According to section 54F of the Income Tax Return (ITR)

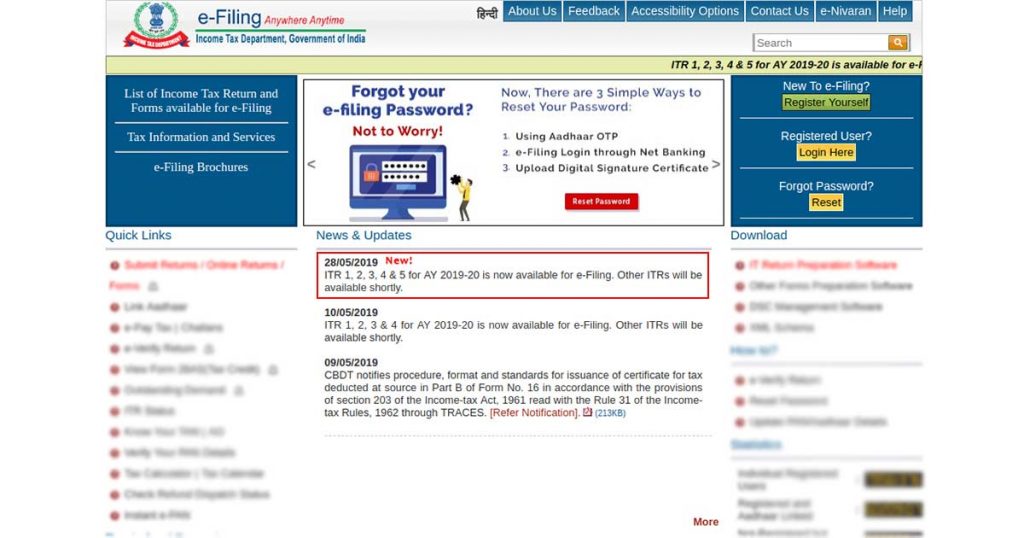

The assessee is a Director of M/s Markets Technologies (India) Pvt. Ltd Bangalore. He filed the return of income for the Assessment year 2009-10 claiming total income of Rs.1,53,44,940 below the source income from salary, business, capital gains, and additional roots.

Read Also: What Income Tax Provisions Say for Property Sale by NRI in India?

In section 143(1) the process of return of income was done and the case comes under the scrutiny process through issuing the notice. The officer refused the exemption of Rs 11,30,20,000 with respect to investment done in residential property stating that the investment in property outside India is not available and then built a demand for Rs 6,53,96,362.

The suspects filed an appeal in front of the Commissioner of Income Tax. Anyone made an investment outside India will have to claim the benefit of exemption under Section 54(1) of the Act. but the appeal was rejected by them. The assessee immediately filed an application before Income Tax Appellate Tribunal, in which it held that the assessee allowed an exemption under Section 54F of the Act and granted the claim favored by the assessee.

The administrations say that according to law the assessee is applicable to pretend the freedom under the Section 54F

“In the light of aforesaid well-settled legal principles as well as the memorandum of objects of Finance Act, 2014, which clearly provide that amendments will take effect from April 01, 2015, and will apply to Assessment year 2015-16 onwards as well as the CBDT’s Circular dated January 21, 2015, it is evident that amendment incorporated in Section 54F(1) of the Act is prospective in nature,”.