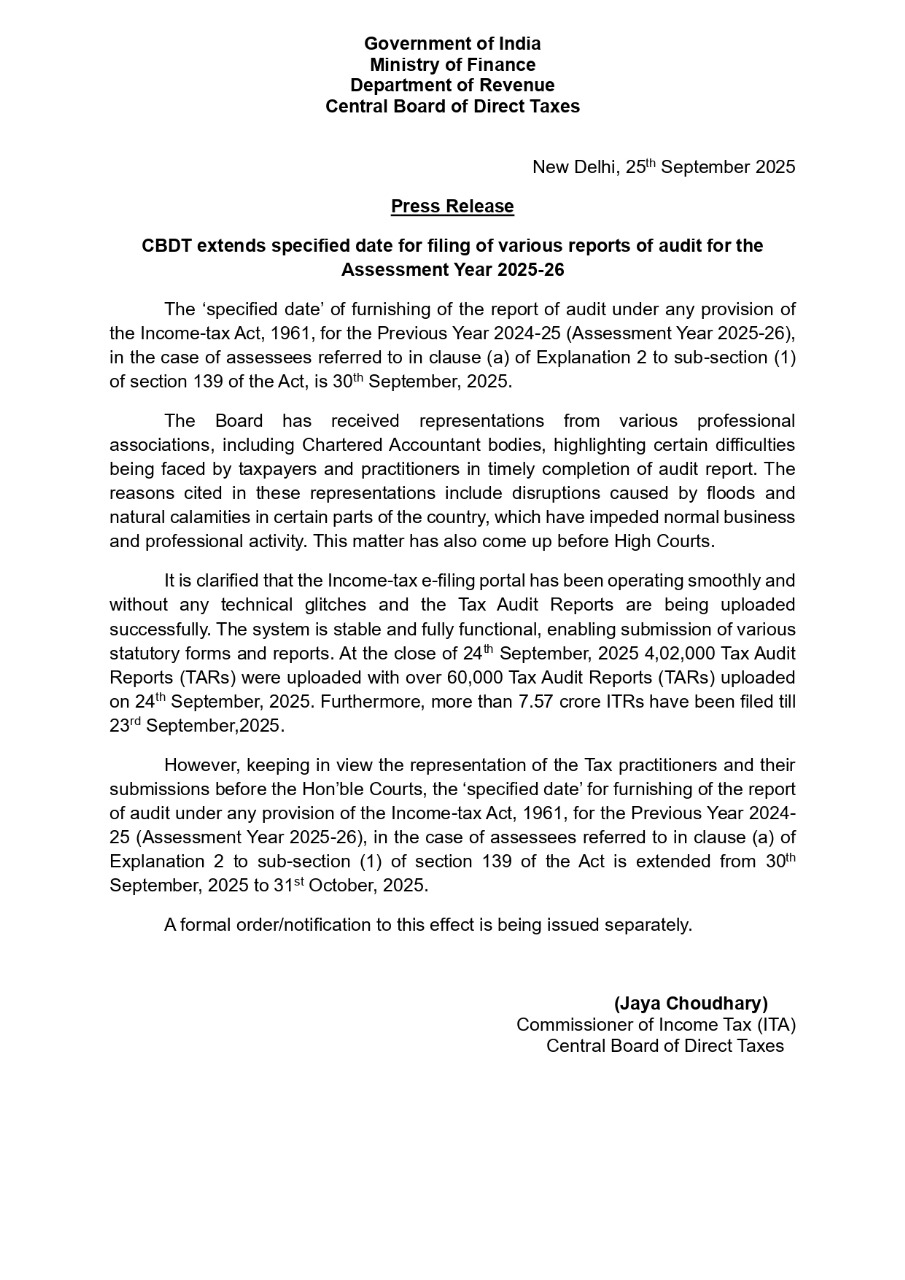

The Central Board of Direct Taxes (CBDT) has announced an extension for the submission of various audit reports required under the IT Act, 1961, for the Assessment Year 2025-26.

The new deadline for filing tax audit reports has been moved from the previous date of September 30, 2025, to October 31, 2025.

In response to distinct representations from the professional associations along with the Chartered Accountant bodies, the same extension has been arrived at that specifies the issues encountered by taxpayers and practitioners in the timely completion of the audit reports.

Disruptions caused by floods, natural calamities, and their impact on business and professional activity are some of the factors that are specified as major concerns.

The Central Board of Direct Taxes (CBDT) has highlighted that the case in question has been presented before multiple High Courts. In its statement, the Board clarified that the Income-tax e-filing portal has been functioning smoothly without any technical issues.

As of September 24, 2025, significant progress has been made in the filing process, with over 4.02 lakh Tax Audit Reports (TARs) submitted, including 60,000 TARs that were uploaded on the same day. Furthermore, by September 23, 2025, more than 75.7 million income tax returns (ITRs) had been successfully filed.

Considering the problems encountered by taxpayers and submissions before the court, the government has determined to extend the due date by 1 month. There will be a separate issue of a formal order/notification to this effect.

Read Also: Full Guide to File Form 3CA-3CD/3CB-3CD By Gen Bal Software

Tax practitioners and businesses will get much relief from the same extension, which ensures that enough time has been given for precise compliance under the Income Tax Act.