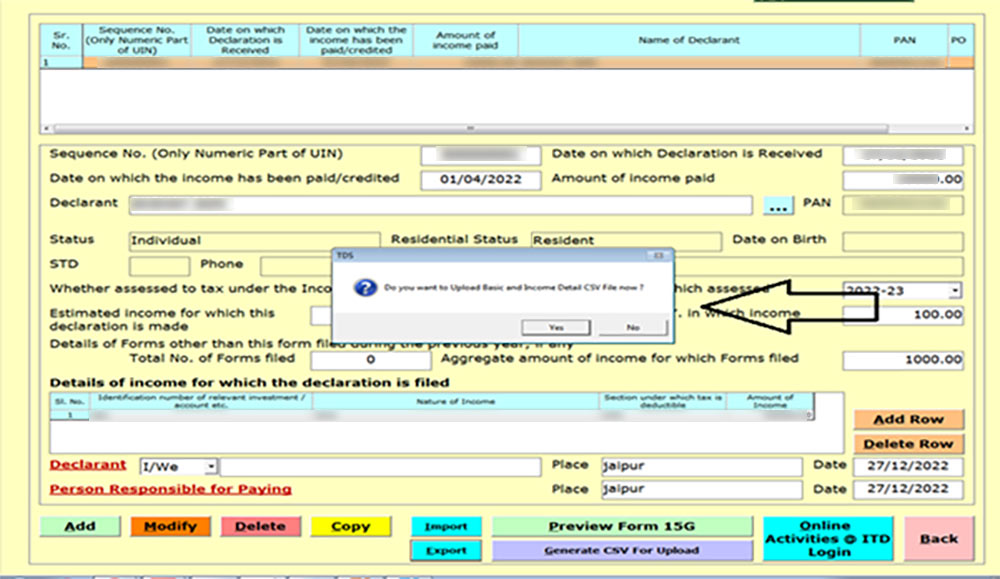

Step 5:- Fill in the details like Status, Date of Remittance, Amount of income paid, Date on which the income has been paid or credited and various other details etc. and click on the update button.

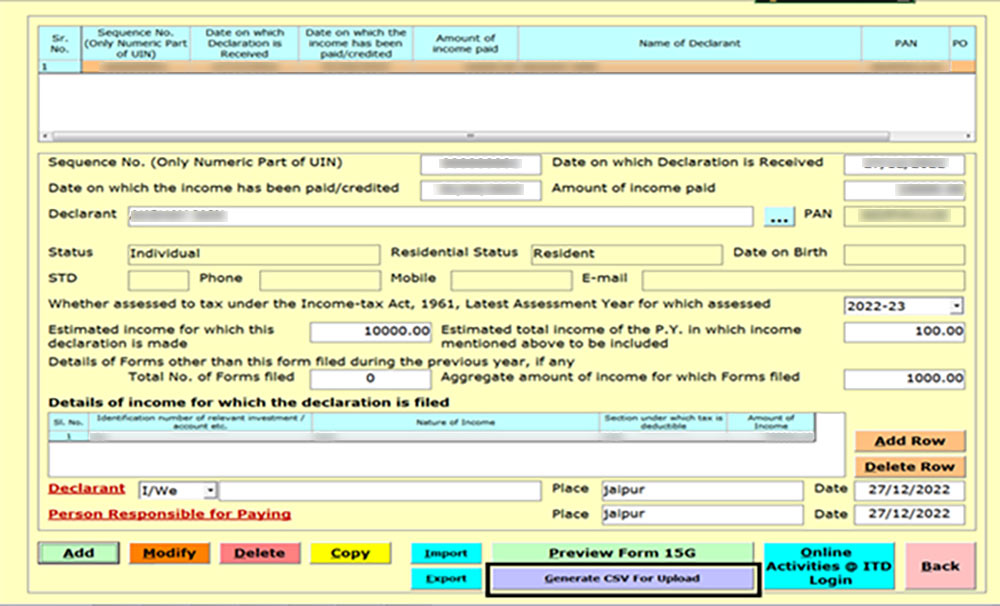

Step 6:- After that click on Generate CSV for the upload button to Upload the 15G Form.

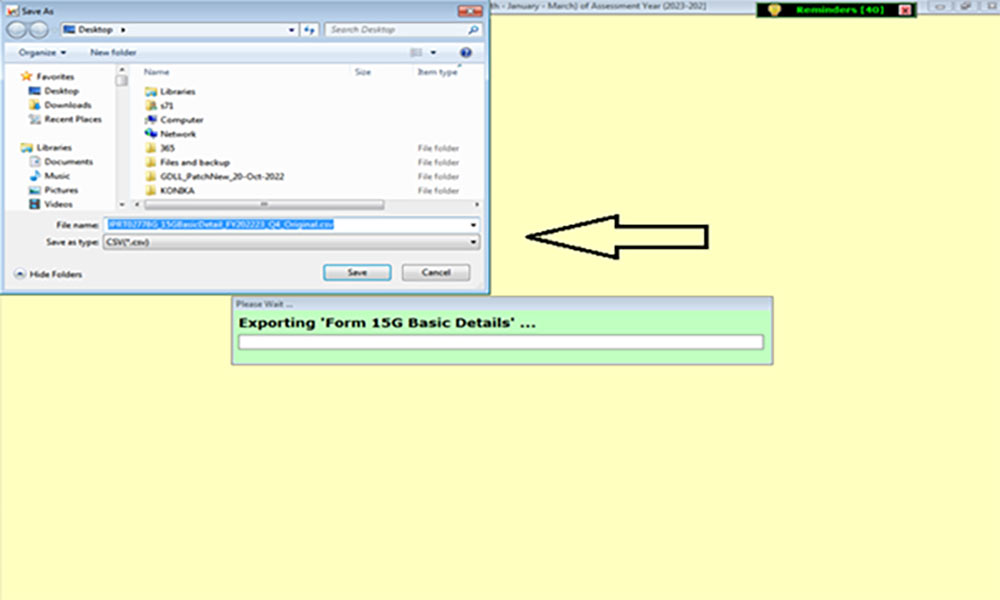

Step 7:- After that Click on Save File and select the location where you want to save the File.

Step 8:- After that click on the Yes button to upload the Basic details and CSV File.

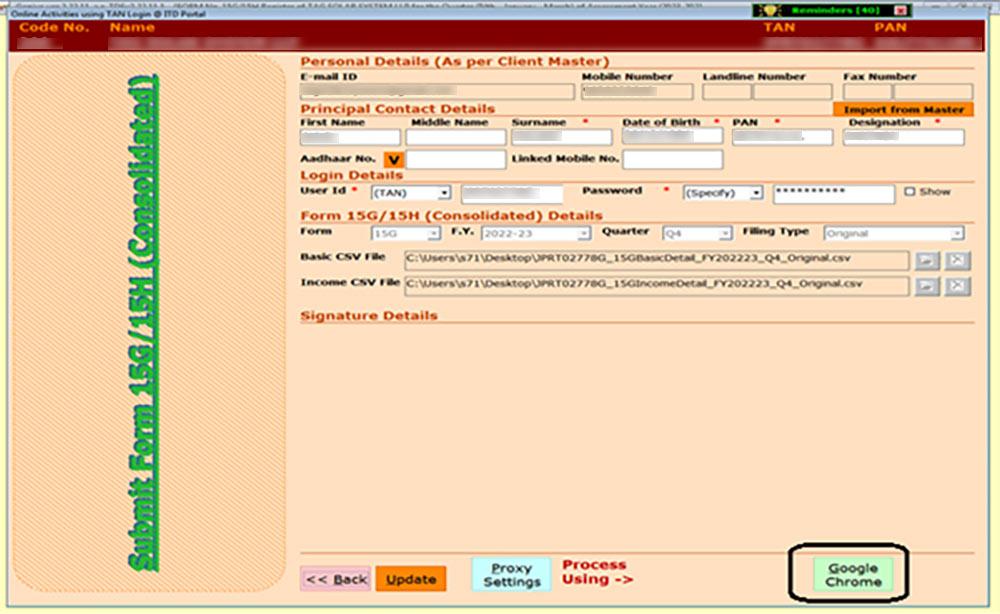

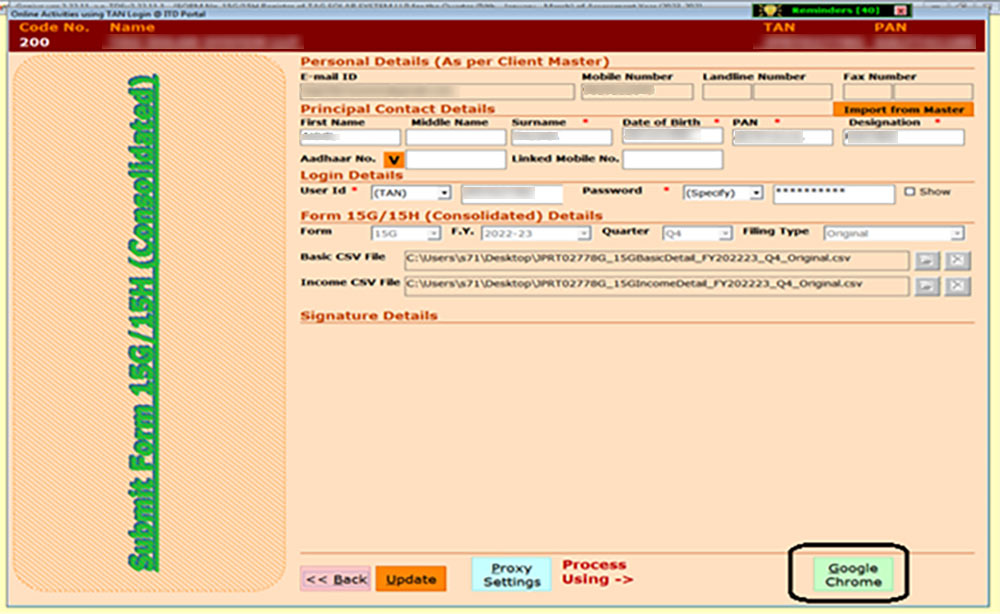

Step 9:- After that click on the Google Chrome button to upload the same.

Case 2: E-file Form 15H

Step 1:- First Open the TDS Software and then click on the 15G/15H Tab.

Step 2:- After that select client to which you want to submit Form 15H.

Step 3:- Click View/Edit Statement to prepare the statement. You can view all the statements you prepared through View Complete Statement if there is more than one. Click on Prepare New Correction Statement to create a new statement of correction.

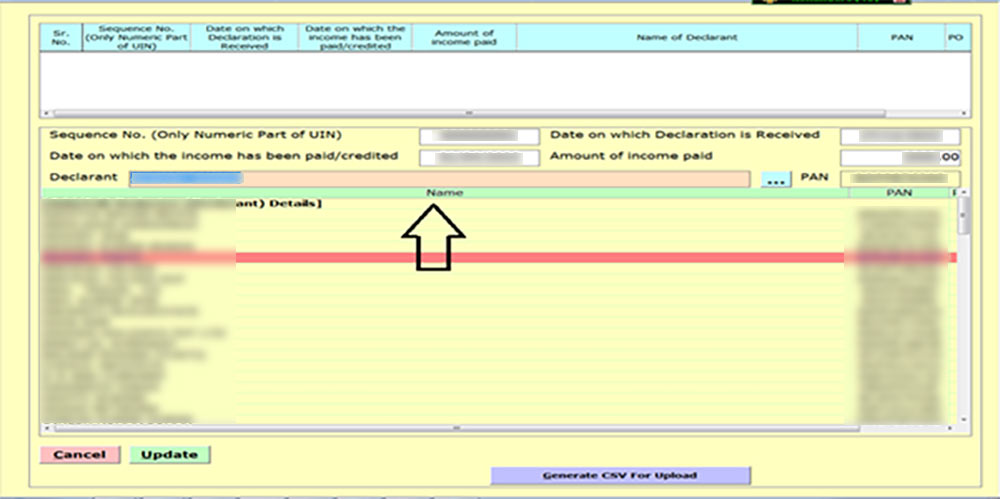

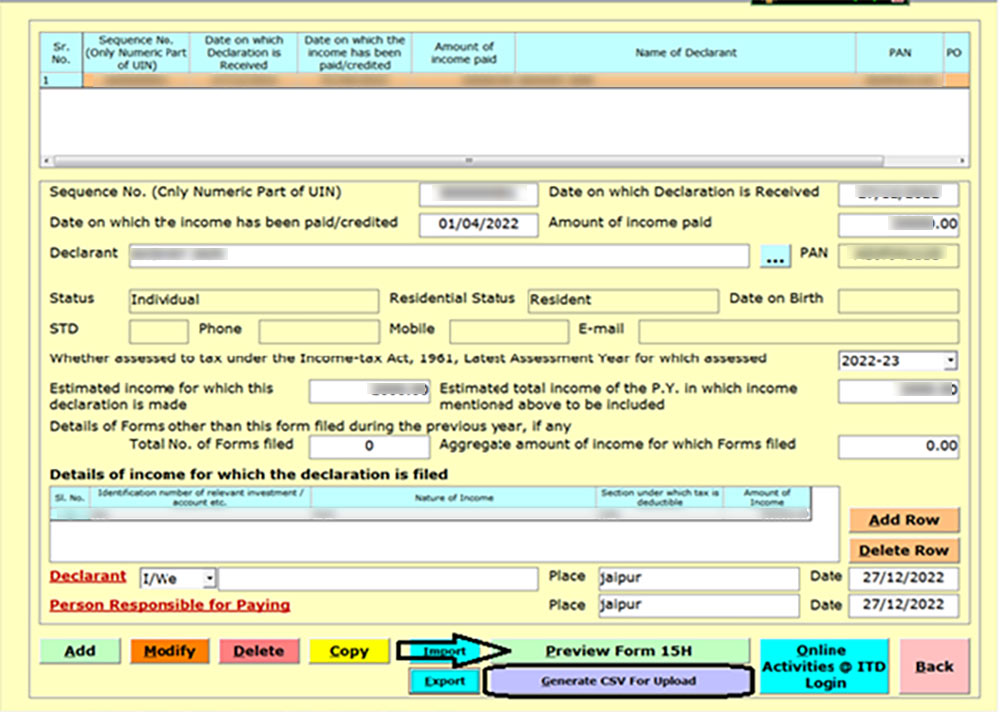

Step 4:- Fill in the details like the amount of income paid, the Date on which the income has been paid or credited, Declarant Details, Status and various other details etc. and click on the update button.

Step 5:- You can take the preview of the Form through the tab Preview Form 15H and for uploading the Form click on Generate CSV for the upload button.

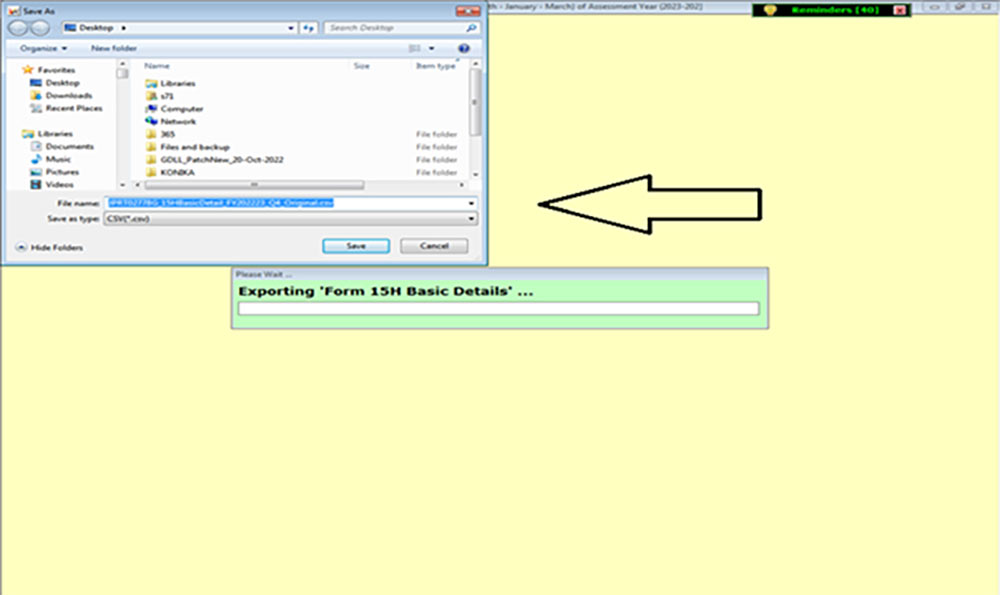

Step 6:- After that Click on Save File and select the location where you want to save the File.

Step 7:- After that click on the Google Chrome button to upload the same.