The ITAT Indore ruled that the taxation of unexplained cash credit is invalid if the books of accounts are rejected, particularly in light of the significant increase in cash deposits during the demonetization period.

The taxpayer, Dharmendra Doshi, who runs Parsvnath Industries, a proprietorship that deals in plastic scrap and old bottles, submitted an income tax return for the financial year 2017-18. Thereafter, the return was chosen for scrutiny due to an influential rise in cash deposits during the time of the demonetization period.

Total cash deposits of ₹42,52,500 have been discovered by the assessing officer during this period, accepting merely Rs 9,85,000 as explained and considering the rest as unexplained cash credit under section 68 of the Income Tax Act, 1961. Also, AO rejected the books of accounts of the taxpayer u/s 145(3) of the Act.

The counsel department, Sanjeev H. Bhagat, asserted that the taxpayer is unable to provide books of accounts despite repeated notices under Section 142(1). He mentioned that a key debtor, Sati Polyweave Ltd., did not respond to a summons issued u/s 131, which raised doubts about the claim of the cash realization of the taxpayers.

He mentioned that a rise in the cash deposits of the taxpayer’s bank account at the time of the demonetization period, claiming that unverified sources and inconsistencies in records justified the rejection of books u/s 145(3).

The counsel of the taxpayer, Kunal Agrawal, claimed that all cash deposits incurred at the time of demonetization were true and not unaccounted for.

Also, he mentioned that the period coincided with Diwali, a cash-heavy time for the business, elaborating on the large cash holdings. Bank statements, cash books, and purchase details supported this, which depicted a surge in activity at the time of the festive season.

Also, the counsel defended that AO incorrectly rejected the books even after submitting them and stressed that the taxpayers must not be held obligated for Sati Polyweave Ltd.’s failure to answer a summons.

Read Also: Kerala HC: An Income Tax Assessing Officer Cannot Ignore a Taxpayer’s Claims Without Proper Inquiry

It was claimed by the taxpayer that post rejection of books of accounts u/s 145(3), no additions could be made u/s 68, citing the case of CIT v. Dulla Ram (2014).

The bench of Vijay Pal Rao (Vice President) and B.M. Biyani (Accountant Member), post-hearing both parties, noted that the taxpayer has furnished enough proof to support the cash deposits at the time of demonetization.

It was concluded by the bench that after the AO rejected the books u/s 145(3), no addition could be made u/s 68. Citing CIT v. Dulla Ram (2014), the Tribunal asked the AO to delete the addition, granting relief to the taxpayer.

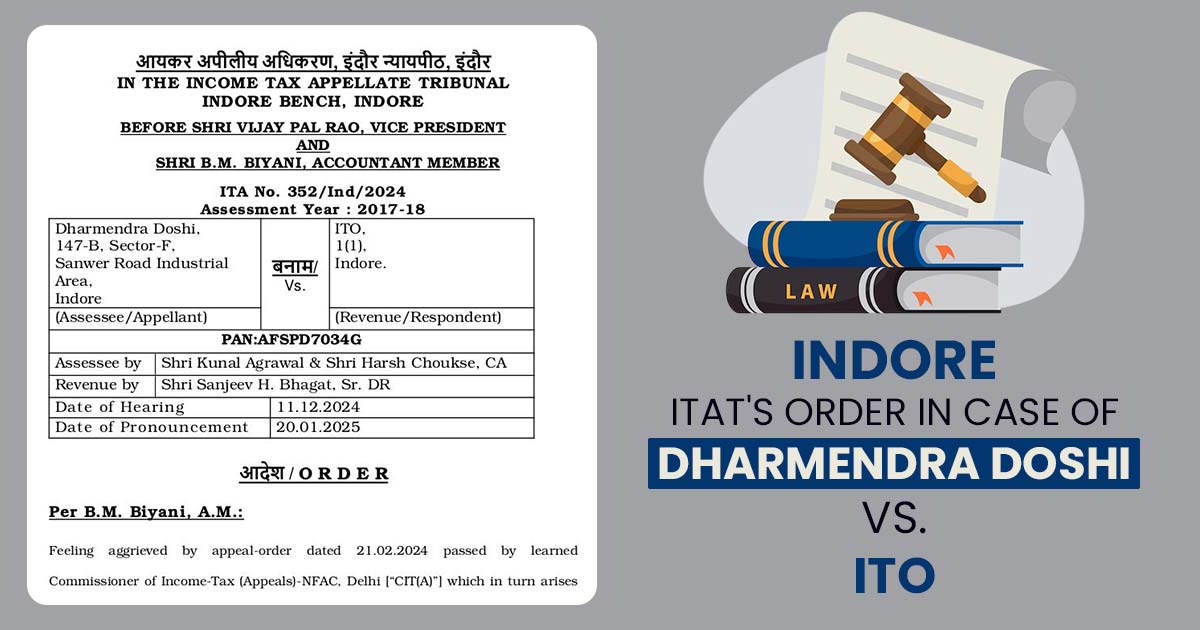

| Case Title | Dharmendra Doshi Vs. ITO |

| Citation | ITA No. 352/Ind/2024 |

| Date | 20.01.2025 |

| Assessee by | Shri Kunal Agrawal & Shri Harsh Choukse, CA |

| Revenue by | Shri Sanjeev H. Bhagat, Sr. DR |

| Indore ITAT | Read Order |