Did you furnish a less amount of tax refund with respect to your claim during filing of the ITR for FY 2020-21? If yes then there are similar people who pose the same issues there are various tax returns filers this year who received lower tax refunds this year. The reason behind this was that the upgraded income tax portal has not acknowledged or carried into account the full tax credit available in Form 26AS for these tax return filers.

The purpose mentioned through the income tax department in the intimation notice to provide a lower tax refund with respect to the claim is “Form 26AS does not contain/contains the partial amount of TDS with respect to the TAN mentioned in schedule TDS 1/TDS 2/TCS.”

But the TDS amount availed via these ITR fliers is similar to the amount displayed in their corresponding Form 26AS (Tax Credit). Form 26AS gets downloaded via the income tax portal. It seems that the information displayed on one section of the portal is not aligned via the processing of the software.

Tax experts mentioned that “We have seen more than 10 cases where full TDS credit, as shown in Form 26AS, is not given by the income tax department at the time of processing of ITR. Due to this, individual taxpayers are getting less income tax refund than what is actually due to them.”

The tax expert and CA mentioned that such condition comes once in while and is not a regular thing that takes place in the duration of Income-tax return filing “However, this year there have been instances where at the time of filing income tax return the pre-filled data fetched on the new income tax portal shows a mismatch in the TDS amount available against the PAN of an individual i.e., full TDS as reflecting in the Form 26AS is not fetched/pre-filled into the ITR. Even though the TDS amount is corrected at the time of filing ITR, it seems that the income tax department is processing the ITR using pre-filled data rather than information reflecting in the Form 26AS.”

See Here Reason of Mismatch in I-T Dept Notice

Available TDS Amount in Income Tax 26AS Form

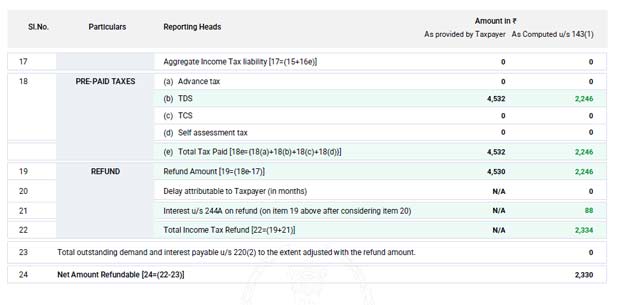

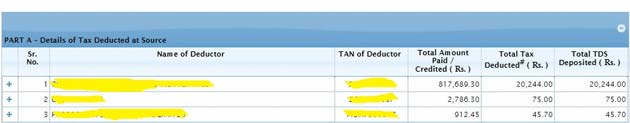

Through the attached screenshots above as per the assessees form 26AS the sum of the amount of TDS furnished with respect to PAN of the person towards FY 2020-21 is Rs 4532.31. This amount is similar which was claimed in the person’s Income tax return form. But the income tax department provides the tax credit during working on the ITR stands on Rs 2246. Rs 2286 is the amount of the TDS credit which has been refused through the tax department and is 50% of the TDS furnished with respect to the PAN of the person. The major thing is that the TDS credit has been refused even if the refund claimed is shown in Form 26AS. The same is not to happen in a regular way. It is due to Form 26AS which is supposed to have TDS details available with the income tax department on its own. Below are the examples of full refund amounts that get refused through the income tax department and the methods that an assessee can opt to deal with the same.

Case I: INR 2,286 Tax Refund is Refused by IT Dept

Case II: INR 13,106 Tax Refund is Refused by IT Dept

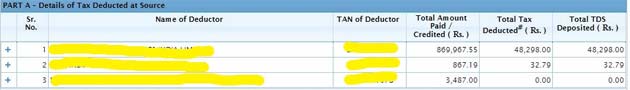

In this, the assessee’s Form 26AS displayed that the sum of TDS furnished to PAN is Rs 20,365, but the TDS credit provided through the income tax department post to processing of the income tax return is the intimation notice is Rs 7259. Hence the income tax department refused the tax credit of Rs 13106 that was directed towards the lower tax refund.

Case III: INR 9,707 Tax Refund is Refused by IT Dept

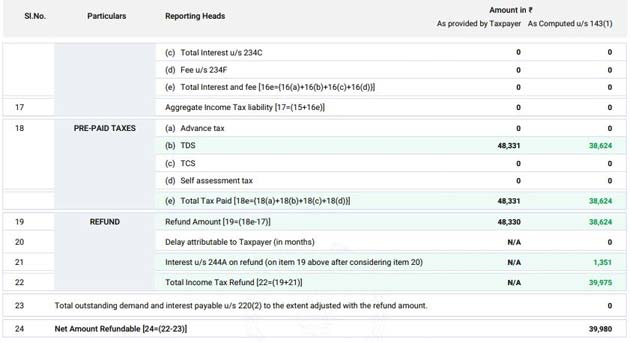

The sum of TDS furnished with respect to the PAN towards the FY 2020-21 stands at Rs 48,331, but the amount of TDS credit provided through the income tax department stands at Rs 38,624. Hence income tax department refused the tax credit of Rs 9707.

What Assessee Could Opt-in to these Conditions?

“If the income tax refund issued to you is less than what claimed by you due to denial of TDS credit as shown in the Form 26AS, then in such a situation an individual will have to file rectification request under section 154 to claim the balance tax refund,” mentioned by tax expert.

Source: https://economictimes.indiatimes.com/

As per assessment order

U/S 143(1) dated 25/02/2022 , no credit of TDS deducted of Rs 110372 has been given while same is also appearing in 26AS and raised the demand raised for Rs 114781( which includes TDS deducted of Rs 110472 and Rs 4309 on account of consequent penalty).