Simple Intro About the Depreciation

Depreciation is a concept that is used to write off the cost of an item over its usable life. Depreciation is a necessary deduction in an entity’s profit and loss statements for depreciable assets, and the Act enables deduction using either the Straight-Line technique or the Written Down Value (WDV) method.

The WDV technique of calculating depreciation is extensively utilized. However, if the enterprise is involved in power generation or generation and distribution, the option of straight-line technique can opt.

Requirements For Claiming Depreciation

- The taxpayer owes the assets wholly or partly.

- The assets must be used for the taxpayer’s business or profession. If the assets are utilized for purposes other than business, the permissible depreciation will be proportionate to the usage for business reasons. Section 38 of the Act also gives the Income Tax Officer the authority to assess the proportional share of depreciation.

- Depreciation to an extent value of the assets which owns by each co-owner that can get claimed by them.

- You could not avail for depreciation on Goodwill and cost of land.

- From A.Y. 2002-03, the depreciation would be obligatory and will be permissible or treated to be permitted as a deduction of whatever the claim incurred by the assessee in the profit and loss account. The assessee is enabled to carry forward the WDV post diminishing the amount of depreciation.

- The deemed profit would be stated to have acknowledged the depreciation effect when chosen for the presumptive taxation scheme.

- Under the Companies Act, of 1956 depreciation varies from that of the income tax act. Hence the depreciation rates specified under the income tax act would be merely permissible whatever the depreciation rates levy in the books of accounts.

Benefits of Using Gen Income Tax Software

For calculating Income Tax, Advance Tax, Self Assessment Tax, and Interest under sections 234B, 234A, and 234C, Gen income tax filing software would be the effective solution. Through the assistance of the Gen ITR e-filing software, an individual could fastly build and file the ITR precisely and the same secures the option for direct e-filing through the software.

For furnishing the income tax return there are obligatory industry features that are available in the software, that comprise the automatic selection of the return forms, the XML or JSON generation of tax forms, the import of master data and income details, calculation of arrear relief and e-payment of challans with verification. Various distinct features are included with the ITD (Income Tax Department) web services, including MAT/AMT calculation, income deductions summarization, and quick ITR uploading, that the assessees and clients could reveal.

Steps to Make Depreciation Chart via Gen Income Tax Software

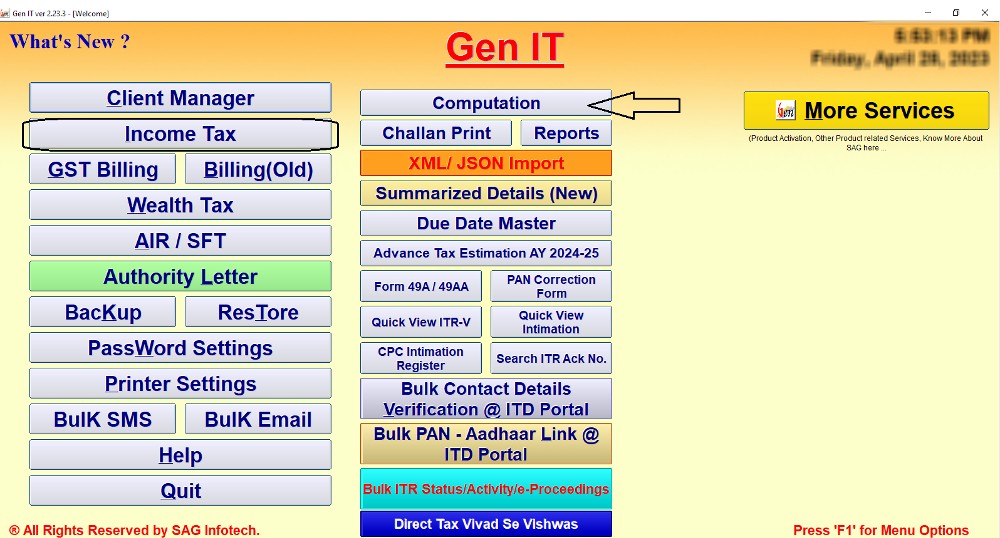

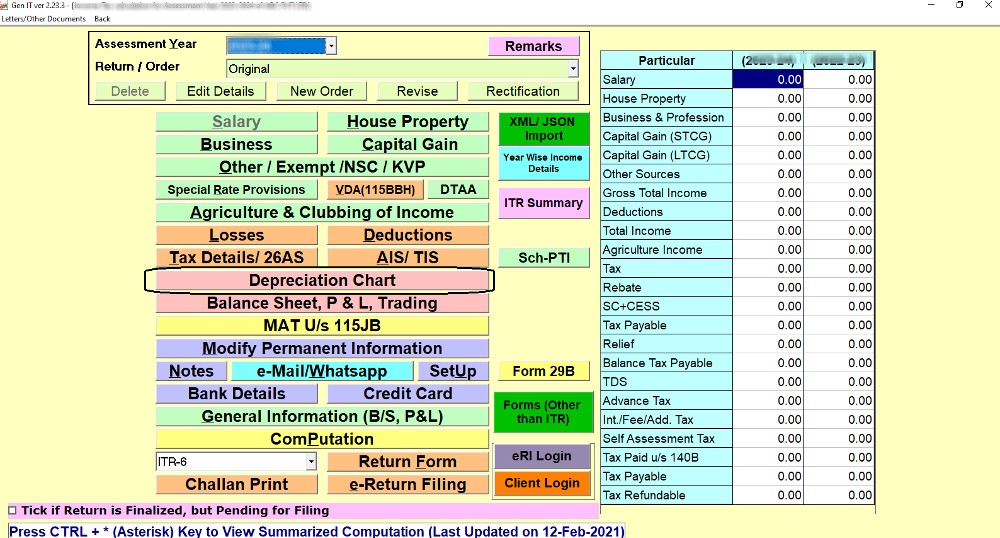

Step 1:- First Install Gen Income Tax Return Filing Software on your laptop and PC. After that click on Income Tax and then click on the Computation tab.

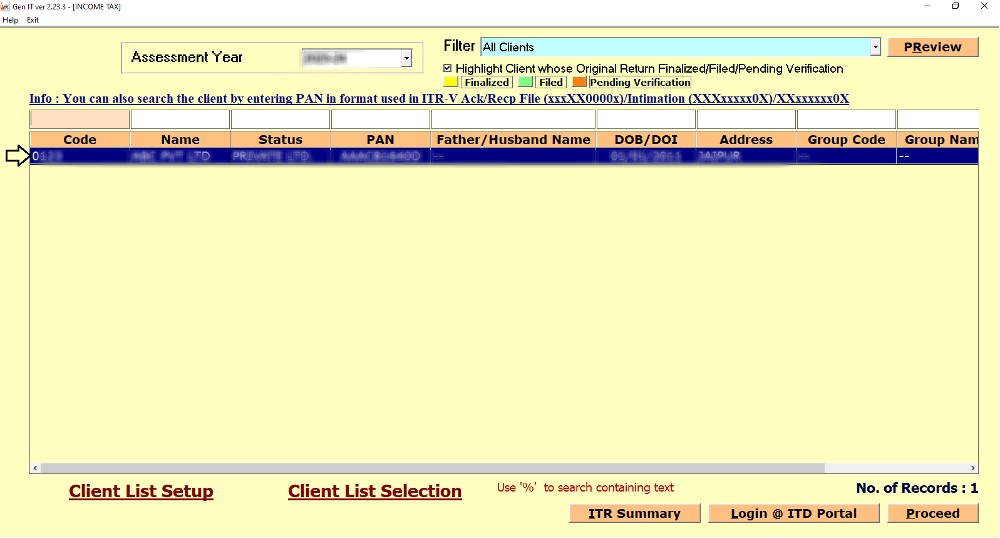

Step 2:- Select the Client of which you want to view the Depreciation Chart.

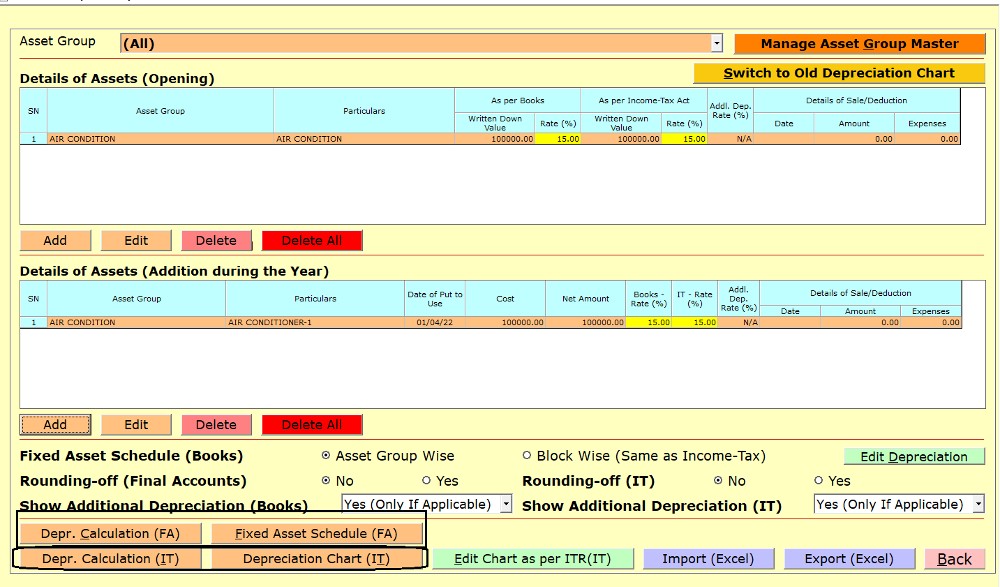

Step 3:- Click on Depreciation Chart to view the Depreciation Chart of the year.

Step 4:- After entering the details of Assets you can view the Depreciation Chart as per the Companies Act by clicking on Fixed Asset Schedule (FA) and as per IT by Clicking on the tab Depreciation Chart (IT).