An Explanation About the Form 10B

By filing Form 10A, taxpayers who have applied for or are registered as a charitable or religious trust/institution can file an audit report through Form 10B. This form can be accessed through the ‘My CA service’, where the taxpayer has added a Chartered Accountant and the appropriate form will be assigned.

Eligibility to File Form 10B for Taxpayers

Chartered Accountants who have registered on the e-filing portal can gain access to Form 10B. However, for the CA to be able to access, review, edit, and submit the form, the taxpayer must assign it to them.

What is the Requirement for Filing Form 10B?

If the earnings of a trust or organisation, calculated without considering Sections 11 and 12, exceeds the limit exempt from income tax in a particular financial year, the annual accounts must be audited by a Chartered Accountant. This necessitates the submission of the income receipt and return of income, as well as a Form 10B audit report that has been signed and verified by the CA.

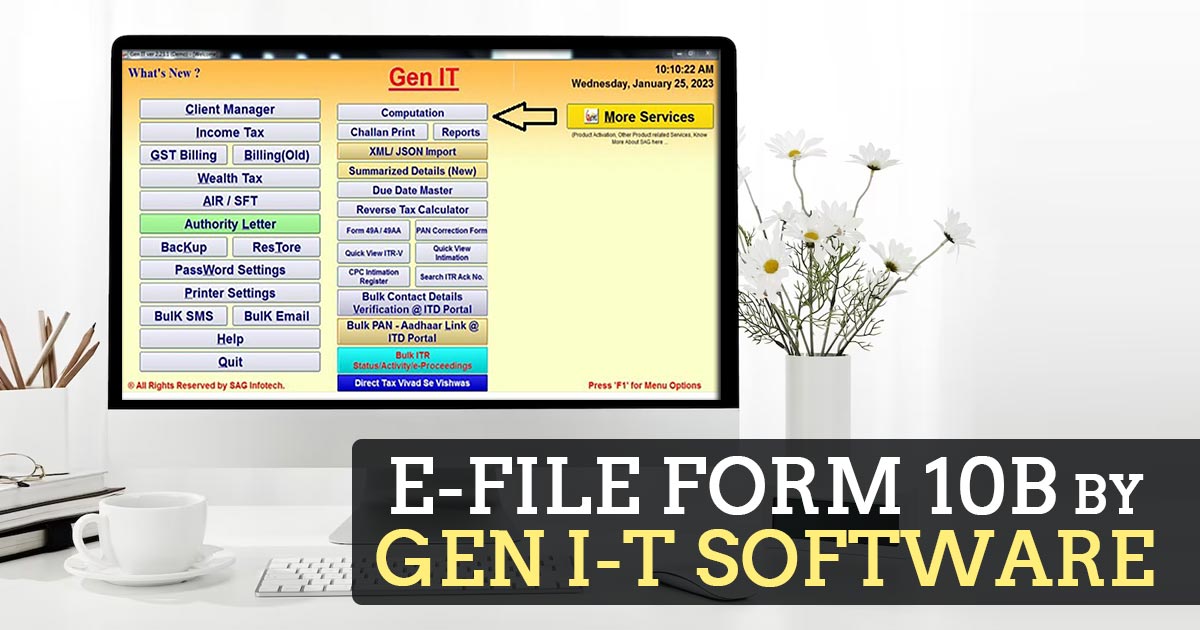

What Makes Gen Income Tax Software a Suitable Choice for Filing Form 10B?

The Gen Income-Tax Filing Software is a remarkable tool for determining Income Tax, Self Assessment Tax, Advance Tax, and Interest under sections 234A, 234B, and 234C. Utilizing this software, you can efficiently and accurately organise and submit income tax returns. Additionally, it offers the convenient option of directly e-filing from the software itself.

The Software is equipped with all the necessary features required for filing income tax returns, including automatic selection of return forms, generation of XML or JSON tax forms, calculation of arrear relief, import of master data and income details, and e-payment of challans with verification. Additionally, the ITD (Income Tax Department) web services offer numerous other valuable features, such as calculation of MAT/AMT, summarization of income deductions, and fast ITR uploading, making it a comprehensive solution for taxpayers and clients.

Procedure to e-File Form 10B Using Gen IT Software

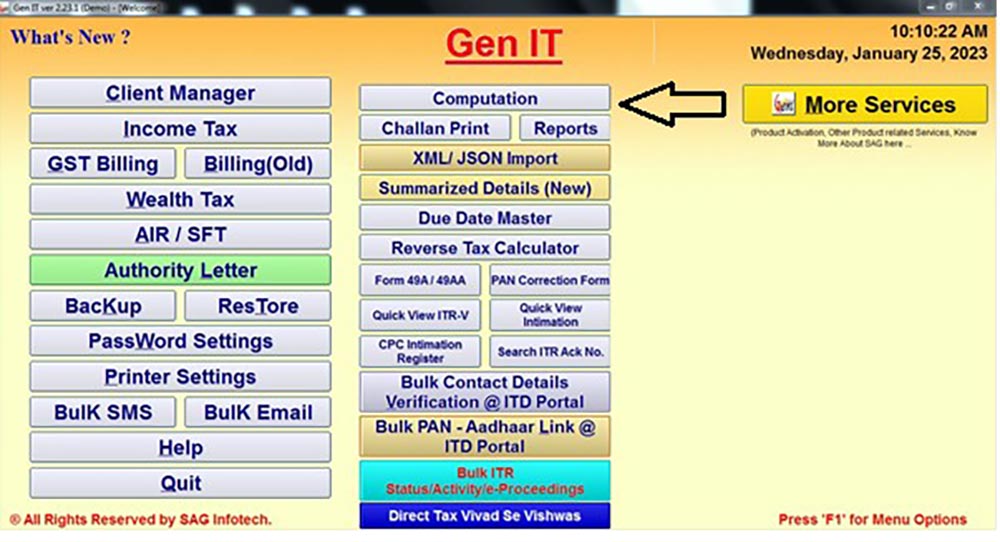

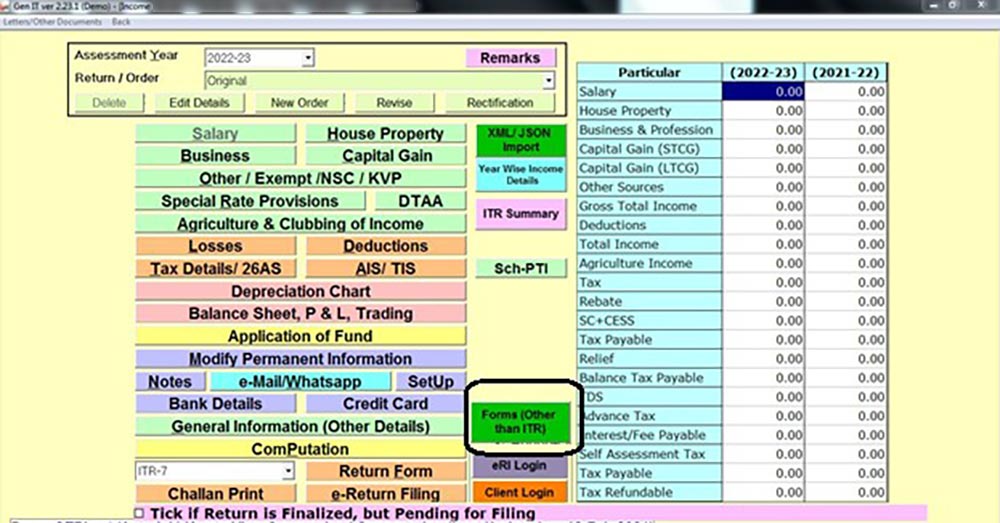

Step 1:- Open the Gen I-T Software and then Go to Income Tax and click on Computation.

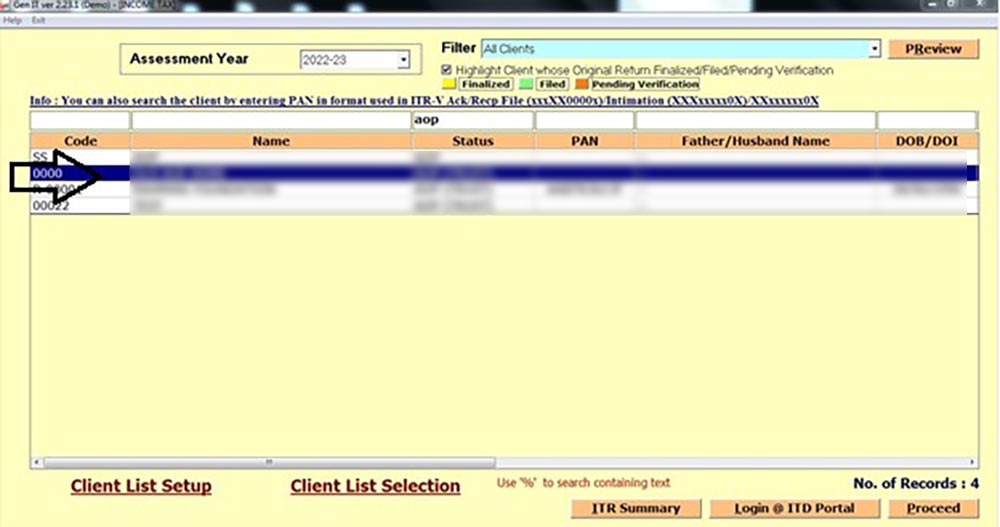

Step 2:- Select the Client to which you want to submit Form 10B.

Step 3:- Go to tab Forms (Other than ITR).

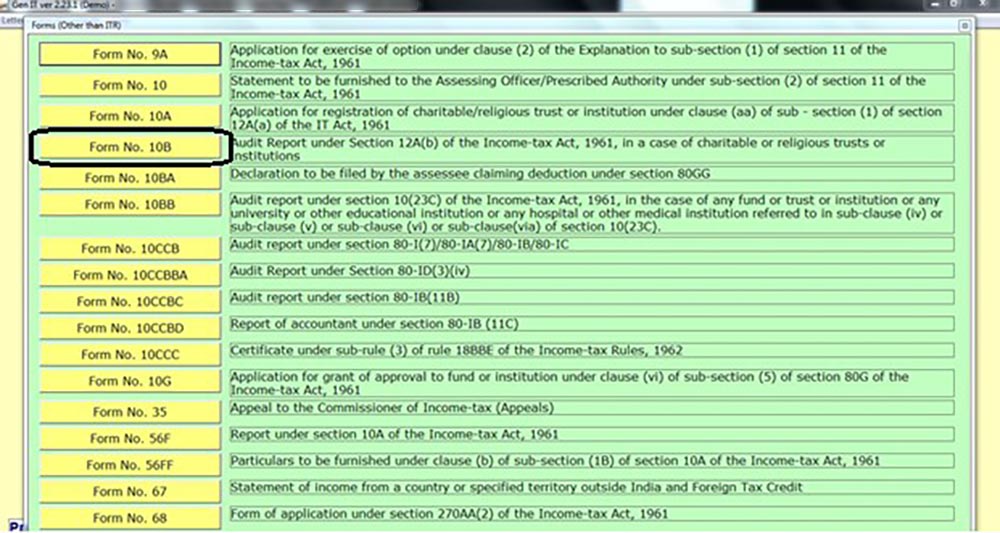

Step 4:- Click on Form 10B.

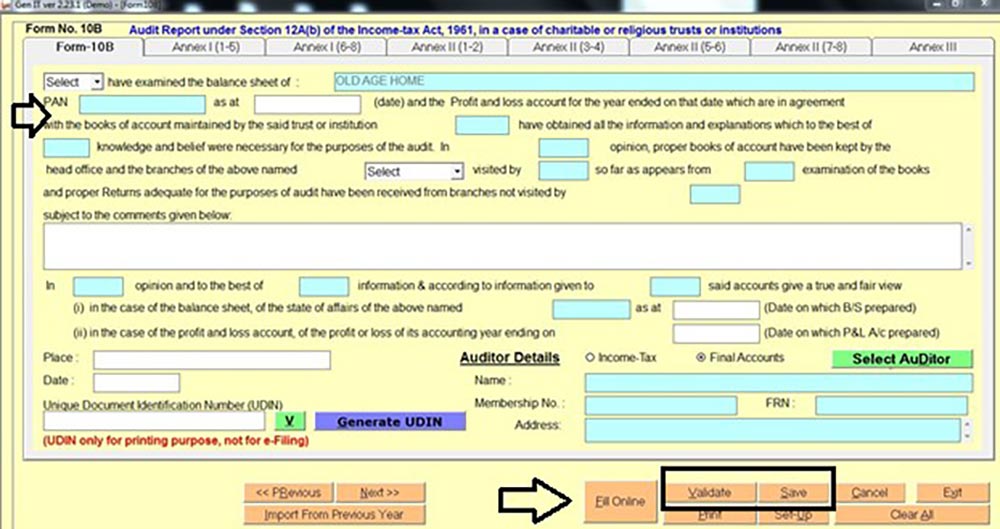

Step 5:- Form will get open. Fill out the details as required in the form and click on the save and validate button and then click on the Fill online button.

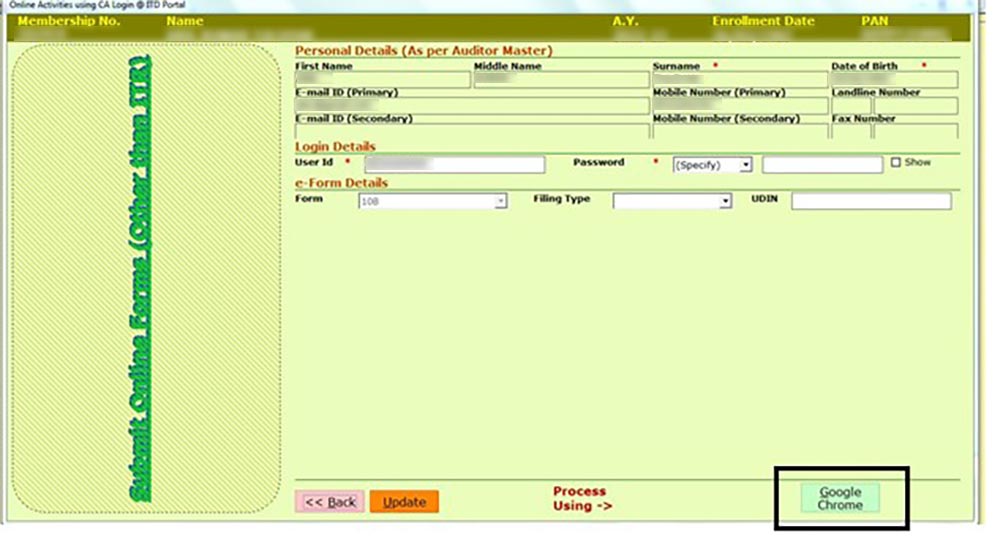

Step 6:- Once the Form will get prepared click on the Google Chrome button and upload the Form.