The Central Board of Direct Taxes (CBDT) has introduced a new draft Form No. 168, which aims to simplify how taxpayers receive important information about their finances and taxes.

This new form will provide a clear and organised overview of a person’s financial details for a specific tax year, making it easier for individuals to understand and handle their tax responsibilities.

The goal is to help improve transparency and make the process of complying with tax laws more straightforward for everyone.

Draft Form No. 168

Form 168 is created as the Annual Information Statement that includes crucial personal information of the taxpayer, including multiple categories of tax-pertinent data. The form strives to serve as a single reference document showing the taxpayer’s interactions with the Income-tax Department during the pertinent tax year

Key Components of Form 168

The draft Form 168 is classified into two main sections:

Part A: Particulars of the Person

This section includes the basic identification and contact details of the taxpayer, including:

- Name

- Date of Birth or Incorporation

- Address

- PAN

- Email ID

- Contact Number with Country Code

These particulars support ensuring precise mapping of financial data to the correct taxpayer profile.

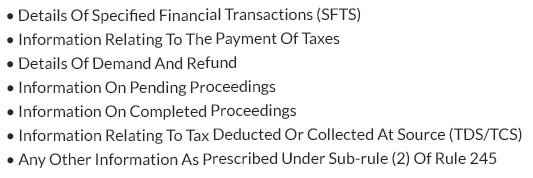

Part B- Nature of Details

Part B is the major part of the Annual Information Statement and consists of a wide range of tax and compliance pertinent information, like:

This holistic method ensures that taxpayers can view all reportable transactions and proceedings in one place, decreasing discrepancies while filing a return.

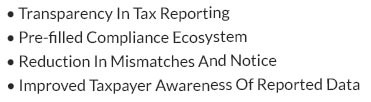

What is the Significance of Draft Form 168?

The rollout of Draft Form 168 shows the focus of the government towards:

By consolidating tax deductions, transactions, demands, refunds, and proceedings, the AIS under Form 168 can support taxpayers in verifying information in advance, choosing the corrective steps, if needed.

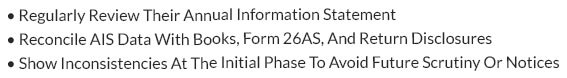

Taxpayers Must Look Out

Once notified, the taxpayers must:

Way Forward

As Draft Form 168 is part of the consultative process, stakeholders can anticipate additional refinements before final implementation. Once notified, the AIS in this structured format may become a key compliance document under the evolving Income-tax framework.