The assessee is provided with the lower tax refunds concerning their claimed figures towards furnishing the ITR of FY 2023-24. The reason behind that is the latest income tax portal does not acknowledge the full tax credit available in Form 26AS towards these tax return filers. In this situation, the assessee would furnish a rectification request beneath section 154 of the Income-tax Act, 1961 to avail of the balance tax refund.

What is Rectification Request U/S 154?

After furnishing the ITR the income tax department processes the return and gives a circular. The circular includes the information on the return furnished by the taxpayer and the figures which the department holds.

If there is any mismatch that is the demand or more refunds with respect to what you availed in the return then you would perform the mentioned objective:

- File a Rectification Request under Section 154

- Agree with the Demand and Pay the Tax

What Kind of Errors Could be Amended Through Filing the Rectification?

Beneath section 154(1) income tax department permits a rectification request to amend the errors when there is an obvious error in your ITR.

The mentioned errors will be handled by filing the rectification request on the Income-tax portal:

- An Error of Fact

- An Arithmetic Mistake

- A Small Clerical Error

- An Error Due to Overlooking Compulsory Provisions of Law

There are some instances of these errors:

- A Mismatch in Tax Credit

- Advance Tax Mismatch

- Gender Cited Wrongly

- Further Information not Submitted for Capital Gains at the Time of Filing Return

Do not utilize the rectification request to amend the bank account or address information of your ITR.

When Could a Rectification Request be Furnished?

Only towards the returns, the rectification request would get furnished that are formerly processed in CPC Banglore. A rectification shall not be filed if there is a change in the income on rectifying the mistake. Towards the concern, an amended ITR must be furnished. No newer deductions or exemptions would be permitted to avail.

Who Furnishes the Rectification Request?

A rectification request would be furnished by you or the income tax authority could upon its own amend the mistake and is obvious.

Should the Rectification Request be Furnished Online?

If the ITR was furnished online then the online rectification needs to get furnished.

Below is the procedure to furnish the rectification request upon the latest e-filing tax portal on the website of the income tax departments.

Steps to File Tax Rectification Request Under Section 154

Step 1: Log in to the e-filing portal using your valid user ID and password.

Step 2: Under Services, click Rectification Request on the ITR new portal.

Step 3: On the Rectification page, click New Request.

Step 4a: PAN will be auto-filled. Choose the Income Tax or Wealth Tax from the drop-down menu. In this, we shall opt for the income tax.

Step 4b: Choose the Assessment Year from the dropdown. Tap Continue.

Note: One should furnish the current intimation reference number towards the income tax and tap continue if you opt for the wealth tax option.

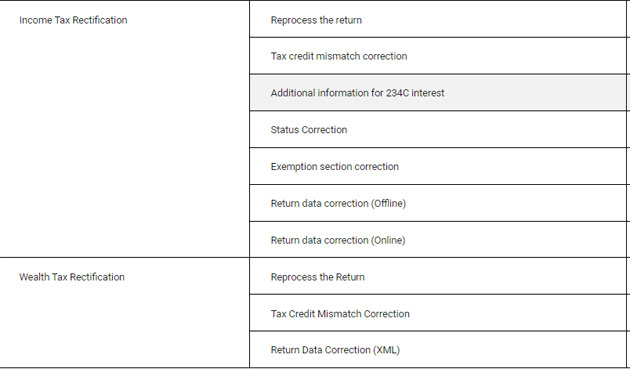

Step 5: Rectification requests contain the subsequent classification: Income tax rectification towards the Tax Credit Mismatch Correction

Choose the Request Type as Tax Credit Mismatch Correction

Step 6: The schedules towards the request type get automatically filled up as per the records in the processed return. To edit or delete a schedule, choose the same and then tap edit or delete.

Step 7: Tap Continue to submit the request.

Step 8: The taxpayer shall be carried to the e-verification page upon submission.

You must ensure to e-verify the request towards rectification on the new ITR portal.

Essential Notes for Rectification Request Under Section 154

Post 4 years from the finish of the Financial year where the intimation u/s 143(1) was passed, one is not subjected to pose out the rectification request in the income tax.

- If you utilized DSC (Digital Signature Certificate) to e-verify your Income-tax return, you should indeed practice DSC to e-verify your rectification request. Your DSC must be active, not expired, and registered through e-filing. If one does not then he will be rendered to the register or Update Digital Signature Certificate (DSC) page to execute that.

- The rectification request shall not be amended by anyone, and also one is not able to withdraw it. One would submit an additional rectification request post to manage the initial rectification request in CPC.

- The request for the rectification is only entitled to the returns that have previously been processed by the CPC.

- The prescribed cases would furnish the rectification request on the e-filing portal if they obtain the order or notice from the CPC beneath section 143(1): Registered taxpayers ERIs (who have added client PAN); Authorized Signatories and Representatives.

i have paid tds under two different TAN NUMBERS,but it got reflected under one tan number while filing returns.so i got demand notice for a portion of the it already paid under another tan. it is clearly shown in the 26as.pls.guide me how to file rectifiation under tax credit mismatch category i want to show the two different tans.

I received rectification order under 154 for AY2021-22 due to incorrect TAN entry.

However there is no rectification option for “Tax Credit Mismatch” reason on new portal.

What option to use for tax credit mismatch rectification ?

I am a Tax consultant. I have to file a rectification return for a customer who file the return self. He is a bank employee and he got an amount od Rs 250000 as arrear in the year 20-21 . The arrears for 3 years. he filed the return without calculating arrear and without filing form 10E. In addition to that certain deductions are not entered in the return and so huge amount of tax is paid. Now he wish to correct the return . But while trying to file the rectification request under section 154 “data correction online ” is not found in the drop box. In data correction off line mode it is insisted that any new income and deduction is not to be entered. How can I file the return so as to get the refund amount.

You can’t file the Rectification Request as new income and deduction not allowed there and also you can’t file an updated return as Updated Return is not allowed in Refund Case as well. You can only file a Revised Return for the case but the time for the same has expired. So, you have to contact to Income Tax Department for this.