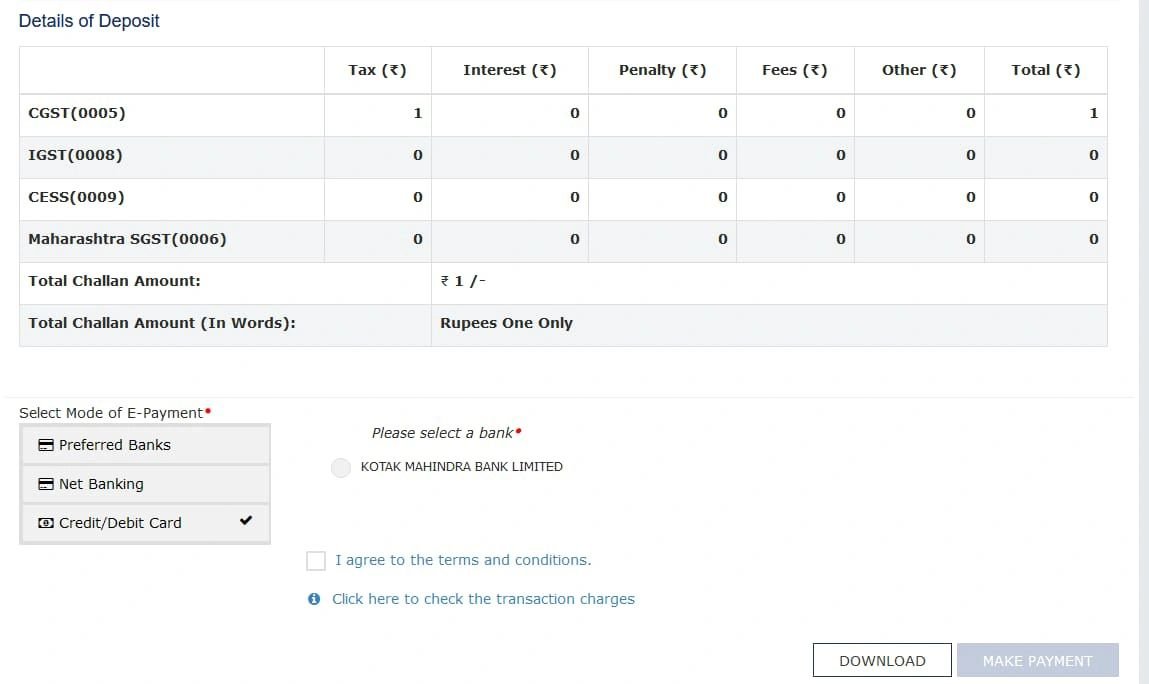

The latest update on the Goods and Services Tax (GST) portal introduces a new functionality allowing GST payers to use debit or credit cards via the Kotak Mahindra Payment Gateway. Presently, the portal exclusively accepts cards through the Kotak Mahindra Gateway, but there are plans to include more Credit Card options soon.

Fill Form for GST Compliance Software

Latest Update

- “Manipur taxpayers can now make GST payments via UPI and credit/debit cards.” View More

- “Punjab and Uttarakhand taxpayers can now make GST payments via debit and credit cards. View More Also, the department has added a new TMB bank for the taxpayers.” . View More

- “Arunachal Pradesh taxpayers can now complete GST payments via UPI and debit or credit card facilities at the official GST portal”. View more

- “IDFC First and Bandhan Bank have now enabled GST payment via Credit/Debit Card at the official portal.” View more

- “GSTN updated its payment procedures to make people pay using UPI, and credit/debit cards, with the help of Axis and Karnataka Bank.” Read more

- “GSTN department enables the GST payment via UPI, debit card and credit card for West Bengal taxpayers.”

- “HDFC Bank now allows UPI and debit/credit card payments for GST at the official portal.” View more

- “Jammu & Kashmir taxpayers can now make GST payments via UPI and debit or credit card facilities.” View more

- “For taxpayers, the GST department has added a new bank, Dhanlaxmi to facilitate GST payments on the official portal.” View more

- “The GST department has added more banks to make a GST payment at the official portal.” View more

- “The GST department added a new state Uttar Pradesh for UPI facilities and CC/DC payment.”

- “Four additional states have been included (Jharkhand, Karnataka, Rajasthan and Tripura) to provide Credit Card, Debit Card, and UPI facilities for GST payment.”

- “Kotak Mahindra bank users can make GST payments via UPI facility in selected 10 states.” View more

The portal offers both online and offline payment avenues. While generating the GST challan (PMT-06), businesses need to choose their preferred mode of GST payment. Factors to consider include the time remaining before the GST return due date, convenience, the selected bank, and other pertinent factors.

For the GST payment as of now, the active online methods are net banking, Immediate Payment Services (IMPS), and UPI. The payment through a debit card or credit card is indeed enabled.

The available method of online/offline GST payment consists of over-the-counter (OTC) options like cheques, demand drafts, and cash. Also, NEFT or RTGS are accepted.

To make a payment using a Credit/Debit Card, users are required to follow these steps:

- Select the E-payment option

- To make an electronic payment, go to the E-Payment section and select the Credit/Debit Card option

- Please choose the bank that you would like to use for the transaction

- To proceed, kindly tick the box to indicate your agreement to the terms and conditions

- To finish the transaction, please click on the “Make Payment” button

Why only Kotak Mahindra credit cards