A recent decision by the Rajasthan High Court has struck down an order related to tax rules in India. The court ruled that just because someone uses money earned abroad to buy land in India, it doesn’t mean that money is automatically subject to Indian taxes. For it to be taxed, it must fall under the specific categories of income that the tax law recognizes as taxable.

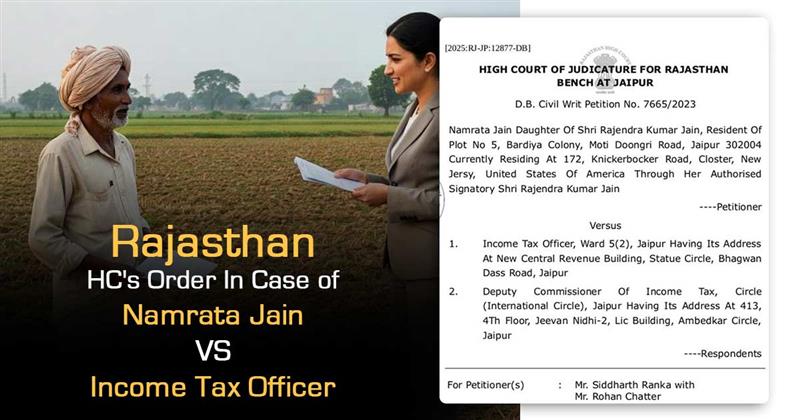

A Division Bench of the Rajasthan High Court has ruled on a writ petition filed by Namrata Jain against the Income Tax Officer and the Deputy Commissioner of Income Tax in Jaipur. The case facts comply with the Income Tax Department’s initiation of proceedings against the applicant/taxpayer, a Non-Resident Indian ( NRI ), asking for the source of funds used for purchasing land in India during the Assessment Year (A.Y.) 2016-17.

It was ruled by the department that the amount utilised for the transaction must be regarded as taxable income, triggering reassessment u/s 148A, and the proceedings were transferred to the Assistant Commissioner (International Taxation), which directed to the impugned order.

The Petitioner, represented by Siddarth Ranka and Rohan Chatter claimed that just bringing foreign-earned income into India does not make it taxable unless it comes within the ambit of the Income Tax Act. The petitioner had revealed details of her two bank accounts in the USA and NRE account held with CITI Bank, Jaipur, and that the applicant had used appropriate banking channels to route the US income to India for purchasing the property.

For the revenue Shantanu Sharma, Aditya Doda and Parth Vashishtha appeared and said that the department was not fulfilled with the contentions of the taxpayer for the source of her alleged foreign income.

The Bench of Justice Avneesh Jhingan and Justice Maneesh Sharma reviewed the provisions of the Act and relied on precedent cases, including (cases referred to in the document). The court noted that the phrase “income chargeable to tax” is to be interpreted strictly as per the Income Tax Act.

It was outlined by the Rajasthan High Court that the foreign income made via an NRI does not become levied to tax as it is been used to make the purchase in India and that the revenue has been unable to prove any taxable event, easing the assessment reopening.

Quoting the decision of the Supreme Court in Chhugamal Rajpal vs. S.P. Chaliha and Ors. (1971), where it was maintained that the Assessing Officer must have an assumption ground for taking measures u/s 148 of the Act and a requirement for additional enquiry cannot be equated as the reason for issuing notice u/s 148 of the Act.

The impugned order has been quashed by the Rajasthan High Court, marking that the revenue does not have any data to recommend that the applicant has made an income obligated to be taxed in India and that it has been elaborated duly that the investment source has generated in a foreign country, thereby warranting no proceedings u/s 148.

| Case Title | Namrata Jain Vs. Income Tax Officer |

| Civil Writ Petition No. | 7665/2023 |

| Counsel For Appellant | Mr. Siddharth Ranka with Mr. Rohan Chatter |

| Counsel For Respondent | Mr. Shantanu Sharma with Mr. Aditya Doda & Mr. Parth Vashishtha |

| Rajasthan High Court | Read Order |