The Punjab & Haryana High Court upheld the revisional order passed by the Principal Commissioner Income Tax (PCIT) under Section 263 of the Income Tax Act. as the assessment was wrongly passed by the Assessing Officer ( AO ) under Section 44ADA of the Act.

The taxpayer Harjot Singh, is an individual who filed his return. Upon search operation, the taxpayer surrendered an additional income of Rs.15,11,555 on account of excess stock, construction of a residential house, and renovation of business premises.

The Income Tax Assessing Officer evaluated the income from professional usage before depreciation and interest apart from income under section 44AD and reached the determination of overall income to be Rs.39,15,840 for AY 2018-19. The PCIT practicing his revisionary jurisdiction, discovered the order of the AO was incorrect and prejudicial to the interest of Revenue.

Read Also:- Haryana and Punjab HC: SCN U/S 148 By Assessing Officer Defeats The Object of Faceless Assessment

It was revealed by the bench that AO has furnished the benefit to the taxpayer taking account of the income as per Section 44AD. It was remarked by the bench that the assessment needs to be done under the head income from other sources u/s 115 BBE.

The Division Bench of Justice Sanjeev Prakash Sharma and Justice Sanjay Vashisth kept that the taxpayer had neither had his accounts audited by the accountant nor provided a report of such audit under the provisions of section 44AB of the income tax law. The case of the taxpayer, prima facie was covered u/s 44ADA but the return of Income filed was not under the provisions of section 44ADA.

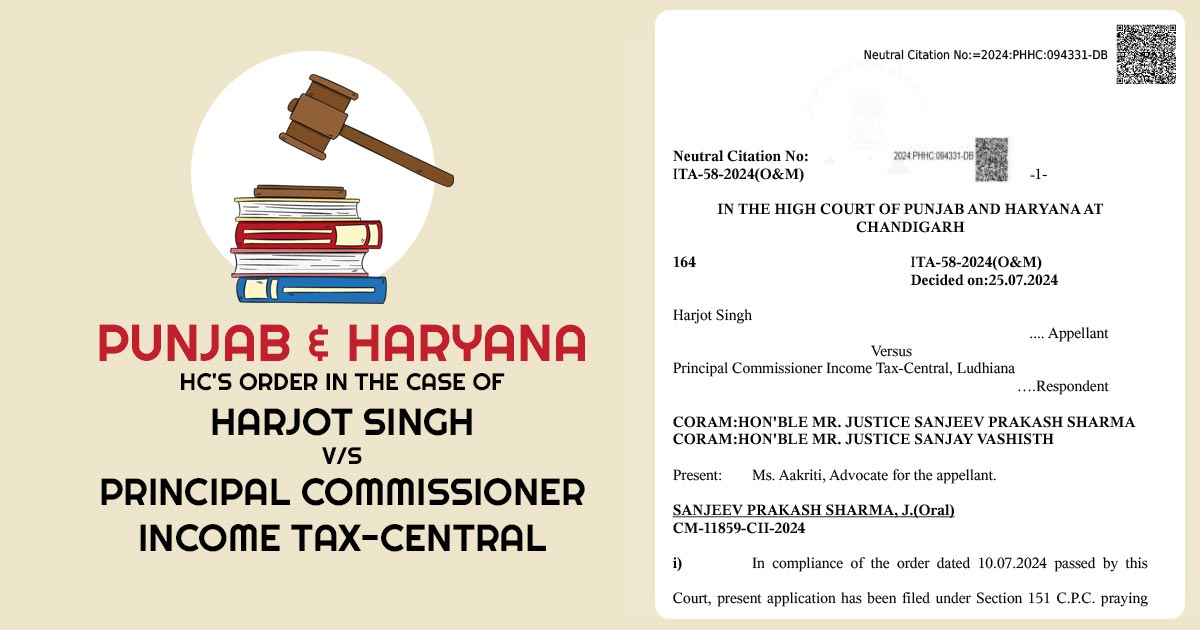

| Case Title | Harjot Singh V/S Principal Commissioner Income Tax-Central |

| Citation | ITA-58-2024(O&M) |

| Date | 25.07.2024 |

| Counsel For Appellant | Ms. Aakriti, Advocate |

| Counsel For Respondent | Mr. Justice Sanjeev Prakash Sharma, Mr. Justice Sanjay Vashisth |

| Punjab & Haryana High Court | Read Order |