The Orissa High Court, in a recent judgment, has mandated the revocation of a registrant’s cancelled Goods and Services Tax (GST) registration. This decision is contingent upon the registrant’s clear willingness to pay all outstanding taxes, interest, late fees, penalties, and any other amounts required for the department to process his GST forms.

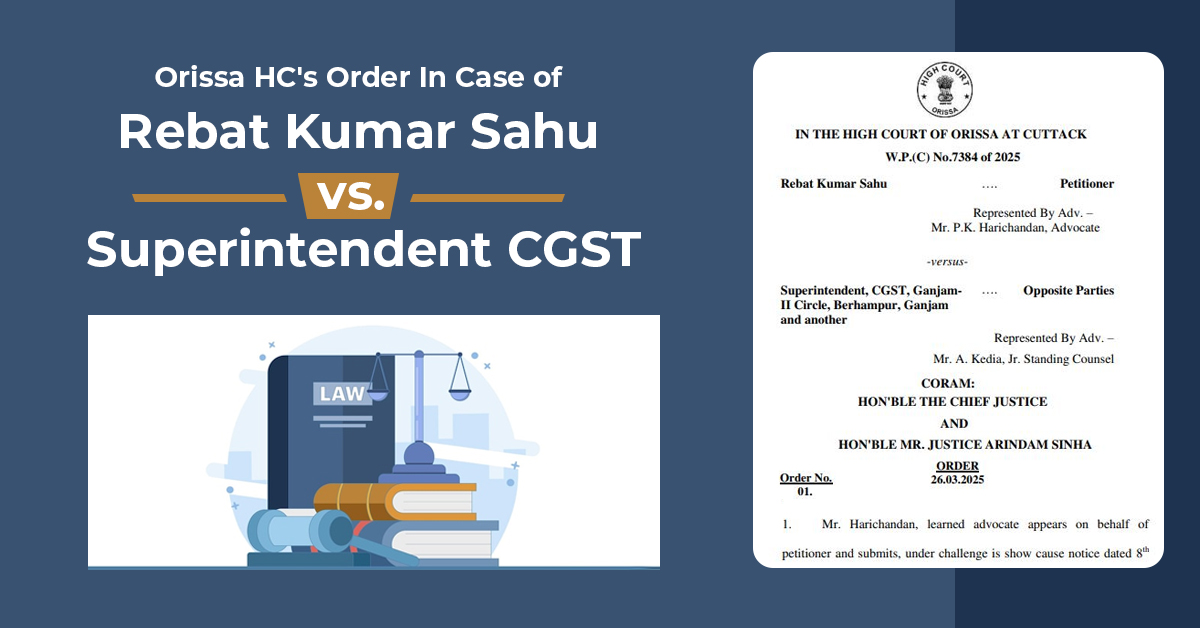

The applicant Rebat Kumar Sahu, represented by P.K. Harichandan, has chosen a Writ Petition against a Superintendent within the Central Goods and Services Tax (CGST) department at Berhampur after the GST registration of the applicant was cancelled through an order dated December 12, 2023, following a Show Cause Notice (SCN) issued on August 8, 2023.

The applicant’s counsel prayed for condonation of delay while depicting the intent of the applicant to pay off all outstanding dues and penalties before the Orissa High Court while relying on the decision given by a coordinate Bench of the High Court in W.P.(C) No.30374 of 2022 (M/s. Mohanty Enterprises vs. The Commissioner, CT & GST, Odisha, Cuttack and others).

For the Revenue, the standing Counsel, A. Kedia, Jr., appeared.

Read Also: Orissa HC Quashes GST Penalty Under Section 74, Citing Jurisdictional Error

A Division Bench including Chief Justice Harish Tandon and Justice Arindam Sinha has analysed the appeal of the applicant under the Mohanty Enterprises ruling wherein the bench condoned the delay invoking the proviso to Rule 23 of the Odisha Goods and Services Tax Rules to ask the applicant to deposit all taxes, interest, late fee, penalty etc. while adhering with other formalities to effectuate revocation of cancellation of the GST Registration.

Chief Justice Harish Tandon and Justice Arindam Sinha, keeping in line with the judgment of the coordinate bench, have disposed of the writ petition, passing an order of the same effect in Mohanty Enterprises, furnishing the applicant relief in the interest of Revenue.

| Case Title | Rebat Kumar Sahu vs. Superintendent CGST |

| Citation | W.P.(C) No.7384 of 2025 |

| Date | 26.03.2025 |

| Petitioner by | Mr. P.K. Harichandan, Advocate |

| Represented by | Mr. A. Kedia, Jr Standing Counsel |

| Orissa High Court | Read Order |