The Income Tax Department launched the new website of Income Tax on June 7th, 2021. The website has had various technical problems since its launch. One of these is the problem related to ITR. Let’s know it in detail here.

Various Errors Related to ITR

People were excited about the new Income Tax website, but after the launch, they are facing various problems with it. The long list of problems also includes problems related to ITR filing, due to which people are getting frustrated. It is obvious that ITR filing is one of the main functions of the Income Tax website, along with other functions. But right now, the website is not able to perform its main function properly.

Submit Query for Error Free Return Filing Software

Common ITR Issues Faced by Taxpayers in FY 2024-25

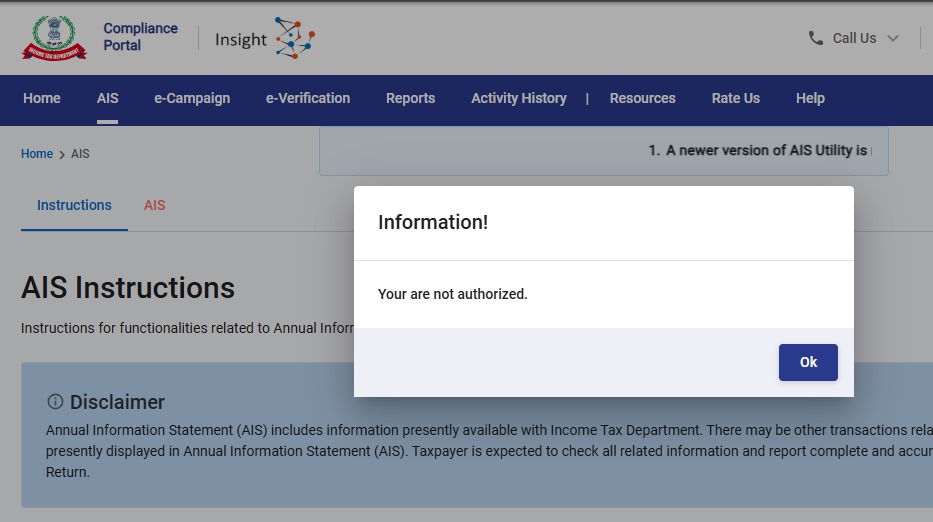

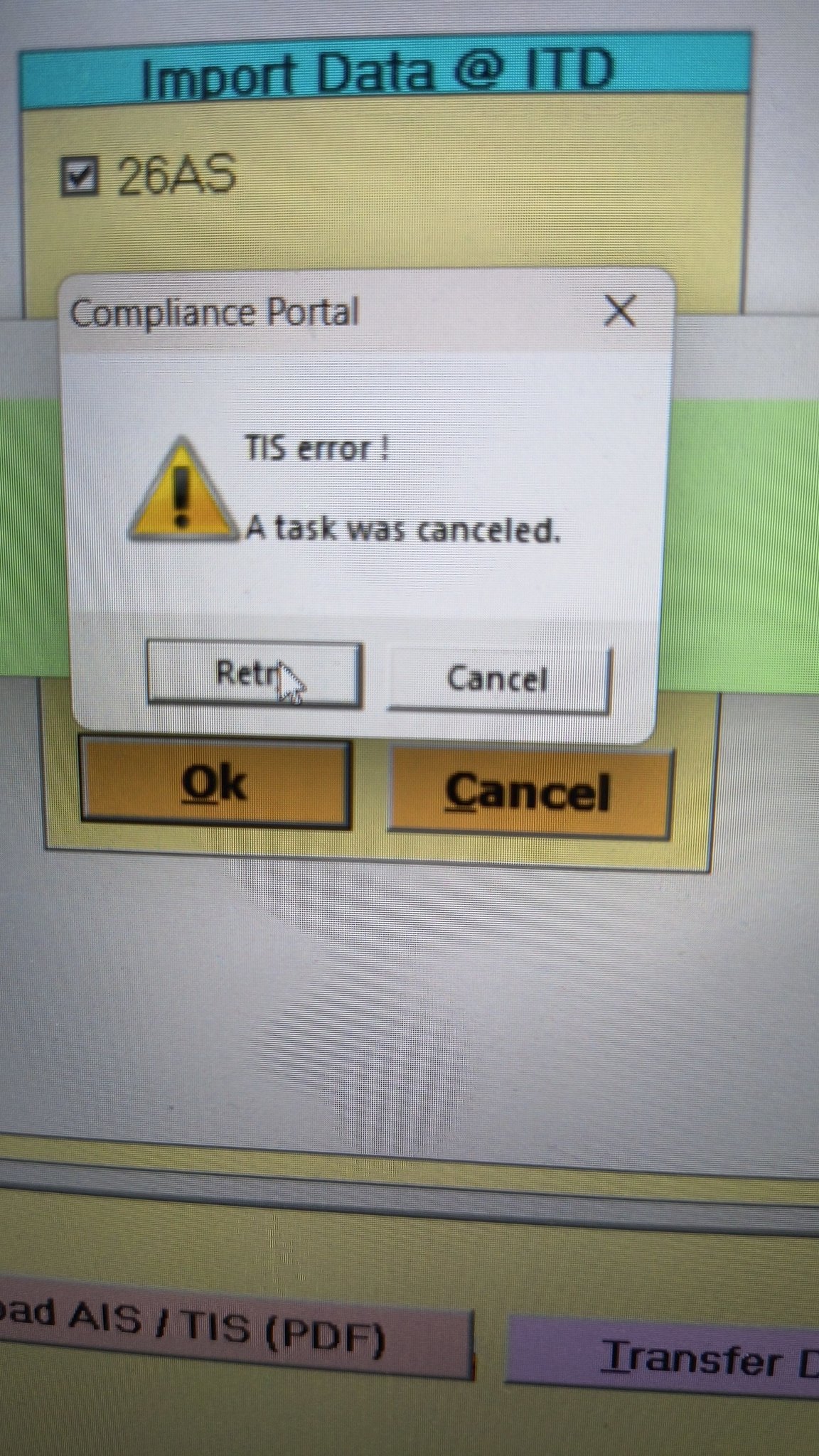

- Error 1: The income tax portal has been issuing an error for the past few days, making it impossible to download the AIS and TIS Data. According to the given challenges in the ITR filing, it would be mindful to think about extending the additional deadline by 2 to 3 weeks. The lack of these important records significantly complicates the tax filing process. Here is the error below –

- Error 2: While submitting the return in ITR-2, the Assessee is facing the following validation error. This error is not coming while filing ITR-3:

- In Schedule CG, the value of b1eii should be: (a) the difference of B1eiA and B1eiB, if eiA > eiB, else 0, if the date of acquisition is before 23 July 2024 and the transfer is on or after 23rd July 2024; (b) 0 in any other case.

- Error 3: While submitting the return in ITR-2, the Assessee is facing the following validation error. This error is not coming while filing ITR-3: In schedule CG, the dropdown at sl. no. B10a, &; Whether the date of limitation /withdrawal was before 23rd July 2024 & is not selected.

- Error 4: While submitting the return in ITR-2, the Assessee is facing the following validation error:

- In Schedule Part-BTI, Sl. No. 15 Aggregate Income of Schedule B-TI is not equal to Sl. No. 12 – 13 + 14

Genius Software Makes Income Tax Filing Easy and Secure

Since Assessment Year 2001-02, Genius tax software has been the number one tax return filing software among Indian tax professionals. Clients can file unlimited returns with this software, including income tax, TDS, AIR/SFT, and other tax forms. Gen BAL (Balance Sheet), Gen IT (Income Tax), Gen CMA, Gen FM, TDS (Tax Deducted at Source) and AIR/SFT make up the six modules of the Genius program. Among the best taxation software in India, Genius provides multiple features such as Backup, Restore, and Password Settings.

I have been trying to e-file ITR-2 for AY2021-22 for past several days and am stuck on 1 item relating to my LT Carried Forward Losses from AY2020-21 not getting populated in Schedule CFL and the editing page doesn’t allow me to input the same manually (AY selection button stays gray and as such, no changes or additions can be made). I have been sending queries and grievances about this issue but no response on this issue even though some of the other issue regarding TDS were resolved at least partly.

This CF Loss doesn’t even affect my taxes for the year because it is not going to be used in AY2021-22 and just needs to be carried over. But they won’t even let me know if I should go ahead and file without it and that this issue can be resolved later. Very poor service by the e-filing Helpdesk.

If anyone has ideas on how to resolve this issue, it would be greatly appreciated.

I am facing the same problem. But I will need to remit extra tax if CFL for AY 2020-2021 not taken in to account. Thank you for your post which helped me to find out this is a common problem.

I think I faced this problem last year. The solution, as far as I can remember, is, you first tick the box by the year to which the carry forward loss pertains and click edit. Input carry forward loss manually into each respective year.

With this new portal I am unable to file the return (ITR-2) due to name mismatch with PAN. Never had such problems earlier. The portal is not reflecting the corrected name as per PAN or Aadhaar. Its been almost two months, I have raised grievance, spoke to customer care, emailed efilingwebmanager mutliple times but the issue is still not fixed. With just another 2 days left, I am not sure what to do.. Any advises?

I have the same issue, not sure what to do

I also face the same issue. I have no idea what to do. I just filed a grievance, but I don’t think they will address it.

Hey JeanRaj,

I just found a solution, you could try this.

Prepare the json file from income tax website itself, donot use any thirdparty websites like cleartax or something else to create json file. For some reason they don’t work. Actually I compared two json files from cleartax and incometax websites, both the names are same, but the differences are in some other fields.

Please give it a try. Use https://www.incometax.gov.in/iec/foportal this to create and upload json.

E-Verification using addhar based opt is not happening. Showing note as “technical error try later”

I am getting “Date of deposit cannot be prior to 01-04-2020.” error even though I’ve made self tax payment on 24th Dec 2021.

Hi, did you get any solution this error?

It worked for me using Chrome. I had deleted the earlier entry (created in Safari Browser) and created another entry (now using Chrome Browser) and it worked like charm.

Happy Filing.

Were you able to solve this date of deposit issue

you can go back to the place and try to add another entry of those details, for me the initial details that I had added did not have any date showing that’s why I added another row of details and then delete the earlier one so it worked fine for me.

Hope this helps!

Hi, does your issue resolved ?

I am facing the same error. I Made the payment on 24th dec 2021, but getting error like “Date of deposit cannot be prior to 01-04-2020.”

I am also getting the same response. Did you find a solution. Please let me know.

I am also getting same problem. any fix?

did you get your issue resolved?

being forced to select 80DD or 80U also under Chapter VI-A , when I only want 80TTB

Facing same issue and updated on this for resolving it

I faced this problem when using Safari browser on MacBook. On using Chrome browser the issue got resolved. The self assessment tax paid entry also added using Chrome after deleting the entry made using Safari which was showing the error ““Date of deposit cannot be prior to 01-04-2020.” The problem seems to be Safari browser specific.

the date should be before 01/04/21 for ay 2021-22 error shown when I try to submit return on 24.12.2021

If you are using I-Pad or apple, then please try using andriod platform, your problem will be solved.

3CA-3CB & 3CD , FILE NOW LOGIN RESULT AS -SERVER NOT REACHABLE , TRY AFTER SOME TIME

email error to efilingwebmanager@incometax.gov.in

Need help to clear below error while online ITR 2

1. Please select the drop down of head of income for which corresponding income offered

2. Please select the radio button for the field TDS credit relating to Self/Other Person.

Please select income head under tds details.

Go to Schedule TDS Paid . Select Tax deduct at source. There will be two options . Self and others. Click on Self .

In the same menu , scroll down . There will be an option to select ” head of income for which Tax deducted at source ” Select option from drop down menu ie Income from other source / House property etc.”

Thanks, but it has to be done for every TDS entry. So I have 54 dividend entries and hence 54 TDS entries – do I have to manually do it for every one of those 54? If there is any bulk update method, then pls guide.

Thanks

Go to Schedule TDS Paid . Select Tax deduct at source. There will be two options . Self and others. Click on Self

how to fix this error- ‘Please select radio button for the field TDS credit relating to Self/Other Person in Schedule TDS 2’

Form 3CA/CD has been filed by Chartered Accountant but while accepting the form by the assessee and proceeding to sign the form with the help of DSC the error is showing as “Something went wrong Please try after sometime” and due to which I am not able to accept the 3CD form and sign with DSC. Also I have checked in my profile under key person category that DSC has been registered of the person who is responsible for signing the form with DSC. Kindly help with the problem.

Did your issue got resolved? Although mine issue is the same but while submitting my ITR 3.

While filing ITR 1, radio buttons for answering one of three questions are not working. I can’t move further till I click this radio button. Some times , confirmation of each segment not working even after modifications. Pl let me know the solution.

Hi

While validating ITR, I am getting an error saying-

Please enter amount against nature of Exempt allowances.

Can some one help me how to resolve this issue. All the deductions are already been filled under total deduction section.

Thanks

I used to get “Request not completed due to technical issue. Please try again.” erorr while verifying thru Aadhar OTP. This was coming up in edge browser. And Internet Explorer (IE) wasnt loading the login page at all. But both login and the verification went thru in chrome. So whoever have this pariticular issue, can try in different browsers. Trying in Chrome worked for me you can as well try in other browsers too.

It is not working for me in Chrome too.

Error : Request not completed due to technical issue. Please try again.

gETTING THIS ERROR WHILE RECOVERING PASSWORD VIA AADHAR

Getting 2 errors while filling IT 2 –

Please select the radio button for the field TDS credit relating to Self/Other Person.

The total of all the quarter of respective CG must be equal to the final figures of schedule BFLA.

How to solve?

I’m also facing the same issue “The total of all the quarter of respective CG must be equal to the final figures of schedule BFLA.”

Can someone help me how to solve this?

Click on Sl. No. F ” of Schedule CG (Information about Accrual / Receipt of Capital Gain )

Add details and enter the quarter wise details of Capital Gain . Enter 0 if there in NIL CG in any quarter .

I am still unable to do all is highlighted in red after entering as well how to see to this.Moreover it does not accept negatives

Select BFLA schedule and enter gains for each quarter so total equals total gains already entered

select the error and in the redirected page, select “Self” radio button. Next if you try to save it will ask head of salary, there if its FD, update “Other Sources”

I am facing a problem with regard to Capital Gains on Sale of Property. The Online version does not reflect the details captured in this section once you logout and login, though the calculations are appropriate. The Offline version is calculating the entire sale value as Capital Gain.

Also there is a problem in filling the details related to sale of equity mutual fund units in both the online and offline versions where the online version exits on inputting the ISIN and the offline version has a different problem. I am not sure who is going to solve these and when I am going to file my returns.

I am also facing this issue and complained to efilingwebmanager@incometax.gov.in wth screenshots and preview download before logout and second login

Many times after filling ITR-3 tried to revalidate, but msg comes

2 Errors found to be rectified

‘Pl select the button for the filled TDS credit relating to self/other person in schedule’

Same is repeated at s.no.

Tried but could not rectify. Pl suggest.

Thanks.

You have to Click on each error, new window will open.. select “Self” click save… since u r getting 2 errors therefore u need to do it 2 times to file your return..

Edit the TDS collected under the schedule “Tax paid ” and tick either self or other person

Dear All, Error when uploading Json File, generated from the ITR-5 Excel utility available in Income tax Portal Invalid hash value identified, modification to ITR details outside utility is not allowed……

Please help how to resolve the issue

After successful validation of ITR 2 the verification shows Error:

Gratuity amount re enter under Sec10(10).

Even after re entry the error persists.

Hi Saji,

Same issue here. Have raised grievance. Received a standard reply saying trying filling fresh online form or new offline utility. Tried everything. Error persists. Have you found a solution?

Only thing I can think of is to not report the Gratuity. Anyway, there is not tax implication if less than 20 lakh.

Regards,

Arun

Same error related to Sec 10(10). No resolution yet despite repeated grievance’s with efiling manager as well as income tax grievances portal.

If there is a resolution, pls post.

thanks

I received an email that my grievance was resolved to which I sent a strongly worded email stating that the grievance has NOT been resolved and that they should not close the ticket. After that I received a call from CPC Bangalore stating that they will organize a webex call with the relevant team who will guide me. 5 days since then and I am still waiting. Keep raising grievances and keep mailing them. Lets get this issue up in the list of bugs to fix. That’s the only way!

Exemption u/s 10(10) for gratuity shall not exceed income offered under the head salary under sub head gratuity receipt and cannot exceed Rs20 lakhs

Exactly facing the same error.

Even after splitting up the ‘Nature of Salary’ to have Gratuity reflect the value, it is not allowing the same value in exempt allowance and throwing the above error.

keep emailing error to efilingwebmanager@incometax.gov.in

how did you over come this?can you help me please? i have tried 100 time s already

I was able to add the gratuity exemption under “Any other” and description as under section 10(10) gratuity

One thing the utility had to be completely closed and reopened for this to work. Otherwise even after this change it was giving the same error.

Reason was the earlier error was not opening up the link directly when clicked and so any modification still gave the same error.

This is definitely a bug that needs to be fixed and have raised grievance also.

Thanks, that worked! Looks like as part of the resolution, they added Gratuity and some other categories of income (Leave Encashment) in the Salary break-up dropdown. Providing the break-up using “Add Another” ensured the rectification of validation error.

I also faced the same problem but as you mentioned. Yesterday mailed to IT department efiling mail ID but not receive any response and today also called to the helpline and raised the ticket for the same and they told me that I will get the response within 24 to 48 hours.

Thank You for the solution which you had posted & it worked. Removed the gratuity field and added the same in “Any Other” option under section 10(10) exemption with the same description I had provided in “any other” field.

Thank you again for the solution.

Thanks this worked for me also. Essentially the deductions under section 10 like gratuity, leave encashment etc. should be provided under the salary breakup by adding “Add Another” section. But its a bug nonetheless.

Thank you Rajesh… your post helped me file my ITR2.

Namaskar! For me the issue is the ITR2 form shows ZERO salary, ZERO income from other sources. If I try to put in the salary as per Form 16, the ITR2 utility does not allow me to edit the salary. I raised Grievance on 4 August and again I reported on 11 Nov. I also sent email to efilingwebmanager@incometax.gov.in. No resolution so far. Anybody facing this kind of issue?

Hello- Were you able to resolve this error ? I am facing the same error !

It was never resolved, so I filled it manually. It took me a long time to fill in manually every field of the ITR2 form.

Missed seeing this message, replying really late. Hope it was better for you, i.e., got a solution.

I am getting below error while adding the Advance Tax and Self Assessment Tax payment for the assessment year 2021-22.

Error: Date of deposit cannot be prior to 01-04-2020.

I had deposited the challan on 16/10/2021 and selected the same date but I am still getting the same error.

I am also facing the same problem. Is your problem resolved?

I am getting the same error. has anyone been able to get this resolved?

Hi Murali, Did u you find solution for the Error: Date of deposit cannot be prior to 01-04-2020 ?

change the browser to google chrome… it worked for me…

Error resolved or not.same prob here if solution tell

I was also getting this error in safari browser. So I tried using chrome browser and it worked.

change the browser to google chrome… it worked for me…

After facing same issue for past 08 days today I updated my chrome browser in my phone , cleared cookies and filled it through my phone itself and finally submitted successfully without error. Earlier I was trying through my iPad and It was continuously giving errors.

Hi Ankit, I tried your method of clearing caches in Google Chrome but I am still getting date error while filling Self assessment tax details . Because of this error, I am not able to verify my return. Do you have any other solution?

It was giving the error today in chrome as well. I went to incognito mode and then it worked!

I got the same error when paid on 17/12/21.

I am also facing the same error. Tax deposited on 20 Dec 2021 but it gives the same error as faced by you

try in incognito mode

I also get the same issue: Date of deposit cannot be prior to 01/04/2020

After successful validation no acknowledgement no. and message on email is coming also not verifying….

ITR FOR AY 20-21 INTIMATION HAS BEEN RECEIVED AND ALSO REFUND RECEIVED BUT ITR SHOW UNDER PROCESSING AND ITR STATUS BY ACK NO SHOW E VERIFIED

Forgot password in income tax portal don’t get OTP for forgot password

Still facing e-filling through black. It’s saying the error “your filling encountered an error at IT”.since one month facing the same issue. Kindly do the needful. Due to this error I am unable to receive my return ammount.

In ITR 2 after successful validation at the time of verification and submission an same observation repeated again and again after about more than 100 times correction in last two months that is” Kindly enter sum of amount filled in”TDS b/f” and “TDS Deducted” in the field TDS claimed but same is showing again again even after correction. Plz any one having solution for the same

i am also getting the same error since last 3 months and whatever i do, its not getting rectified. Anybody has found a solution for this ?

After validation again & again error message comes .So unable to e-file till now.Really it is total time consuming only .

Getting the same error. Could you get it resolved somehow? Can someone else please guide here

did you get a solution for this issue? I am also facing “Kindly enter sum of amount filled in “TDS b/f” and “TDS Deducted” in the field “TDS claimed” and not able to understand, what is the issue.

I am getting the following error while uploading ITR-5: “Invalid hash value identified, Modification to IT details outside Utility is not allowed”.

No modification has been done by me. How to resolve

Anyone facing this issue while validating?

Schedule VI A, the total of 2i to 2 u not equal to the total of 2v?

Actually I have only one amount u/s 80c (5L) which is auto populated from info given while answering questions at the start. My taxable income is less than 1 L. So that amount is auto populated u/s 80 C as the available total deduction. The same amount is appearing in the total (2v). Of this 1L my LTCG is about 55000/- which again is not taxable. But I am getting this defect and unable to file return.

Multiple grievances raised, but no reply from the department.

Anyone else facing this issue. Anyone knows how to resolve this?

ITR-2 doesnot show 80C fields for amounts to be entered while 80D, 80TTA, 80TTB, 80RRB are displayed. Anyone has found a solution how to enter 80C amounts

Did u get any solution, can u please share that

Same problem for ITR 5 on 18th October 2021. Someone suggested that an old excel utility was converted and due to program bugs ,the json file generated cannot be uploaded.

Brother, i am also facing the same error. If you have a solution, please help also.

Hi MK,

How did you solve your query.

I am also getting the same error in ITR-5.

Please advise.

Thanks.

I am also facing the same problem. Did you get any solution for this ?

Even I am getting same error while uploading .json file of ITR-5. Pls help at the earliest.

Welcome new version. Released yesterday 16th Nov 2021. Try to re-prepare ITR and upload now!

While Attaching JSON file for ITR-5 I amgetting the message” Invalid hash value identified. Modification to ITR details outside utility not allowed” How to resolve.

ITR2: Interest on borrowed capital on house property values entered but still showing zero at the end . [old tax regime].

Has this got resolved?

I have interest on home loan and hence a negative House Property income. but this is not getting set off against salary income. It shows under carried forward losses. How to fix it?

I am also facing the same issue. were you able to resolve this issue?

Facing the same issue currently for AY 2023-24. If u are filling online, try downloading the json file and import it in the desktop utility and then re-enter the interest amount. It worked for me!

Receiving this Error Message while submitting Condonation Request on Portal :

“error Error : : Due to some technical error not able to process. Please check corresponding class and error code ITD-EXEC2003”

Any Clues !!

Thanks

I face an issue which says contact person details not available even though all the details are correctly fed. Please help

I am facing the following validation error while filing my IT for AY 2021-22 today,

The date should be before 01/04/2021.

Can anyone suggest how and where to correct it?

I got the same problem

Did you find any solution for that

same issue

I got the same error, did you or anyone else find the solution ?

I am getting the same issue.. Did anyone found solution?

Hi . Try changing browser from Safari to Chrome, it should work.

Switching from safari to chrome solved the problem.

When going to register TAN at efiling through traces link it says ” request to go to traces can not be completed. Please try tan registration after some time” this error occurs from last two months how to solve it. ?

Got the same issue .have been trying to submit the return for weeks now .always showing this same error

“The date should be before 01/04/2021 for AY 2021-22.”

No idea how to rectify this. Please suggest a solution if some found something . In another site some one said its a browser issue some people opened the site in chrome rather than in safari was able to verify the Return .but now a days chrome is also showing the same error.

Mozilla Firefox is working fine. I switched from Safari to Firefox and did not get the error anymore.

This issue happens in safari browser. I tried submitting the form in chrome and it worked.

To confirm if this will work, check that the ip is listed next to place on the second last step.

I was facing the same problem while filing the return from my iPhone/iPad. Then I tried from android phone. It worked and there was no error.

On new IT TAX Portal – Getting Error during validating ITR-2 . For TDS 2 – Tax Deducted at Source on Income – TDS Credit relating to Self – selected as Self and not the other person or Spouse selected but still it gives error during validation that PAN is Mandatory.

Why should it ask for PAN if TDS Credit is being claimed for Self ?

I am getting the same error. Were you able to find a resolution?

No still the same issue.

Worst thing is it asks to update Self for each and every entry in TDS 2.

Every time I patiently do that to file IT return in ITR-2 and later when go for validation it gives error PAN Mandatory.

I have been doing this since last 3 months. Every month it asks to Pay some additional Self Assessment Tax. Really very frustrating experience.

Not sure how much more, honest tax paying citizens have to shell out more TAXES because of this system.

How can CBDT be so insensitive to issues raised by tax payers ?

I am getting similar error after successful validation in verfication and submission stage

“Kindly enter sum of amount filled in “TDS b/f” and “TDS deducted” in the field TDS claimed”

Hey, I am also getting the same error. What is the solution for this??

There is no solution. I am also facing this error. Such a poor design by Infosys. Pathetic implementation. Shame on Infosys.

Can’t even design this basic system. I am sure they must be failing badly on advanced client deliverables.

Personal information data not getting validated. Even on clicking confirm option it is not getting validated and asking for validation

are you able to get a resolve on this one?

getting the same error, even after click on confirm button, it’s not confirming the verification

Facing same issue. Is it resolved?

Did you able to resolve it

If you are getting such error, the solution is to discard the draft and start afresh. Don’t select the draft in which you are getting the error. Select the ITR as if you don’t have a draft in the first place. This will fix the above error.

Not able to validate prefilled date as confirmed button doesn’t work. Please let me know if anyone knows how to resolve

Same here ! Got a solution yet?

Receiving this Error Message while submitting Condonation Request on Portal :

“error Error : : Due to some technical error not able to process. Please check corresponding class and error code ITD-EXEC2003”

Any Clues !!

Thanks

I HAVE SHOWING SAME ERROR CODE AGAINST REFUND REISSUE CLAIM ASSESSMENT YEAR 2020-21

Can someone share how did they resolve the error as below, ” In Schedule OS, Sl. No. 10 the quartely break up of Dividend Income (i+ii+iii+iv+v) is not equal to [1a – DTAA Dividend -System calculated value at 3aii] of Schedule OS ” this error im getting on 14th sept 2021?

I am facing a problem to change password by dsc. Although DSC is made by PAN verification, but after inputting the DSC details, it says that PAN in DSC is not matching. in Google chrome, Edge or Mozila browser. Internet Explorer is also not opening the login page. If anybody knows the solution, please let me know.

ITR-2 is not auto populating salary heads from Form-16. Everything showing 0.

Also eligible deductions in 80C show ZERO even if I put 150000 (within limit). And I have not opted for new tax regime.

Anyone getting something similar?

I have the same problem. Did you get any work around ?

Error coming while validation of ITR 1 “Please enter a valid Bank Name” . All the banks name are already prefilled. My all bank a/c are linked with Aadhar & Pan cards

I am trying to file income tax return for ay 2021-22. TDS is showing but tax paid is showing as zero. Hence Refund is also not showing. Please tell how to file?

Facing error while filing ITR-4. I do not want to opt for the new tax regime and selected “No” in the respective field in the form. The return is validated successfully but at the time of verification it shows the error “New tax regime u/s 115BAC can not be opted without furnishing Form 10IE or the details provided in ITR is incorrect”

Anyone facing the same issue? Please guide as to how should I proceed.

Hi Mam, were you able to find a solution to that error? I am facing the same error for AY 2022-23. Do let me know if you have a solution to that. Thanks.

yeah me too facing same error. brother pls send me a mail if you find a solution.

Error coming while validation of ITR

“Please Enter a Valid Bank Name”

Error coming while validation of ITR-1

“Please Enter a Valid Bank Name”

All the banks Name are already prefilled

On new IT TAX Portal – for Error during validating ITR-2 .

For TDS 2 – Tax Deducted at Source on Income – TDS Credit relating to Self – selected as Self and not the other person or Spouse selected but still it gives error during validation that PAN is Mandatory.

Getting the same error. Not sure how it will get resolved

Same error today. I dont think they will do anything in net few days. Better to proceed by entering own PAN number to avoid any interest penalties if you have tax liability. If yours is a refund case, you can wait.

Facing the same problem hence unable to file.

Also there is no provision for entering PAN of self.

After a new update of efiling 2.0 portal, o cant be download and view pan card which we applied previously. Its showing opyion for download and view, but it not getting click or not connecting request to destination host

IN THE PREVIEW AND SUBMIT RETURN PAGE ,IN THE VERICATION PAGE,MY NAME IS NOT AVAILABLE THERE ,HOW WILL I DO ,ALL THE THINGS NEEDED LIKE PANCARD NO AND FATHERS NAME IS AUTOMATICALLY THERE,PLEASE HELP

I am getting address mismatch in adhaar, PAN and profile

Though all the data in adhaar and PAN are same in income tax e-filling portal it is not fetching the details correctly and causing the mismatch. Please advise on that.

while filing its showing the error like ITD-EXEC2003

at the time of filling income tax return I am also facing ITD-EXEC2003 error. if you resolve it please guide me. thanks

RESPECTED SIR, SECTION 80GG IS NOT UPDATED EVEN I FILLED FORM 1OBA FOR THE SAME