Simple Definition of Tax Audit Report

In certain specified situations, a business or profession may be subject to a tax audit under Section 44AB of the Income Tax Act. Chartered Accountants prepare audit reports after auditing businesses’ books of accounts in practice. In a Tax Audit, a CA ensures that the books of accounts are properly prepared and that the taxable income is calculated accurately as per the Income Tax Act.

The following steps apply to an assessee who is subject to a Tax Audit under Section 44AB of the Income Tax Act, 1961:

- Audit the books of accounts by a Chartered Accountant in practice

- Form 3CB-3CD or Form 3CA-3CD is filed by Chartered Accountants

- Form ITR 3 is filed by the taxpayer

Different Forms 3CA, 3CB, 3CD, 3CE for Tax Audit Report

The Income Tax Department specifies the format of Audit Reports. In Forms 3CA and 3CB, auditors’ information is included, while in Form 3CD, details of the tax audit are included.

| Name of the Form | Definition |

|---|---|

| Tax Audit Form 3CA-3CD | For taxpayers with business or professional income who are mandated to have their accounts audited under another Act (other than the Income Tax Act), a Tax Audit Report is required. |

| Form 3CB-3CD for Tax Audit | A taxpayer with business or professional income who is not required to get their accounts audited under any other law (other than the Income Tax Act) will receive a Tax Audit Report. |

| Tax Audit 3CE Form | A tax audit report for a taxpayer receiving a royalty or fee for technical services that is not a resident or a foreign company. |

Penalties If Not Filed Form 3CD for a Tax Audit

If an assessee fails to get their books of account audited as per Section 44AB, the Assessing Officer (AO) will impose a penalty under Section 271B. The penalty will be the lesser of the following:

- 0.5% of the total sales or turnover of the business, or 0.5% of the gross receipts of the profession

- INR 1,50,000

Filing Deadline for Tax Audit Reports

All assessee who are required to have their accounts audited must submit their Tax Audit Report file one month before they are due to file the income return required under section 139(1). Every year, the deadline for the previous financial year is 30th September.

Why You Should Choose Gen Bal Software for Tax Audit Filing?

Gen BAL is one of the best software programs to prepare Balance Sheets for accounting professionals. The software has an advanced feature that will automatically calculate P&L statements for the fast practice of balance sheets.

It will also allow you to for importing of trial balances directly from third-party popular accounting software such as Tally and Busy. With this software, users can also file 3CA or 3CB forms instantly within the software and upload the forms later. A sample fund flow statement and a cash flow statement are also included.

Using this software, you can prepare audit forms, annual returns, and calculate depreciation. A powerful feature of our Gen Balance Sheet Software is the ability to directly import data from popular accounting and tax software such as Tally, Busy, MS Excel, and others. According to the Trial Balance provided by the user, the application can automatically generate balance sheets, profit-loss data, trading accounts, and lists.

E-Filing Procedure for Audit Forms 3CA-3CD/3CB-3CD via Gen Bal Software

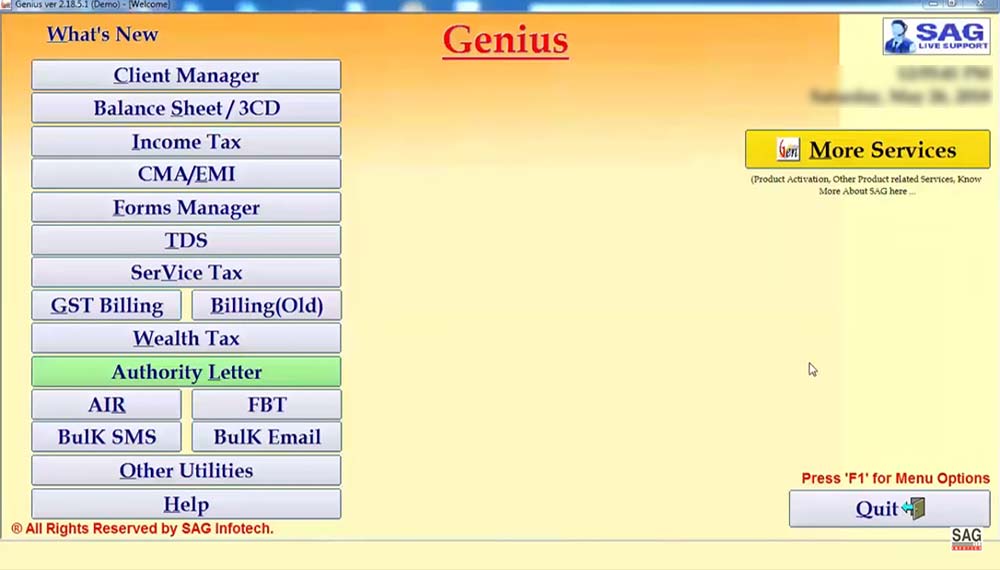

Step 1:- Install Genius software on your desktop and PC.

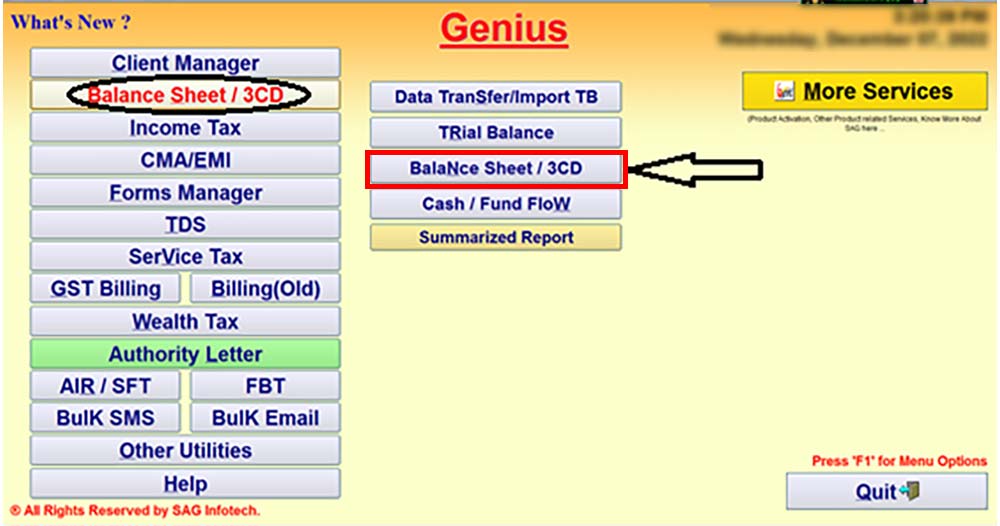

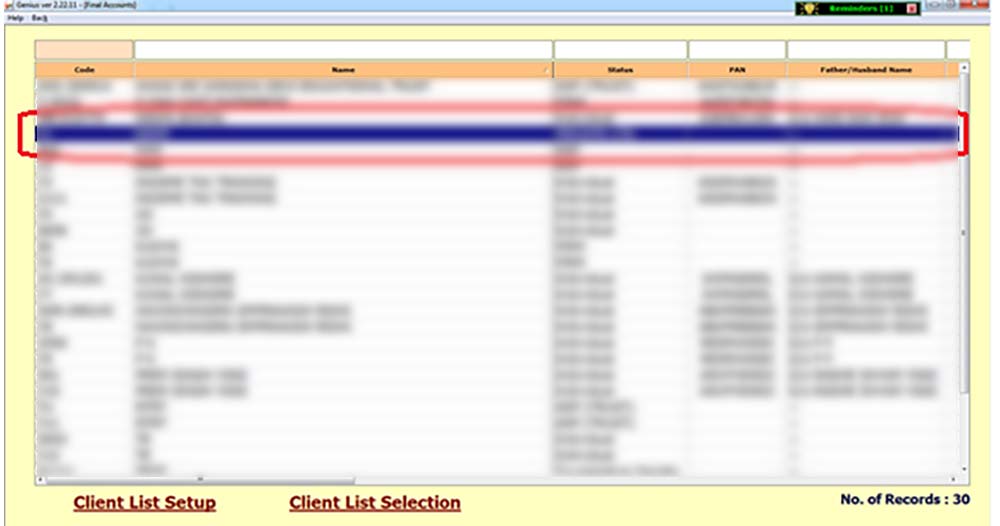

Step 2:- Now, open the software and click on ‘Balance Sheet/3CD’ from the list.

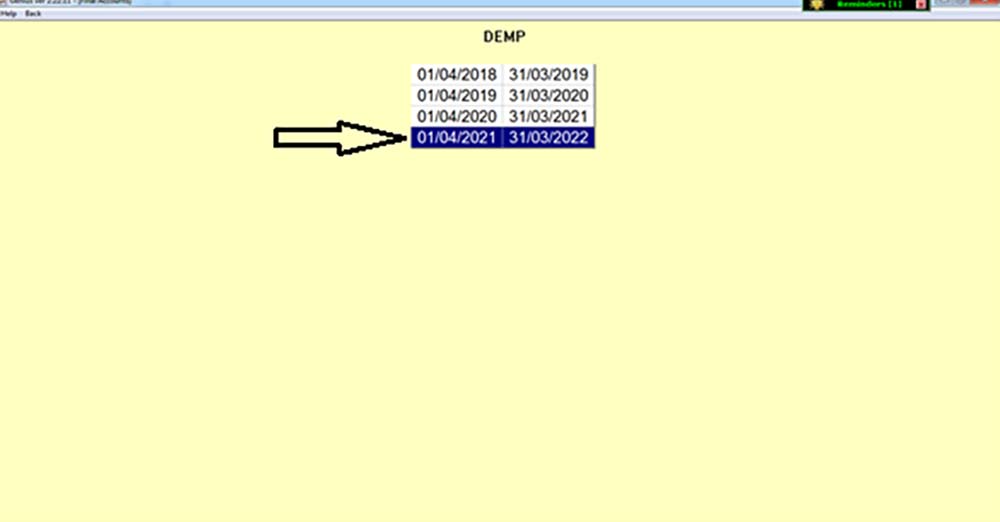

Step 3:- Select the ‘Client and Year’ of which you want to File the Tax Audit Report i.e. 3CA-3CD/3CB-3CD.

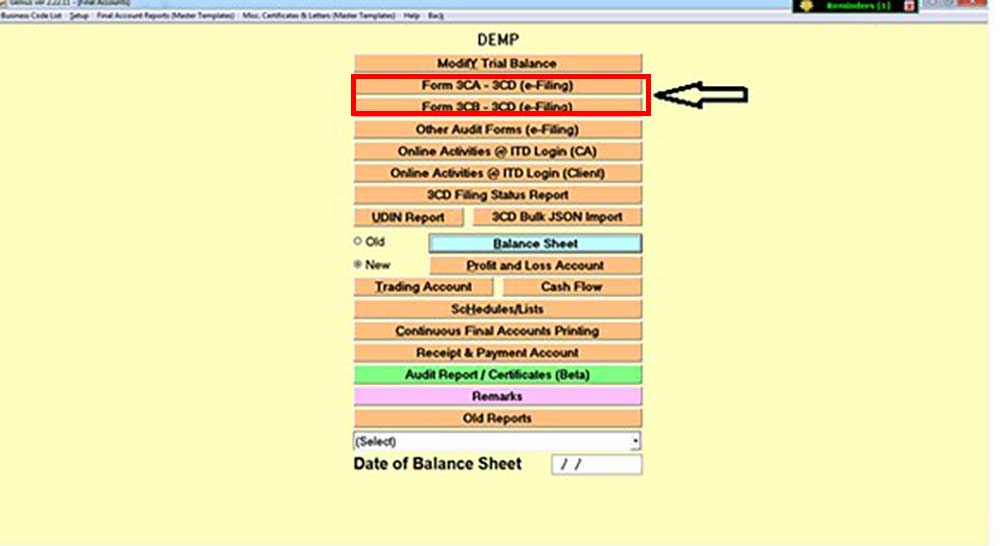

Step 4:- Select ‘Form 3CA-3CD/3CB-3CD’ as applicable to you.

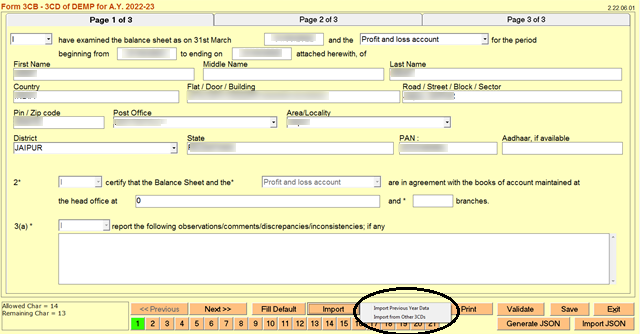

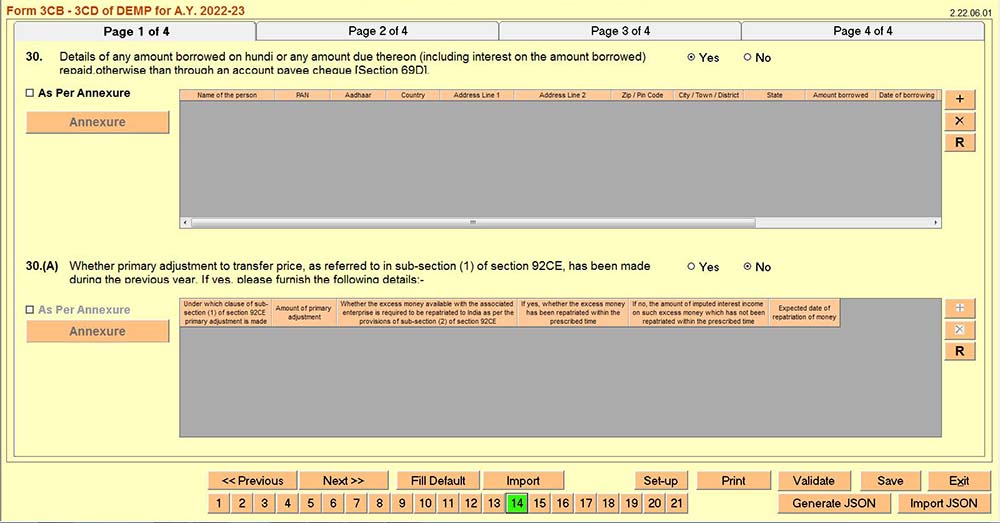

Step 5:- Now fill in the clauses of ‘Form 3CA-3CD/3CB-3CD’ that are applicable to you or you can also import the Data from the previous year or from other 3CDs as well.

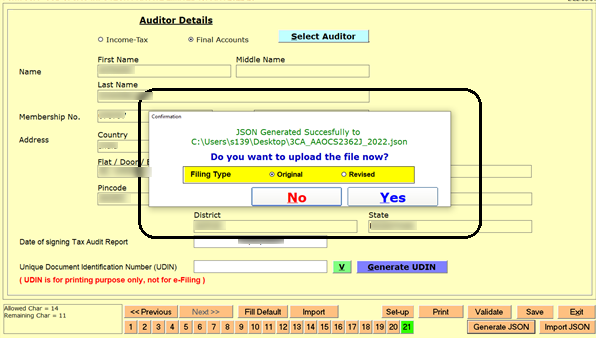

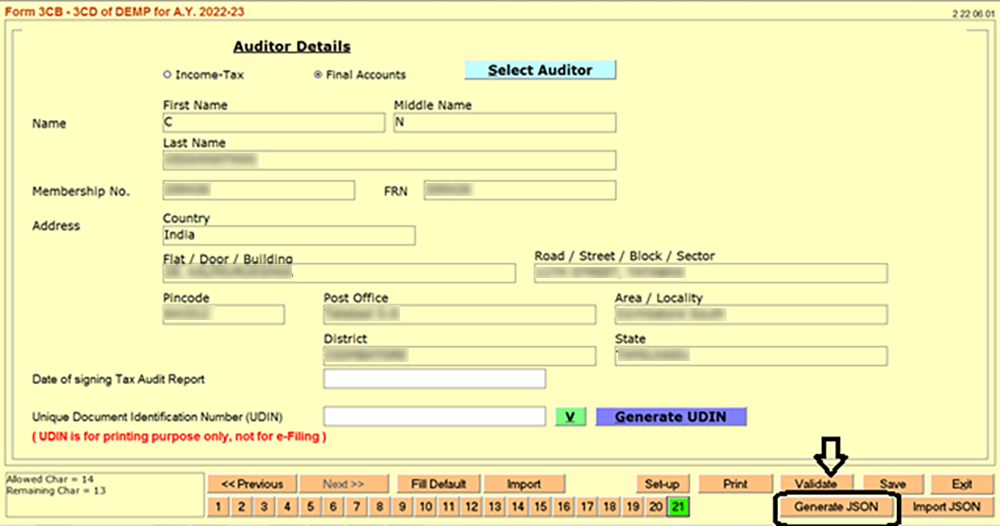

Step 6:- Pop-up will appear as shown in the image below. Click on Yes and Upload the Return.