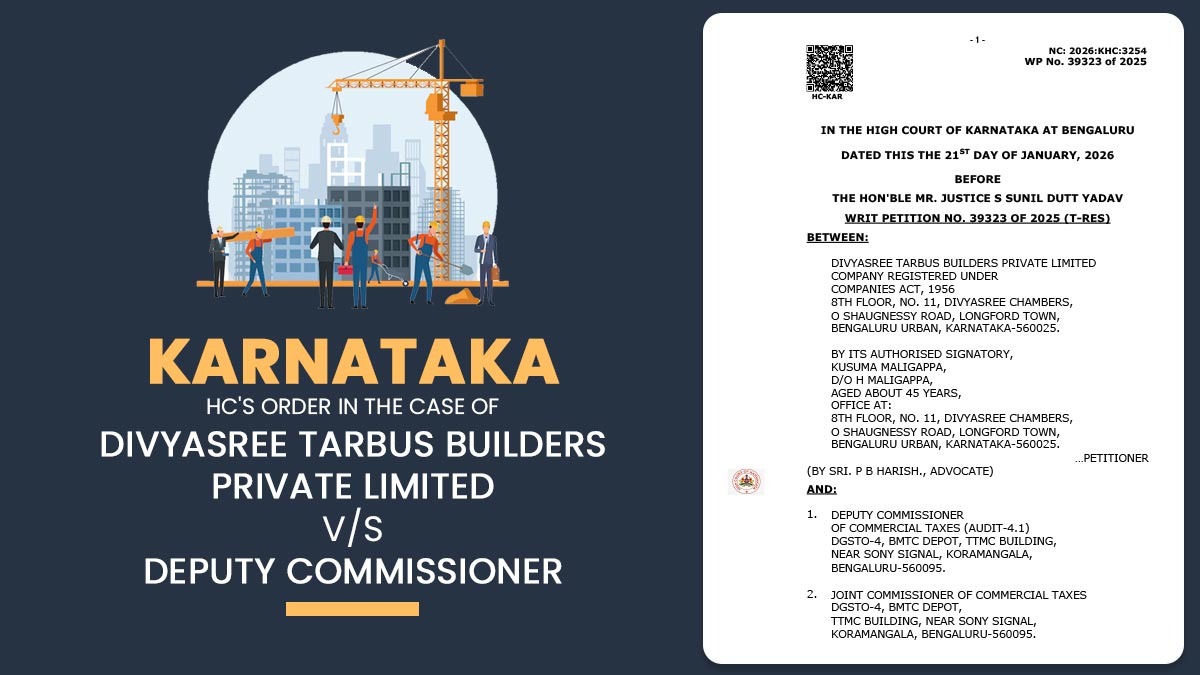

The Karnataka High Court has ordered the State tax authorities to refund the GST amount they recovered from Divyasree Tarbus Builders Private Limited, after retaining only the mandatory deposit required under Section 112 of the Central Goods and Services Tax (CGST) Act, 2017.

A panel led by Justice S. Sunil Dutt Yadav has determined that, based on the unique details of this case, the applicant is eligible for the benefits outlined in a specific government circular. This Circular No. 224/18/2024-GST provides protection against collection actions for taxpayers who express their intent to appeal before a new GST Appellate Tribunal, which has not yet been established.

Under Article 226 of the Constitution, a writ petition was submitted seeking a writ of mandamus, asking the Deputy Commissioner of Commercial Taxes (Audit-4.1) to sanction the refund of the amount recovered as per the summary of demand.

The applicant company had contested an order of the appellate authority and appealed to pursue a regulatory appeal u/s 112 of the CGST Act. But, because of the non-constitution of the GST Appellate Tribunal, the appeal procedure was not operational.

The applicant, relying on Circular No. 224/18/2024-GST, claimed that recovery proceedings must not have been initiated once an undertaking or declaration to submit a plea had been provided. According to paragraph 6 of the circular, where a taxpayer furnishes an undertaking to file an appeal and complies with the pre-deposit requirement, recovery proceedings should not be initiated.

Even after the same department moved to recover the demand shown in the summary of demand (Annexure-C), pressing the applicant to ask for the refund of the recovered amount, including consequential interest.

The writ petition has been countered by the State, claiming that the benefit of the circular was conditional. Taxpayers should deposit the regulatory pre-deposit amount u/s 112 of the CGST Act, and the taxpayer needs to deliver a formal undertaking to the proper officer.

As per the department, the applicant did not comply with such obligatory preconditions, and thus recovery was validly commenced. The High Court Government Pleader mentioned that the question of refund with interest did not emerge in the absence of compliance with paragraph 6 of the circular.

The Court stated that the applicant did not provide an intimation (Annexure-D) before the appellate authority within 7 days of communication of the summary of demand showing its desire to submit a plea.

While the Revenue urged that the undertaking needs to have been made to the proper officer, the applicant mentioned that it was willing, without bias to its legal rights, to authorise retention of the statutory pre-deposit and not insist on interest for the refunded amount.

Acknowledging such submissions and the objective of the GST circular to avert coercive recovery in the period when the Tribunal is not constituted, the Court embraced a pragmatic guideline.

Justice Yadav said that, in the facts of the case, the intimation provided via the applicant can be considered adequate compliance with paragraph 6 of the circular.

The HC disposed of the writ petition with various directions. The authorities will refund the amount recovered as per the summary of demand (Annexure-C). Post withholding the pre-deposit amount as specified u/s 112 of the CGST Act. Within 4 weeks of the receipt date of the certified copy of the order.

The Court recorded that the applicant had withheld its claim for interest on the refunded amount.

Read Also: How Modern GST Software Keeps Your Financial Data Safe

The Court specified that the order was passed in the peculiar facts of the case and need not be considered as laying down a binding interpretation of paragraph 6 of the circular. All regulatory claims were kept open.

| Case Title | Divyasree Tarbus Builders Private Limited vs. Deputy Commissioner |

| Case No. | Writ Petition No. 39323 OF 2025 (T-RES) |

| For Petitioner | Sri. P B Harish. Advocate |

| For Respondent | MT. Jyothi M Maradi, HCGP |

| Karnataka High Court | Read Order |