GST council and GSTN offered normal GST RET 1 (Return) Form with revised details for all the normal taxpayers. The GST return forms have been officially released on the goods and services network (GSTN), giving taxpayers an idea of the new returns, filing process and formats. The new GST returns have been running on a trial basis since 1st January 2020, and the final version will go live from October 2020 as per the latest recommendation by GST council members.

After which all the forms i.e. ANX 1, ANX 2 will be implemented on a regular basis to all the taxpayer from October 2020.

Finally, in October 2020, all the taxpayers will have to mandatory file the new return forms including RET 1 and the older GSTR 3B will be phased out from the system.

The RET-1 form will also be applicable starting from October 2020 on a mandatory basis. The taxpayers are filing GSTR 3B right now and are for the taxpayers having a turnover up to 5 crores.

The revised return forms will effectively replace the existing GSTR-1, GSTR-2, and GSTR-3 returns for regular taxpayers which come up to 5 crore turnover.

Note: GST RET 1 form goes live on the GSTN portal with complete steps on a trial basis. Taxpayers are now required to check out the form and start validating their filing on the portal itself

Format and Filing Procedure of Normal GST RET 1 Return

The GST RET-1 (Normal) form has been divided into 7 parts.

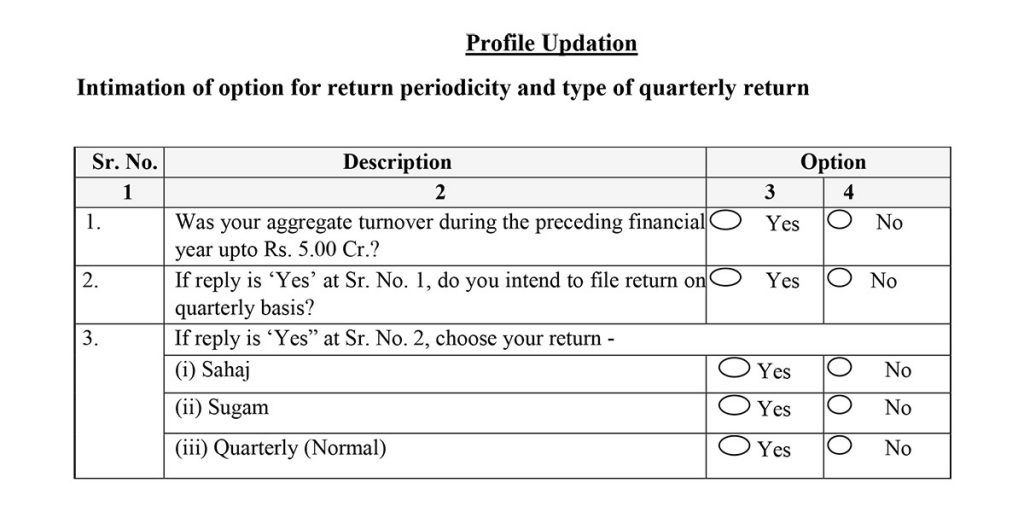

GST RET-1 Form Profile Updation

Intimation of option for return periodicity and type of quarterly return

In this section, the user needs to provide answers to a number of questions pertaining to their preferred options for return periodicity (monthly/quarterly) and the type of quarterly return (Sahaj/Sugam/Normal) they wish to file. Read the instructions carefully before providing your answers.

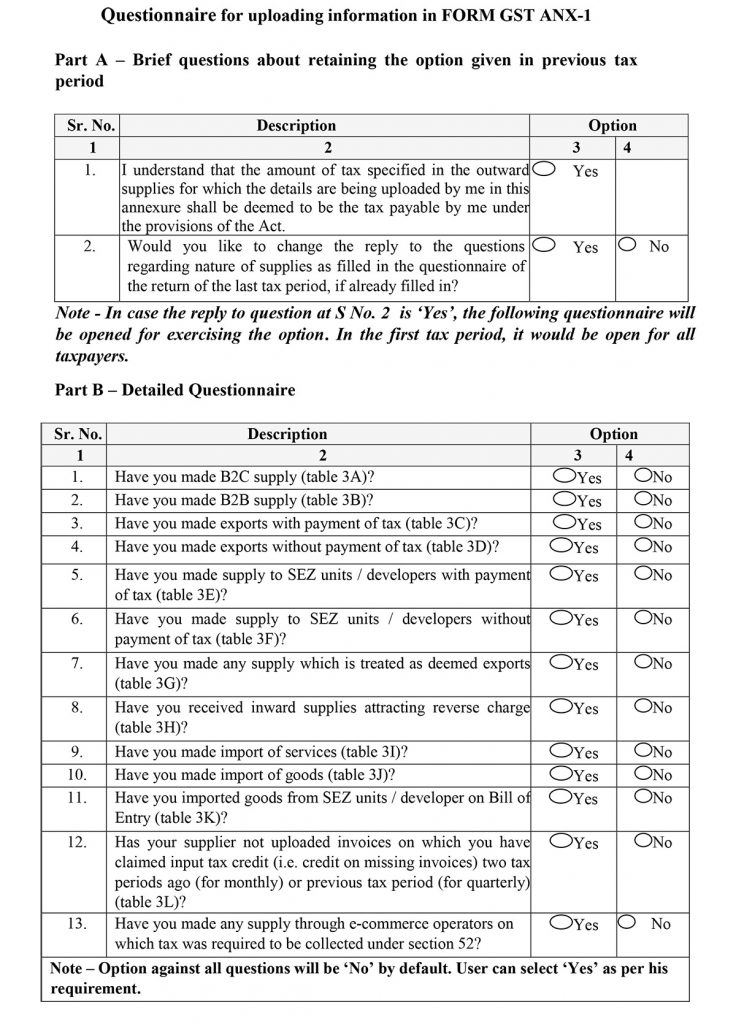

- In Part A, one needs to answer the questions about retaining the option given in the previous tax period.

- In Part B, questions must be answered about supply type, exports, supply to SEZ, etc.

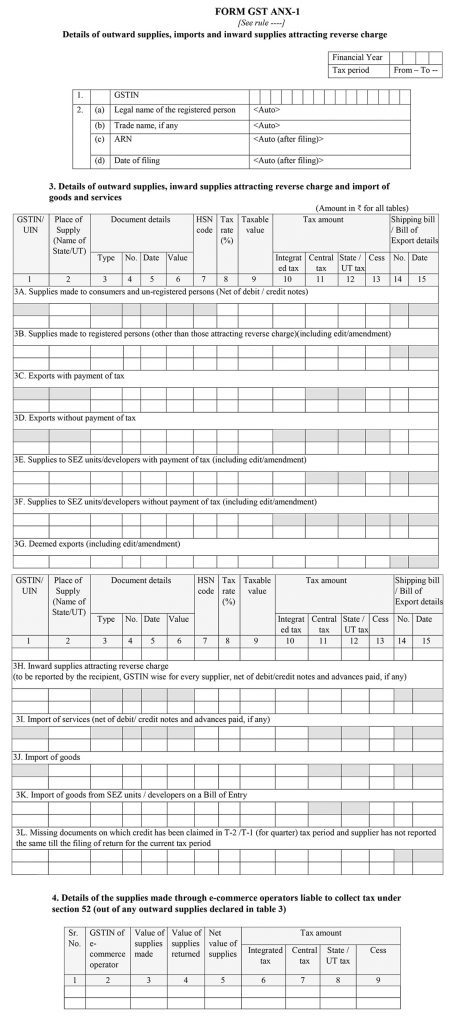

GST ANX-1 Form Format

This is the Annexure containing details of “Details of outward supplies, imports and inward supplies attracting reverse charge”

The form has 4 parts. In the first and second parts, a taxpayer is required to provide their GSTIN, registered person name, business name, ARN, and the date of filing. The details of the outward supplies, inward supplies attracting reverse charge and import of goods and services made by him/her during the particular tax period will be furnished in the next table. The fourth table contains the details of the supplies made through e-commerce operators liable to collect tax under section 52 (out of any outward supplies declared in table 3).

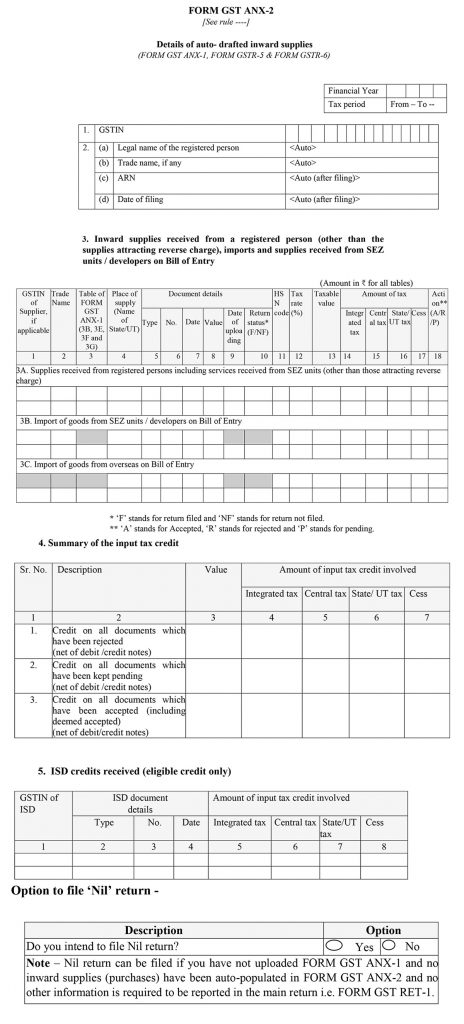

Format of GST ANX-2 Form

This is for Details of auto-drafted inward supplies (FORM GST ANX-1, FORM GSTR-5 & FORM GSTR-6)

There are 5 sections here. The taxpayer is required to provide details of the Inward supplies received from a registered person (other than the supplies attracting reverse charge), imports and supplies received from SEZ units/developers on Bill of Entry in table 3. Summary of an input tax credit (ITC) goes into the next field, while the last section contains the details of ISD credits received.

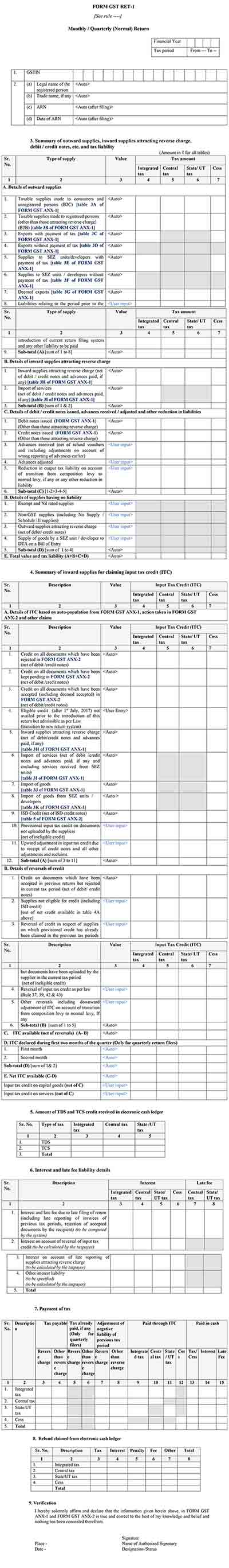

GST RET 1 Format for Monthly/Quarterly Taxpayer

This is the Monthly/Quarterly (Normal) return to be filed by the taxpayer. Details of outward supplies, inward supplies attracting a reverse charge, debit/credit notes issued, advanced received, supplies with no liabilities, and total supply value with tax liability will be provided here. The details of inward supplies for ITC claim, TDS/TCS amount received, interest and late fee, tax payment, refund claim, etc. will also be furnished through this return form.

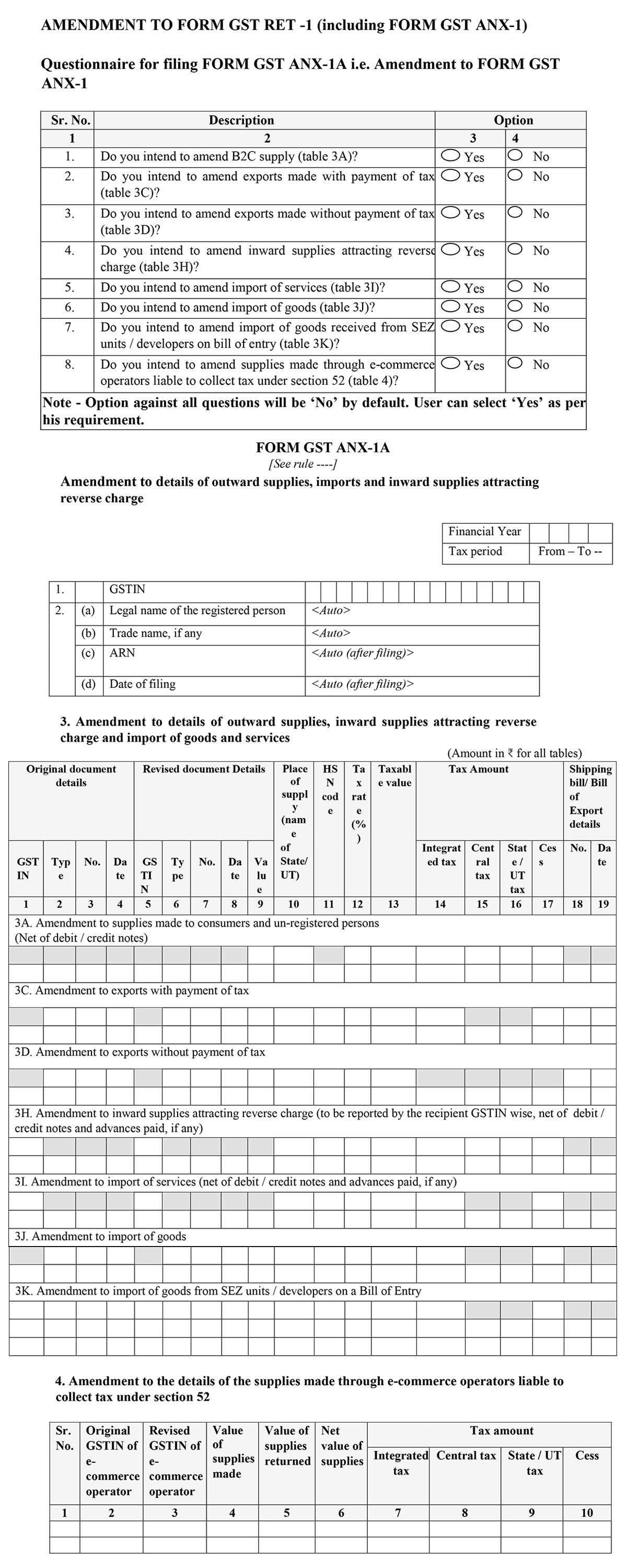

GST ANX-1A Amendments Form GST RET 1

This form is to be filed for making amendments in form GST ANX-1

The taxpayer needs to answer a basic questionnaire and then proceed to file the form for “Amendment to details of outward supplies, imports and inward supplies attracting reverse charge”

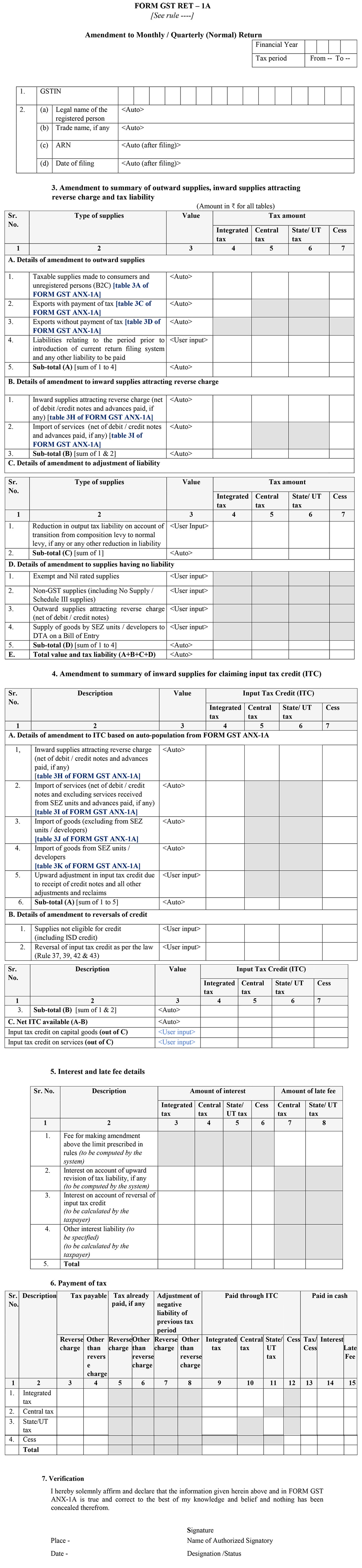

Form GST RET-1A Amendment to Monthly / Quarterly (Normal) Return Form

This form is to be filed for making amendments in form GST RET-1

In this form, the taxpayer will provide details of Amendment to the summary of outward supplies, inward supplies attracting reverse charge and tax liability, Amendment to the summary of inward supplies for claiming an input tax credit (ITC), Interest and late fee details, and Payment of tax.

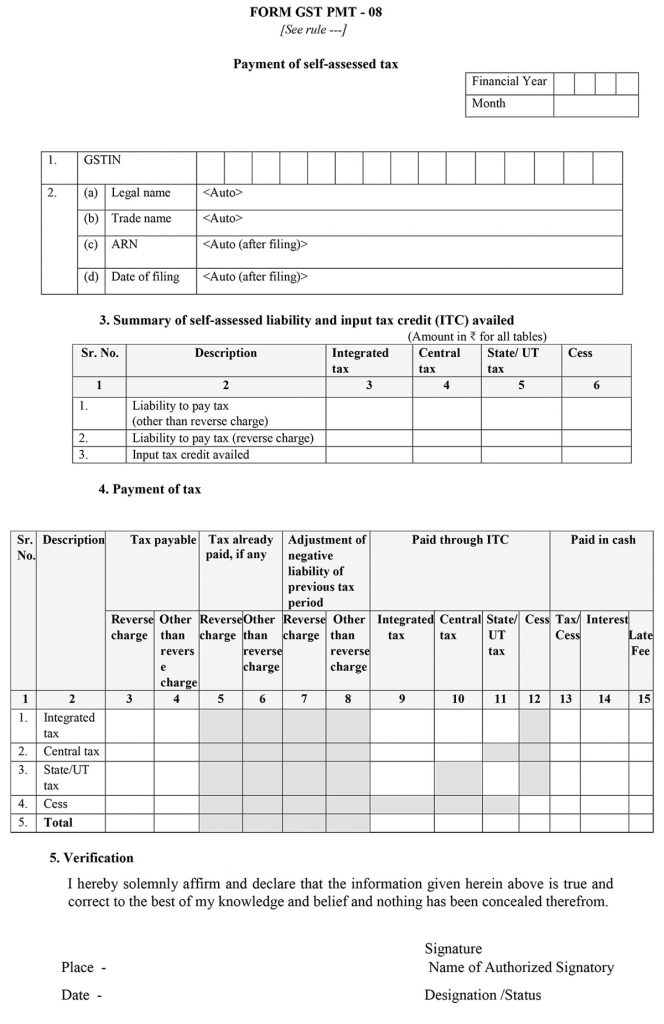

Form GST PMT-08

This form is to be filed for “Payment of self-assessed tax”

It contains details of Summary of self-assessed liability and input tax credit (ITC) availed and Payment of tax.

Convey to clients

Dear Sir, the accounting year 2018-2019 exempted sale 10000 show in GSTR-3B 11000 shown in GSTR-1 9000 please advice me how to correct this? ret up to July.2019 filed

with thanks

dear sir, I have claimed input on the basis of the bill available with me but some bill not uploaded by the counterparty. Please advise me should I reverse that input? some party did not respond to upload bill. Please advise me with thanks

You can claim an Input tax credit in accordance with the bill issued by the counterparty. there is no need for reversal.