Simple Meaning of TDS Challan

TDS challans are used to deposit TDS with the Indian government. There is only one challan that can be utilised for depositing taxes collected under each section of the Income Tax Act. Assessees who want to pay the TDS without a challan must deposit the TDS collected on the same day.

Different Kinds of TDS Challan

Basically, there are two types of TDS Challans as described below –

TDS Challan 280

Income Tax India’s official website has a form called TDS Challan 280. It is possible to pay income tax online or offline using Challan 280.

In addition to Advance Tax, Regular Assessment Tax, Surcharge, Self-Assessment Tax, and Tax on Distributed Profits, Challan 280 can also be used for Income Tax payments.

Challan No./ITNS 280 is required to pay Income Tax and Corporation Tax, regardless of the mode of payment chosen.

For Challan 280, the following details are required:

- Permanent Account Number(PAN)

- Assessment Year

- Taxpayer Name (Firms / Other than Firms)

- Address of the Taxpayer

- Name of the Branch and Bank

TDS Challan 281

TDS challan 281 is used by corporations and non-corporate commodities to deposit TDS or Tax Collected at Source. As part of the sale of specified goods, the seller typically collects this fee from the buyer. A Challan Identification Number (CIN) is generated when the payment is made.

Essential Points to Remember When Collecting TDS

- Tax Deduction and Collection Account Numbers (TANs) are issued to individuals responsible for collecting taxes through TDS.

- On the NSDL website, you can find an alpha-numeric TAN number.

- In order to obtain your TAN number, you must submit Form No. 49 B along with a fee.

- Individuals who fail to quote TAN in their communications with the Income Tax Department will be fined Rs. 10,000.

Step-by-Step Procedure to Add Challan Details Via Gen TDS Software

The following steps will guide you through the process of adding challan details to the Original and Correction Statements:

Case 1: How to Add Challan in the Original Statement

Step 1: First Install the Gen TDS Return Filing Software On Your Laptop and PC.

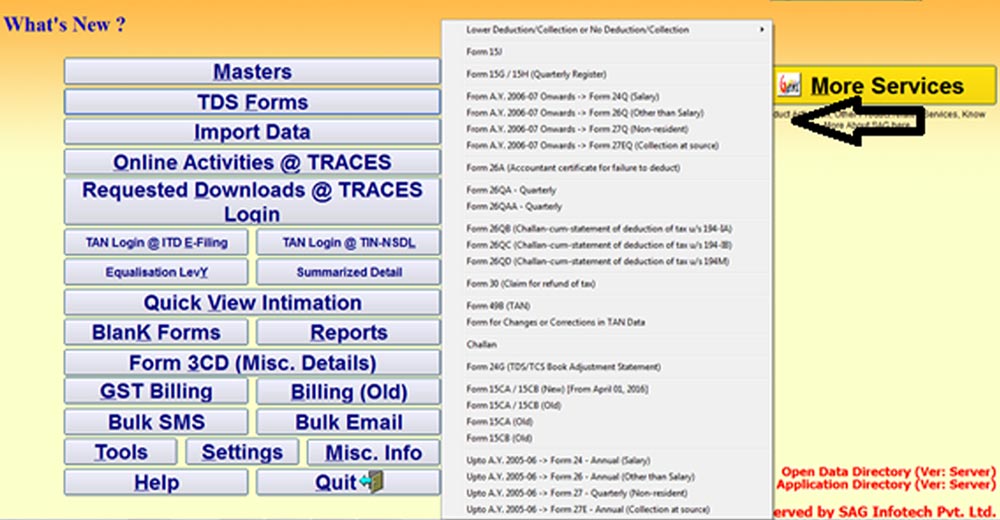

Step 2: Now Select the form on which you want to file your ‘Original TDS returns’. Just click on the ‘TDS Forms’ option as shown in the screenshot.

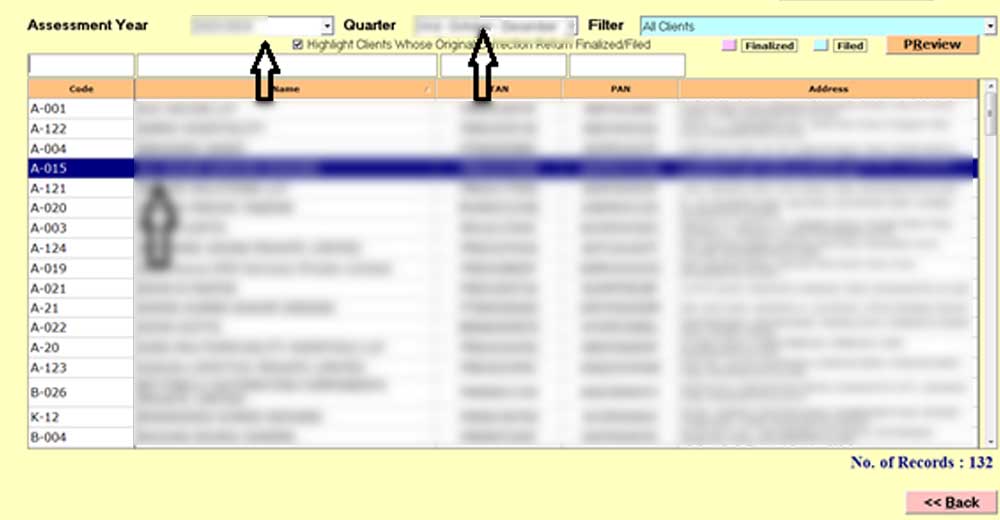

Step 3: Click the Particular Client, Quarter and Assessment Year.

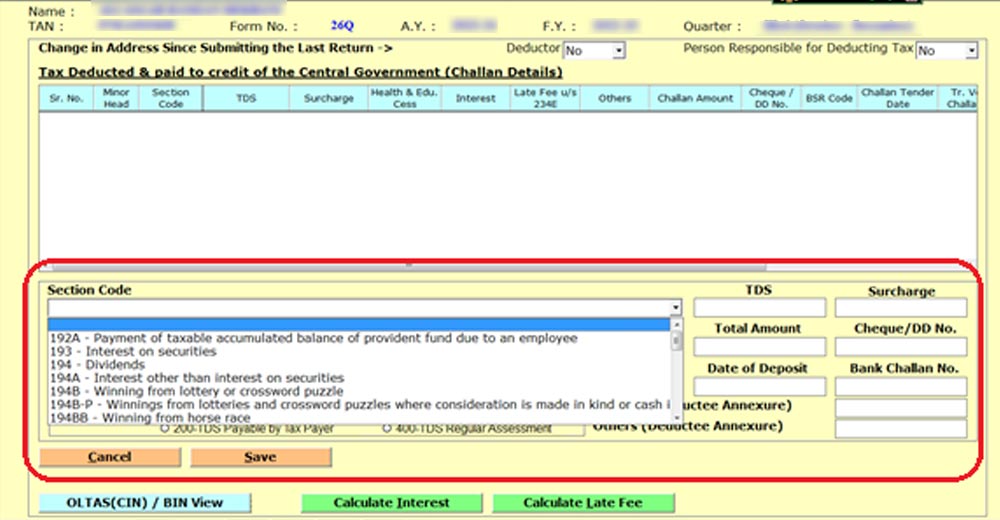

Step 4: Select the Section in Which You Have Made the Payment and Fill in the Challan Details Like BSR Code, Challan Date, Amount etc.

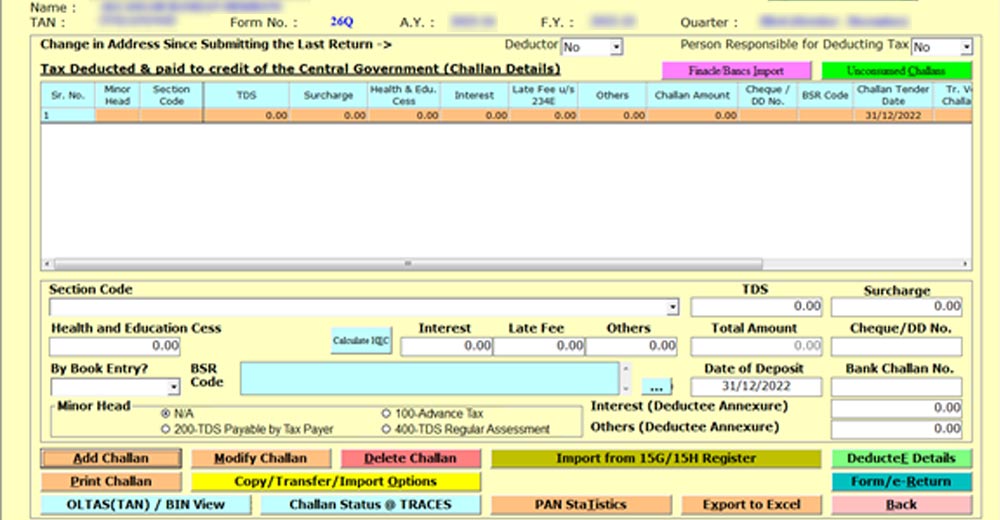

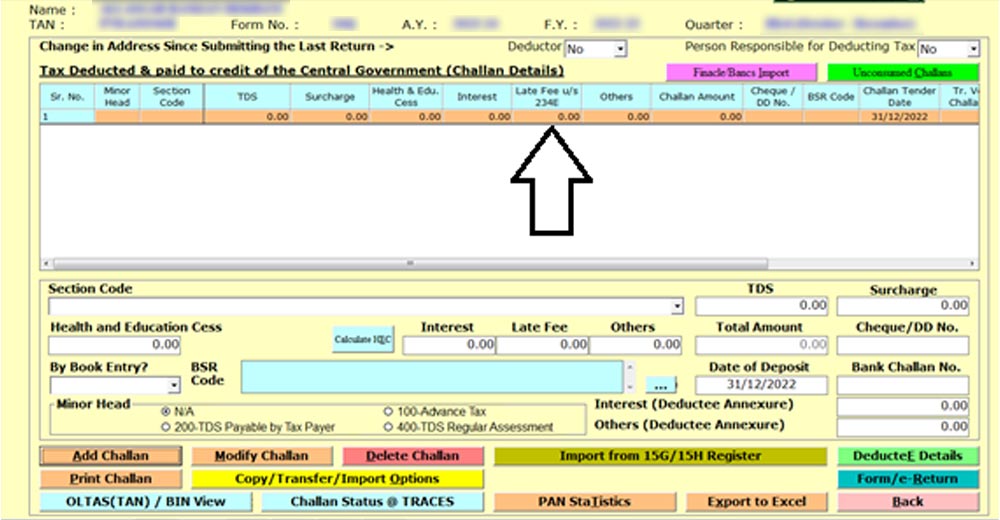

Step 5: The next step is to add your challan details by clicking the save button. In the upper row, you can see the details of the challan.

Step 6: After Double Clicking on Challan You Can Add the Deductee Details.

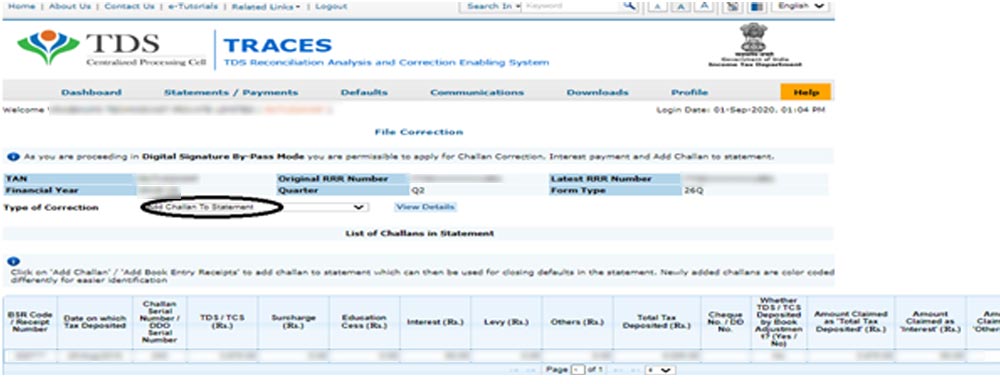

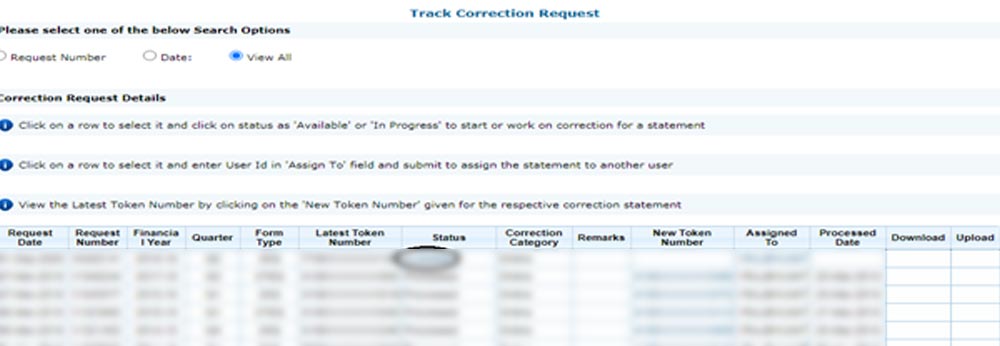

Case 2: How to Add Challan in the Correction Statement

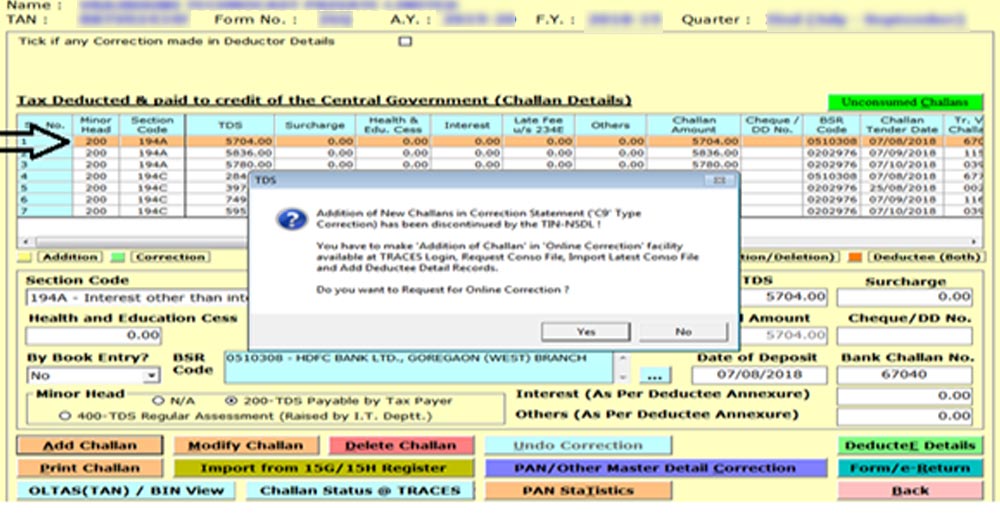

Step 1: In the case of the correction statement. If the client clicks Yes on the Request for Online Correction, they can add the details of the challan while making the correction.

Step 2: After that Click on the Available Status

Step 3: In the next process you can add challan as shown in the below screenshot