GST RET 1 form is newly introduced form by the GST council for the easy return filing of GST returns. The normal GST RET 1 form has arrived with the revised details and columns.

The new RET 1 form under GST has been released on the GST portal and is ready to be filed on a trial basis as per the guided steps. Along with the GST RET 1 formThe GST council and GSTN offered normal GST RET 1 (Return) Form with revised details for all the normal taxpayers. Read More, there are ANX1 and ANX 2 forms to be filed by the taxpayers.

The revised forms are relacing the old GSTR 1, GSTR 2 and GSTR 3 forms for GST return filing for the normal taxpayers who have a turnover of fewer than 5 crores.

These are the steps to start filing new RET 1 form under GST:

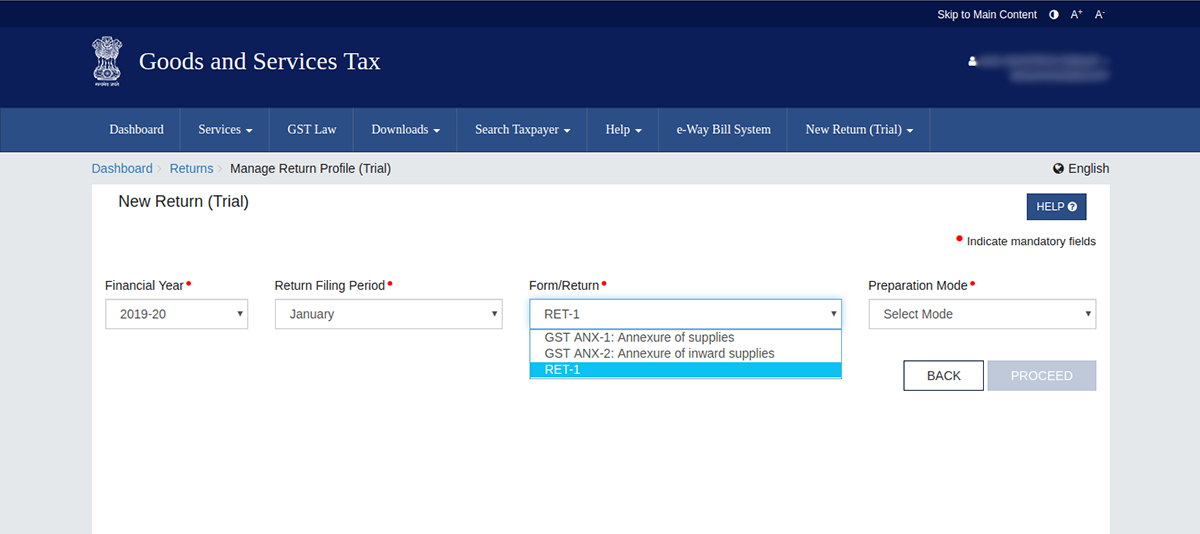

- First of all, open the portal of GSTN and click on New Return Tab.

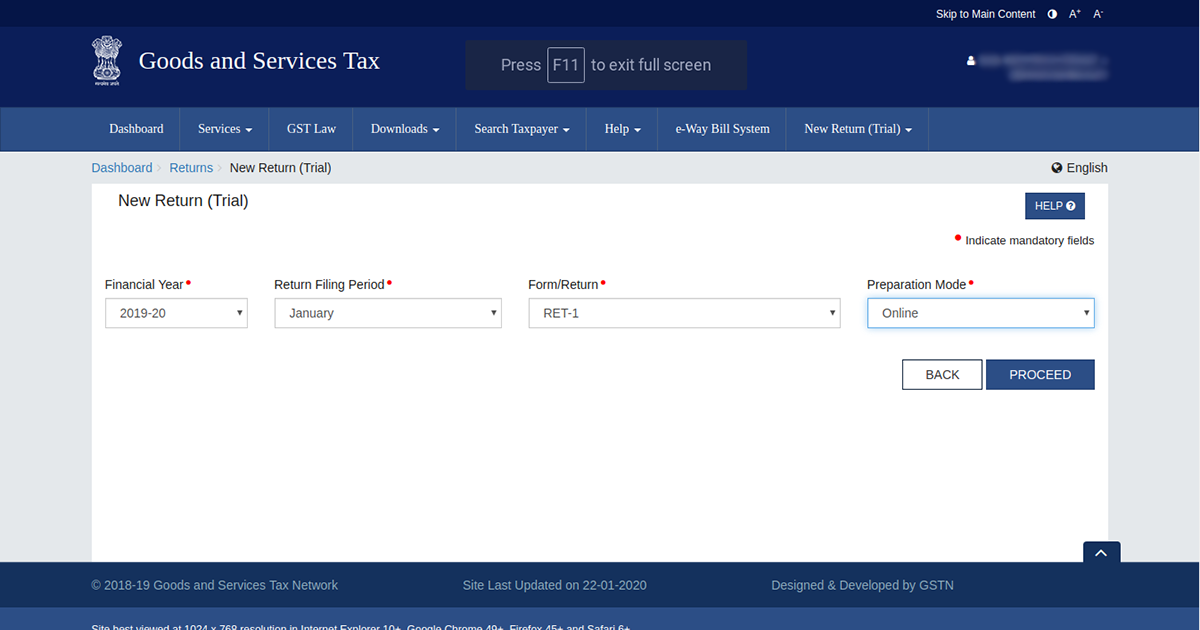

- Second, Select the Financial year, Opt for the return filing period and then RET 1 form while selecting the preparation mode ‘Online’.

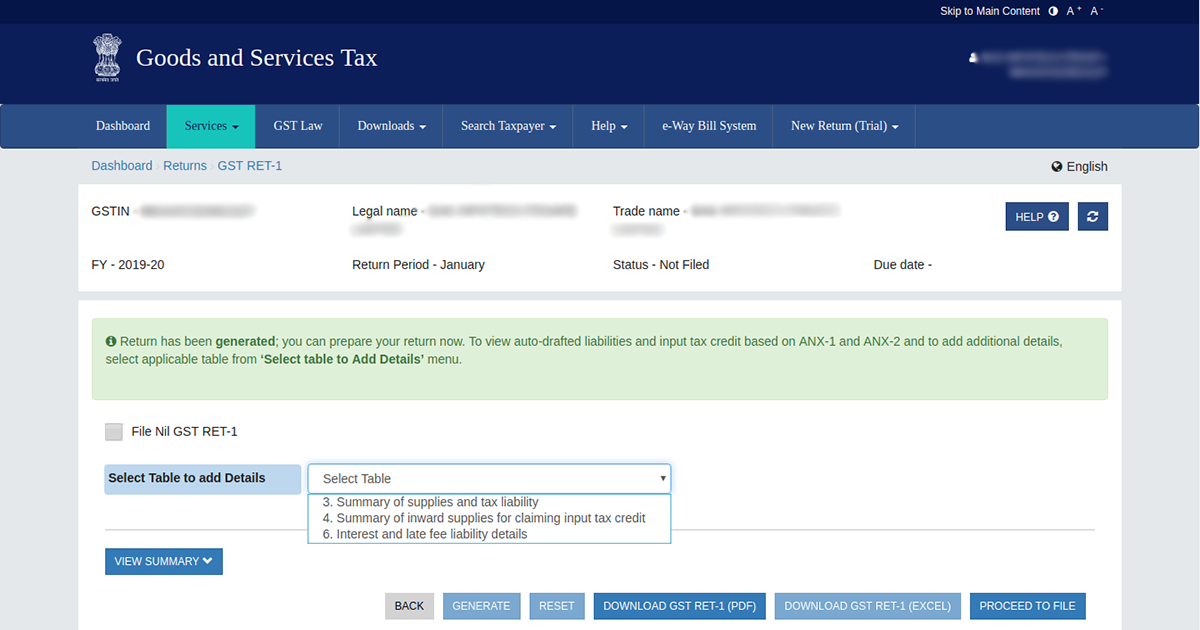

- Finally, the taxpayer will be able to start filing the GST RET 1 form with select details as per govt requirement.

GST return 3B was is queue to be replace but it is still exists.