The ITAT Jodhpur has ruled that rectification under section 154 of the Income Tax Act, 1961, is allowable where an inadvertent mistake in tax return filing results in double taxation of the same income.

The appellant, M/s Jain Natural Pickles Private Limited, encountered a survey u/s 133A of the Income Tax Act, 1961, during which it voluntarily surrendered the income of ₹64,35,168 for the Assessment Years 2015-16 and 2016-17. From which ₹42,99,430 was already brought to tax in Assessment Year 2015–16 under Section 143(3).

The company, while submitting its return for AY 2016-17, accidentally proposed the whole surrendered amount again, rather than restricting it to the balance of Rs 21,35,738. The next rectification petition has been rejected by the Assessing Officer (AO), which was filed under section 154, citing that the correction was beyond the extent of “mistake apparent from record.”

Amit Kothari, a Chartered Accountant representing the appellant, argued that the inadvertent declaration of the entire amount resulted in impermissible double taxation. He pointed out that survey records clearly indicated that a significant portion had already been taxed in the previous year. Kothari contended that the rectification being sought was not a new claim or deduction, but rather a correction of an obvious mistake that was evident from the records.

Brij Lal Meena, Additional CIT-DR, representing the Revenue Authorities, supported the orders of the AO and Commissioner of Income Tax (Appeals) [CIT(A)], claiming that once the taxpayer had voluntarily proposed the income in its return, no rectification can be considered except through filing of a revised return. He emphasised the decision of the Supreme Court in Goetze (India) Ltd. v. CIT (2006) 284 ITR 233, which restricted the AO from considering fresh claims outside revised returns.

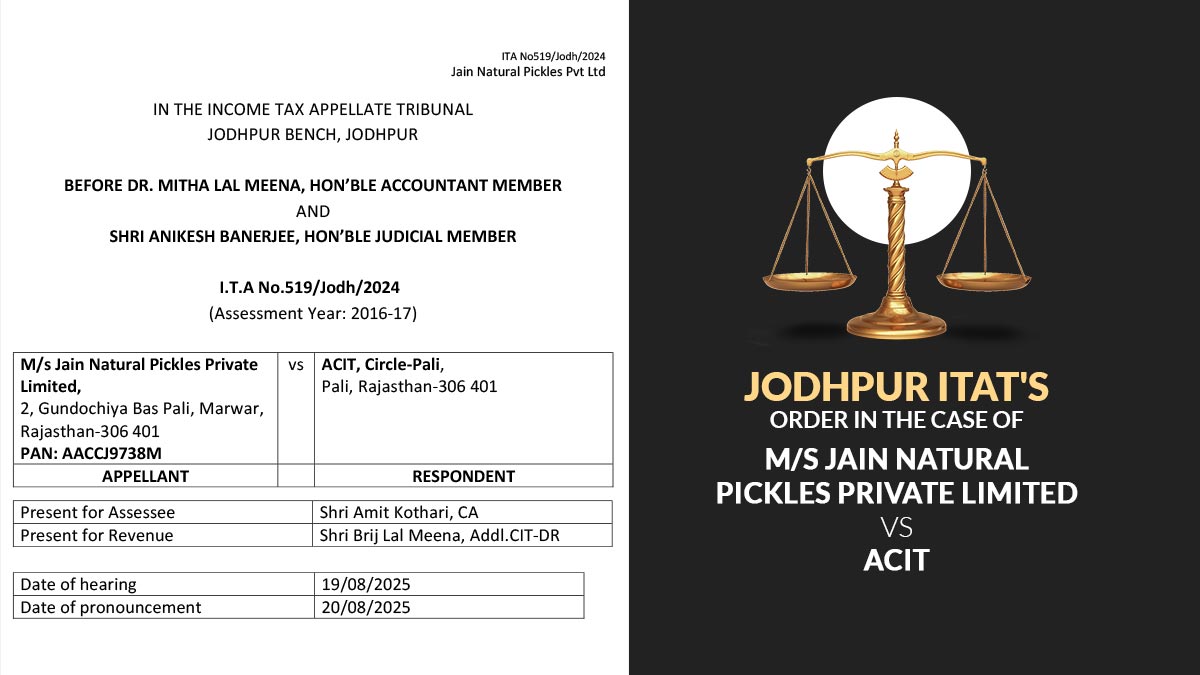

The Bench, including Anikesh Banerjee, Judicial Member, and Dr. Mitha Lal Meena, Accountant Member, ruled in the taxpayer’s favour. It distinguished the Goetze (India) ruling by citing that the present case was not about making a new claim but revamping an error that resulted in double taxation.

The survey and assessment records of Assessment Year 2015-16 show that ₹42,99,430 was levied, and subjecting the same amount again in AY 2016-17 was impermissible, the bench observed.

This documentary evidence of survey records u/s 133A and the completed assessment order u/s 143(3) for AY 2015-16, directly affected the application of Section 154, as it exhibited a mistake apparent from the record warranting rectification.

As per that, the AO asked to restrict the addition to 21,35,738 and delete the balance amount.

Hence, the appeal was permitted.

| Case Title | M/s Jain Natural Pickles Private Limited vs ACIT |

| Case No. | I.T.A No.519/Jodh/2024 |

| Assessee by | Shri Amit Kothari, CA |

| Revenue by | Shri Brij Lal Meena, Addl.CIT-DR |

| Jodhpur ITAT | Read Order |