In this article, we will discuss the Digital signature certificate which is an encrypted and secure way of acknowledging the certificate holder. Also, DSC under GST is an important term that is used in each and every form for the identification of the taxpayer.

Here we will also go through the GST DSC utility and its registration process which will be used in every form filing. DSC software download is done when the taxpayer files the certificate therefore digital signature certificate for GST is equally important for every taxpayer, therefore let us go through complete details of the DSC online.

- What is the Meaning of a DSC?

- What is Requirement of a Digital Signature Certificate?

- How to Successfully Register the DSC in GST?

- Steps to Download and Install the Web Socket Installer

- What to do when there is EMSIGNER error in GST portal?

Latest Update

- “Allowing filing of returns by companies using Electronic Verification Code (EVC), instead of Digital Signature Certificate (DSC) till 31.08.2021” Read Press Release

What is the Meaning of a DSC?

A Digital Signature Certificate is a safe digital key issued by the certifying authorities to authenticate the identity of the certificate holder. Public key encryptions are used to create Digital Signatures. Digital Signature Certificates (DSC) are like physical certificates, the difference is DSC is in digital or electronic form and Physical certificate is in paper form.

A digital signature certificate (DSC) encompasses the holder’s information such as his/her name, country, pin code, email address, date when the certificate is issued and name of the certifying authority. Just like driving license and passport act as proof of identity of the license holder and passport holder, similarly, DSC is used to electronic prove an identity.

What is the Requirement of a Digital Signature Certificate (DSC)?

Digital Signature Certificate (DSC) can be digitally presented to turn out an identity, to view information or services on the web or to electronically sign some documents. E-forms are signed digitally via a Digital Signature Certificate, the way tangible documents are signed manually.

Many government agencies have adopted digital signatures and also in some applications, DSC has become a statutory requirement. For example, Individuals and organizations who need to get their accounts audited have to mandatorily file their ITR (income tax return) using a digital signature.

How to Successfully Register the Digital Signature Certificate in GST?

Before we dive into the steps to register the DSC in GST, let us first have a glance at the system requirements to use Digital Signature Certificate.

System Requirements to Use DSC Under GST

- Java – Download JRE & install

- Browsers – Following browsers can be used for Digital Signature Certificate. It is recommended to use the latest version of these browsers.

- Internet Explorer version 9 and above

- Firefox version 3 and above

- Internet Explorer version 10 & 11

Steps for Internet Explorer 9, 10 & 11 Settings:-

Internet Explorer 9 10 & 11 Settings – Click on Tools > Internet options > Security > Trusted site > click “Sites” button > add the website > click “Close” button

To Enable the Java – Open IE > Go to Tools > Click on Manage Add-ons > Below-given pop message will be displayed

Steps to Download and Install the Web Socket Installer:

Step 1. Download the “Web Socket Installer” available on the GST Common Portal’s DSC Registration page.

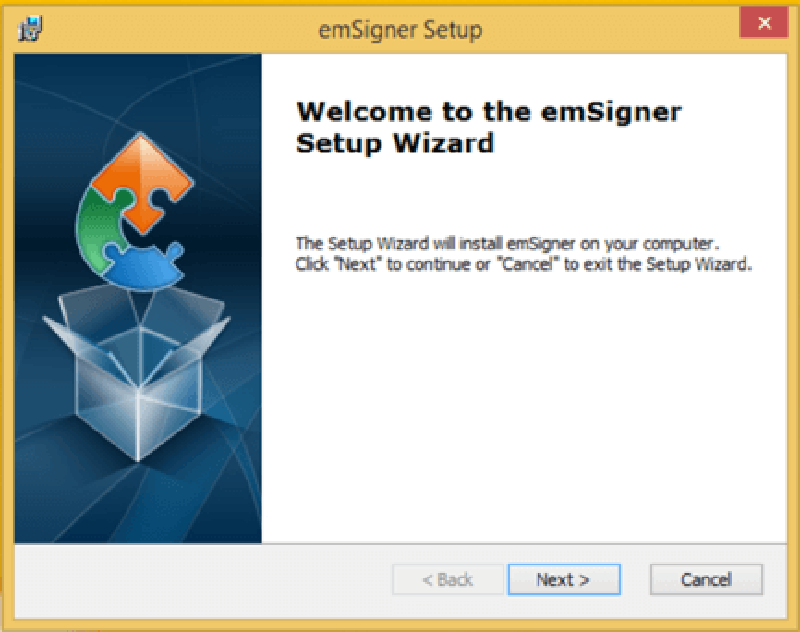

Step 2. Double-click on the “emSigner.msi file”

Step 3. This will show emSigner Setup assistant wizard. Click “Next”.

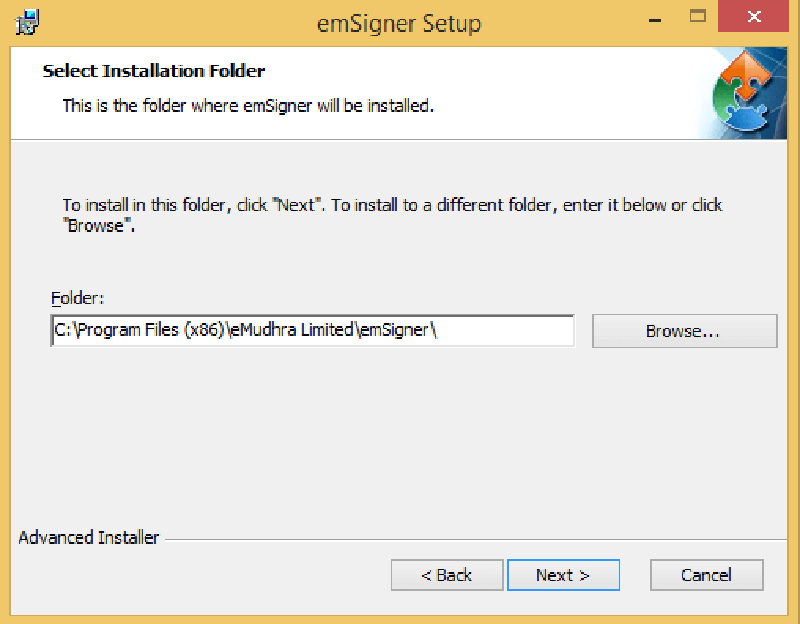

Step 4. Click “Next” to install emSigner in the default folder made under Program Files.

Or

Click “Browse” button > navigate > choose the folder to install emSigner.

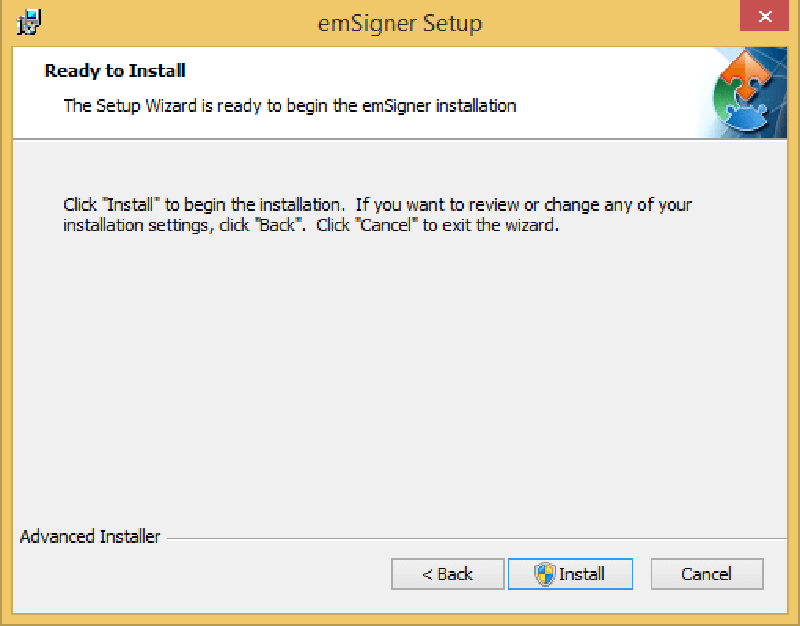

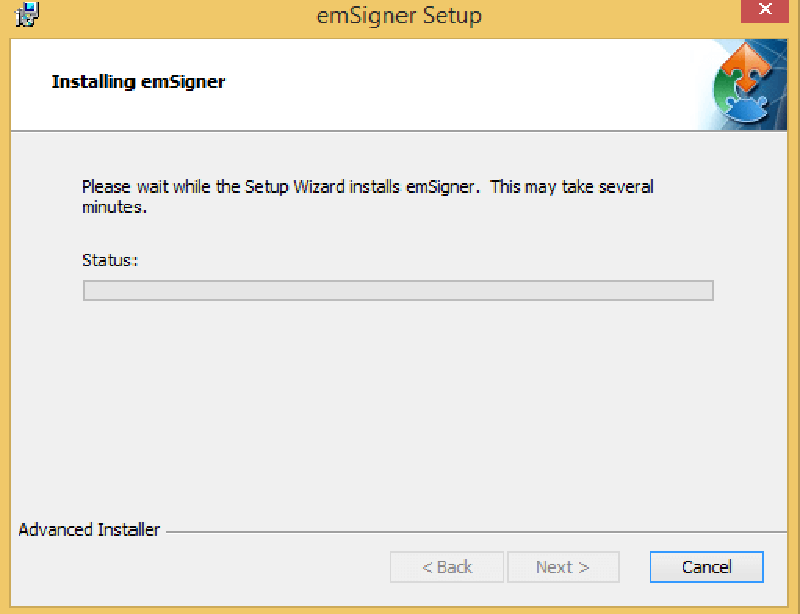

Step 5. This will display emSigner Setup page. Click the “Install” button to start the installation process.

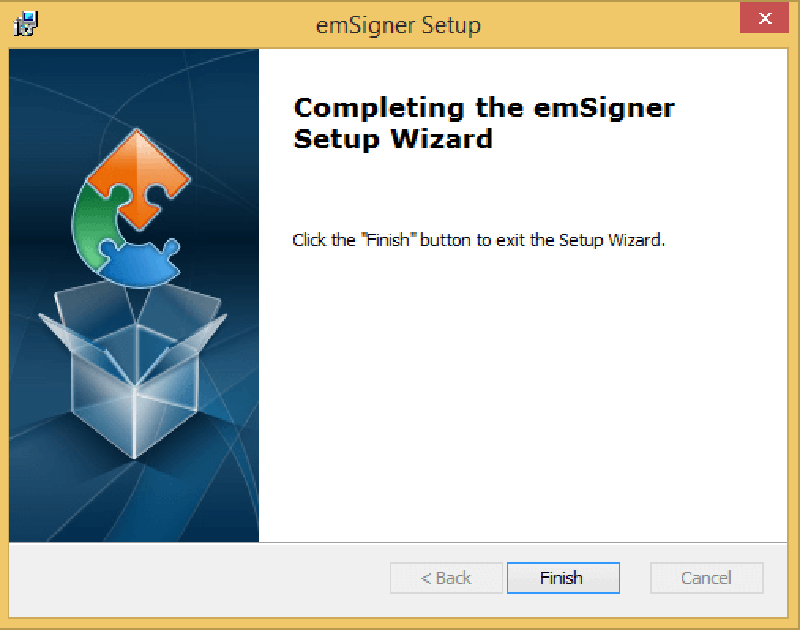

Step 6. Click the “Finish” button to move out of the Setup wizard.

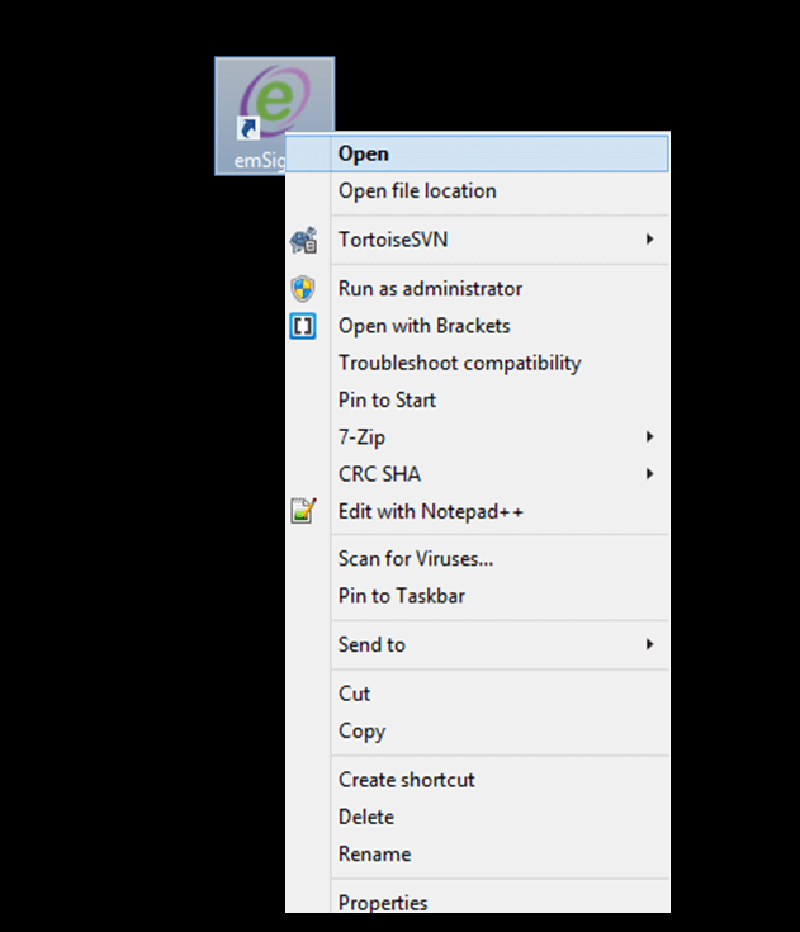

Step 7. Right-click “emSigner icon” on your Desktop and run it as Administrator.

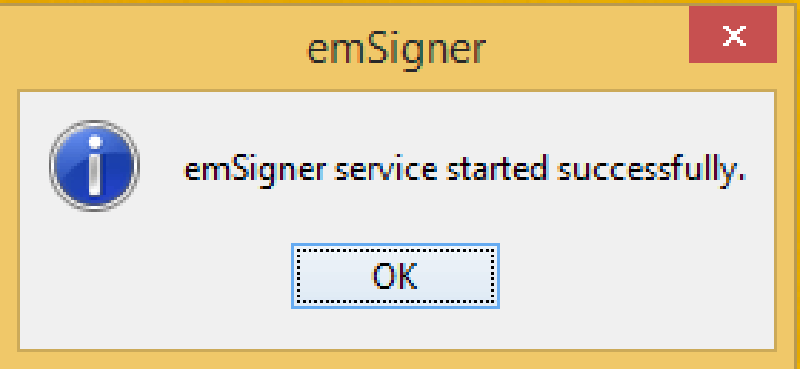

Step 8. When you see a message displaying that emSigner service is begun, Click “OK”.

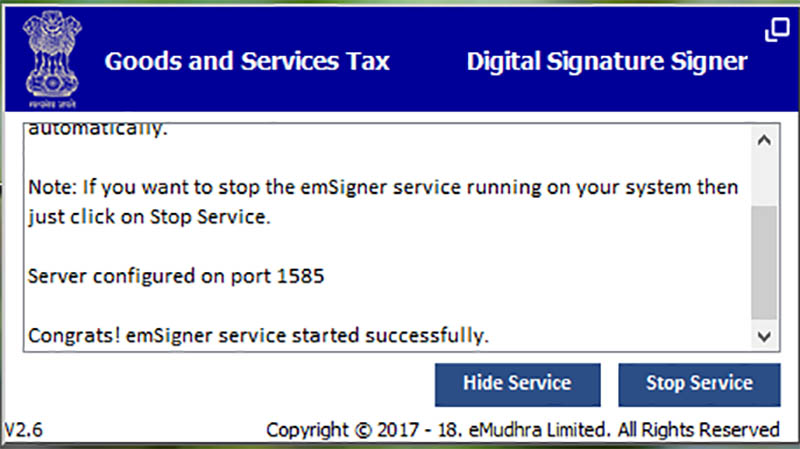

After the successful setup, Digital Signature Signer window gets displayed.

Read Also: DSC Issues Disclosed While Filing GSTR 9C Form on GST Portal

What to do when there is EMSIGNER error in GST portal?

In case the connection to the server has failed, restart the emsigner.

Steps to be performed before using DSC are as follows:

- Run the emsigner as administrator

- Open the portal > fill the relevant details > go to “update register DSC”.

- Open another tab in the same browser > type https://127.0.0.1:1585

- Click “Advanced”

- Click “proceed to 127.0.0.1(unsafe)”

- Return to GST portal > refresh the page

- Click “Register DSC”

Finally, we have detailed the complete description of the digital signature certificate here which will further help the taxpayer in undertaking the basic use fo the DSC under GST.