Form GST PMT 07 is now available to the assessee to inform you of the payment relevant to the flaw on GST Portal. The Form is to report towards the mistakes in which the amount shall get debited from the taxpayer’s account but the electronic credit ledger has not to get updated.

GST PMT 07 requires to get furnished through the enrolled individual showing the tax filed beneath CGST, SGST, UTGST, IGST, and cess and the generated challan date practicing Form GST PMT-06. The enrolled individual is required to sign the Form GST PMT-07 through his digital signature on the GST portal.

GST PMT-07 Payment Related Grievances Manual Filing

What is the method to submit a reply to the Grievance Officer’s further query?

To furnish the grievances/complaints perceiving GST Portal, do the subsequent steps :

Step:1 Reach www.gst.gov.in URL. The GST Home page is shown.

Step:2 Log in to the GST Portal with valid credentials.

Note: Grievances can be furnished either prior or post to logging the GST portal, but the payment concerned to the grievances could be furnished through the enrolled users or assessees since they are needed to show the GSTIN.

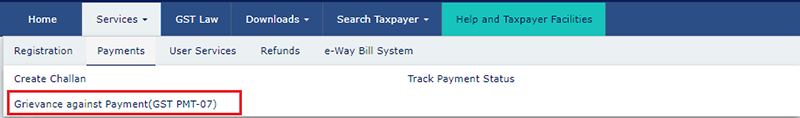

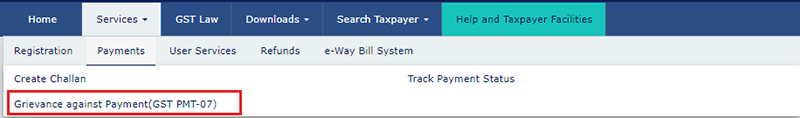

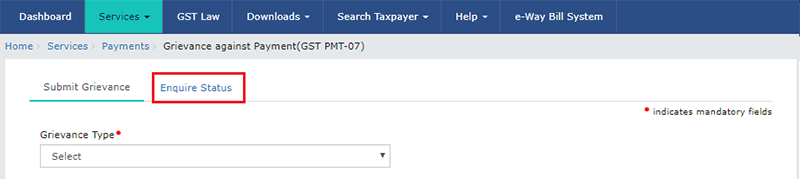

Step:3 Tap on the Services > Payments > Grievance against Payment (GST PMT-07) command.

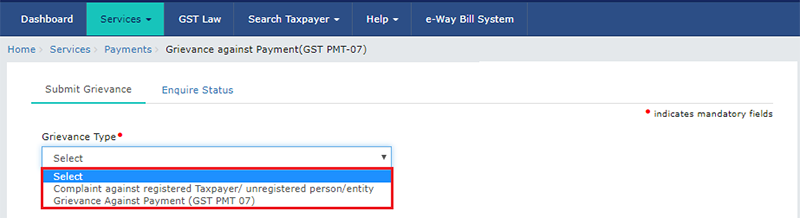

Step:4 The Grievance / Complaints page is shown. The Submit Grievance section shall open by default.

Step:5 In the Grievance Type drop-down list, choose the Grievance Against Payment (GST PMT 07) option.

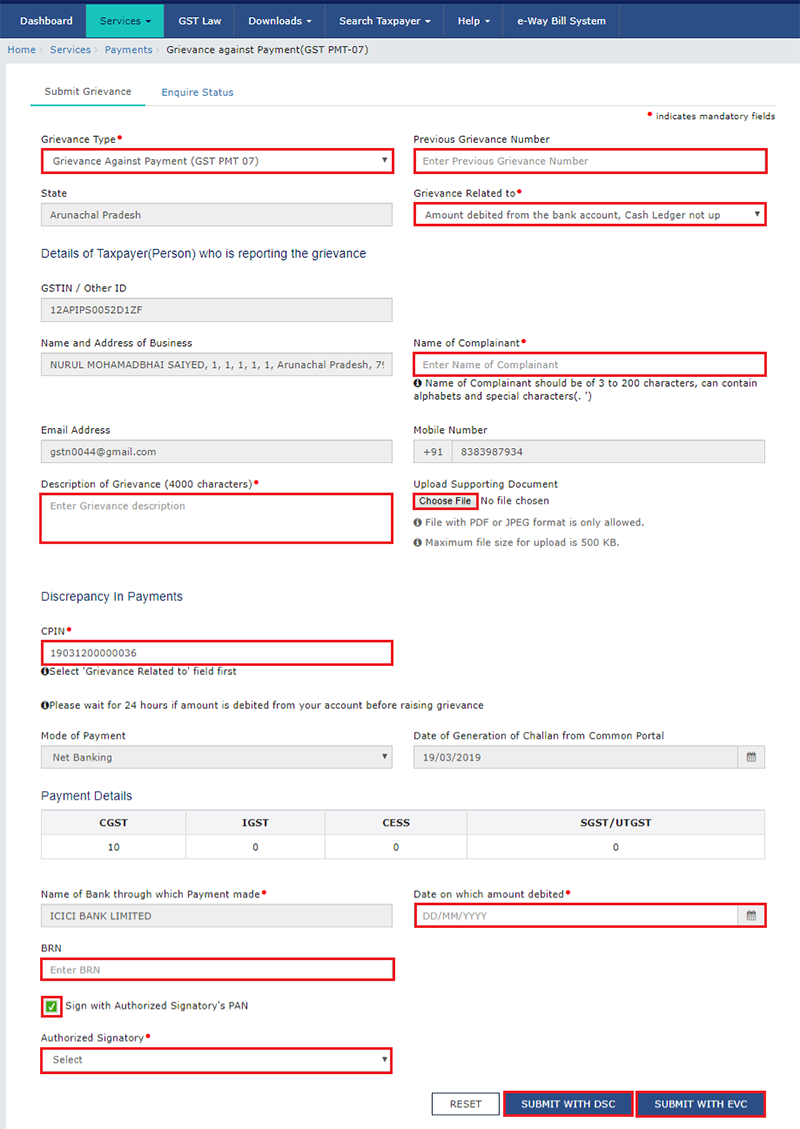

Step:6 Towards the case in which you had furnished the grievance and you are furnishing the grievance again go to before grievance ID in the Previous Grievance Number field.

Read Also: GST PMT 08 Online Filing Process with Due Date

Note: State is auto-populated towards you have logged inside the GST portal or else towards the pre-login choose the state from the drop-down list.

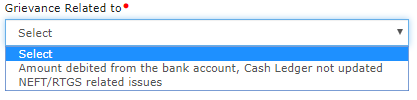

Step:7 Inside the Grievance concerned to the drop-down list choose the precise option.

Step:8 The information in the Details of Taxpayer (Person) who is reporting the grievance section is auto-populated. Towards the scenario in which you have not logged in to the GST portal where you shall require to go into your own information in the Details of Taxpayer (Person) who is reporting the grievance section.

Step:9 In the name of the complainant field go to the name of the complainant.

Step:10 Inside the Description of Grievance field go to the information of the grievance.

Step:11 Tap the choose file button to upload the needed credentials concerned to Grievance.

Step:12 In the Discrepancy in payments slab in the CPIN field insert the CPIN of the challan. The information relevant to the CPIN is shown.

Step:13 Choose the date on which the amount gets debited through the calendar.

Step:14 In the field of BRN, insert BRN.

Step:15 If in case of pre-login insert Captcha code.

Step:16 Choose the sign with Authorized Signatory’s PAN choice after that choose the Authorized signatory from the drop-down list.

Step:17 Click the submit with DSC (Digital Signature Certificate) or submit with EVC button to submit the grievance form.

File With DSC:

a. Tap the YES button.

b. Select the certificate and click the SIGN button.

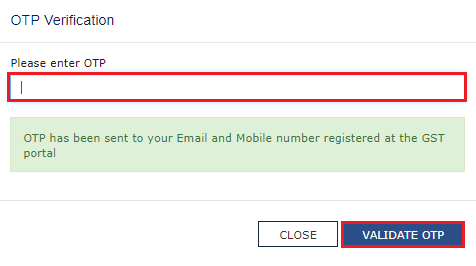

File With EVC:

a. Enter the OTP sent on email and mobile number mentioned in the grievance form and click the VALIDATE OTP button.

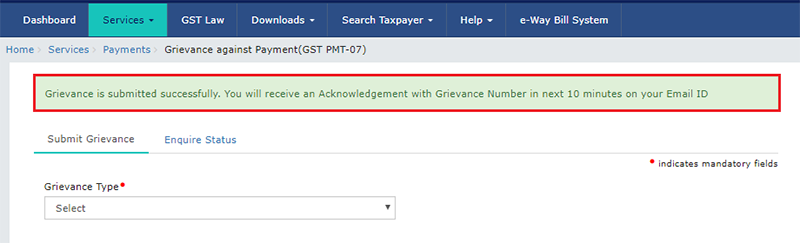

Step:18 On furnishing the grievance form the GST portal shall generate the Grievance Tracking Number and transfer it to the e-mail address as specified in the form. You can review your grievance status post 10 minutes, through the ‘Enquire Status’ service.

GST PMT-07 Payment Grievances Form Status Check

To track the status of the furnished grievances/complaints concerning the GST Portal, complete the subsequent steps:

Step1: Enter the www.gst.gov.in URL. The GST Home page is shown.

Step2: Log in to the GST Portal with correct credentials.

Note: Status of Grievances can be verified prior to or post to logging in to the GST Portal.

Recommended: GST PMT 09 Format with Online Filing Eligibility

Step3: Click the Services > Payments > Grievance against Payment (GST PMT-07) command.

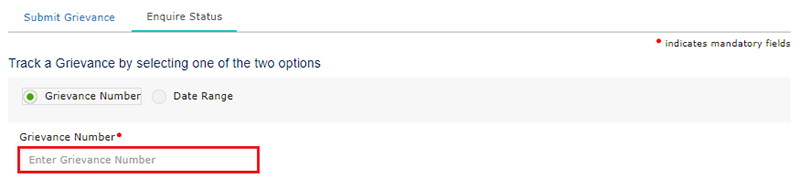

Step4: The Grievance / Complaints page is shown. Tap the Enquire Status section.

Step5: Inset either your Grievance Number or Date Range. If you have not logged in, you can only search for the Grievance Number.

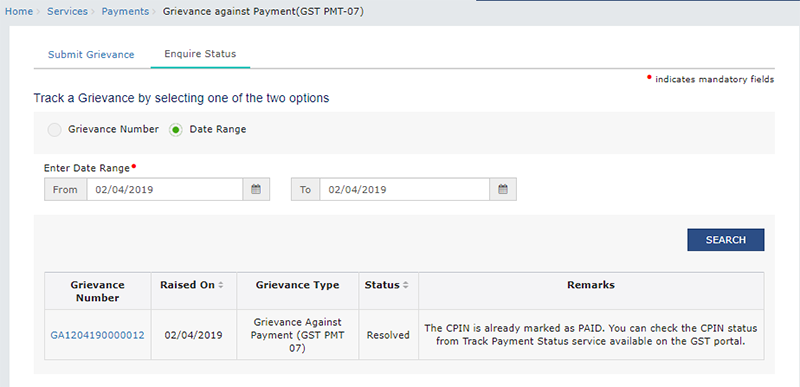

Step6: Tap on the Search button.

Step7: The search results are being shown permitting you to access the status of your furnished Grievance.

Note: If you are logged in to the portal and explore using the given option of Date range, the mentioned outcome will be the status of all the submitted grievances as well as their corresponding Grievance numbers.

Numbers: All the grievances reveal one of the subsequent statuses, which rely on their resolution:

- Submitted: On submission of grievance

- Resolved: Once the grievance gets resolved.

Step8: You can tap on the Grievance number and the respective information which is shown in the read-only mode.

FAQs Filing Payment Associated Grievances PMT-07

Q.1 – To what glitches can I raise a grievance?

Towards the mentioned cases the Grievances can be urged:

The amount debited from the bank account Cash ledger, not updated NeFT/RTGS relevant issues

- Do not ask for the grievance beneath the mentioned circumstances.

- Before 24 hours of debit of the amount via bank account.

- If the payment status is PAID and the amount is updated in Cash Ledger.

- In the case of E-payment, payment is not done from the GST Portal.

- If the Memorandum of Error (MoE) is raised upon the CPIN.

- Payment status is Failed and the amount is not debited from a bank account

- For the OTC Payment, status is AWAITING BANK CLEARANCE and cheque/ Demand Draft is not realized.

Q.2 – Who can describe grievances? Is there a requirement to be a registered user of the GST Portal for filing grievances?

Any enrolled assessee and the user can be allotted with the Temporary ID can ask grievance for problems concerned to the payments.

Q.3 – Who labels the submitted grievances?

Through the GST portal, the payments get managed which is relevant to all the grievances. Upon the grounds of CPIN and the bank name inserted through the Assessee in Grievance Form upon the request shall be sent to the related bank. Upon the answer, through the bank, the electronic cash ledger shall get updated through precise comments and the grievance shall be sealed.

If there is no answer from the related bank or wrong answer is collected through the bank, the Grievance ticket shall be closed with the precise remarks which elaborate the mistakes occurred eg.“No details received from your bank for CPIN. Please contact the bank to resolve this. You can also contact the ombudsmen of the concerned bank if the bank is not responding.”

Q.4 – During GST payment filing the money was deducted through my bank account however in the electronic cash ledger, it is not showing, and neither I had obtained the CIN. Towards the circumstance at what time should I need to report my grievance?

Towards Grievances concerned to the payments or the Electronic Cash Ledger and the circumstances in which money gets deducted in the bank account however not showing in the electronic cash ledger or CIN not obtained or others, the users are recommended to have patience for 24 hours from the time of building the payment. The majority of cases get solved out on their own in 24 hours.

If your payment is not successful the dedicated amount might either get refunded to your bank account or it might get processed to generate the CIN and thus it will be seen in your electronic cash ledger. If the situation shall not automatically get solved out in 24 hours then you might choose to furnish the grievance for your case in the GST portal.

Q.5 – Is there a method that I can track the progress or status of my grievance post furnishing?

The users can review the progress or the status of their grievances in the GST portal on its own using the “Enquire Status” service below the Grievance Menu. Every grievance shall mention one of the mention statuses relied on the resolution path and checkpoint:

- Submitted: On submission of grievance.

- Resolved: Once the grievance gets resolved.

When there is an update on the grievance ticket, the assessee or the petitioner shall receive updates through SMS and e-mail message.

Q.6 – Do I furnish the grievance in pre-login mode?

The grievance shall be furnished in both pre-login and after login.

Q.7 – Do I enable you to see the status of the grievance in pre-login mode?

Yes

Q.8 – What is the method to furnish Grievances or complaints on the GST portal?

Navigate the Services > User Services > Grievance / Complaints and submit the grievance form thereafter.

Q.9 – What is the method to find out the status of the grievance or complaints furnished on the GST portal?

Navigate the Services > User Services > Grievance / Complaints > Enquire Status and enter the Grievance Number and the status will be shown.