The Bombay High Court has determined that Assessing Officers (AOs) must verify information before initiating reassessment proceedings based on faceless data. This ruling comes from a bench of Justices G.S. Kulkarni and Somasekhar Sundaresan, who underscored the importance of verification when AOs intend to act under Section 148 of the Income Tax Act, particularly when the information is derived from electronic sources as outlined in Section 135A.

The court clarified that AOs should not issue notices under Section 148 without properly verifying relevant materials, whether obtained from the taxpayer or other sources. This verification is crucial to forming a legitimate opinion on whether it is permissible to bypass the procedural requirements outlined in Section 148A before issuing a notice under Section 148.

In the current scenario, the petitioner filed an income tax return for the assessment year on December 22, 2020. On January 16, 2021, the petitioner received an intimation confirming the acceptance of the declared income without any adjustments. However, on April 2, 2021, the petitioner was informed via the Insight Portal of discrepancies related to the reported “interest income.”

The portal showed that the petitioner’s income from other streams amounted to Rs. 26,41,234.65. In response, the petitioner clarified on April 3, 2021, that the correct interest income was Rs. 8,88,577, and that the additional amount of Rs. 17,52,657.65 was based on incorrect information provided to the tax department.

More than a year later, the petitioner received a reassessment notice under Section 148, accompanied by the necessary approvals and a preliminary verification report (PVR). The acceptance under Section 151 indicated that the notice could be issued without adhering to the pre-issuance procedures mandated by Section 148A.

The petitioner claimed that the reassessment notice was issued without sufficient consideration, rendering it arbitrary. They argued that the department relied solely on erroneous information from the electronic portal, which was generated under the framework of Section 135A.

The petitioner asserted that since the foundation of the information was flawed, it was the responsibility of the Assessing Officer (AO) to thoroughly review the responses provided by the taxpayer. Only after a proper examination of the relevant materials should a notice under Section 148 be issued, following the required procedural provisions.

In a recent ruling, the department maintained that the details submitted by the petitioner in their income tax return were accurate, now reflecting the correct interest income of Rs. 8,72,799.65 in the system. This assertion underscores the importance of accurate data in tax assessments and the role of technology in ensuring compliance.

Section 135A of the Income Tax Act grants the Central Government the authority to establish a scheme via notification in the Official Gazette for the collection and inspection of information. This provision aims to enhance transparency and responsibility by reducing direct interactions between income tax authorities and taxpayers, utilizing technological advancements to the fullest extent possible.

The section particularly applies when the Assessing Authority relies on information collected through a faceless mechanism to issue notices under Section 148.

The court highlighted the critical need for verification before any actions that could adversely affect the taxpayer, such as issuing a show-cause notice under Section 148. It emphasized that the tax authorities must conduct basic scrutiny of the information, ensuring that it aligns with the details provided by the taxpayer.

This verification process is essential to reach a prima facie finding that income has escaped assessment, which justifies further action under Section 148. The court noted that failing to perform this verification could lead to the misuse of inadequate data, undermining the integrity of the assessment process and rendering the first proviso of Section 148 ineffective.

Read Also: Bombay HC: A Change of Opinions Does Not Justify Assuming Income Chargeable to Tax

Ultimately, the court ruled in favour of the petitioner, declaring the notice given under Section 148 as arbitrary and lacking proper consideration. The court ordered that the notice be quashed and set aside, reinforcing the principle that tax authorities must engage in diligent verification before initiating reassessment proceedings.

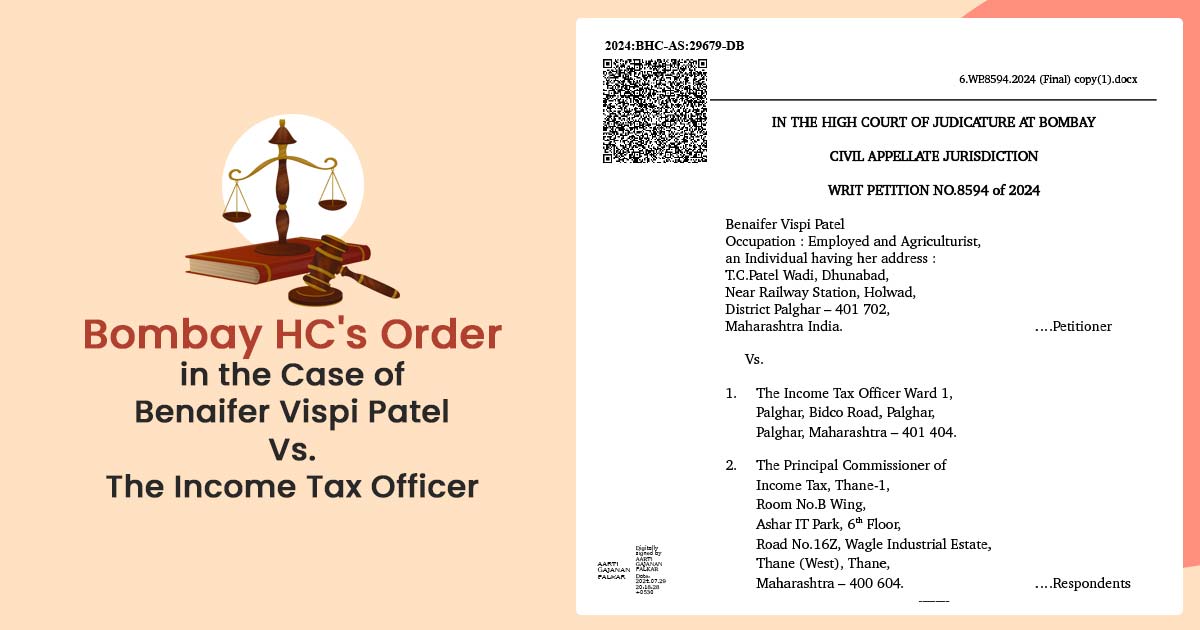

| Case Title | Benaifer Vispi Patel Vs. The Income Tax Officer |

| Citation | WRIT Petition No. – 1026 of 2024 |

| Date | 15.07.2024 |

| Counsel For Petitioner | Mr. Dharen V. Gandhi |

| Counsel For Respondent | Mr. Akhileshwar Sharma |

| Bombay High Court | Read Order |