It was quoted by the Kerala High Court that the medical condition mentioned by the taxpayer is not enough grounds to ease the condoning of a four-year delay in appeal filing.

The Bench of Justice Gopinath P. noted that “the assessee has not made out any ground for grant of relief in the writ petition. Admittedly, the assessee filed appeals against the orders only in the month of February 2024 i.e., four years after the date on which the orders against which the appeal was sought to be filed had been issued.”

In this matter, the orders were issued on 11.02.2020 and 12.02.2020 u/s 62 of the CGST/SGST Acts. The taxpayer/applicant asserted that, as he was recommended bad rest for a fatty liver condition, he was not able to furnish the appeals against these orders within the mentioned time.

As per the department, the impugned orders in the same matter were furnished in February 2020. The plea was being furnished in February 2024 after an inordinate delay of 4 years. The taxpayer furnished that he was under treatment for fatty liver disease and consequently, he was recommended bed rest. It was proposed that the medical certificate itself is unsure.

It was cited under the bench that the taxpayer does not provide any reason for grant of relief in the writ petition. The taxpayer submitted the plea against the orders merely in February 2024 i.e. 4 years post date where the orders against which the plea was asked to get filed have been issued.

While directing to the matter of Singh Enterprises v. CCE and Ors, (2008) 3 SCC 70 the bench cited that the same court could not in the practice of jurisdiction under Art 226 of the Constitution of India extend the time limit for filing an appeal u/s 107 of the CGST/SGST Acts.

Additionally, the bench cited that though Article 226 of the Constitution of India does not designate any duration of limitation for the writ petition filing, it is settled law that a writ petition may be dismissed based on the inordinate filing delay of the writ petition. Adjudicating authorities issued orders in February 2020. Merely in the year 2024, the same writ petition has been filed.

The taxpayer contends that he was sick and recommended bed rest as the fatty liver disease needs to be taken in a pinch of suspicion, bench cited.

The bench in the aforementioned thought dismissed the petition.

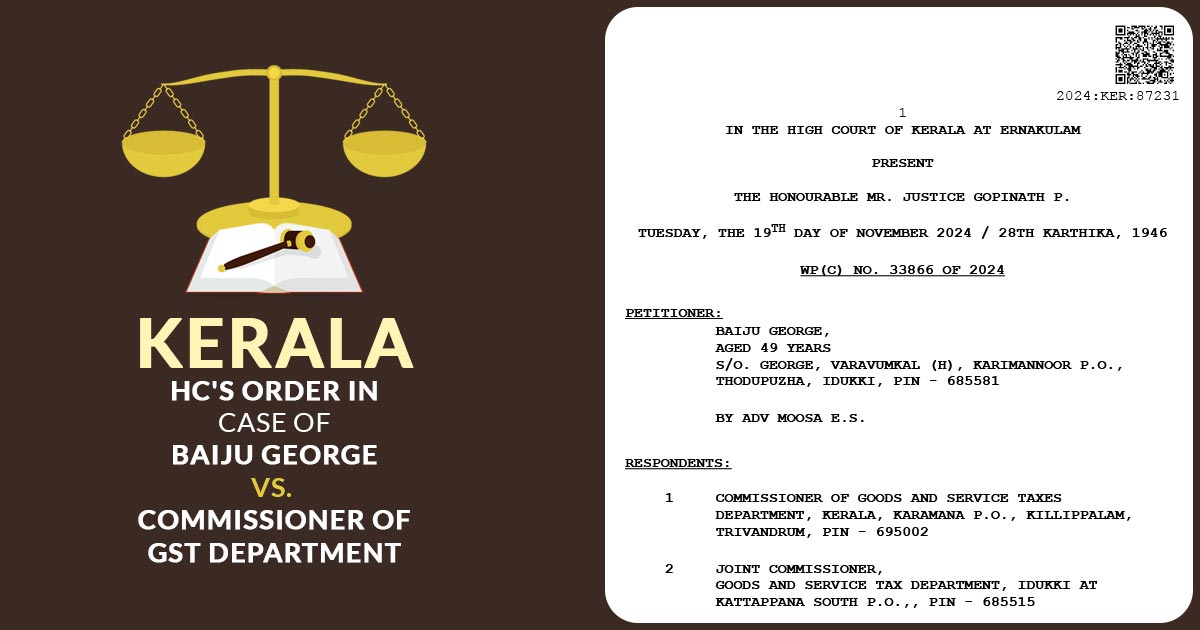

| Case Title | Baiju George vs. Commissioner Of Goods And Service Taxes Department |

| Citation | WP(C) NO. 33866 OF 2024 |

| Date | 19.11.2024 |

| Counsel for Petitioner | Moosa E.S. |

| Counsel for Respondent | Thushara James |

| Kerala High Court | Read Order |