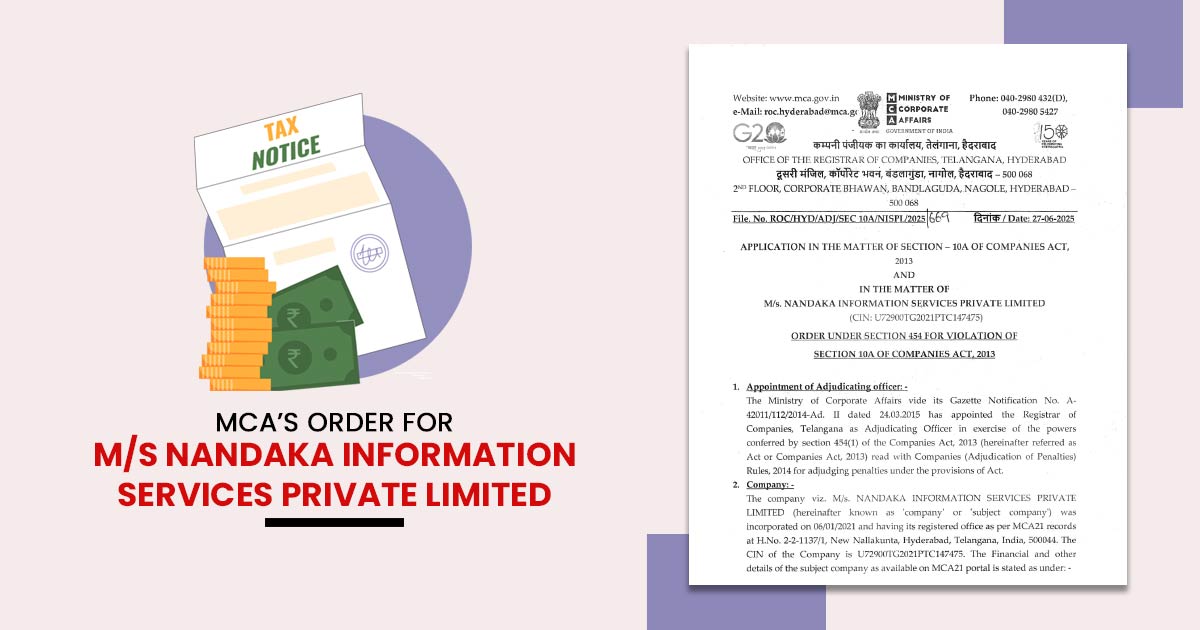

The Ministry of Corporate Affairs (MCA) has imposed fines on Nandaka Information Services Private Limited and its leaders because they did not keep a registered office as required by law. This is in line with Section 12 of the Companies Act, 2013, which states that companies must have an official office address.

The Registrar of Companies (ROC), Karnataka, issued a show cause notice under the facts on record following a physical verification of the registered address of the company. At the time of inspection, it was discovered that the company was not functioning at its declared registered office address.

This violates section 12(1), which states that every company must have a registered officer who is responsible for receiving and addressing all communications and notices.

A chance has been provided to the company, though they were not able to furnish an effective explanation for the non-compliance. The adjudicating officer arrived at the conclusion that the company has broken the regulatory provisions after analysing the submissions and validating the available data.

Read Also: Most Common MCA21, V2 & V3 Problems with Proper Solutions

The Registrar of Companies in Hyderabad has imposed a penalty of ₹1,00,000 on the company for some violations. Additionally, a fine of ₹50,000 each has been given to the Managing Director and another officer who was responsible for the issues. This action is based on specific laws governing company operations.

Based on the number of days of default till the date of the order, the penalty was computed.

Recommended: MCA Fines CA ₹50K for Failing to Report Auditor Resignation

ROC asked that the penalties be paid via the MCA21 portal within 90 days from the date of the order, and if not, then prosecution or recovery proceedings may be initiated. Also, it asked that the penalty levied for payment on the officers is to be from personal sources/income.

Read Order

Did you obtained prior approval of company and directors for publishing this in public domain ?