The Rajasthan High Court in a matter of the transition credit issue permitted the petitioner to make an application before the Good and Services Tax Council. It comes in the case of Obelisk Composite Technology LLP Vs. Union of India & Others.

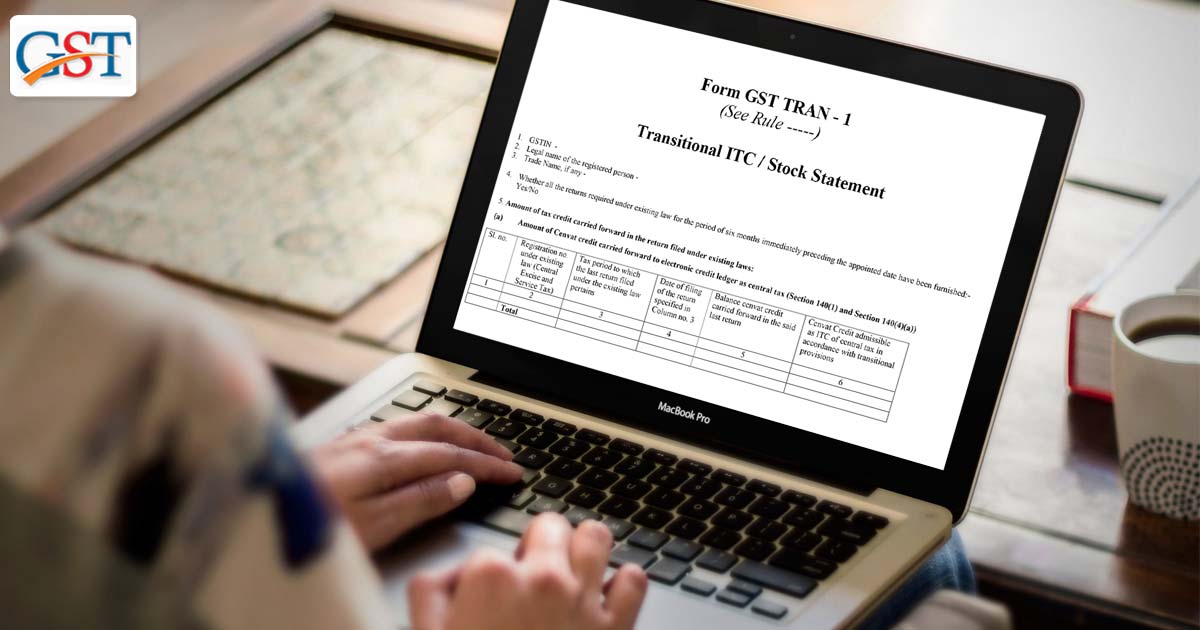

The Petitioners reached High Court seeking permission to furnish Form TRAN-1

The Petitioner also requested that the respondent authorities should consider the Form GST Tran-1, which was manually submitted to the respondent department to obtain benefits of the relevant valid Input Tax Credit (ITC)

In this matter, the decision has been passed by the division judge bench consisting of Justice Chandra Kumar Songara and Justice Sabina by considering the decision of the co-ordinate Bench in the case and granted the liberty to file an application to the GST Council. So the same can be forwarded to the GST Council to issue a certificate of recommendation with necessary details, evidence, and a certified copy of the order and such decision be taken immediately and if the petitioner’s claim is found to be true, the GST council meeting