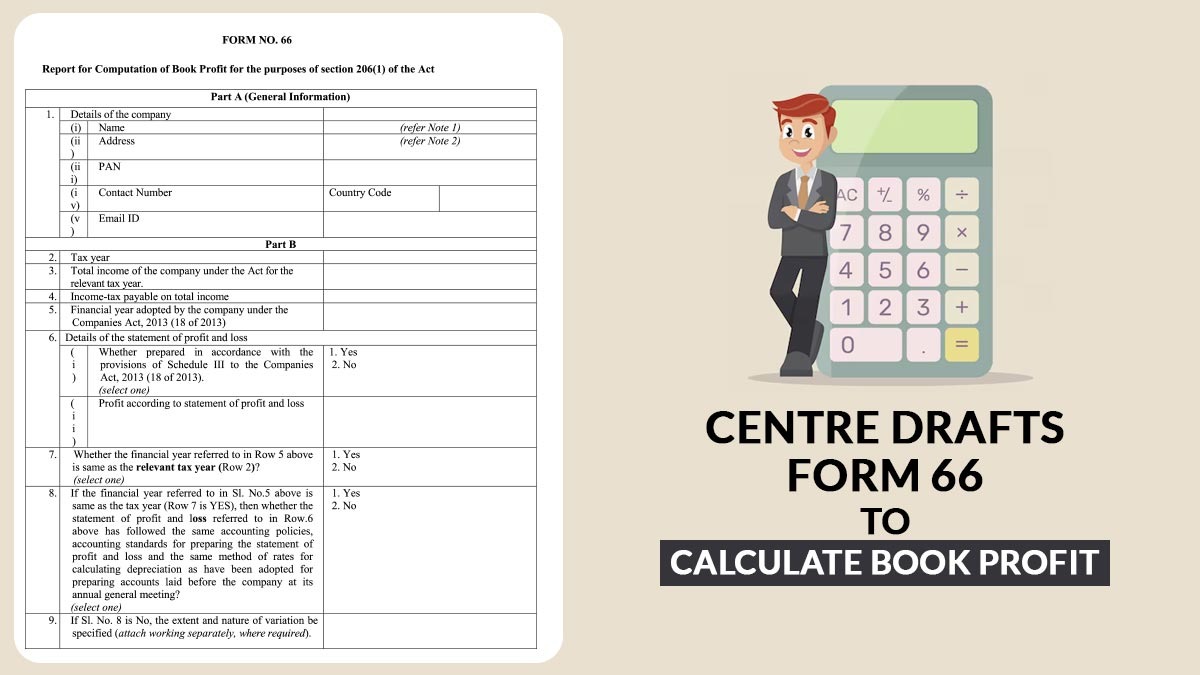

The new draft Form No. 66 has been released by the Government, rolling out a structured reporting framework for the computation of book profit u/s 206(1) of the Income-tax Act, 2025. Detailed disclosure requirements, transition adjustments, and certification norms for companies obligated to tax on book profit are counted under the proposed form.

The draft format signifies a decision for effective clarity and uniformity in computing book profit, for companies complying with Indian Accounting Standards (Ind AS) and those undergoing accounting convergence adjustments.

What is the New Draft Form 66?

Form 66 is a certification and reporting format that must be filed by companies for the computation of book profit u/s 206(1). The report should be certified by a Practising Chartered Accountant under the Institute of Chartered Accountants of India framework and in accordance with the Chartered Accountants Act, 1949.

The form is classified into various parts which cover-

Important: CBDT Releases Draft Form 168 to Standardise Annual Information Statement (AIS)

Structure of Draft Form 66

In the section below, we have discussed the major points of draft form 66 structure:-

Part A – General Details

Companies need to reveal:

The form needs confirmation that the statement of profit and loss has been made as per Schedule III of the Companies Act, 2013.

Part B – Adjustments to Book Profit

The same section needs detailed additions and deductions u/s 206(1)(c) and 206(1)(d). Companies need to-

The structure resembles a Minimum Alternate Tax (MAT)-style computation procedure, ensuring book profits are aligned with statutory adjustments.

Part C – Transition Amount and Ind AS Adjustments

Draft Form 66 reports “Transition Amount” under section 206(1)(t).

Companies transitioning to Indian Accounting Standards (Ind AS) need to reveal:

The form needs the calculation of 1/5th of the transition amount, showing phased adjustment over multiple years.

The same provision ensures tax neutrality at the time of accounting convergence.

IFSC Units

Companies located in an International Financial Services Centre (IFSC) making income only in convertible foreign exchange need to reveal their status separately for rate applicability.

CA Certification

Form 66 should be certified by a Chartered Accountant holding a valid Certificate of Practice. The CA should confirm:

Membership number, firm registration number, and UDIN details are obligatory.

Significance of New Draft Form 66

The rollout of Draft Form 66:

For companies, large corporates, and Ind AS-compliant entities, this draft structure shows stringent compliance oversight and structured documentation requirements.

What Must Companies Do Now?

Complete Draft Form No. 66