An income tax return can be filed online through the government website portal or any authorised software. In this post, taxpayers can get all the information to file an online income tax return via the Gen I-T software. Income Tax Laws are the list of provisions set by the government in order to maintain a standard discipline related to tax collection in the country and to put a check on those who are unethically involved in tax evasion.

Paying tax is a mandatory requirement for every individual, business, Hindu Undivided Families (HUFs), LLP, association, and local group that has registration under GST.

As mentioned in the laws of Income Tax, may it be an individual or entity or group of people or HUFs, those who are residents of India and have income more than a certain prescribed limit need to pay taxes on their income. Income here means income from salary, business, foreign assets or services, import/export, LTCG, interest from banks or any financial institutions, and so on.

Registered assessee needs to file an income tax return(ITR) mentioning all the mandatory details of their income and tax applicability. The forms must be filed in a manner assigned by the Income Tax Department, which is a government-authorised regulatory body for tax compliance and management in the country.

Introduction to Income Tax Return

An income tax return or ITR form is a comprehensive form of your income details according to which your tax liability is calculated. The taxability of the person/entity or group is judged based on the income received, and if there is more tax outgo than they are eligible to get a refund from the company.

ITR is the annual return that is filed once a year. The aggregate income of the taxpayer is counted based on the earnings from salary, business, renting house property, dividend payout, capital gains, and interest.

There is a prescribed due date for filing the tax returns; the taxpayer needs to file the returns on or before the said due date, after which the taxpayer is penalised owing to the late submission of returns.

It is Compulsory to File an ITR in India

Every registered taxpayer is obliged to adhere to the norms set by the government, and as mandated by law, individuals paying taxes are liable to file the returns. Well, income tax return filing is beneficial for both parties (the taxpayer and the government) as there is an accurate calculation of taxes payable, making sure that no taxpayer is paying more or less than the applicable amount.

Delay in return filing will invite penalties and may also bother you when you are applying for a loan or an international visa.

Individuals or Companies Liable for e-filing the Tax Return

There is an income bracket prescribed by the government related to the payment of taxes. Individuals, businesses, or HUFs falling under those income brackets are liable for paying taxes and filing the returns of the taxes paid by them. The Income Bracket:

- Less than 59 years – the threshold limit is Rs 2.5 lakh or more during the financial year.

- Between 60-79 years – the threshold limit increases to Rs 3 lakh or more during the financial year.

- Aged 80 years and above – the threshold limit is Rs. 5 lakhs or more during the financial year.

It is important to note that the income amount should be calculated before factoring in the deductions allowed under Sections 80C to 80U and other exemptions under Section 10.

There are immense benefits of filing an ITR, but the foremost is that the companies can earn profits no matter whether they are progressing or not in that relevant year, and this can be done by availing the refunds on the taxes paid by them.

To be noted: Refunds can only be claimed if one has filed the ITR for that relevant year. Those who wish to claim the returns must file the ITR with all the requisite details.

Foreign companies that enjoy treaty benefits on transactions made in India. And NRIs who earn or accrue more than Rs. 2.5 lakh in India in a single financial year are liable for filing the ITR as per the prevailing tax laws.

Read Also: Free Download Software And File Your Income Tax Return – Easy Steps

Documents Mandatory While Filing an Income Tax Return

While filing the ITR, it is necessary to keep the following documents that will help you with the filing process:

- Bank and post office savings account passbook

- PPF account passbook

- Aadhar Card, PAN card

- Interest certificates from banks or any other financial institution

- Salary slips

If TDS is Deducted

- Form-16- It is a certificate issued by the employer to the employee from whose salary account they are deducting the TDS.

- Form-16A – The form is relevant if TDS is deducted on payments achieved via modes other than salaries, like interest received from fixed deposits, recurring deposits, etc., over the specified limits as per the current tax laws.

- Form-16B – Applicable when the buyer of a property deducts TDS on the property he purchased, showing the TDS deducted on the amount paid to the seller.

- Form-16C – Applicable when the tenant is eligible to deduct the TDS on rent paid to the property owner.

- Form 26AS – The annual TDS statement. The form contains details of the entire TDS deducted against your PAN in a year (from any source).

a) TDS by the employer

b) TDS by banks

c) TDS by any financial institution from payments made to you

d) Advance taxes deposited by you

e) Self-assessment taxes paid by you

- Tax-saving investment proofs

- Proofs to claim tax deductions under sections 80D to 80U (health insurance premium for self and family, interest on education loan)

- Home loan statement from the bank

It is mandatory to file an ITR for every person whose total income exceeds the basic income not chargeable to tax.

The due date for filing the Income Tax Return by the Assessee is 31st October 2024 for all the Audit cases, and for the Non-Audit cases, the due date is 31st July 2024.

ITR1- ITR1 is applicable for Individual residents (Not Ordinarily Resident) having complete annual Income up to Rs.50 lakhs, Salaried income, single House Property, varied Sources (Interest, etc.), and Agricultural Income up to Rs.5 thousand (Not applicable to Individual being Director in a company or has invested in Unlisted Equity Shares).

Step-by-Step Filing ITR 1 via Gen IT Software

Taxpayers can get complete details about online income tax return filing through the Gen IT software, which is technically coded by the SAG Infotech company, so follow the steps below to easily file the ITR 1 form:

Step 1: Start by creating/importing the Master from the filled XML/JSON Client

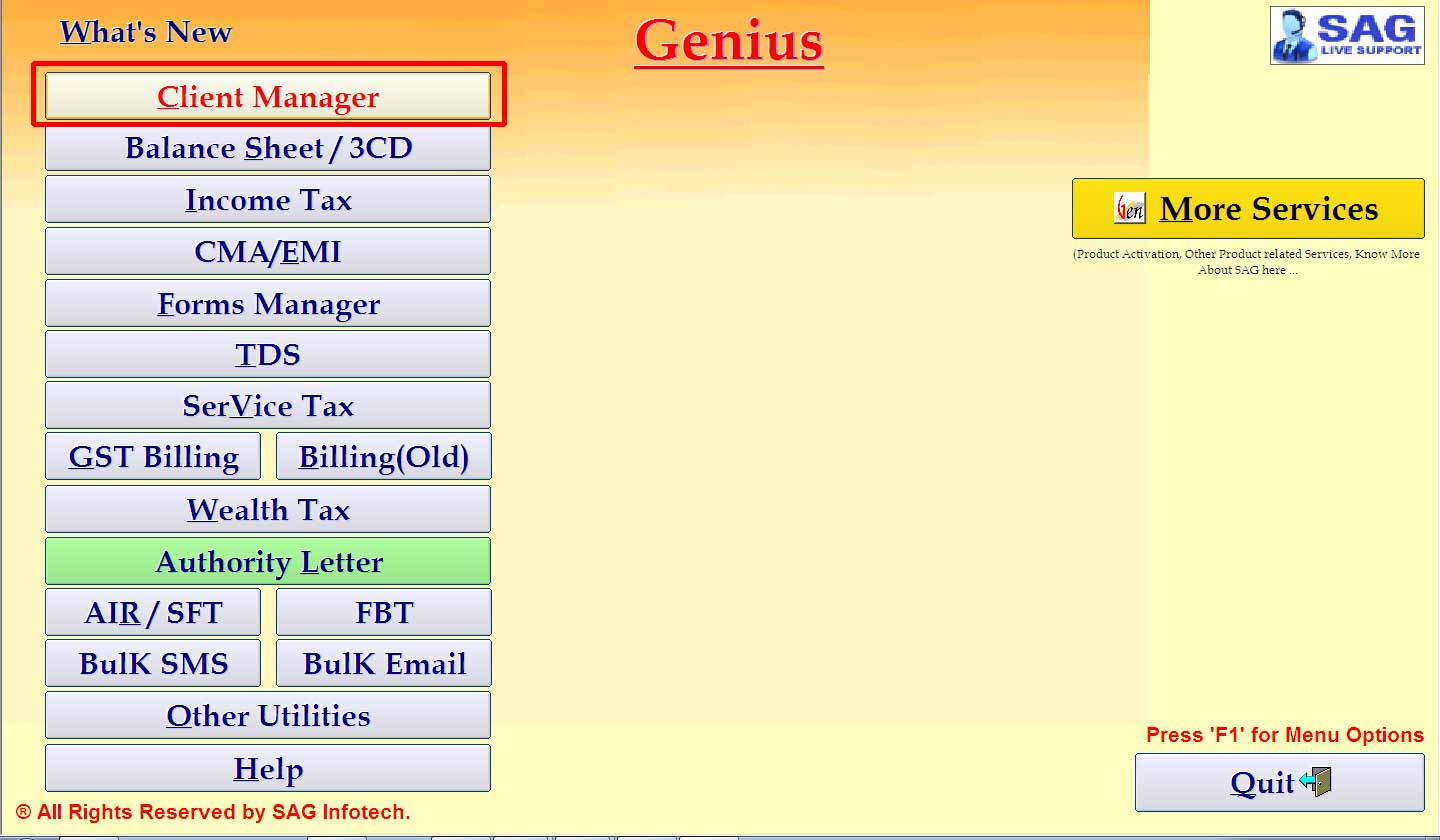

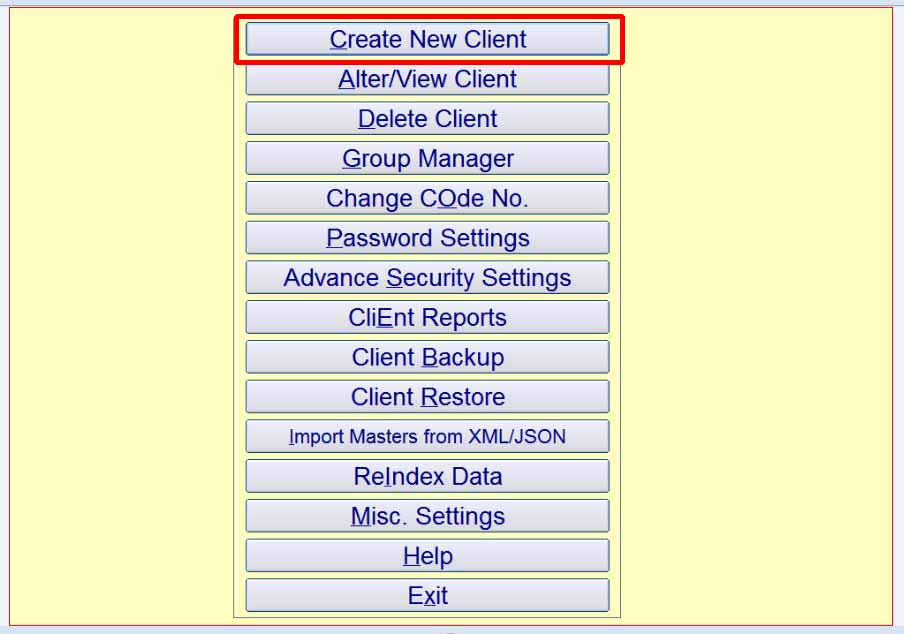

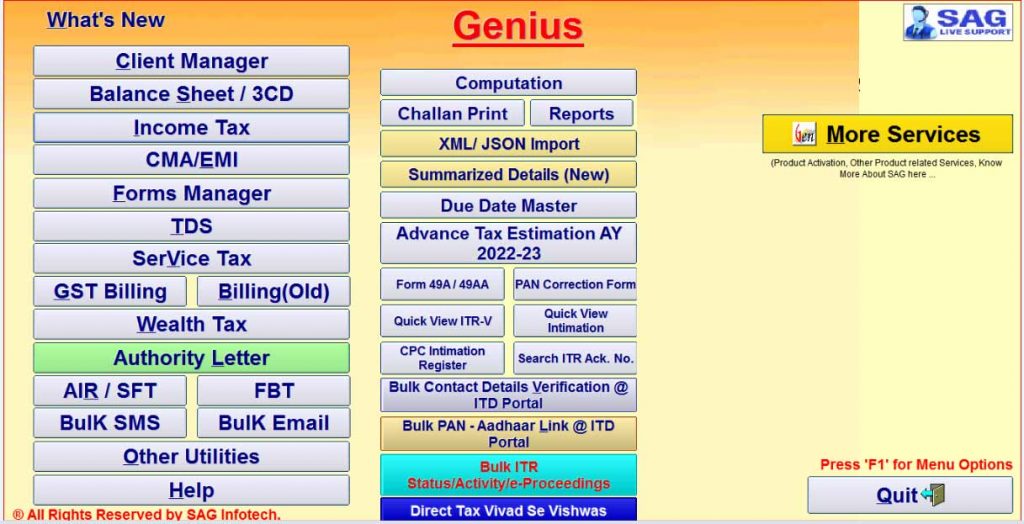

Step 2: Create the Client: Go to Client Manager ⏩ Create the client

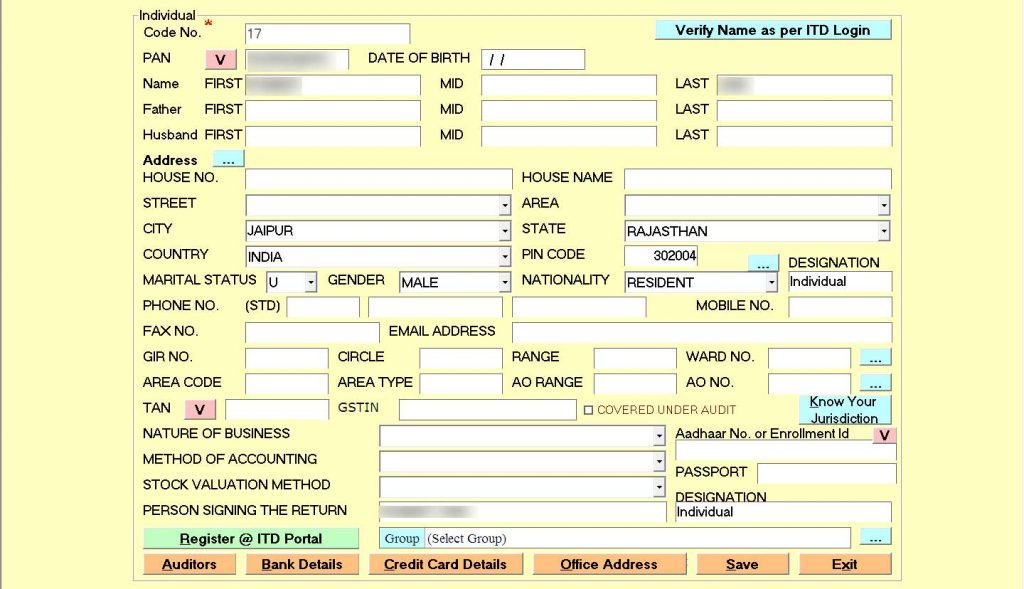

Step 3: Select your status ⏩ to enter the required information* such as Name, address, PAN No, and Nature of employment.

- From FY, Details of a valid Indian Passport are mandatory

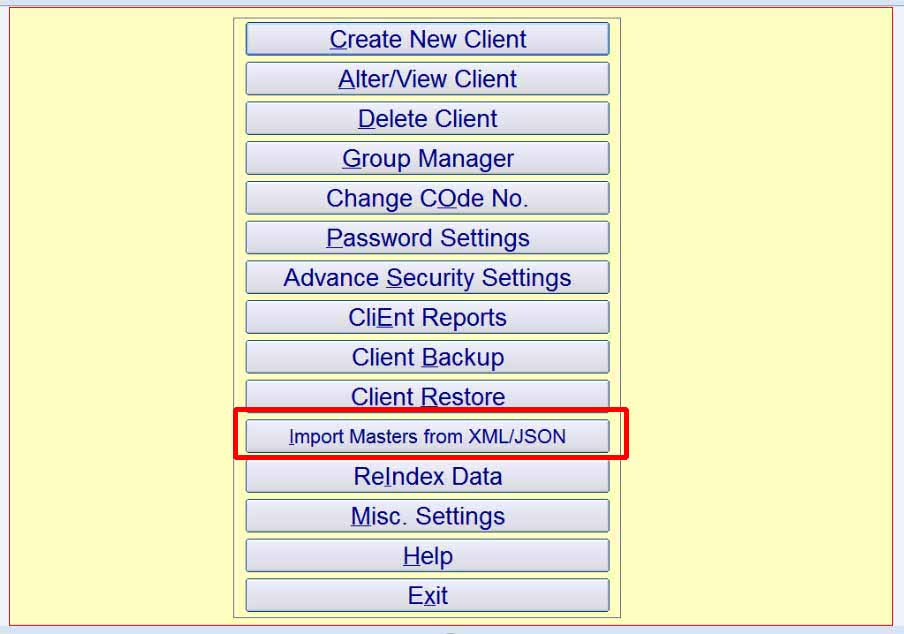

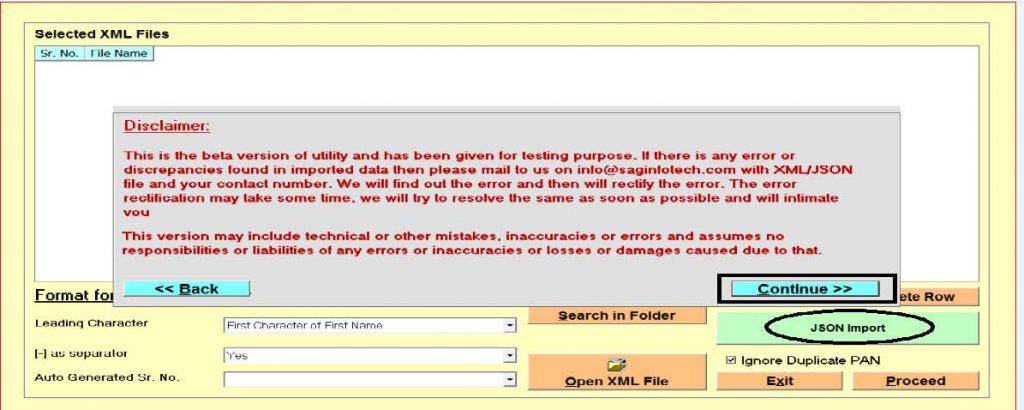

Step 4: Import Master from filled XML/JSON ⏩ Import Master from XML/JSON ⏩ JSON Import

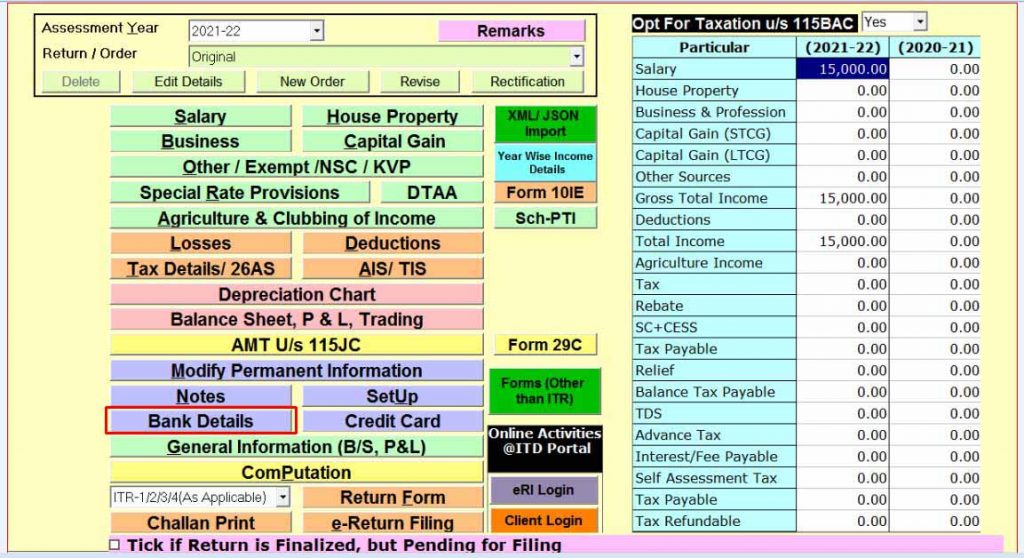

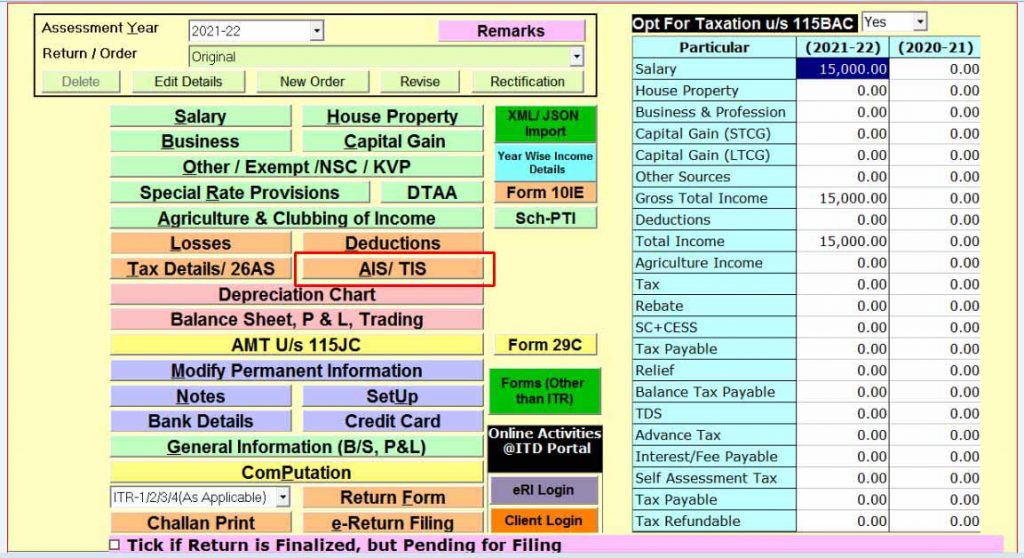

Step 5: Go to Income Tax ⏩ Go to Computation ⏩ Select the client

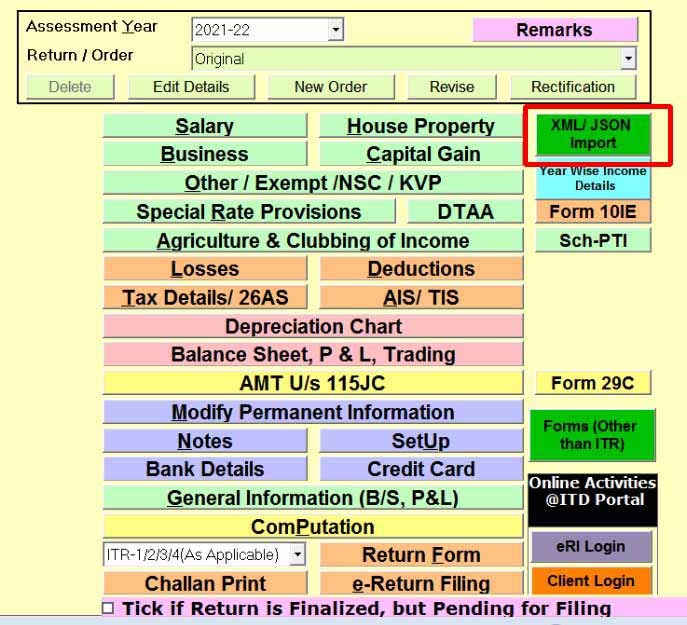

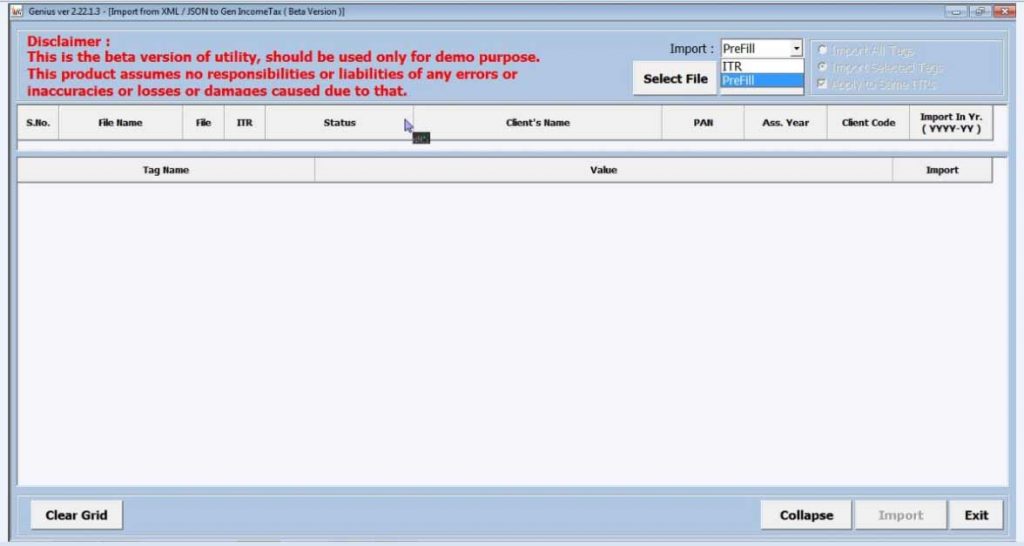

Step 6: You can import the Data from a filled XML/JSON or Pre-filled File. ⏩ Click on XML/JSON Import. ⏩ Continue to ⏩ Select the File

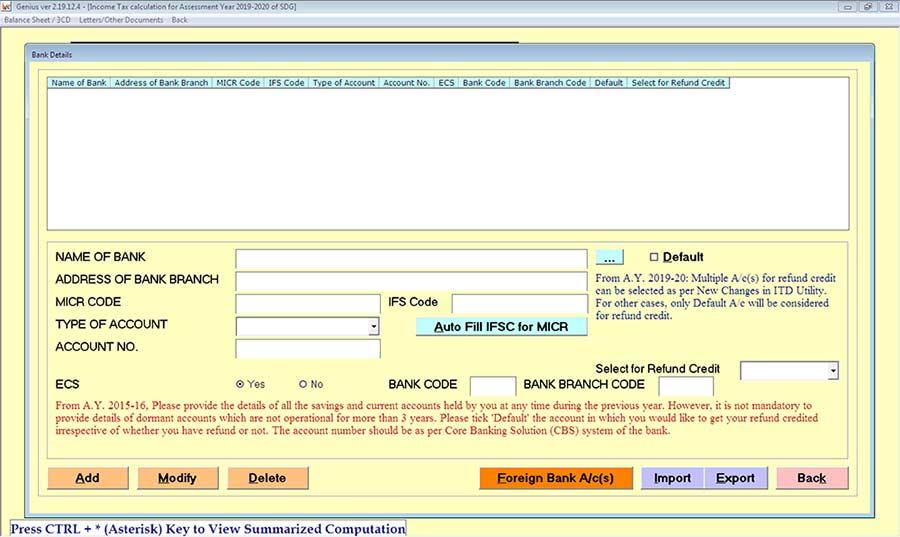

Step 7: Bank Details ⏩ Enter all bank a/c details

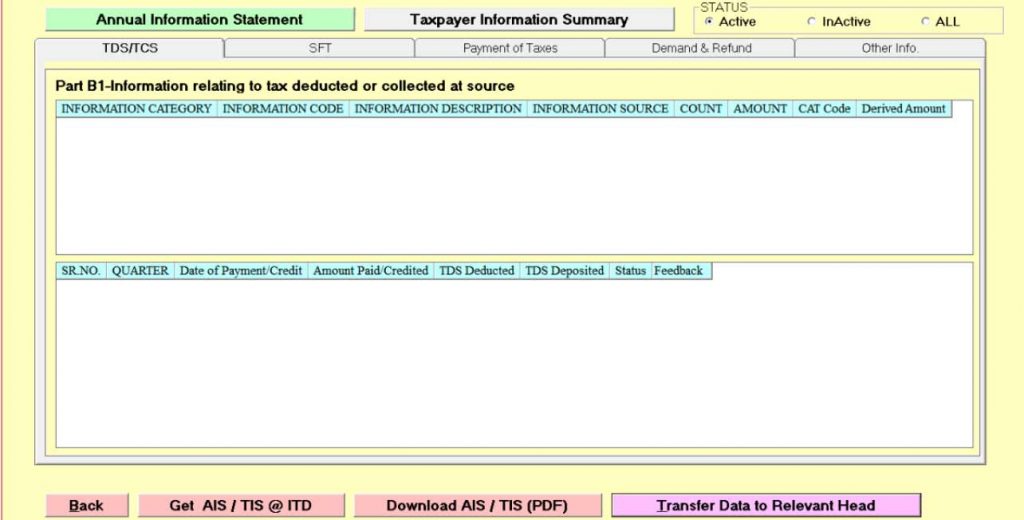

Step 8: Click on AIS/TIS ⏩ Get AIS/TIS @ ITD ⏩ Go to Taxpayer Information Summary ⏩ Click on Item Head ⏩ Select Item ⏩ Transfer Data to Relevant Head

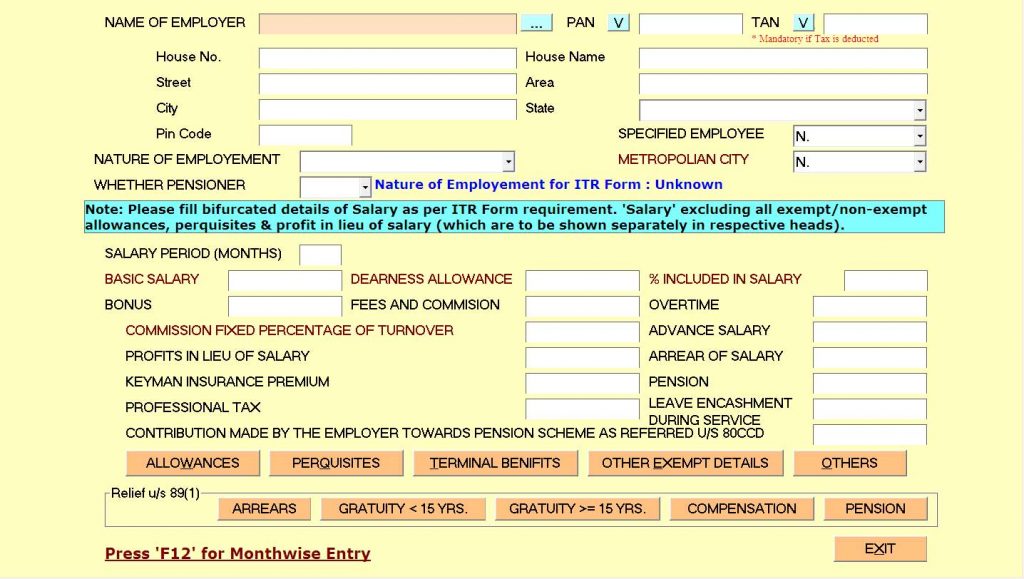

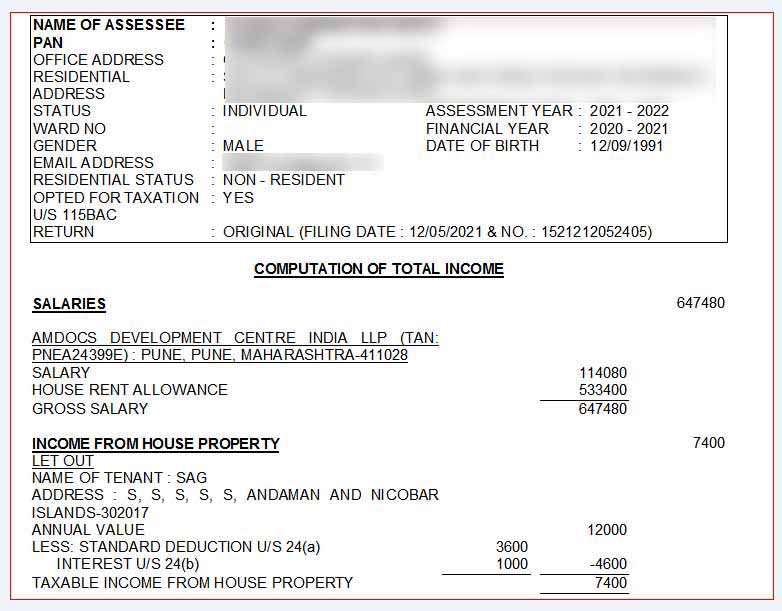

Step 9: Click on Salary Tab ⏩ Fill in the required information such as employer details, nature of employment, etc and input your income details from salaries, including salary period, Basic salary, DA, and Bonus. You can also enter your bifurcated allowances, perquisites, terminal benefits, and arrears details here.

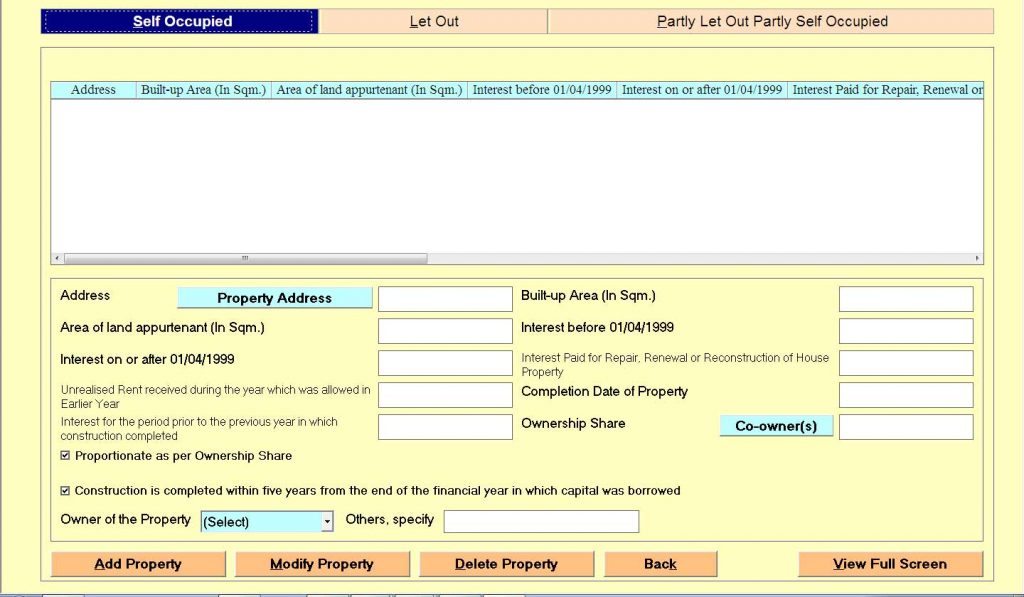

Step 10: Next, enter your House property income. Click on the House Property Tab ⏩ if you have any self-occupied and let-out property, enter the details here, such as Gross rent received, unrealised rent (latest amendments in ITR Form), annual value, interest payable on borrowed capital, etc. Enter the address and co-owners of the property, if any.

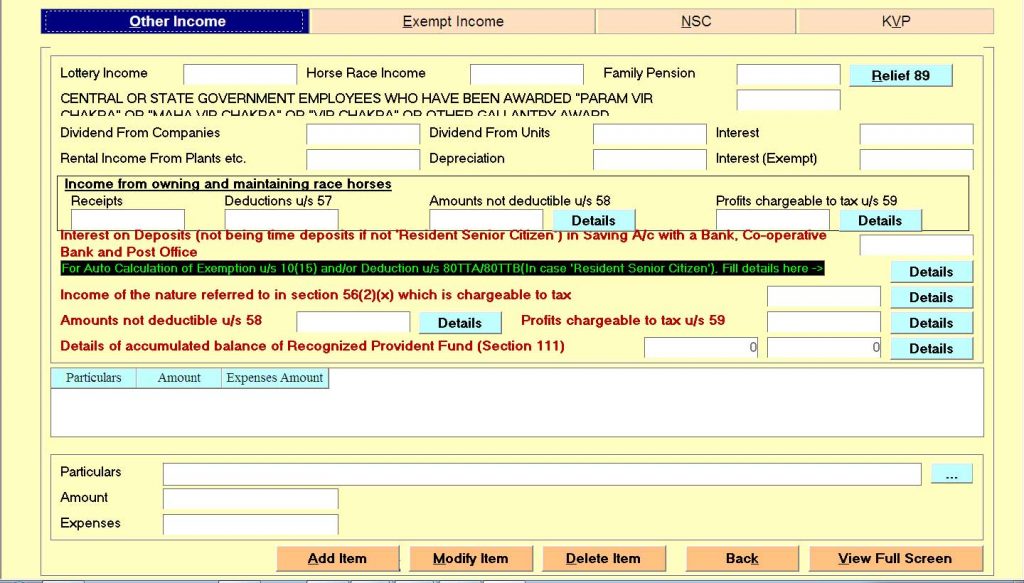

Step 11: Next, enter your other income details, such as Interest income from banks, FD Interest, Post Office Interest, and any other income.

Enter the deductions such as deductions u/s 57(iii), deduction u/s 57(iv)-in case of interest received u/s 56(2)(viii)(amended by finance act 2019).

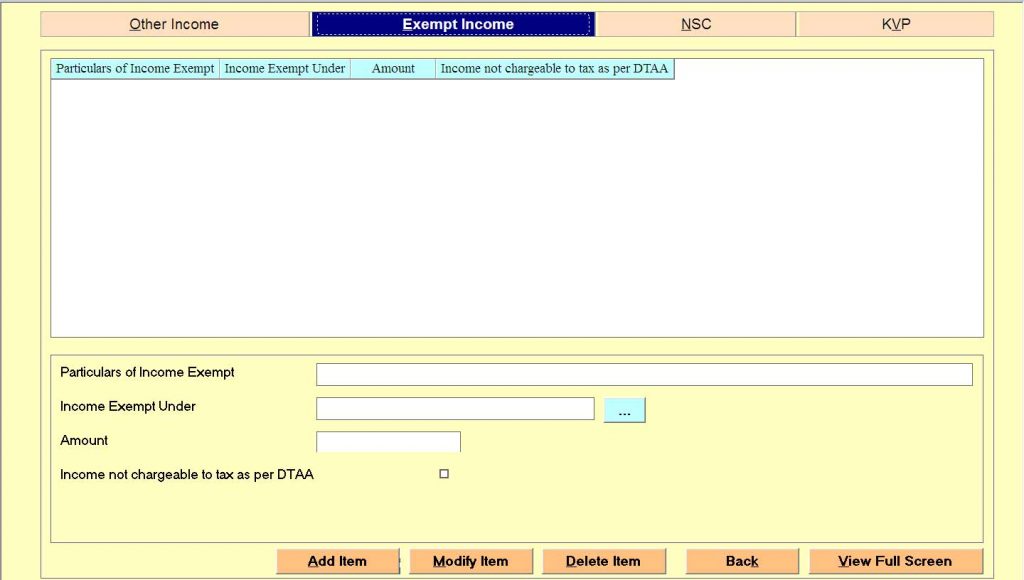

Step 12: Enter your Exempt Income Details like mutual fund income, interest from PPF, etc, here

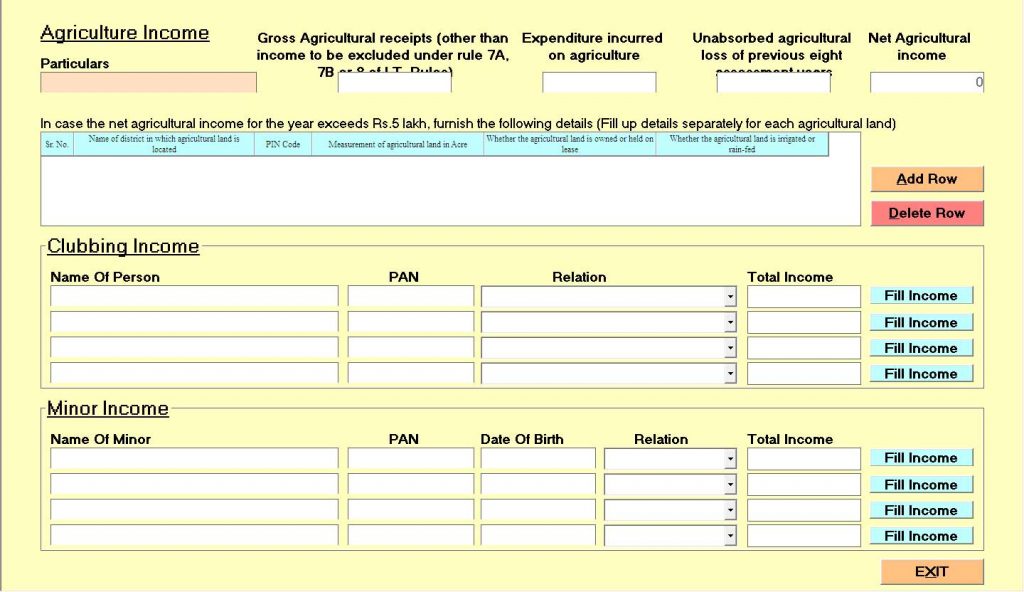

Step 13: If you have agricultural income, then click on the Agriculture Income Tab ⏩ Specify the details such as Gross agricultural income, expenditure incurred, and unabsorbed agricultural losses of the previous eight assessment years.

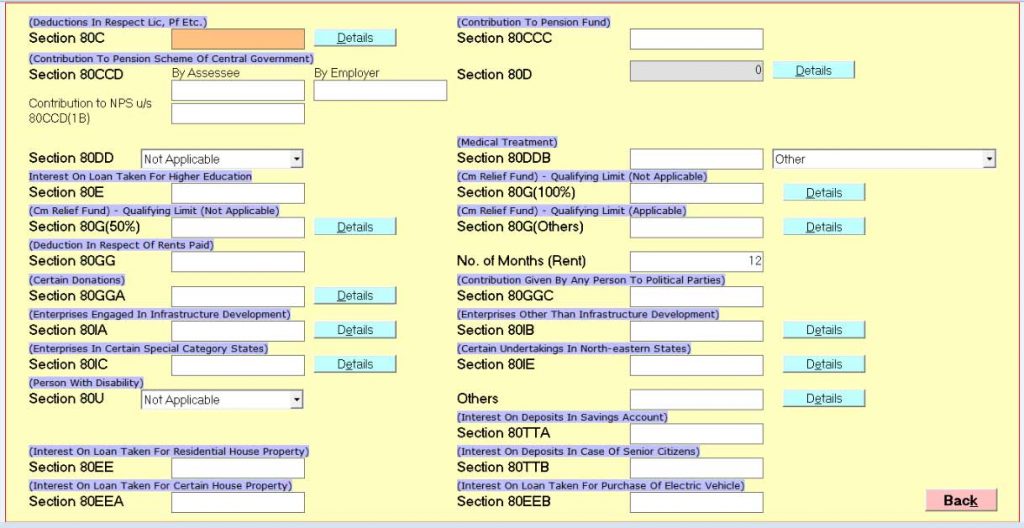

Step 14: Enter your Deductions details like deduction u/s 80C, 80D, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U.

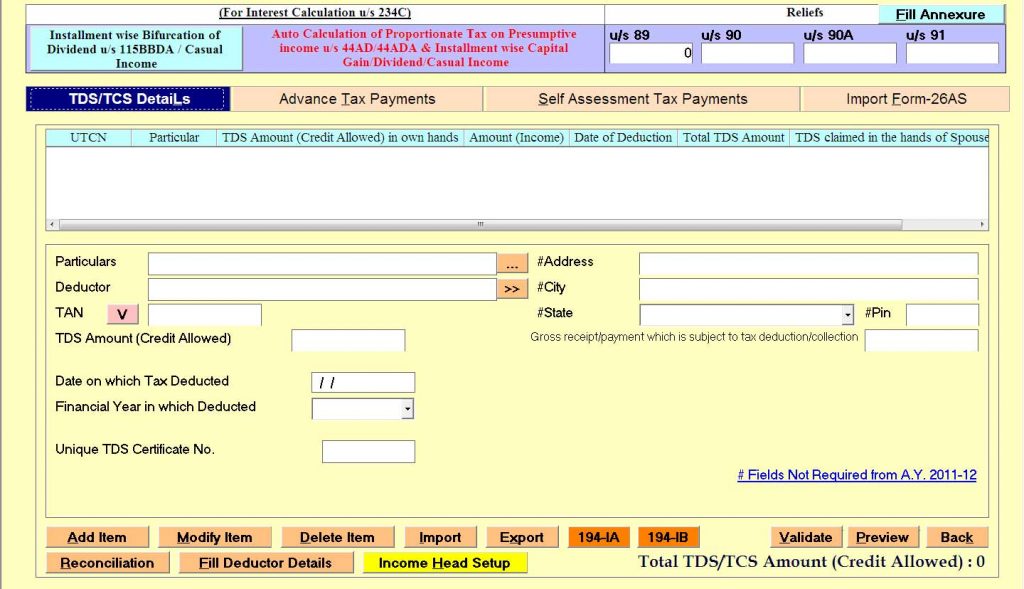

Step 15: Enter your tax details, such as TDS/TCS, Advance Tax and Self Assessment Tax under the Tax Details tab.

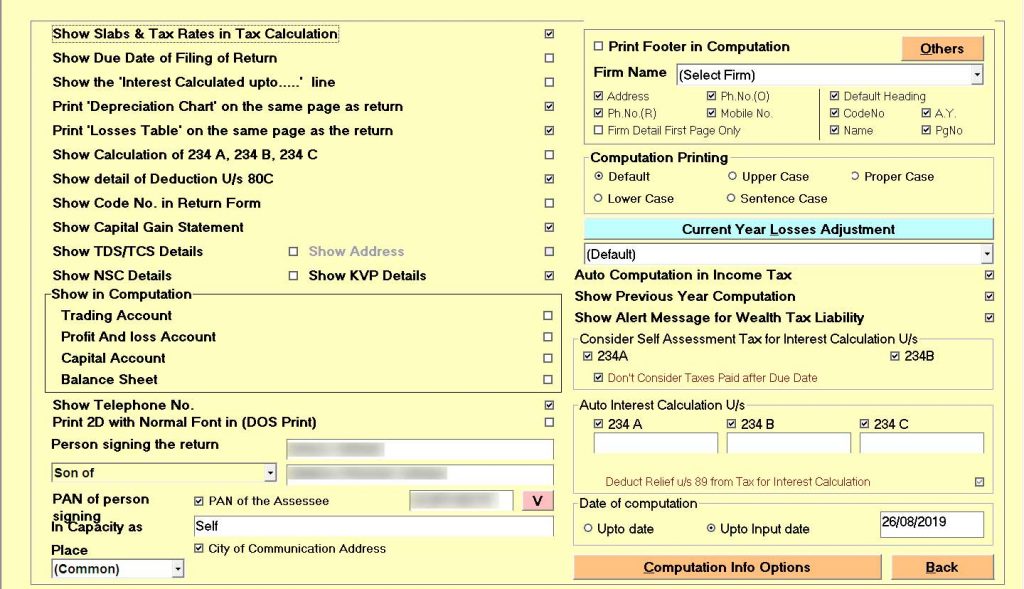

Step 16: Set Up ⏩ Through the setup tab, you may select the appropriate information that you want to print on the computation.

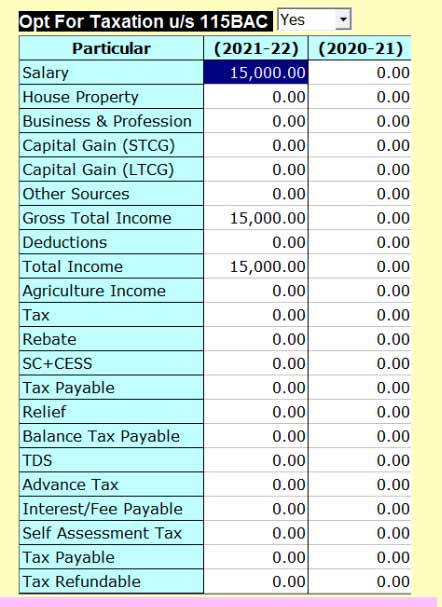

Step 17: You can opt new regime, i.e. 115BAC

Step 18: Through the Computation tab, you may check the computation of your income before filing the return.

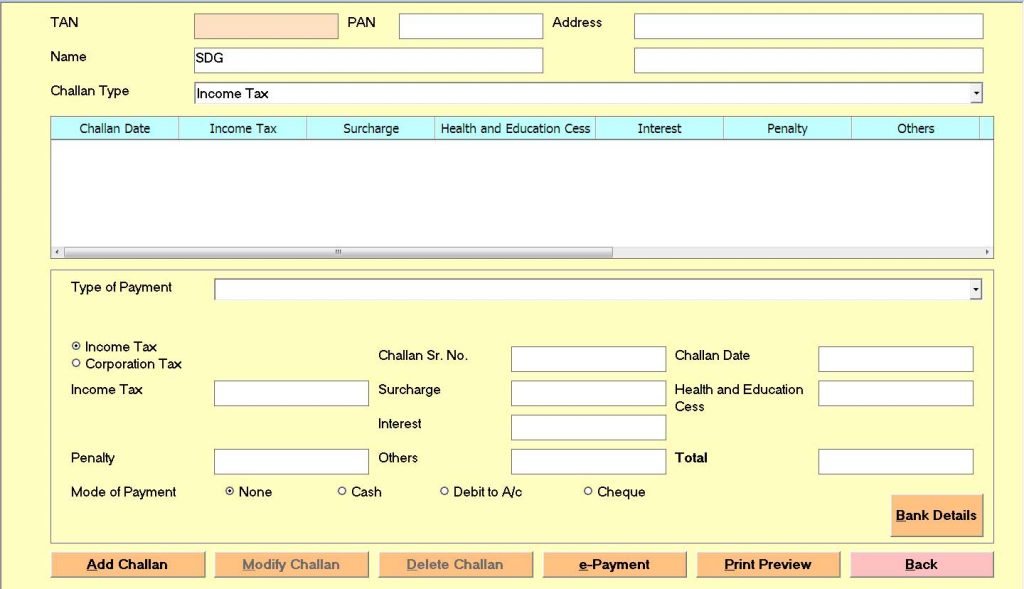

Step 19: Challan Print ⏩ You can make the payment of taxes as well as take a printout of the challan through the Challan Print tab.

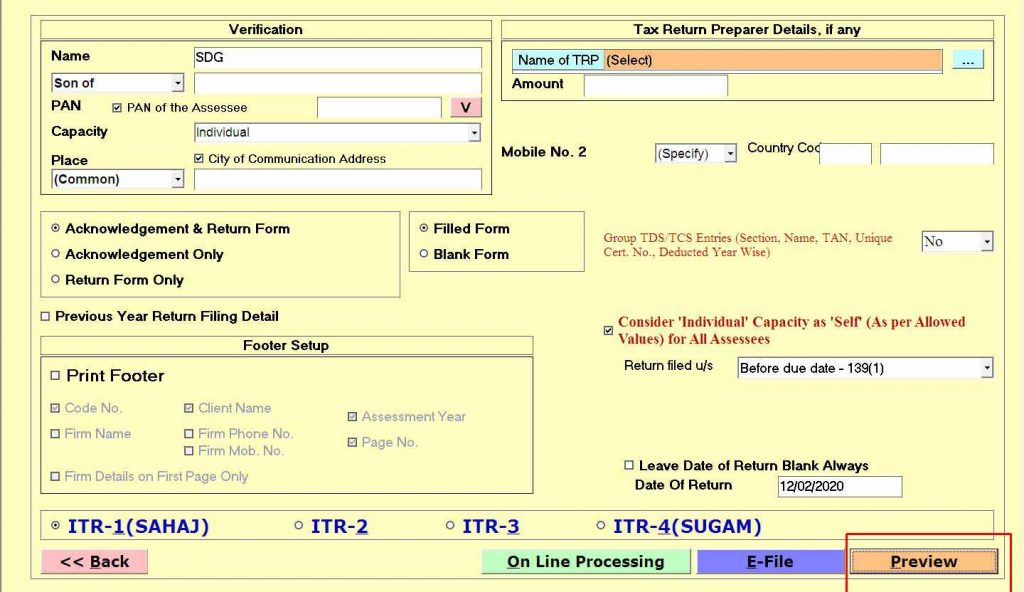

Step 20: Return Form ⏩ You can also review your return form before filing the return through the return form tab.

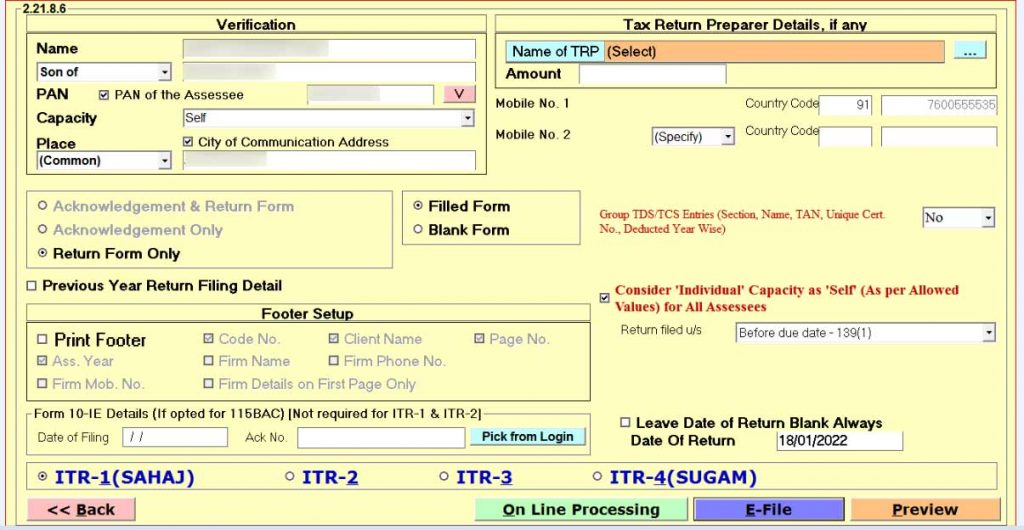

Step 21: E-Filing ⏩ Through this tab, you may e-file your return by clicking on the e-filing button after selecting the appropriate section, such as 139(1)/139(5)/139(4)

Way to Choose Gen Income Tax Software

The Software of Gen Income Tax becomes chartered accountants (CA) first choice as it computes Self Assessment & Advance Tax, and Interest calculation under sections 234A, 234B, and 234C. The development process of the Gen Income Tax e-filing software is completed by SAG Infotech Private Limited (a Jaipur-based company). It is loaded with many features like auto return form & XML generation, arrear relief calculation, PAN application and correction, 26AS Import, and much more.

ok