Supreme Court Stayed Punjab Haryana GST Tran 1 Form Orders

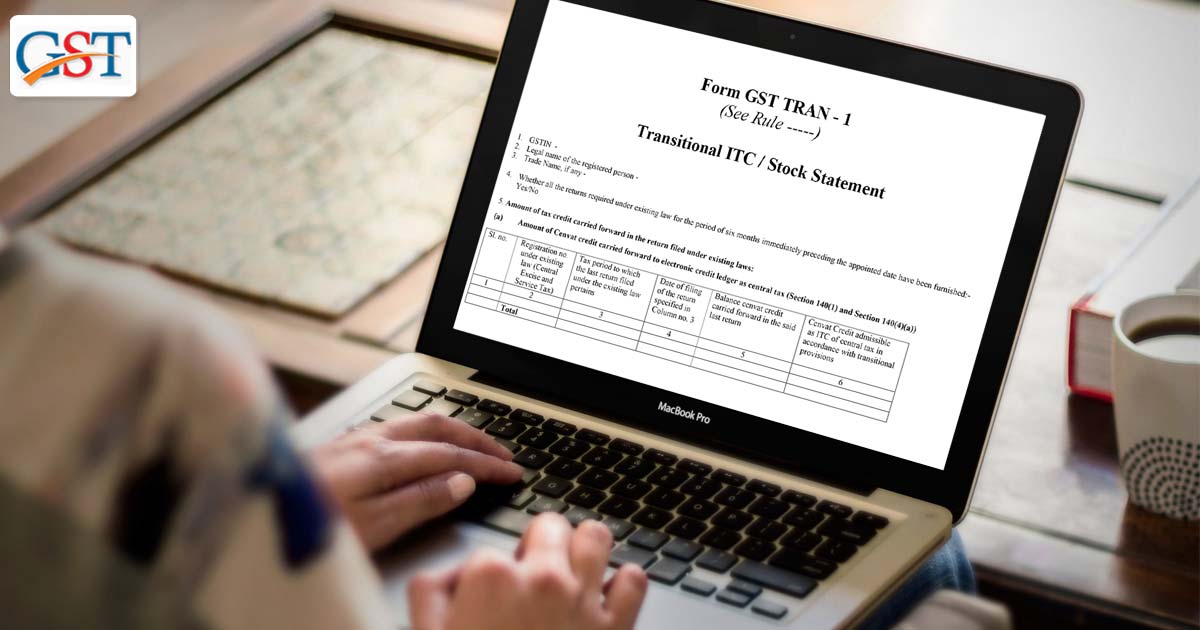

In a recent turn of event, the supreme court has stayed the orders of Punjab and Haryana high court which had asked the GST department to reopen the facility of filing and revising the GST TRAN 1 form in both manual or electronic format.

Goods and Services Tax ( GST ) department has received orders by the Punjab and Haryana High Court to reinitiate the facility of filing or revising Tran-1. The directions have been given to the GST department to allow the Petitioners to file TRAN-1 Form

Petitioners have been urging the High courts for directions under Article 226 of the Constitution of India to Respondents for allowing them to carry forward the unutilized CENVAT credit of duty discharged under Central Excise Act, 1944 and Input Tax Credit

These petitioners are registered under the Central/State Goods and Services Tax Act, 2017 and their credits could not be carry forwarded because they either failed to file the stipulated Form i.e. TRAN or filed it incorrectly by the prescribed due date of 27th December 2017.

Such petitioners have been behesting for permitting them to revise the incorrect TRAN or file a new TRAN in any mode and carry forward the unclaimed credits.

Justice Jaswant Singh and Justice Lalit Batra of the division bench decided and directed to allow the claimants to claim the transitional credit of the eligible CENVAT / ITC duties by filing a declaration in GST TRAN-1 and GST TRAN-2 Form

It should be noted that only those duties are permitted to be claimed which are related to the inputs kept in stock on the appointed day as per Section 140(3) of the Act.

The Court also said that “the due date contemplated under Rule 117 of the CGST Rules for the purposes of claiming transitional credit is procedural in nature and thus should not be construed as a mandatory provision”.

Petitioners are given a time-restricted opportunity to claim or carry forward their unclaimed credit. 30th November 2019 is the due date of filing the statutory Form(s) TRAN-1 or revising an already filed erroneous TRAN.

“The Respondents are at liberty to verify the genuineness of claim of Petitioners but nobody shall be denied to carry forward the legitimate claim of CENVAT / ITC on the ground of non-filing of TRAN-I by 27.12.2017”, added by the Court.

SIR

WHILE FILING TRAN1COMMITTED A MISTAKE BY ENTERING IN TABLE 7(D) OF TRAN1 CORRECT AMOUNT IS ENTERED IN 5(A) TABLE SUBSEQUENTLY, I REVERSED IN MARCH 2019 THE WRONG AMOUNT MENTIONED IN TABLE 7(D) THE NODAL OFFICER ISSUED SCN THAT YOU HAVE CLAIMED TWICE ALSO I WISH TO STATE THAT WRONG AMOUNT IS NOT REFLECTED IN THE LEDGER KINDLY ADVISE

THANKS

JAYARAMAN

Please contact GST practitioner for the same.