The Mumbai Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has annulled a show-cause notice directed at fruit vendors who are not involved in any activities subject to service tax.

The bench, consisting of Judicial Member Suvendu Kumar Pati and Technical Member Anil G. Shakkarwar, noted that the show cause notice failed to demonstrate that the appellant was offering any taxable service. The notice was issued to a premise in Navi Mumbai, while the appellant operates their business in Dombivli, Thane, which is distinct from Vashi, Navi Mumbai.

Consequently, the appellant did not receive the notice or the subsequent order until they requested it in November 2022. The appellant’s business involves selling fruits, which falls under entry (e) of the negative list specified in Section 66D of the Finance Act, 1994.

The appellant, a fruit seller, is not responsible for any service tax-liable activities and accordingly did not register for service tax. A show cause notice was issued based on information from the Central Board of Direct Taxes, sent to an address in Vashi, Navi Mumbai.

The notice claimed that the services offered by the petitioner were not included in the negative list. The notice requested information from the petitioner, and despite receiving data from them, the service tax was deemed to be zero.

Consequently, using the provisions of Section 72 of the Finance Act, 1994, the authorities estimated the service tax due (which is Rs. 6,00,000) from the appellant for April 2015 and June 2017. The authorities made the demand for the said amount.

The original mandate was issued ex parte, confirming the demand and imposing penalties. This demand was also sent to the Vashi, Navi Mumbai premise. When recovery actions were initiated, the appellant became aware of the order and subsequently requested certified copies, informing the revenue officer that they were not subject to service tax and could not make the required pre-deposit of 7.5% of the sure demand to file an appeal.

The appellant submitted an appeal to the Commissioner (Appeals), clarifying that their proper address was 42, Janubhau Smruti Chawl, Din Dayal Road, Near Bedekar Galli, Thakurwadi-1, Dombivli (West), Thane 421202.

The Commissioner (Appeals) dismissed the appeal, deeming it to be filed beyond the allowable time frame.

The appellant argued that they had not received either the show cause notice or the order, as both documents were sent to a premise in Vashi, Navi Mumbai. After submitting a request, the appellant obtained certified copies of the demand and subsequently filed an appeal with the Commissioner (Appeals) after making a pre-deposit on November 24, 2022.

As a fruit seller, the appellant maintained that the show cause notice failed to demonstrate that they were providing any taxable service. The sale of fruits is included in the negative list under entry (e) of Section 66D of the Finance Act, 1994, indicating that trading activities fall outside the scope of service tax.

Upon reviewing the case, the tribunal ruled in favour of the appellant, stating that the department lacked the authority to issue a show-cause notice requesting service tax from the petitioner.

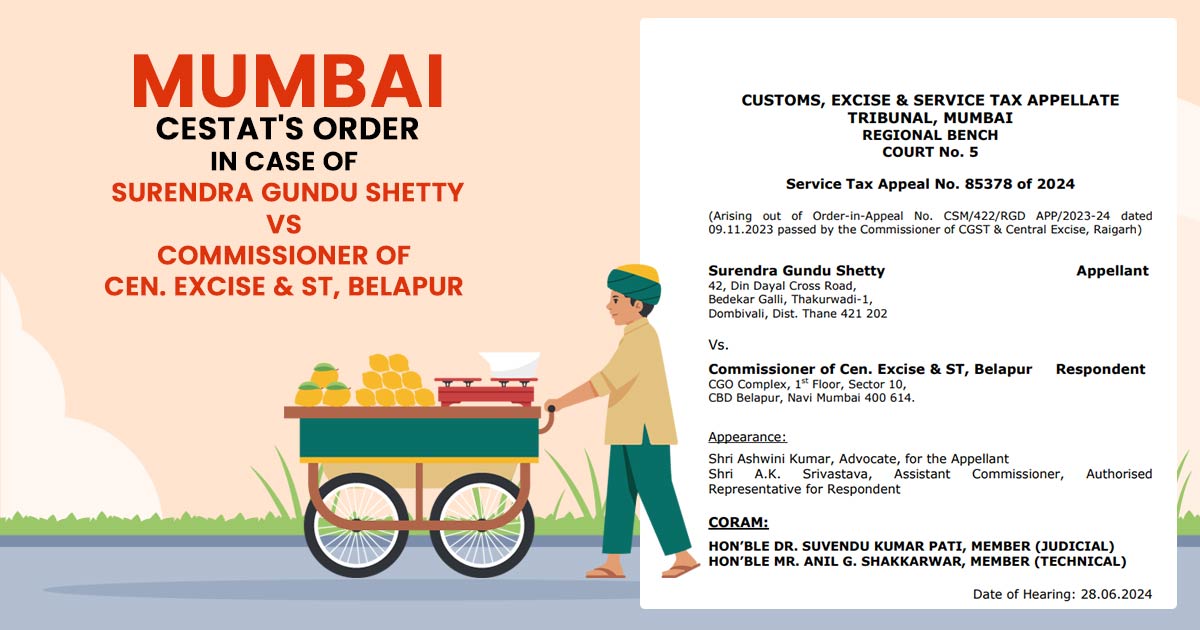

| Case Title | Surendra Gundu Shetty Vs. Commissioner of Cen. Excise & ST, Belapur |

| Service Tax Appeal No | 85378 of 2024 |

| Date | 28.06.2024 |

| Appearance | Shri Ashwini Kumar, Advocate |

| Counsel For Respondent | Shri A.K. Srivastava, Assistant Commissioner |

| Mumbai CESTAT | Read Order |