PAN cards will now be issued online and instantly in India by the Income Tax Department. This is a good move towards digitalization of services by the Income Tax Department.

Applicants will not need to fill out an application form and submit the required documents manually as now the income tax department would procure the details from the Aadhar card of an applicant and issues a PAN card instantly. Besides the facility is free to use.

The procedure is entirely online and since it knocks off every single manual processing which consumes a time-frames of 15 days, the e-PAN facility guarantees a “near to real-time” process.

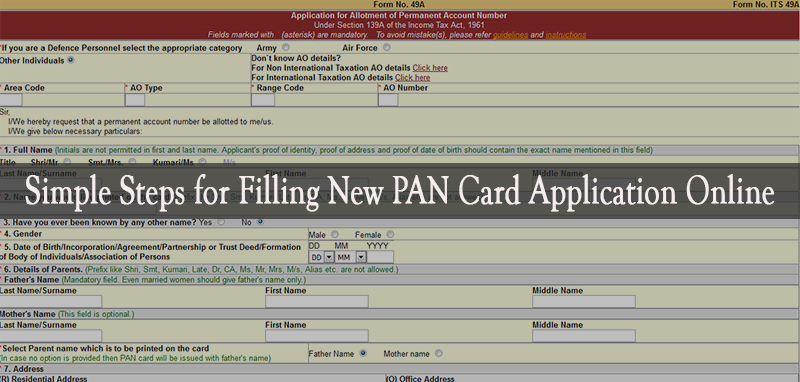

Read Also: Simple Steps for Filling New PAN Card Application Online

To apply for the instant e-PAN, the applicants would need to quote their basic details such as name & address along with Aadhaar details which are mandatory to be mentioned. The details would need to be verified by the applicants using a one-time password (OTP) which will be sent on their registered mobile phone number. Since Aadhaar card already carries details such as Date of birth, Address and Father’s name so the applicant would not need to upload any substantial document as an address proof or any other evidence. However, it should be noted that applicants must send correct Aadhaar details because any mismatch would lead to the rejection of the application.

Once the details of Aadhar get verified through OTP, a digitally signed e-PAN will be issued to the applicant. The e-PAN will feature a QR code that will carry the applicant’s photo and demographic information in an encrypted manner for security reasons and to avert the risks of fraudulence & forgery or digital photoshopping.

Read Also: Avoid Errors in Aadhaar/PAN for Income Tax Return Filing

“The move is part of greater digitization of income tax services and aimed at providing the facility without anyone having to visit any office,” an official said.

The e-PAN facility will benefit the new applicants as well as the existing PAN users. A few clicks and minutes, the existing PAN holders will get a duplicate.

In the ongoing pilot test of the instant e-PAN service, more than 62,000 e-PANs have been issued in the period of merely eight days. After the successful test, the facility will be launched throughout the country.

nice !