GST E Way Bill registration or enrollment is an easy procedure on Indian Government official portal (ewaybill.nic.in or ewaybillgst.gov.in) as we have described in a very simple manner. To generate GST e way bill,

The businesses have to be registered and have to prepare a GST e-waybill every time they transport goods above the value of INR 50,000. There are various eway bill the validity periods and distance meters which the government has authorised for the transportation of goods. Finally, after the decision to roll out the GST e-way bill across the nation, there are provisions and steps available on the complete GST e-way bill system and generating methods.

- Steps to GST E Way Bill Registration for Registered Suppliers:

- E Way Bill Registration Steps for GST Registered/ Unregistered Transporters

- Registration Steps Under E Way Bill for Unregistered Transporters Under GST:

- Registration Steps Under E Way Bill for GST Unregistered Supplier:

- General Queries on GST E-Way Bill

Latest Update in E-way Bill Under GST

- Kerala High Court ruled that GST e-way bill revalidation penalties or taxes cannot be imposed if evasion is not found. Read more

- Supreme Court has ordered that no tax evasion on the validity of non-extension of the electronic waybill under GST due to traffic blockage. read order

- The Government of Madhya Pradesh state has mandated e-waybills under GST on 41 goods, earlier it was 11 goods. read more

- “GST officers have been armed with real-time data of commercial vehicle movement on highways with the integration of the e-way bill (EWB) system with FasTag and RFID, a move which will help in live vigilance of such vehicles and check GST evasion.”

- “New E-way Bill functionality Oct-Dec 2020 has displayed for online filing and blocking of (EWB) generation facility.” Read Pdf

- “Blocking of E-Way Bill (EWB) generation facility for taxpayers with AATO over Rs 5 Cr., after 15th October 2020”. Read more

Mandatory Documents For GST E Way Bill Registration?

- GSTIN of the registered taxpayer/ transporter, if registered

- Registered Mobile number with the GST system

Taxpayer Types For E Way Bill Registration?

There are 3 types of taxpayers under the GST e-way bill system:

Steps to GST E Way bill Registration for Registered Suppliers:

Here is the step-by-step procedure for registration under the e-way bill portal of taxpayers/registered transporters:

Step 1: Visit the e-Way Bill (ewaybill.nic.in) portal.

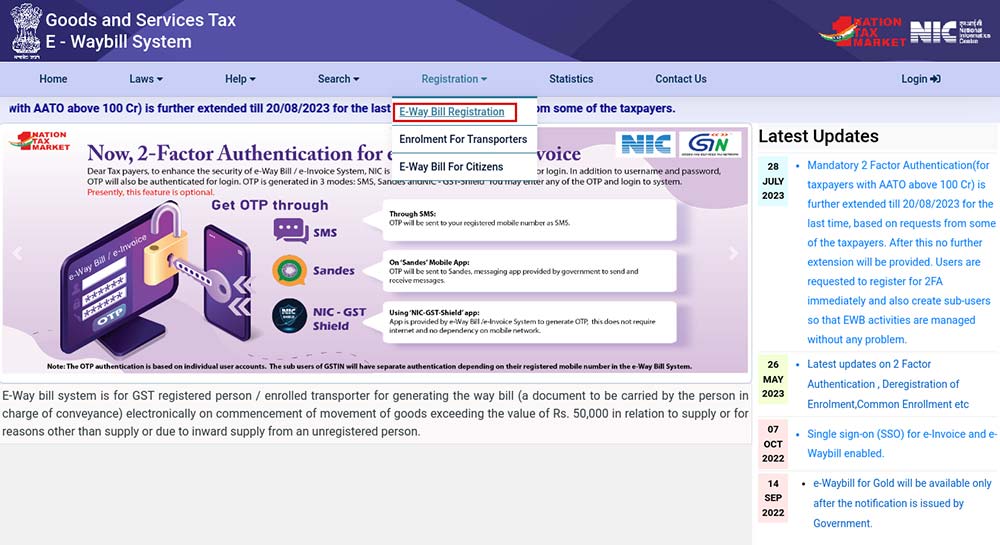

Step 2: Move the cursor on the ‘Registration’ and then select ‘E-way Bill Registration’ from the dropdown menu.

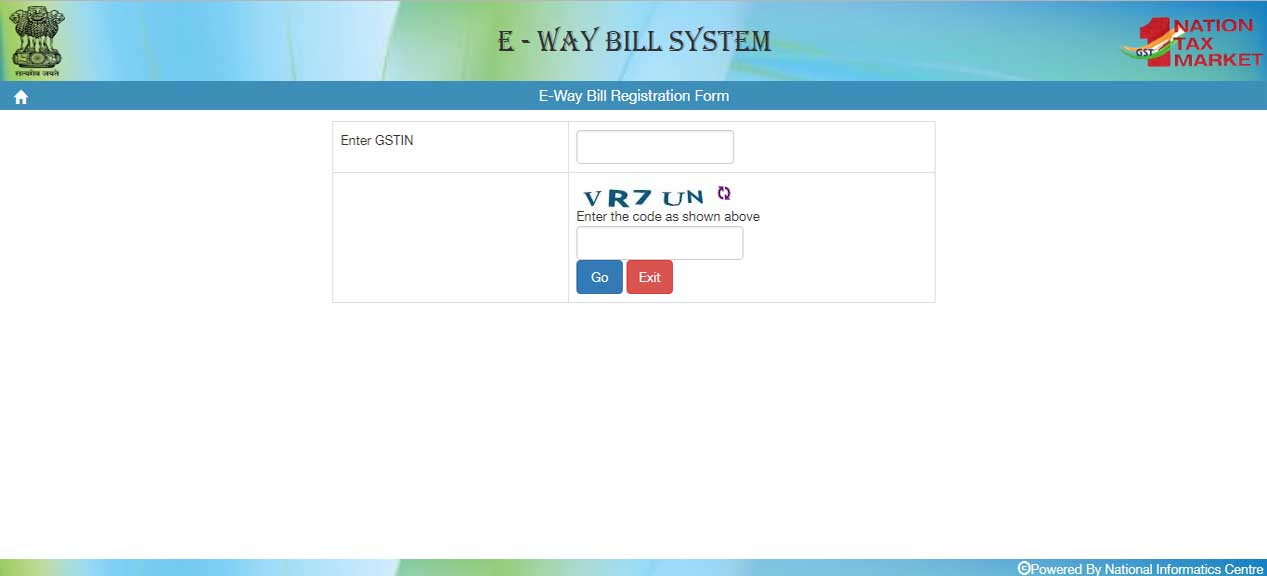

Step 3: Enter the GSTIN and the captcha code -> Click on the ‘Go’ button

Step 4: Generate an OTP and verify the same

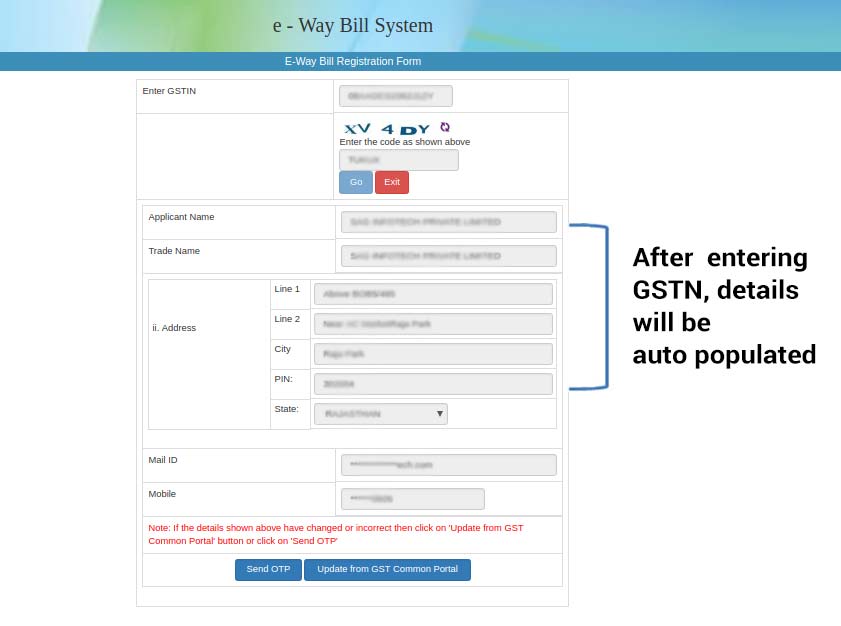

The screen will pop up after the process:

After checking the auto-filled details, click on the ‘Send OTP’ button.

Enter the OTP received on the registered mobile number and verify the same by clicking on the ‘verify OTP’ button.

Step 5: Create a new User ID and Password

- Enter the new User ID and set a password of personal choice.

- The system validates and pops up a message if there is an error in the details entered by you.

- Once all the details are correctly filled, the User ID and password will be created.

E Way Bill Registration Steps for GST Registered/ Unregistered Transporters

There is a requirement for registration for unregistered transporters in cases:

- a) Value of consignment value of goods of a single supplier exceeds Rs 50,000/-

- b) The value of all the goods in a vehicle through which goods are transported exceeds Rs 50,000/-

What is the Meaning of Transporter ID?

- The transporter ID comes when the transporter is unregistered, but the consignment value is above INR 50,000/-. The GST e-way bill has to be generated with a transporter ID. The unregistered transporters will be given a transporter ID, and this ID is to be mentioned on all the GST e-way bills.

After the registration on e-way bill portal, there will be two outcomes:

- A unique transporter ID

- Unique username for operating e-way bill portal

Registration Steps Under E Way Bill for Unregistered Transporters Under GST:

Step 1: Visit the e-Way Bill Indian government official portal (ewaybill.nic.in).

Step 2: Click on ‘Registration’ and select ‘Enrolment for Transporters’ from the dropdown list.

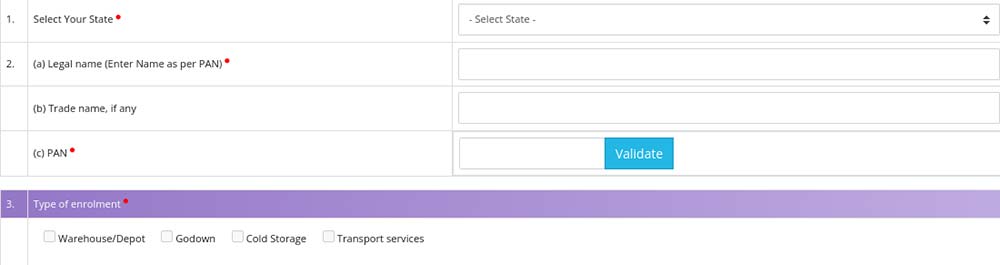

Step 3: Enter the details in the Application at points 1-9 and click ‘Save’. 9 points on the Application u/s 35(2)’ in GST ENR-01:

1. Select Your State*

2. Details to be Entered

- a) Enter Name as per PAN*

- b) Enter Trade name if any

- c) Enter your PAN*

3. Type of Enrolment*:

Note: After PAN validation, the system will find any error or mismatch and will proceed after rectifying.

- Please fill details at points 1 and 2.

- Choose the relevant type- warehouse/godown/cold storage/transport service

4. Constitution of business*:

- Select the relevant business form from the drop-down

- Foreign company/Partnership firm/ Proprietorship/ Private limited company/ Public Limited Company/Unlimited Company/ Others( If HUF, AOP, BOI and so on)

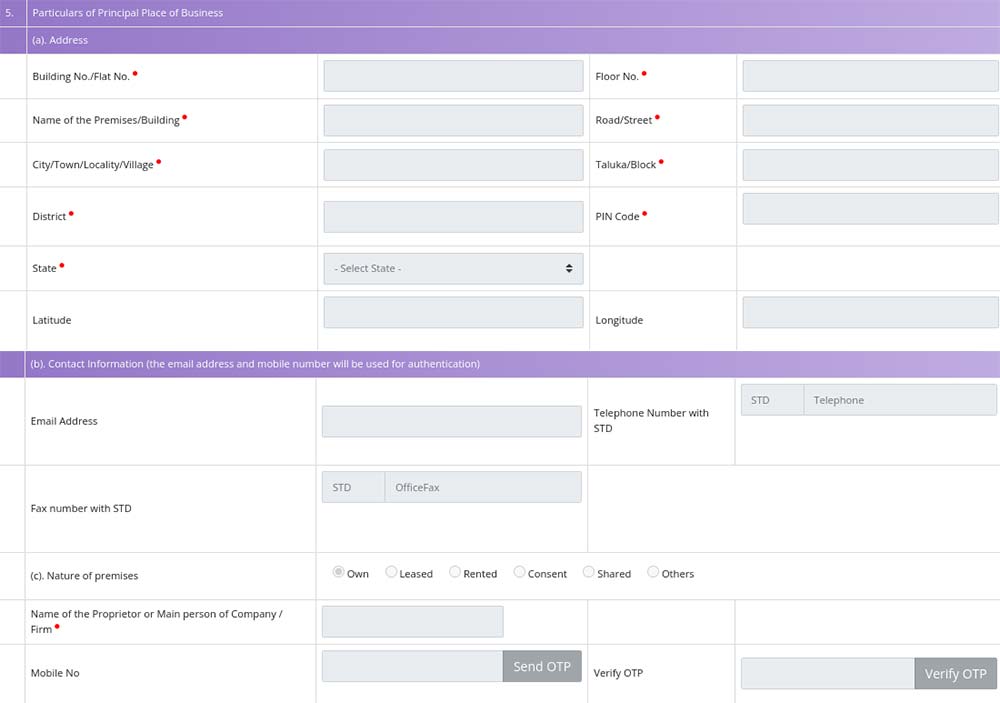

5. Principal Place of Business

- a) Type Complete Address, entering all the red-marked mandatory fields.*

- b) Contact information: Type the e-mail address, Landline number and Fax number (if any)

Note: The e-mail address given here is to be used for authentication.

- c) Nature of premises mentioned at a)- Select whether the address at a) is a building that is Own /leased /rented/ consent/ shared/ any other case.

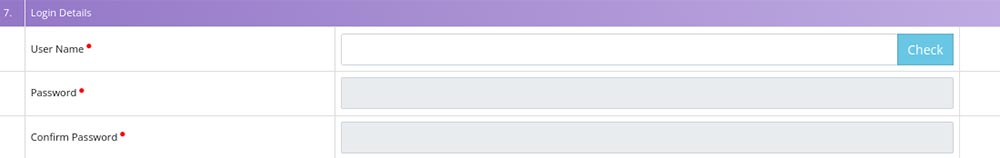

7. Create Login details* :

- Set a new, unique username/ user ID and password.

- Check in case the username you wish to set is already being used or not by clicking on Check.

8. Verification *: Tick mark against the declaration confirming correctness of the Information you give, and click Save

- A 15-digit transporter ID will be displayed. The number should be given to the clients for entering it on the GST e-way bill and enabling the vehicle number to be added to the goods movement.

Registration Steps Under E Way Bill for GST Unregistered Supplier:

In case an unregistered supplier supplies the goods to the registered receiver, the receiver of the goods will have to comply with the procedure and he has to generate an e-way bill on behalf of the supplier. SO the generation of an e-way bill is to be done by the receiver.

Tips for setting User ID/username and password:

- a) User ID must have the following:

- 8 characters but not exceeding 15 characters

- alphabets (A-Z/az), numerals (0-9) and special characters (@, #, $, %, &, *, ^)

- b) The password should be of at least 8 characters

- c) Secure your Username and Password.

Further, Use these credentials to log into the e-way bill portal

General Queries on GST E-Way Bill

Q.1 – What is eWay Bill?

Section 68 of the Goods and Services Tax Act states that the traders carrying a consignment of good valuing more than INR 50,000 are required to have this eWay bill with them. The bill can be generated from GST Common Portal for E-Way bill system by registered persons and traders. They are required to get this bill generated before sending the consignment out

Q.2 – Why is eWay bill required?

The e-way bill is required to be generated by the traders for the goods listed under Rule 138 of CGST Rules, 2017. It is required as the government may need the details of the consignments

Q.3 – Why can generate the -way bill?

The consignor or consignee, who is registered under GST act can get the bill generated. An unregistered trader can get the bill generated for the clients. The bill can be generated for the goods of personal use too

Q.4 – Can the validity be extended?

If the consignment does not reach the destination on time due to natural reasons or some law or some other genuine reasons, then the validity period can be increased. The person will have to submit the details of such delay for extension

Q.5 – When does the validity period start?

It starts with the entry of the vehicle, from which the consignment is being transferred, into part B

Q.6 – Which transactions need e-way bills?

The e-way bill is to be generated for all kinds of transportation transactions whether inward or outwards, whether interstate or intrastate

Q.7 – How to calculate the validity period?

It is calculated on the base of distance. One day validity for every 100km. It may be different for different kinds of goods

Q.8 – Can the bill be edited?

Only the part-B of the bill can be updated and the rest can not be updated. The only option in the case of wrong entry of details is to cancel the bill and get a new one

Q.9 – Is the bill required for all kinds of goods?

It is required to be generated for all goods except the exempted goods, handicraft goods and other specific goods

Q.10 – How to generate the bill if vehicles are changed during the transport?

A bill is to be created for all the vehicles according to Rule 55 of CGST that states that the supplier should issue an invoice for the whole lot and then should issue a delivery receipt and generate the bill. The receipts should be available while changing the vehicles. The bill is to be generated according to all the vehicles separately

IS IT NECESSARY TO MAKE E-WAYBILL IF THE PARTY IS JUST NEXT DOOR FROM OUR PLACE AND NO TRANSPORTATION IS INVOLVED. PLEASE SUGGEST

No, E-way bill is not required

What we have to enter In GSTN column on e-way bill, if the supply to an Unregistered person

As recipient is unregistered, you have to write URP in GSTN column.

I am generating e way bill in Haryana but when we create part b in Delhi registration no. vehicle then vehicle no. not pick.

I am the supplier registered with GST and for e-way bill and I have my own vehicle(Truck) for transportation purpose.

Do I need to generate transportation ID as well? or should I put my company GST no. in transportation ID column?

Regards

You can mention your GSTIN at transporter id.

DEAR SIR,

I HAVE ONE GST NO WHICH IS INACTIVE AND THEN TAKEN SECOND GST NO

NO WI E WAY BILL I HAD to MAKE REGISTER BUT it IS REGISTER UNDER OLD GSTIN NO BUT I NEED TO REGISTER FOR SECOND GSTIN NO

SUGGEST HOW TO CHANGE OR MAKE REGISTER IN E WAY BILL SITE WITH NEW GSTIN

The procedure will be same for new registration as when you applied earlier.

Dear Sir,

We have registered company in West Bengal.We are a service provider in all over India. Our Business is Rental Service provider of Construction Equipment and our office in West Bengal only and we generate our monthly service invoice from West Bengal and we charge SGST & CGST at our WB Bill and charges IGST our other state Bills.

After applicable of E Way Bill we are suffering some problems with movement of our equipment/goods two different states or site. Because we are registered the only wb when our job works complete one site and we received the new one work order to different state or site, then we cannot move it because we are unregistered so we cannot generate E-Way Bill.

Further our client not interested to generate E way bill because this equipment ownership is our and they could not sale/purchase this equipment.

So we cannot understand how this problem solves on urgent basis.Please advice us.

Can a transporter enrol in e waybill system in the state from where his pan card is not issued e.g he wants to register in Rajasthan having pan card issued from Maharashtra?

If he can then which state code will he be considered

Sir we supplying brooms. We are going to line sales when generating e way bill what we should mention into the column because we don’t know who is buying the product?

Who generates the e-way bill in case of the bill to ship the supply of good?

Example- A(Delhi) Sold good to B(Maharastra) and deliver the goods by transport to C(Gujrat) on instruction of

B(Maharastra).

Than who generate an e-way bill and which invoice number is to be mentioned on an e-way bill?

(A to B sales invoice OR (B to C Sales Invoice)

As two sales are involved in the transaction, so you have to generate 2 e-way bills.

How can we generate “Step 1 or Part-A” for Dealer or Taxpayer partier for dispatch the Goods?

You just need to fill the required invoice details and transporters ID (in case of transportation by road) and doc no. and date for part A slip. The e-way bill is not valid without the vehicle number(part-B) updated on the common portal if on the mode of transport is the road. The Vehicle number can be updated by the generator of the e-way bill or the transporter assigned for that e-way bill by the generator.

PLEASE SUGGEST ME HOW TO CREATE E WAY BILL FOR EXPORTING GOODS?

As now dept. withheld the provision related to e-way bill till indefinite period, so there is no requirement for generation of e way bill.

Please tell me old & used House Goods also under E- Way Bill

As due to technical crunches, dept. withheld the provisions related to e waybill for an unknown period.

E waybill generation is not working. How can I load goods in the vehicle?

Contact to the department.

HOW CAN I MAKE EWAYBILL REGISTRATION

Please read the blog thoroughly.