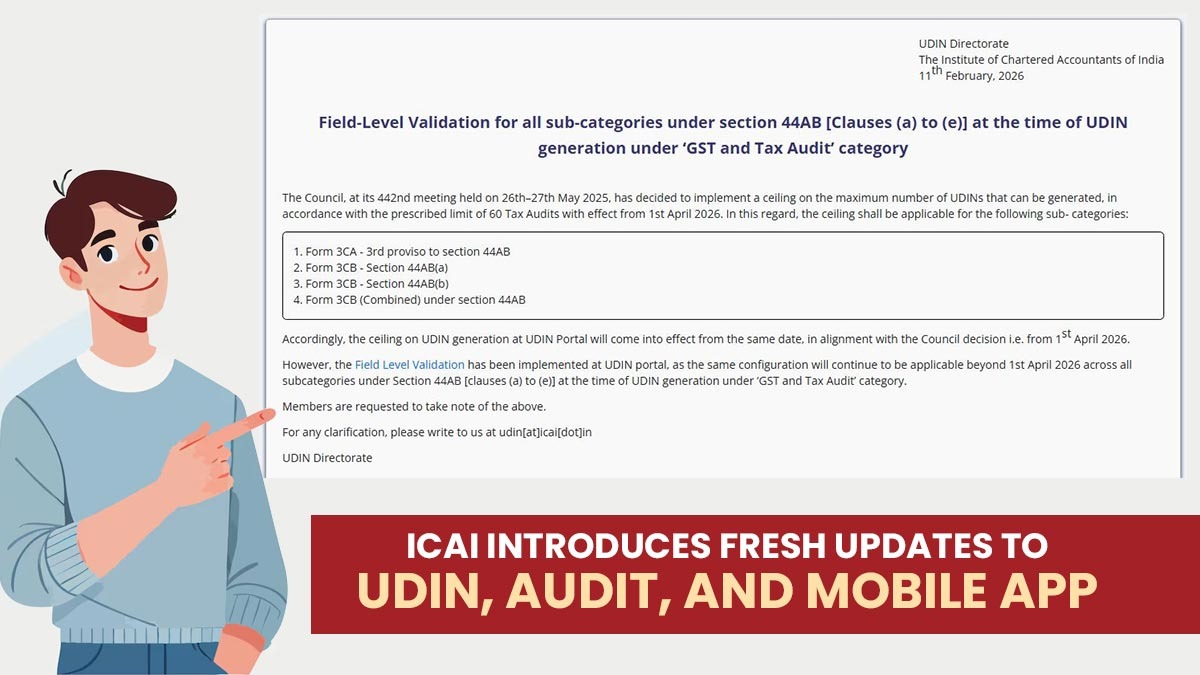

The UDIN system updates have been introduced by the Institute of Chartered Accountants of India (ICAI). The purpose of these revisions is to enhance transparency and ensure effective compliance. The amendments are listed below:

Implementation of Audit Ceiling

From April 1, 2026, a strict limit on the number of tax audits each member can do will be there. Each member shall be permitted to complete up to 60 tax audits, and this limit will be monitored via the UDIN portal to ensure no one exceeds it.

UDIN App for Mobile

On February 6, 2026, ICAI released the UDIN mobile application for Android and iPhone users. UDIN Mobile application permits the ICAI members to form and check UDIN numbers from their phones, anytime and anywhere.

Validations of Field-Level

ICAI has made new field-level checks while generating UDIN for GST and tax audit reports. Such checks shall ensure that the inserted information complies with the mandated norms, such as turnover limits, cash transaction percentages, and requirements pertinent to sections such as 44AD, 44ADA, 44AE, 44BBB, Cash Criteria, and more.

The objective of the new field-level validation is to prevent errors, confirm effective complaince and make the process of UDIN precise and reliable.

More Information