What is New Income Tax E-form 71?

The Central Board of Direct Taxes (CBDT) via notification number G.S.R. 637(E) on 31st August 2023, has introduced a new electronic application Form 71 for the objective of crediting Tax Deduction at Source (TDS) by amending the Income Tax Rules, 1962.

These rules are called the Income-tax (Twentieth Amendment) Rules, 2023, and were effected from the 1st day of October 2023.

Read Also: Easy Guide to Claim TDS If Not Showing in 26AS/AIS/TIS Form

Importance of Form 71 for Addressing Incorrect TDS Filings

Form 71 has been introduced in response to numerous taxpayers encountering the problem of their taxes being deducted in the fiscal year when the income was actually paid before the taxpayer. Instead of declaring their income when it is credited or paid into their bank accounts, many individuals report it when it becomes due to them.

This discrepancy leads to a mismatch in the TDS credit. To address this issue, Form 71 is been issued by the CBDT, which simplifies the process of seeking reassessment of TDS, alleviating the difficulties people face when approaching the authorities for this purpose.

Time Limits to Using Form 71

The assessee under the Income Tax Act 1961 has a due date of 2 years to utilize Form 71 in order to amend the incorrect TDS credit issue.

What is the Method to Amend the Wrong TDS Filing?

Starting on October 1, anyone who wants to change the year of their TDS deduction can do so by getting in touch with the Income Tax Department directly.

Procedure to Submit Form 71

- Proceed to the e-filing portal of the income tax department on the link incometax.gov.in and download the form.

- Fill in the needed information along with the name of the assessee, PAN, and address the assessment year where the income was shown in the income tax return (ITR), the fiscal year where the TDS was deducted, the TDS amount deducted, and lastly the cause to claim the TDS credit.

- The claimant should duly sign the form and provide it to the tax council for the purpose of verification. The form should be validated via an electronic verification code (EVC) or with a digital signature certificate (DSC).

If the tax authorities determine that the claim is genuine, they will take action and give a refund.

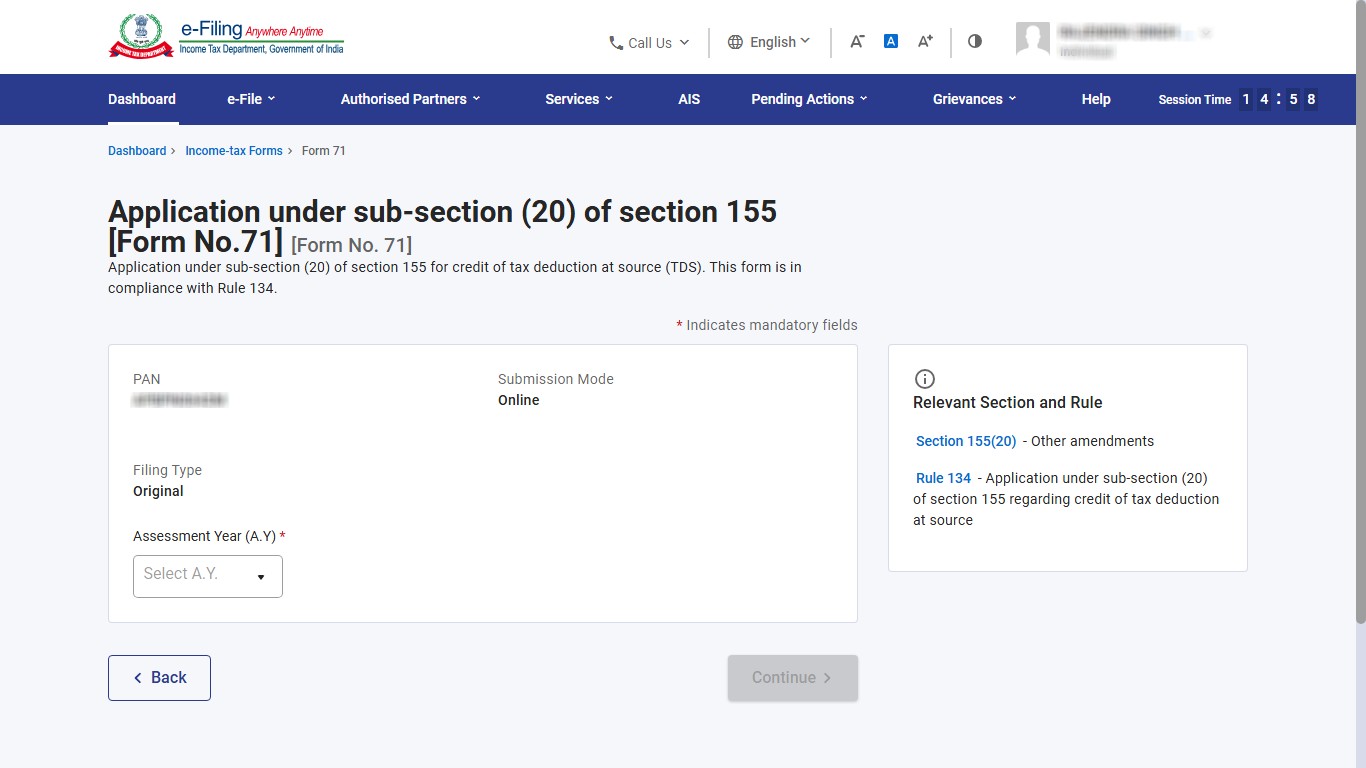

A New Income Tax Rule 134

A new Rule 134 is inserted after 133 which expresses regarding the Application under sub-section (20) of section 155 about credit of tax deduction at source. The taxpayer must make the application under sub-section (20) of section 155 will be in Form No. 71.

e-Form No. 71 Will Be Issued Electronically

Form No. 71 will be provided to the Principal Director General of Income-tax (Systems) the Director General of Income-tax (Systems) or the person authorized by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems).

Form No. 71, will get issued electronically, — (i) under a digital signature, if the income tax return (ITR) is needed to get provided under a digital signature; (ii) through an electronic verification code in a case not covered under clause (i).

According to the case, the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), mentioned the process to issue Form No. 71 as follows:-

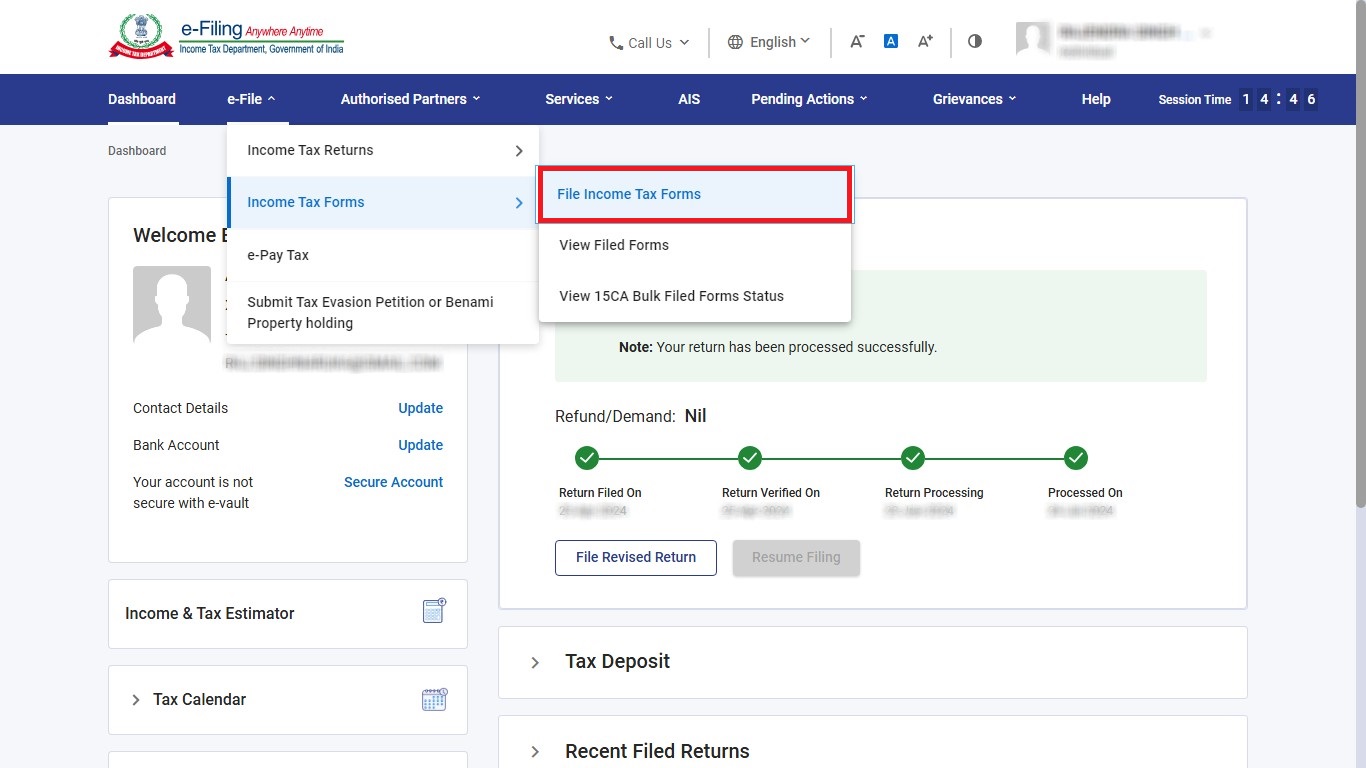

1. Login to https://www.incometax.gov.in/iec/foportal/

2. Go to E File -> Income Tax Forms -> File Income Tax Forms

3. Go to -> “Persons not dependent on any source of income” and Click on File Now on “Procedure for Assessment”

4. Select the Assessment year for Form 71 is being filed

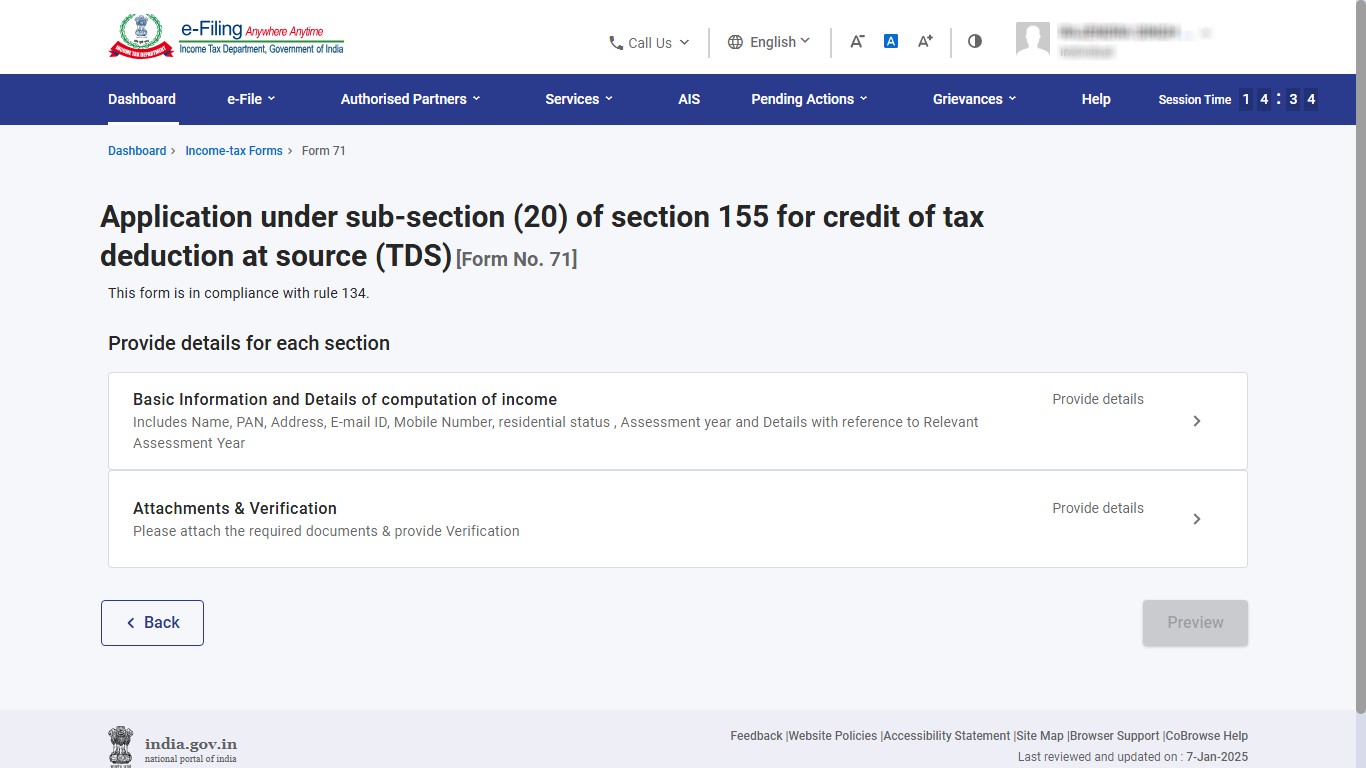

5. Click on Let’s Get Started and there are 2 tabs “Basic Information and Details of Computation of Income” and, Attachments and Verification.

6. Click on Basic Information and enter the details and Details of the Computation of Income.

7. Upload the supporting documents and Save.

8. Do E-verification via Aadhaar OTP, Bank EVC or Net Banking

Form No. 71 must be forwarded to the Assessing Officer by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as applicable, or by any individual authorized by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems).

is it possible to file form 71 in case of 16B (194AI) case. where income under capital gain was declared but TDS was not claimed as buyer had not filed TDS return. later it came in to notice. now question is in form 71 ” Column TAN of Deductor ” is mandatory feild. so how can we file form 71 if there is no TAN as the case is of Sec 194AI. where there is no TAN

When can we expect to available form 71 for claiming Tax credit, in genius software.. Any expected date ??

You can fill form 71 manually

we are trying to fill online form 71. But in form 71 our relevant assessment year i.e. AY 2024-25 is not appearing as we have shown income on mercantile basis in AY 2024-25 and tds was deducted in AY 2025-26.

can any one help why the AY 2024-25 is not appearing in form 71l

thanks in advance.

Contact to th Income tax portal.

Is it necessary that I should have claimed the TDS amount in my return in the year that I have shown the income. Since it was not reflecting in my 26AS, I did not claim the TDS amount in my return. However, I did account for the income. Can I still file Form 71. If not, what is the solution.

I have shown turnover of 50lakhs in FY 20-21 however tds on income of 40 lakhs will be deducted in next each 10 years … In 22-23 tds was deducted on 4 lakhs and on remaining 36 lakhs tds will be deducted in next 9 years

Which amount to be shown as specified income in form 71 whether 40lakhs or 4 lakhs only on which tds deducted in FY 22-23

“Form 71 enable taxpayers to claim TDS credit for income that has been declared in their income tax returns (ITRs) for a previous assessment year, but the tax was deducted at source (TDS) in a subsequent financial year.”

Whether Form 71 available under Genius? if yes, whether available under other forms?

Currently, Form 71 is not available in Genius software

Has any one filed Form 71 as on date? When we download csv template from the portal while filing form 71. it automatically logsout and do not allow to proceed further. also it is difficult to enter huge TDS credit line item wise without CSV