Under the Central Board of Indirect Taxes and Customs (CBIC) the Ministry of Finance issued Notification No. 27/2024-Central Tax dated November 25, 2024, notifying the list of Goods and service tax commissioner to pass an order to the Directorate General of Goods and Services Tax Intelligence issued notices.

On December 1, 2024, the same notification would come into force and expand the authority of Principal Commissioners and Commissioners of Central Tax across India.

The Central Government amended Notification No. 02/2017-Central Tax, dated June 19, 2017, published in the Gazette of India (G.S.R. 609(E)) in the practice of allotted powers under sections 3 and 5 of the CGST Act, 2017, and Section 3 of the IGST Act, 2017.

The notification substitutes Table V of Notification No. 02/2017-Central Tax, on 19 June 2017, establishing the powers of the officers regarding orders and decisions pertinent to notices issued by the Directorate General of Goods and Services Tax Intelligence (DGGSTI).

The amendments align with Sections 67, 73, 74, 76, 122, 125, 127, 129, and 130 of the CGST Act, 2017.

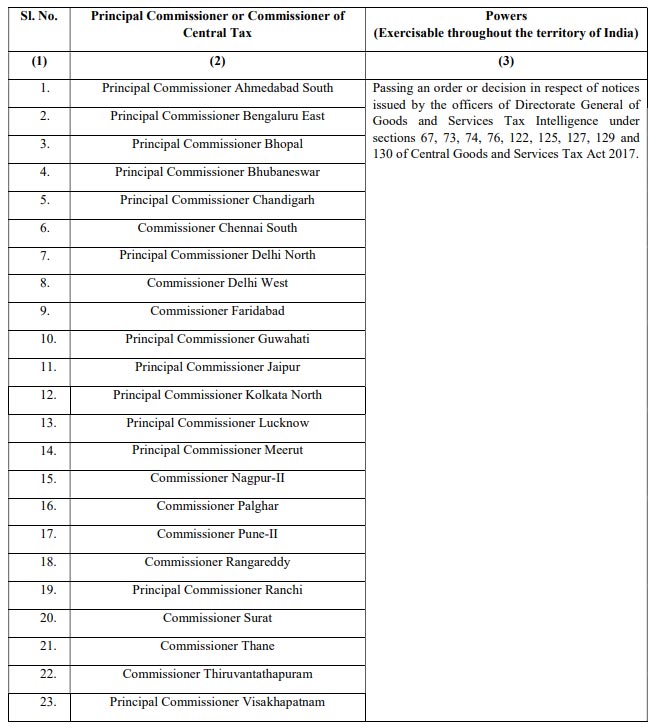

Empowered Officers and their Jurisdiction’s information

Read Also: GST Investigation Wing Issues 20,000 Notices Across Nation for AY 2018-22

The updated Table V is as follows:

The notification has been signed by Raushan Kumar, Under Secretary.