Taxpayers can now make GST payments using the Unified Payments Interface (UPI) and debit/credit cards introduced under the Goods and Services Tax Network (GSTN). This decision is expected to ease tax compliance by offering faster, more flexible, and user-friendly payment options.

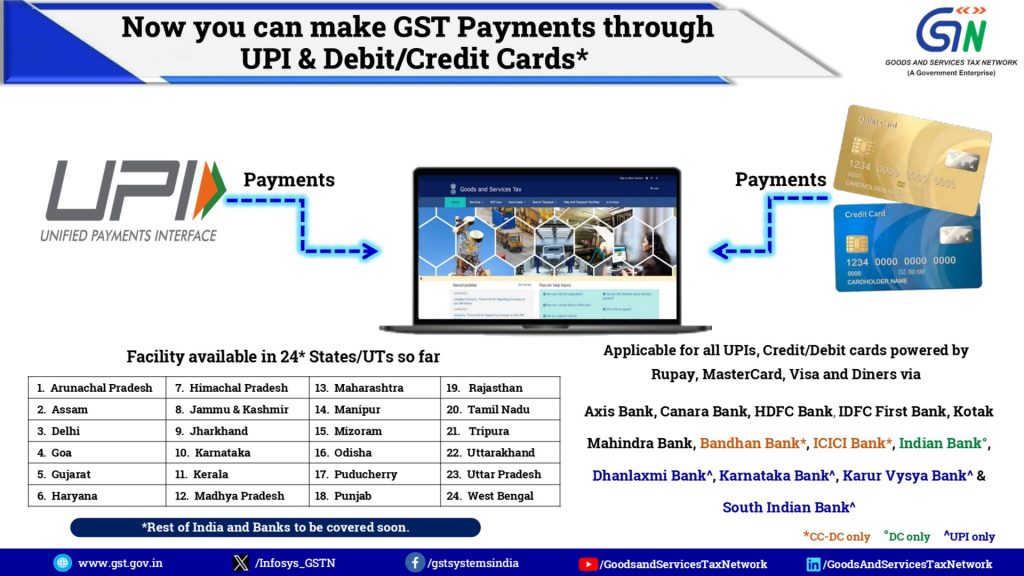

In 24 States and Union Territories, including Delhi, Maharashtra, Karnataka, Gujarat, Tamil Nadu, Kerala, West Bengal, Assam, and Uttar Pradesh, the facility is live. In this list, Mizoram was also added with Debit Card payments enabled through Indian Bank and UPI payments available through South Indian Bank. GSTN confirmed that the remaining states and banks will be onboarded in phases.

Accessibility has been ensured to taxpayers as the initiative supports all major payment networks-RuPay, Visa, MasterCard, and Diners. Through several leading banks, including Axis Bank, HDFC Bank, ICICI Bank, Canara Bank, IDFC First Bank, Kotak Mahindra Bank, Bandhan Bank, Indian Bank, Dhanlaxmi Bank, Karnataka Bank, Karur Vysya Bank, and South Indian Bank, payments can be routed.

The applicability of payment methods varies across banks: ICICI Bank and Bandhan Bank allow credit card payments, whereas Karnataka Bank and South Indian Bank currently offer only UPI services.

GSTN, through the introduction of the same facility, has expanded the payment options apart from net banking and over-the-counter challans, which makes tax payments as simple as everyday digital transactions.

In the government’s “Digital India” vision, this reform specifies another milestone, reinforcing transparency, efficiency, and seamless compliance for millions of businesses and individual taxpayers.

Taxpayers who desire to learn more and to access the facility can visit the official GST portal.