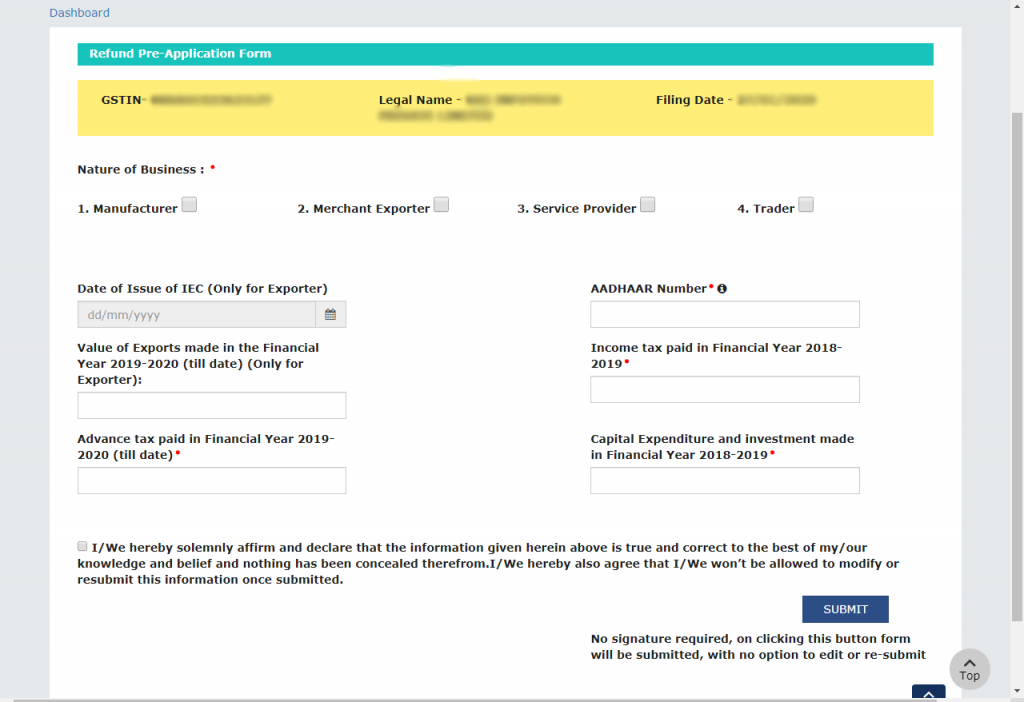

GSTN portal has recently added an option to pre-fill an application form for the tax refund of the tax filed for the taxpayers. The portal has included the columns for the information required by the taxpayer to file the tax refund.

The columns for the tax refund details require certain information such as:

- Aadhar Number

- Income tax paid in Financial Year 2018-2019

- Capital Expenditure and investment made in Financial Year 2018-2019

- Advance tax paid in Financial Year 2019-2020 (till date)

The pre-fill application is supposed to be assisting all the tax claim refund to be quicker and easier to process as per the applicant request. This means that the taxpayer will be able to screen the tax claim for a genuine request and therefore making it accessible for all the taxpayers to claim the tax refund as soon as possible.

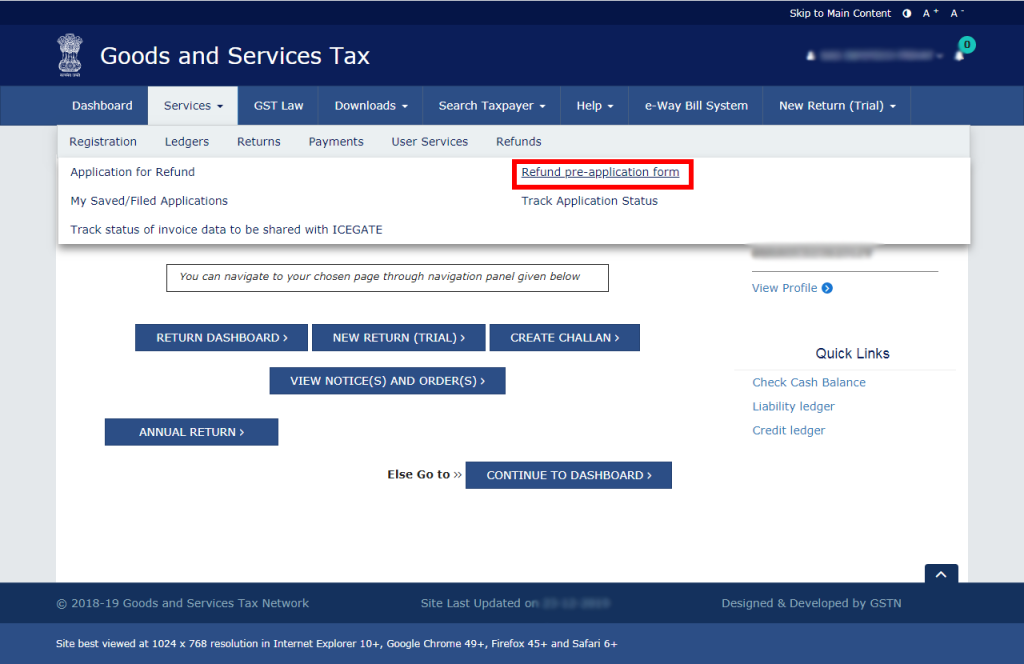

Where to Get Pre-fill Application Form for GST Refund

Step 1: Open www.gst.gov.in official portal

Step 2: Click on “Service” –> “Refund” –> Click on “Refund Pre-fill Application Form”

Step 3: The Pre-fill Application form will be displayed

Sir, we need to file the refund for the year 2020-21 under the inverted tax structure. We are filing the refund but it is not allowing us to type the turnover of inverted rated supply of goods and services and tax paid on such turnover in statement 1 of refund application. Is it because of not filing the refund pre-application form or there is some other problem?

“Please contact to GST practitioner”

I have been filing refund applications for Exports without payment of Tax since July 2017, do I have to file this Refund pre-application form too? Is it compulsory? and could you specify the legal or statutory source of the same?

No

Dear sir is it PAN number-based information or only GST Number based information. Please let me confirm

GST No. based

Sir, pre refund application is filled before the refund application.

Yes

In case of other than individuals, what should be entered in Aadhaar no. column

In case of other than individuals, AADHAAR of Primary/Authorised signatory should be mentioned