On behalf of petitioner Mr Harichandan, the advocate appears and said that the impugned is Show cause notice on 19th February 2024 that has the purported finding of misstatement made by his client, to underpay the tax issued under sub-section (l) in section 74 of Central Goods and Services Tax Act, 2017.

The provision was invoked to take the extended duration of limitation though no allegation of misstatement in the SCN was there.

Situations are been addressed by the Central Goods and Services Tax (CGST) Act, 2017’s Section 74 where the taxes are not, paid in full, or incorrectly refunded, or in which input tax credits (ITCs) are improperly used or obtained as a consequence of fraud, deliberate misrepresentation.

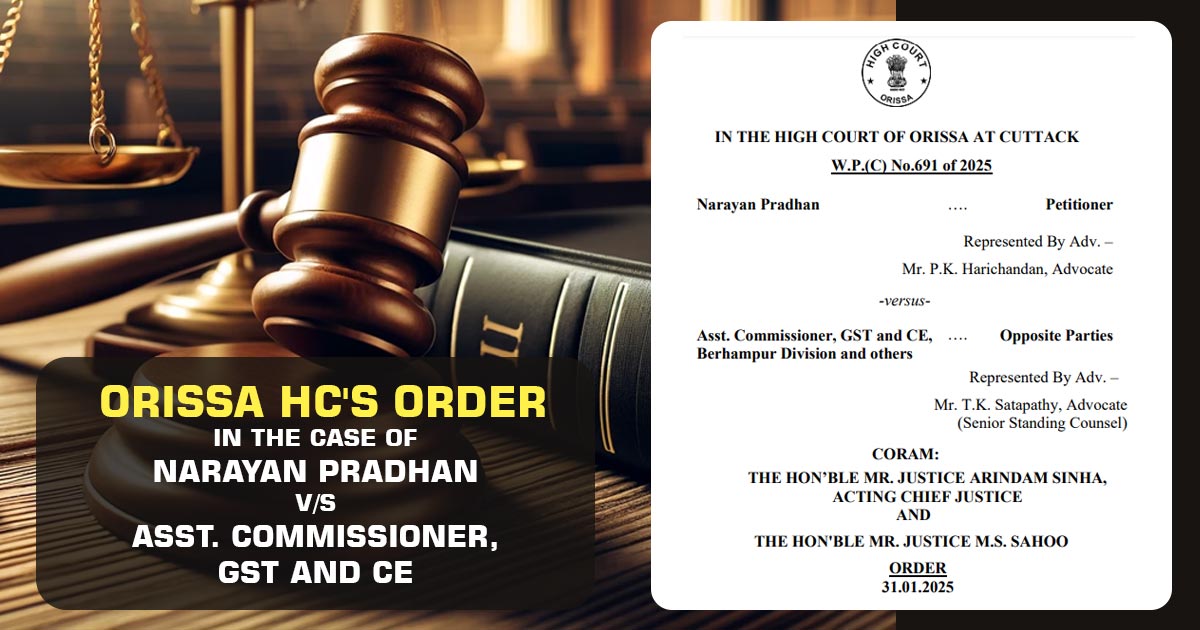

It is been comprehended that there has been a jurisdictional error that proceeds to the root of the impugned order, the division bench of Justice Arindam Sinha, Acting Chief Justice, and Justice M.S. Sahoo set aside on interference. He also aspires to interim protection.

On behalf of revenue Mr. Satapathy, advocate, Senior Standing Counsel appears and furnished that there is a clear finding of the misstatement. The tax rate was intended to be applied at a lower rate.

Read Also: Orissa HC Stays GST Notice U/S 74 Consolidating Multiple AY, Citing Karnataka HC Ruling

Acknowledging the submission of jurisdictional error going to the root of the impugned order, there is a necessity for the writ petition to be heard.

When a tax authority initiates proceedings or takes action beyond its legally defined area of authority then a jurisdictional error under GST arises. If a state officer furnishes a notice for a matter under the Central GST jurisdiction, or vice versa.

Recommended: Orissa HC Sets Aside Tax Penalty Order Under Section 74 for Overlooking Assessee’s GST Payments

If a lower authority manages a case directed for a higher authority. If an officer from a distinct state or region furnishes a notice. When a matter pertinent to a regular is managed under the composition scheme.

| Case Title | Narayan Pradhan vs. Asst. Commissioner, GST and CE |

| Citation | W.P.(C) No.691 of 2025 |

| Date | 31.01.2025 |

| For Petitioner | Mr. P.K. Harichandan |

| For Respondents | Mr. T.K. Satapathy |

| Orissa High Court | Read Order |