The Income Tax Department recently issued an important message to taxpayers, emphasising the importance of safeguarding personal information such as PAN numbers on social media platforms to prevent potential misuse.

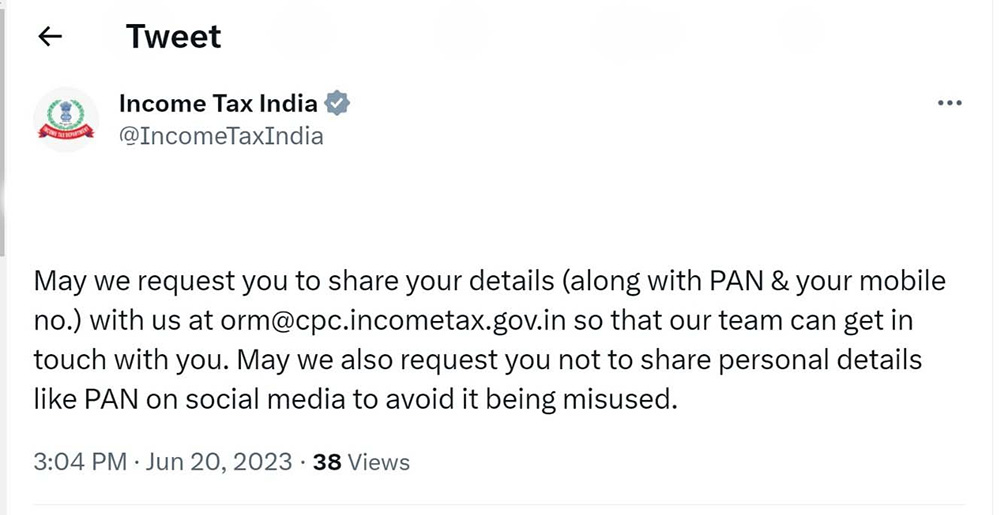

Responding to a taxpayer’s query on Twitter regarding difficulties encountered while filing income tax returns through the official e-filing system, the department advised against sharing sensitive details, including Permanent Account Number card, on social media platforms. The department tweeted:

In a similar vein, the Central Board of Indirect Taxes and Customs (CBIC) has also alerted the public to the risks associated with disclosing PAN and Aadhar information. According to a recent press release by CBIC, unscrupulous individuals exploit unsuspecting individuals, particularly those from disadvantaged backgrounds, by enticing them to Aadhar Seva Kendras where their fingerprints are obtained.

Important: 26K+ GST Offences Report INR 3.11 Lakh Crore Fraud in India

Subsequently, these fraudsters fabricate legitimate organisations using different numbers. By modifying the Aadhar-linked phone number, control of the card is transferred to the perpetrator, while the actual owner remains unaware of the threat. The victims remain oblivious to the fact that a mobile phone number can be utilised to manipulate their Aadhar details.

Furthermore, the Union government has highlighted instances where shell businesses have fraudulently generated multiple counterfeit Aadhar cards using a single photograph, primarily to obtain fictitious GST registrations. Consequently, unsuspecting individuals face significant risks should government authorities investigate potential tax evasion cases.

It is imperative for taxpayers and the general public to exercise caution and protect their personal information, including PAN and Aadhar details. Remaining vigilant and refraining from sharing sensitive data on social media platforms can help mitigate the risks associated with identity theft and fraudulent activities.