The Orissa High Court acknowledged the justification for the delayed response to the GST notice, attributing it to the petitioner’s medical treatment during the specified timeframe. Consequently, the high court permitted a hearing to address the matter.

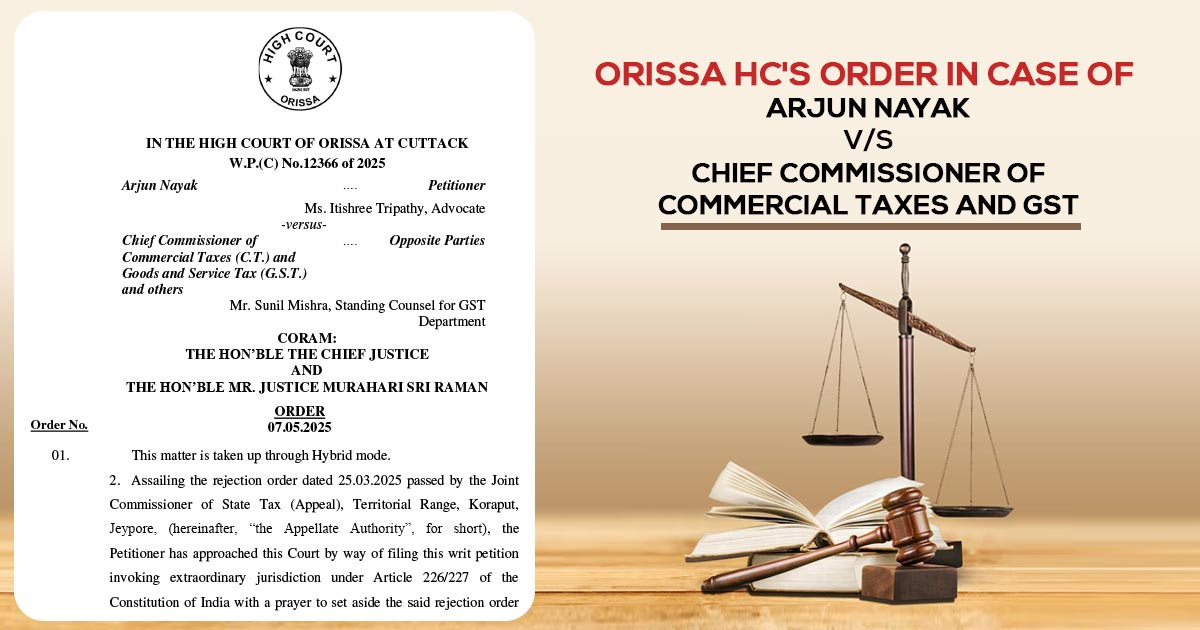

The Commissioner of State Tax (Appeal) rejection order was been contested by the applicant Arjun Nayak. The applicant striking the rejection order on 25.03.2025 passed by the Joint Commissioner of State Tax (Appeal), Territorial Range, Koraput, Jeypore, (“the Appellate Authority”), via filing writ petition approached the court invoking extraordinary jurisdiction under Article 226/227 of the Constitution of India requesting to set aside the stated rejection order to enable him to explain show-cause notice on 04.01.2025.

The applicant’s counsel, Ms. Itishree Tripathy, cited that the applicant is a registered person who is encountering a demand of Rs 14,86,164 based on the assessment specified under section 74 of the Odisha Goods and Services Tax Act, 2017 for 2019-20 vide order on 13.08.2024 against which an appeal was filed dated 11.12.2024 u/s 107 before the aforesaid Appellate Authority.

The applicant’s counsel furnished that though the appeal must be furnished within 3 months, i.e., on or before 12.11.2024, because of some uncontrolled situation, it can be furnished on 11.12.2024. The situation must be liberally considered via the appellate authority invoking discretion under the provisions of sub-section (4) of Section 106, as the appeal has been filed within the condonable period.

Read Also: Orissa HC Sets Aside Tax Penalty Order Under Section 74 for Overlooking Assessee’s GST Payments

The notice cannot be complied with, as the applicant was undergoing medical treatment during the same period in which the notice was issued through the appellate authority, asking to answer.

She said that if provided a chance to the applicant will be able to respond to the late filing of an appeal to the appellate authority. The appeal has been objected to by Mr. Sunil Mishra, Standing Counsel appearing for the CT & GST Department-Opposite Parties

The court opined that the applicant should be furnished a chance to explain that the delay took place because of the uncontrollable situation. It seems that the applicant has enough cause to file a plea beyond the period specified under sub-section (1) of Section 107 of the GST Act.

The rejection order issued via the Joint Commissioner of State Tax (Appeal), Territorial Range, Koraput, Jeypore has been set aside by the Chief Justice Harish Tandon and Justice M.S. Raman on 25.03. 2025 and asked the applicant to appear before the Appellate Authority on or before 17.05.2025 and file a reply to the notice in Letter No.52, on 04.01.2025.

| Case Title | Arjun Nayak vs. Chief Commissioner of Commercial Taxes and GST |

| Case No. | W.p.(c) No.12366 of 2025 |

| Counsel For Appellant | Ms. Itishree Tripathy |

| Counsel For Respondent | Mr. Sunil Mishra |

| Orissa High Court | Read Order |