Solely dedicated to the convenience of the taxpayers, the government has come up with the utility to track the ‘Refund Application Status’ from the GST portal

The process goes on with Public Financial Management System (PFMS) verifying the bank account given by the taxpayer in his refund application (RFD-01) and after the approval from PFMS the tax officer issues the payment order (RFD-05) under the name of the taxpayer. The amount gets sanctioned only after the account details mentioned in the payment orders are verified by the PFMS.

So clearly the account details are validated by PFMS in two stages, in RFD-01, and in RFD-05 respectively. Though the detailed explanation on account verification by PFMS is not served by the authorities on GST Portal, the registered taxpayers can track the status of bank account validation and release of the refund amount via the central portal assigned by the PFMS for taxpayers. Link to the same is given below: https://pfms.nic.in/static/NewLayoutCommonContent.aspx

RequestPagename=Static/GSTN_Tracker.aspx

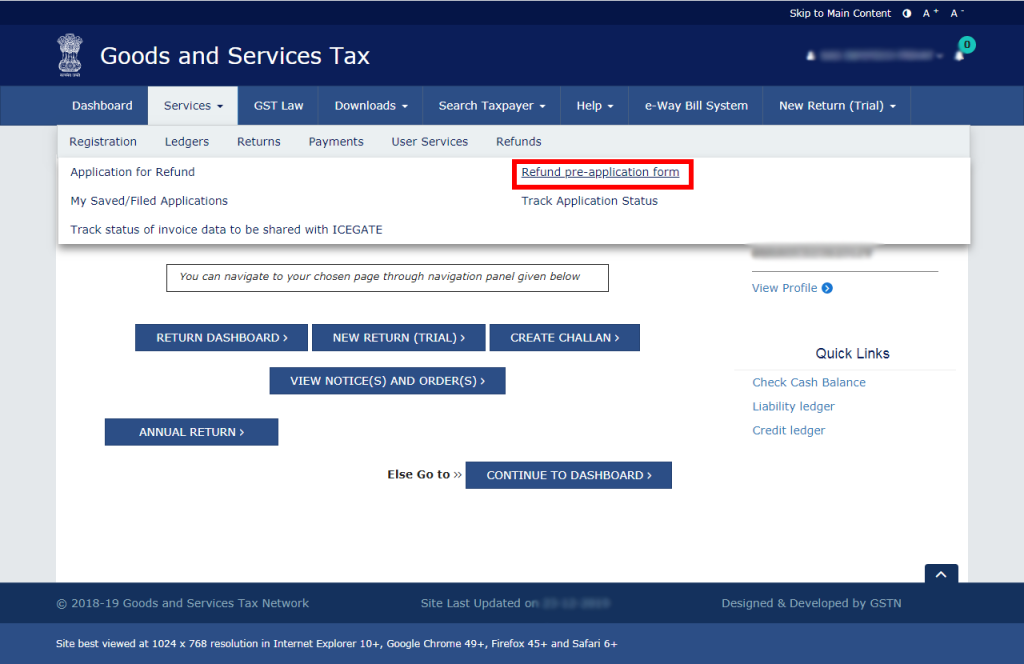

So now refund tracking is no big deal. Taxpayers can easily track the status of their GST refund application

To guide the taxpayers with the complete information on tracking the refund application status and account validation process on GST and PFMS portals respectively, the government has issued an Advisory on the ways by which it is easy to track the process.

Mentioned below is the link to download the Advisory.

https://tutorial.gst.gov.in/downloads/news/Advisory%20on%20Refund%20Tracking.pdf