The Madras High Court in a ruling held that a new SCN u/s 148 of the Income Tax Act, 1961 will be issued for the problems not raised before. The department was asked to provide a fresh order u/s 148A(d) after regarding the reply of the taxpayer.

A Single bench of Justice Senthilkumar Ramamoorthy held that as the impugned order raised an issue not been raised earlier in the SCN, the respondents need to furnish a new SCN asking for an explanation for all the problems that want the issuance of a notice u/s 148 of the Income Tax Act.”

A notice on 28.02.2023, has been received by the applicant, Annam Rajasekher Bindu u/s 148A(b) of the Income Tax Act, pursuing them to show cause as to why a notice under Section 148 must not be issued for said transactions.

The counsel of the applicant raised three objections to the impugned order. First, it was contended that the notice issued under section 148A(d) relied only on the data sourced from the insight portal which as per the statute precedent quoted could not be the only grounds for these notices.

Second, it argued that there is not any direct linkage between the information sourced and the alleged income evasion, a need for initiating the proceedings u/s 148. It was claimed that the impugned order made findings on the problems not raised in the original SCN, refusing the applicant for a fair chance to answer.

Dr. Ramasamy, representing the respondents in answer argued that the order includes enough reasons and shows the differences in the applicant’s submission for the property transactions and gifts obtained. The court revealed that more than such arguments are needed to prove the flawed procedural method opted for by the tax heads.

The major question before the court was whether the situation wanted judicial interruption. SCN (Show Cause Notice) has been investigated by the High Court and the reply of the applicant, noting that the applicant’s explanations were not sufficiently acknowledged in the impugned order. Problems raised in the order were not addressed in the original notice, damaging the proceeding’s fairness.

The Madras High Court after regarding the submissions of both sides held in favor of the applicant. The same has been quashed in the impugned order. It asked the first respondent to provide a new order u/s 148A(b) of the Income Tax Act, furnishing the applicant with a reasonable chance to respond within a maximum period of 3 months from the date of receipt of the order of the court. To ensure the timely completion of the aforesaid practice the applicant was asked to extend the full cooperation.

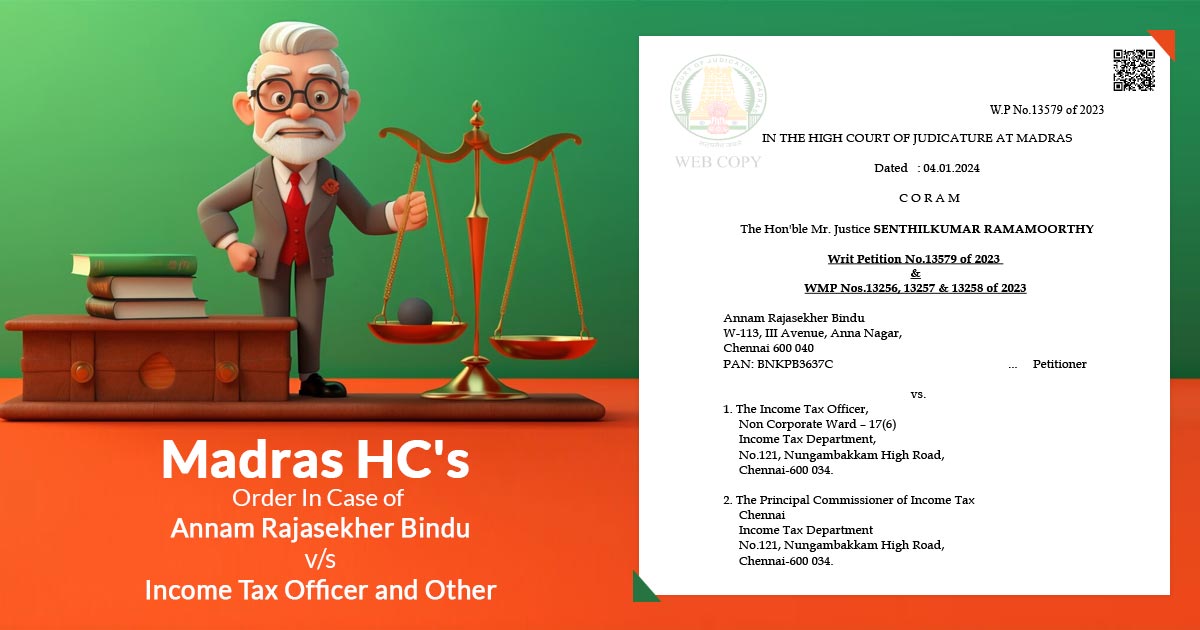

| Case Title | Annam Rajasekher Bindu v/s Income Tax Officer and Other |

| Case No.: | Writ Petition No.13579 of 2023 |

| Date | 04.01.2024 |

| Counsel For Petitioner | Mr.A.S.Sriraman |

| Counsel For Respondent | Dr. B.Ramaswamy, Senior Standing Counsel (Income Tax) |

| Madras High Court’s | Read Order |