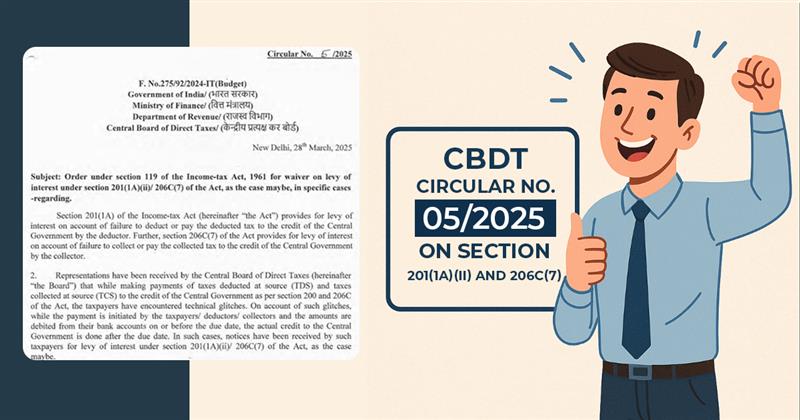

Circular No. 05/2025 has been issued by the Central Board of Direct Taxes (CBDT) to provide relief to taxpayers facing charges under Section 201(1A)(ii) and Section 206C(7) of the Income-tax Act, 1961.

The circular allows for an exemption from interest on late payments of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) that resulted from technical glitches beyond the taxpayers’ control.

CBDT Circular No.05/2025 Highlights

Interest Waiver Eligibility

- The same exemption applies to the cases where the TDS/TCS payments were started on or before the deadline, though the credit to the Central Government was delayed due to technical issues.

- Through the system failures, the taxpayers that consequences in the automatic interest regulations u/s 201(1A)(ii) or 206C(7) can ask for relief.

Authority to provide waivers:

The exemption or reduction of interest will be granted via the Chief Commissioner of Income-tax (CCT), Director General of Income-tax (DGIT), or Principal Chief Commissioner of Income-tax (PCCIT) after affirming the technical problem.

Application Procedure & Time Period

- From the finish of the fiscal year for which the interest is levied, applications are to be filed within 1 year.

- The respective authority is to dispose of applications within 6 months of receipt, after furnishing the taxpayer a chance to be heard.

Read Also: List of Cash Transactions Not Eligible For I-T Exemptions

Refund of Paid Interest: The exemption will permit a refund to the deductor/collector if the interest has been paid before.

Order finality: The decision made by the CCT, DGIT, or PCCIT will be final and non-appealable.

What about TDS delayed payment relating to Quarter 4 of FY 2023-24.