In the GST structure, tax compliance is more than just filing the returns. It needs precise and timely tax payments. In the same procedure, the facility of the challan secures an important role, permitting the taxpayers to deposit the GST liabilities, including tax, interest, penalties, and late fees.

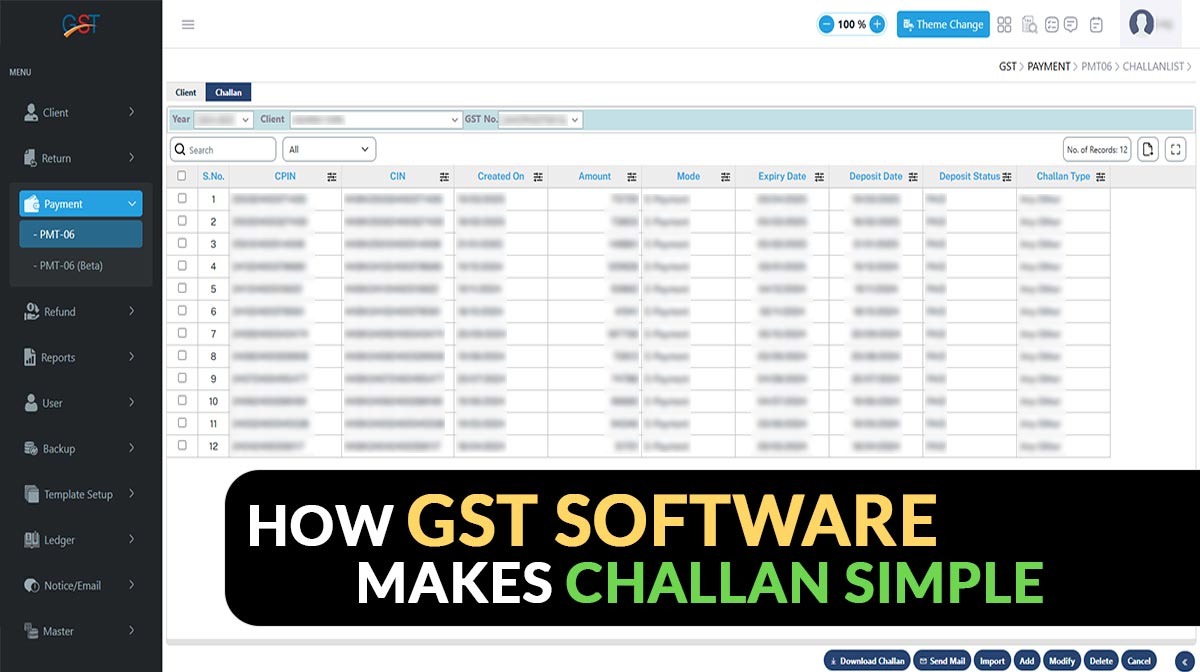

While the GST portal delivers a standard procedure for generating challans, handling the same procedure manually could be difficult for businesses dealing with frequent transactions or multiple registrations. GST software eases the same procedure by delivering a smarter, quicker, and more reliable approach to challan management.

Role of Challans in GST Compliance

Under GST, a GST challan is important for making any payment. A challan should be generated in advance, whether a taxpayer is filing the monthly tax dues, clearing interest on delayed returns, or settling penalties. Manual creation of challans consists of repetitive data entry, selecting tax heads, and verifying amounts. Minor mistakes could result in wrong ledger postings or payment mismatches. GST software addresses such issues via automating and organising the workflow.

Accurate Liability Computation Made Easy

The ability of the GST software to calculate tax obligations is one of its main benefits. The software computes the GST liable to be paid as per sales invoices, purchase data, and applicable tax rates. It organises amounts under CGST, SGST, IGST, and cess, and accounts for any interest or late fees when applicable.

When doing the same GST software confirms that the challan shows the appropriate amount that is to be paid, removing the requirement for manual computations and lowering the risk of underpayment or overpayment.

Quick and Error-Free Challan Generation

GST software permits taxpayers to generate challans post-finalisation of tax obligation. System autofills the related information, like GSTIN, tax period, and tax components. Challans could be made precisely and quickly with minimal user intervention.

Various advanced GST software solutions combine with the GST portal, allowing users to generate challans without the requirement to log in repeatedly or re-enter data. The same process saves useful time, particularly during peak filing periods.

Effective ITC Usage

For decreasing cash outflow, optimising ITC is crucial. GST software automatically adjusts available input tax credit (ITC) against output tax obligation under the norms of GST utilisation. If there is any balance left, then it gets converted to a cash liability and shown in the challan.

The same automated ITC adjustments support taxpayers in preventing excessive payments and ensure that credits are used perfectly and in compliance.

Seamless Payment and Real-Time Tracking

Post generation of a challan, the GST software navigates users via the payment procedure by furnishing a payment reference and options, such as net banking or NEFT/RTGS. After making the payments, the software monitors the status of the challan and updates the records automatically.

The feature of real-time tracking allows taxpayers to monitor due or completed payments. It gives clarity on payment history at any time.

Important: Why You Need Sales Reconciliation in the GST Software

Decreases Errors and Effective Compliance Control

Manual challan generation can cause errors like choosing the wrong tax head, duplicating payments, or choosing an incorrect tax period. GST software consists of built-in validations and compliance checks that avert such mistakes.

Aligning the challan generation with GST norms and return data, the software assures consistency between liabilities, payments, and ledger entries, reducing the chances of notices or compliance issues.

Centralised Records and Easy Reconciliation

GST software keeps a consolidated record of all challans generated and paid. Such records could be reconciled with the electronic cash ledger available on the GST portal. At the time of audits, assessment or internal reviews, the taxpayers can recover challan details, payment proofs, and summaries without searching through multiple systems.

The same organised record management improves clarity and lowers the stress pertinent to compliance.

Appropriate for Businesses and Tax Professionals

For businesses with high transaction volumes and professionals managing multiple clients, GST software can greatly enhance productivity. It allows users to manage challans, payments, and compliance all from a single dashboard, reducing manual work and operational intricacy. User-friendly interfaces, along with alerts and reminders, ensure that critical tax payments are never missed.

Closure: The taxpayer’s way of managing the challan facility under GST has been made appropriate by the GST software. It makes a complex compliance task into a seamless procedure via automating calculations, easing challan generation, optimising ITC usage, and ensuring precise payment tracking. GST software is a crucial tool for taxpayers who desire precision, time savings, and peace of mind.