Keeping in mind the end goal to encourage the little taxpayers, who don’t have admittance to internet banking offices, the government of India has thought over the GST Online Payment and offered the choice of Over the Counter (OTC) instalment has likewise been proposed under the GST administration. Be that as it may, a point of confinement of gthe reatest tax instalment of Rupees 10,000 has been settled on the challan.

The approved banks would be required to redesign their IT software with a specific end goal to acknowledge the OTC instalments under GST. In the talks regarding the matter, it was guaranteed by RBI that the looking of OTC instalments would be finished by the e-FPBs alongside the online tax instalment scroll. The partners in this installment procedure are the same as in the online tax installment system.

Starting with the GST Online Payment Guide as one should take care of some points. The conclave held at the national capital and being headed by Revenue Secretary Hansmukh Adhia cleared some emerging question ahead of GST. The meeting stated some significant provisions in the tax reform and legislation as the revenue secretary Adhia mentioned that GST council holds powers to make final decisions.

The conclave state some points like, all the transactions will be recorded in electronic mode only and the tax can be deposited by the means of internet banking, NEFT/RTGS, debit/credit card or over the counter, whichever is feasible. This has been done to restrain the money, cheques or DD based exchanges in the system.

With this, it was also specified that the returns will be granted within the time period of 60 days. The GST council made some clear instructions regarding the payment which are aforementioned and must be ensured perfectly applicable.

Now, here if notwithstanding for the OTC instalment, the taxpayer should get to the GSTN (Goods and Services Tax Network) online for the era of the challan through which the instalment is to be made. Other than the points of interest in the taxes to be paid, the taxpayer will likewise fill the subtle elements of the approved bank branch where he will make the instalment.

On the off chance that the DD or check number is not accessible ,he can spare the incompletely filled challan and refill the points of interest at a later stage. Outstation checks are not prone to be acknowledged. When every one of the subtle elements is filled in the challan, the taxpayer will produce the challan for an installment of taxes. No change is conceivable after the challan has been produced and it will stay substantial for seven days.

The challan will have the novel Common Portal Identification Number (CPIN). The taxpayer can take the printout to copy and store it at the (filled in) approved bank branch alongside the money, DD or check. The copy duplicate of the challan will come back with an accepting stamp, Branch reference number (BRN) and CIN to the taxpayer.

For encouraging the GST installment the approved bank will acknowledge a solitary instrument from the taxpayer under the OTC installment alternative. They will store the sum in the GST pool account exceptionally made for this kind of installment. The sum will be credited on the realization of the instrument.

And now for the GST Online Payment, the bank would be promptly required to exchange the add up to the individual records – CGST, IGST, Additional tax, or SGST according to the subtle elements filled in the challan by the taxpayer. Since the challan is as of no GST Online Payment Guide for Small Taxpayers India shared on the GST Network, the data will be accessible on real-time sharing premise to the concerned partners. The crediting to the different GST records may be a fulfilment of the bookkeeping methods.

Read Also: Brief Details about SGST, IGST and CGST

A system linkage between the GSTN and Core banking system Network realization (CBS) is proposed so that the subtle elements of the challan are accessible to the clerk of the approved bank when he gets the challan from the taxpayer. This will dispose of the monotonous work and furthermore diminish the blunders in the system.

Additionally, the clerk will have the capacity to dismiss the outstation checks and the total tax challan on the off chance that it has surpassed the legitimacy of seven days. It is likewise being suggested that the GST Core banking system while Network realization would suspend those taxpayers from utilizing OTC whose cheques skip amid the Core banking system Network realization. Hence, GST Online Payment is supposed to be actualized within the parameters with a strong boost to the nation with a wider tax base to be accumulated in the taxation structure. Every registered person under GST is entitled to pay the taxes after adjusting the input tax credit before filing the returns.

Procedure For Making GST Payment Online on GST Portal India

GST Payment can be done through the GST portal by implementing the steps given below:-

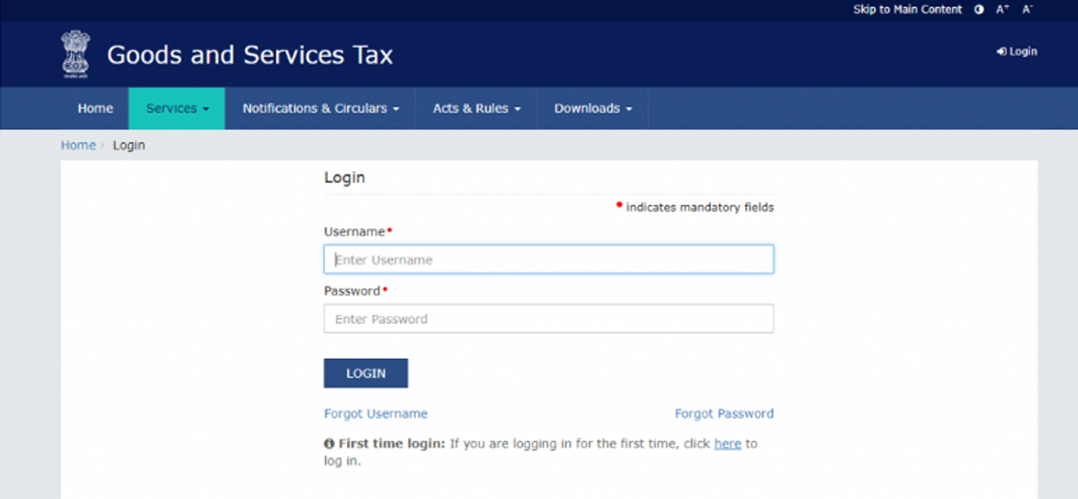

Step 1:- Login to the GST Portal. Enter the details such as username, password, and captcha.

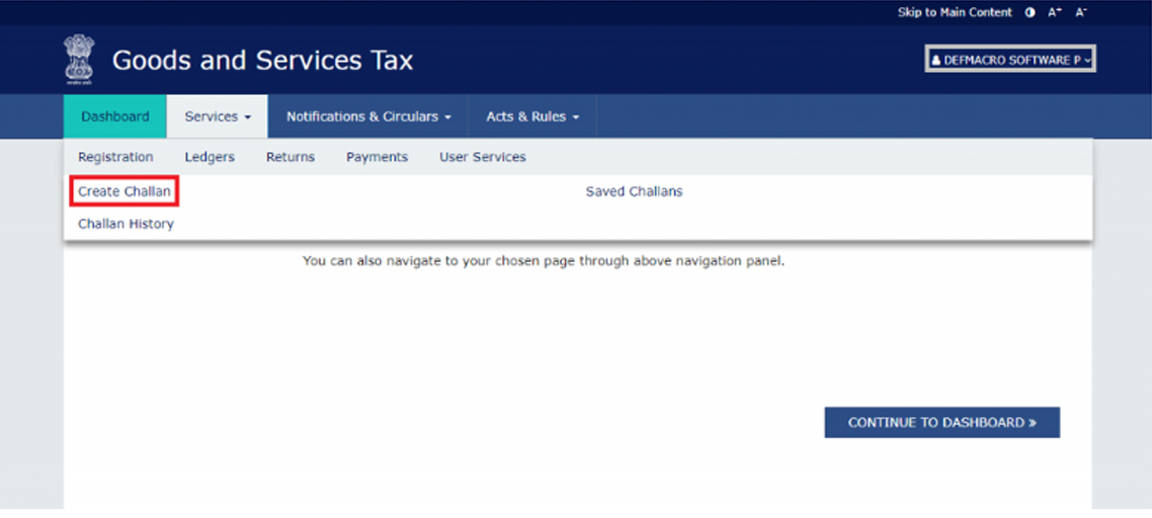

Step 2:- Once you log in, click on create challan in the dashboard.

Services > Payments > Create Challan

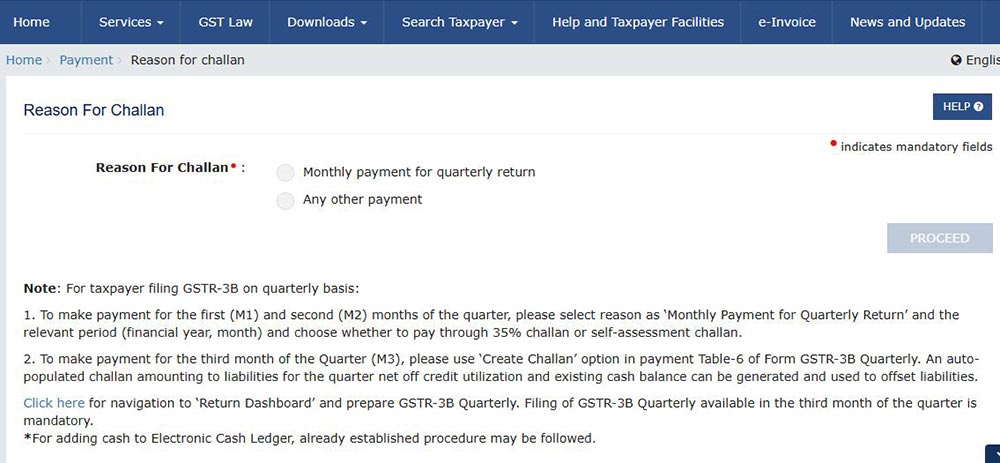

Select the reason for creating challan as shown in the below images

It ask for the reason Monthly payment for quarterly return is used ” To make the payment for the first (M1) and second (M2) months of the quarter, select the reason as “Monthly Payment for Quarterly Return,” specify the relevant period (financial year, month), and choose whether to pay via the 35% challan or the self-assessment challan.

Any other payment option is used to make payments for other than Quarterly taxpayer clients

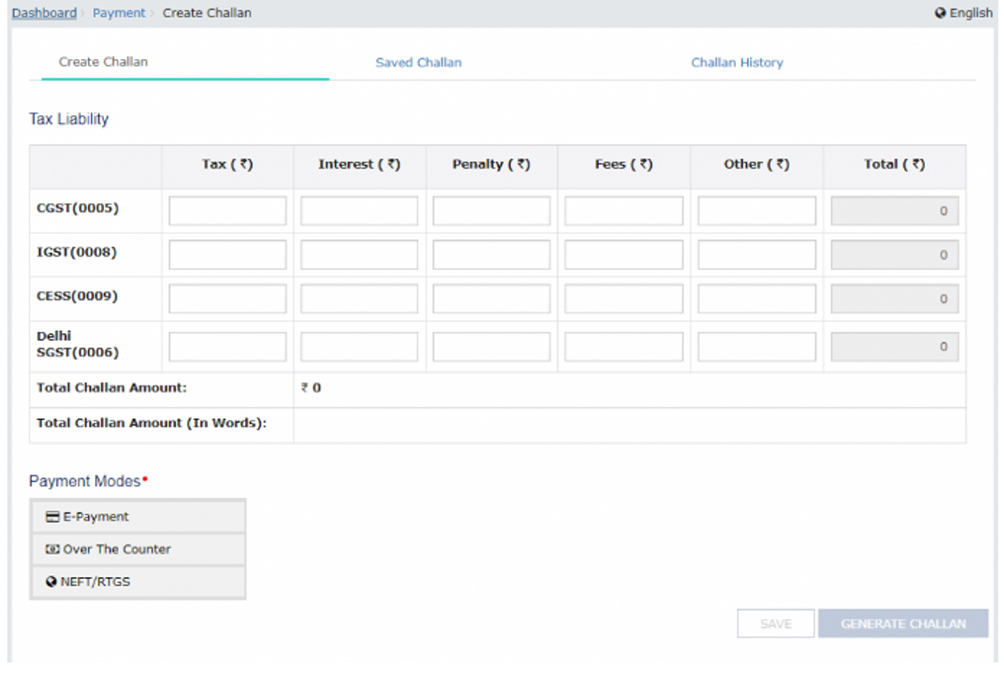

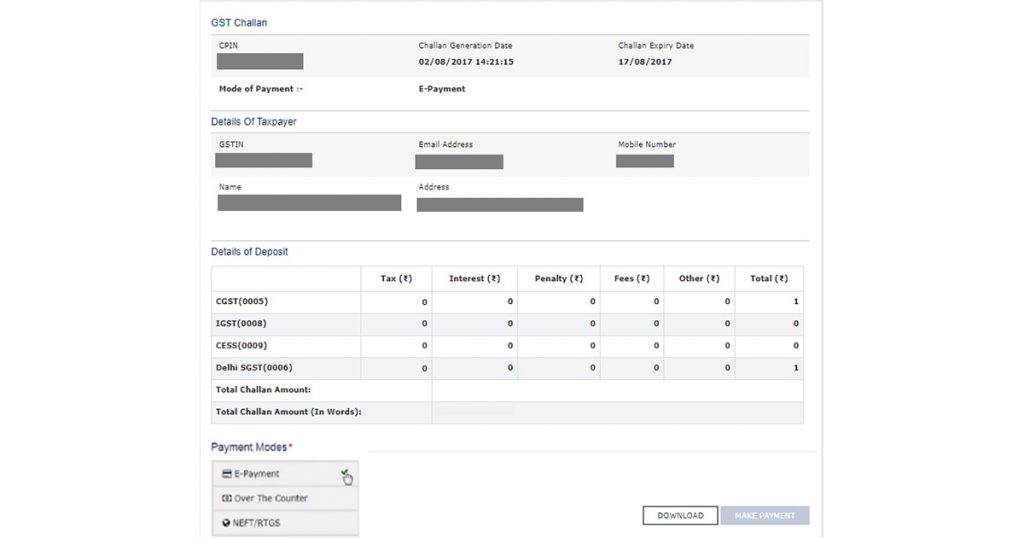

Step 3:- Enter the amount details and select the convenient payment mode. The amount details should be required to be furnished under the head of CGST, IGST, Cess, and SGST. Additionally, the breakup of payments made towards interest, penalty, fee, and others is also mentioned.

GST Payments can be done via using three options that are given below:-

- Option 1: E-Payment:–Debit Cards/ Credit Cards, BHIM UPI and Internet Banking of Authorized Banks

- Option 2: Over the Counter (OTC) via Authorized Banks

- Option 3: Payment via NEFT/ RTGS from any banks

Note:- There is a particular limit of Rs. 10,000 of per challan payment via over-the-counter (OTC) through authorized banks.

Step 4:- A summary page will appear on your screen which contains all the information on challan. Here you are required to opt for the payment mode by selecting the bank through which payment will be made. Click on make payment option which is available at the end of the page.

Step 5:- Make GST Payment Online by selecting the suitable mode.

Once you make the payment of taxes under GST you will get a challan which contains the detailed information of taxes you had paid. After that, the tax paid challan will be credited to the cash ledger account of the taxpayer.

List of Authorised Banks Accepting E-Payments

| Allahabad Bank | Andhra Bank | Axis Bank | Bank Of Baroda | Bank Of India |

| Bank Of Maharashtra | Canara Bank | Central Bank Of India | Corporation Bank | Dena Bank |

| HDFC Bank | ICICI Bank Limited | IDBI Bank | Indian Bank | Indian Overseas Bank |

| Jammu And Kashmir Bank Limited | Oriental Bank Of Commerce | Punjab And Sind Bank | Punjab National Bank | State Bank Of India |

| Syndicate Bank | Uco Bank | Union Bank Of India | United Bank Of India | Vijaya Bank |

List of Authorized Banks Payment via Over the Counter (OTC)

| Allahabad Bank | Bank of Maharashtra | HDFC Bank | Jammu and Kashmir Bank Limited | Syndicate Bank |

| Andhra Bank | Central Bank | ICICI Bank | Oriental Bank of Commerce | UCO Bank |

| Axis Bank | Central Bank Of India | IDBI Bank | Punjab and Sind Bank | Union Bank of India |

| Bank of Baroda | Corporation Bank | Indian Bank | Punjab National Bank | Vijaya Bank |

| Bank of India | Dena Bank | Indian Overseas Bank | State Bank of India | – |

Recommended: Is GST Giving Extra Benefits to the Indian Consumers?

Latest Updates on Online Payment in GST Tax Regime

According to the recent discussions that emerged within the GST council and respected members, it is speculated that taxpayers may get discounts on tax filing while making payments from cards or from electronic wallets. The government is quantifying this payment system for the benefit of the consumers in multiple ways. According to the system, the customers may have to pay less at the restaurants after the introduction of this payment system, also when the person buys consumer durables than there will be lesser amount figured according to this payment structure.

Earlier the electronic mode of payment was initiated just after the demonstration but the success was far away as people were limited to the cash transactions and very few facilities were available at the outlets to take online payments. The government is also determined to bring most of the transactions into the digital format to make the transaction more simple and quick forwards in context to the cashless scheme offered by the authorities.

GST Offline Payments

GST offline payments are done through the bank counter and a challan is to be generated. The challan includes a common portal identification number or CPIN code. Taxpayers need to take 2 copies of the printout and will be required to pay via cash/cheque/DD. The payment will be reflected in the taxpayer’s electronic cash ledger in 1-2 days.

CAN U PLEASE CONFIRM PLEASE DUE DATE OF PAYMENT OF IGST FOR THE MONTH OF JULY, AUGUST, SEPTEMBER & OCTOBER 17

Payment has to be made of the taxes on or before 20th of the next month failing which interest @18% is payable from the expiry of the due date to the date of payment.