The Authority of Advance Ruling (AAR), Madhya Pradesh, has held that the services of fabrication of the body on chassis of a vehicle as provided by the customer, will attract 18% GST (Goods and Services Tax).

The ruling was provided by the AAR amid an issue raised by the applicant, M/s VE Commercial Vehicle Limited, a GST registered assessee engaged in multiple businesses including that of providing manufacturing of Chassis, Trucks & Buses, Engines, Bus body, and automotive components and has manufacturing units in Madhya Pradesh, sought the ruling of the authority on whether services of fabrication of the body on chassis of a vehicle as provided by the customer will be considered as a supply of services on the bus body and the chassis within or will be considered as outsourcing to the applicant under two cases.

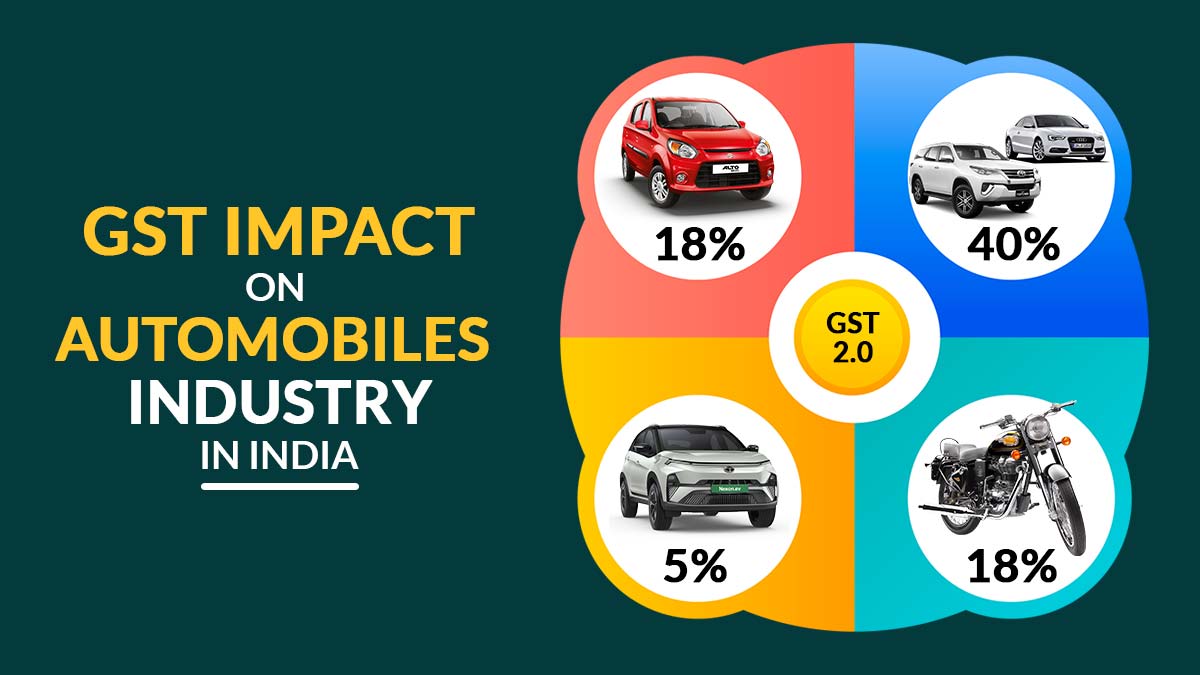

Read Also: GST Impact on Automobile and Spare Parts Industry in India

The chassis is manufactured by the applicant registered under the act and sold to some other person who is receiving the chassis for the fabrication of the body. The chassis is manufactured by an OEM but sold to the dealer of chassis before the fabrication of the body.

The bench of AAR, with Manoj Kumar Chobey and Virendra Kumar Jain as the members, held that the services of fabrication of the body on chassis of a vehicle as provided by the customer will be considered as a supply of bus services as in no case is the chassis a property of the Applicant hence in both the cases detailed above, the transaction will be covered by SAC 998881 ‘Motor vehicle and trailer manufacturing services’ and under entry no. 26(iv) as ‘Manufacturing services’ on physical inputs (goods) and hence will attract GST at the rate of 18%