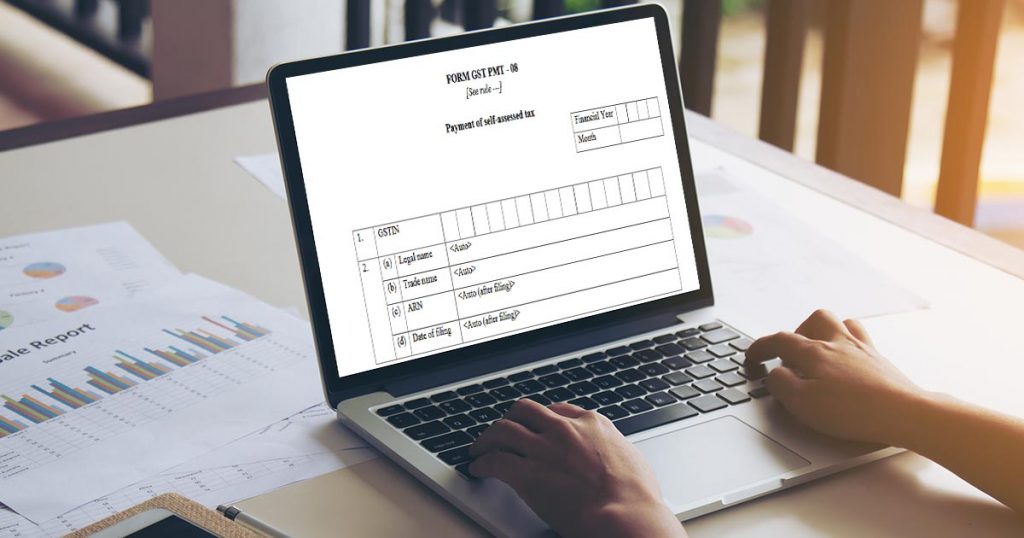

What is GST PMT 08?

Form GST PMT-08 is introduced under the new simplified GST Returns, this helps the taxpayers to make the payment of self-assessed tax like TDS or ITC. The form is used instead of GSTR 3B. A taxpayer has to use this form every month for declaring and paying the monthly tax liability and claiming the input tax credit entitled to him.

Due Date of GST PMT 08

The payment of self-assessed liabilities and its due date arrives every 20th of the month for discharging TDS or ITC payment to the government.

Assessees Mandatory to File GST PMT 8

All the assessees who have opted to file a quarterly return of GST are required to pay such taxes to the government every month. Such payments are to be made through the form GST PMT 8. One should remember that the supplies made during any particular month, determine the tax liability for that month.

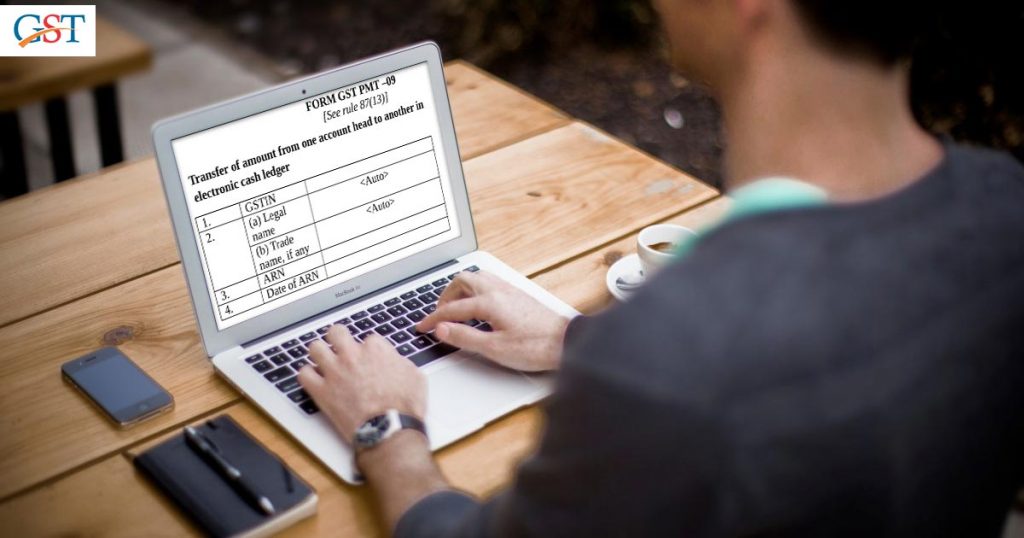

Read also: GOI also Released New GST PMT 09 Challan Form for Amount Transfer

Amounts Included During Payment of Tax

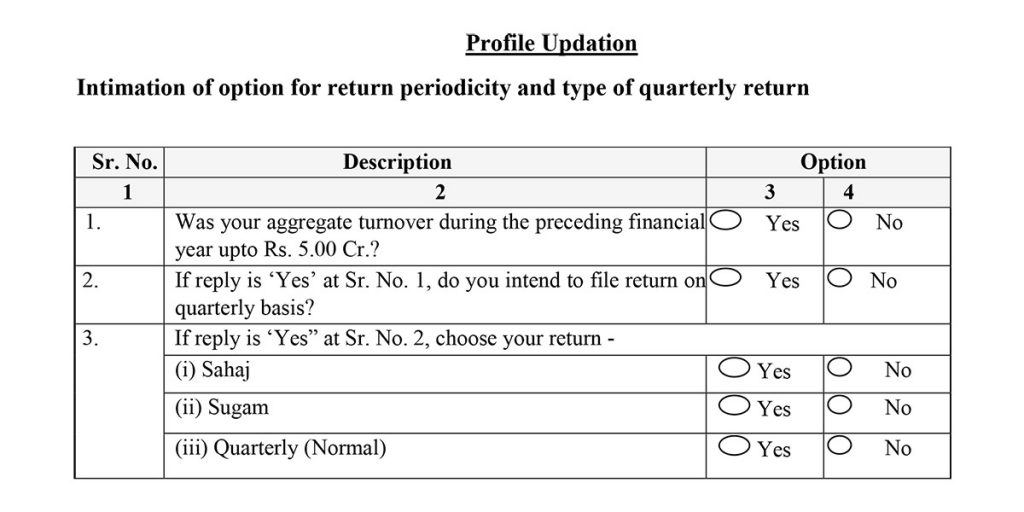

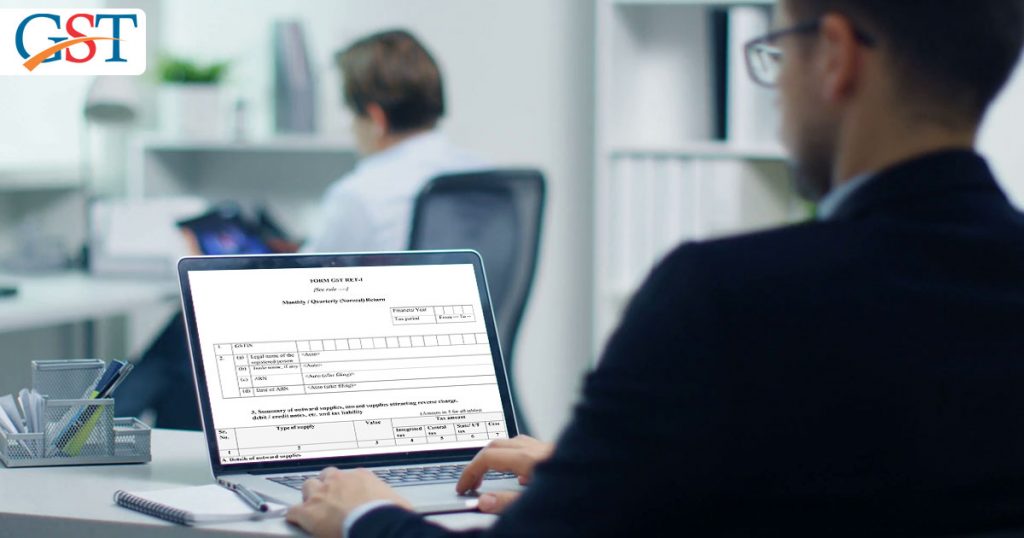

All the assessees who have opted to file a quarterly return of GST are required to pay such taxes to the government every month. Form GST PMT 8 required to be submitted along with all the other returns like normal returns filed quarterly, GST Sugam and GST Sahaj.

The amounts to be included while making tax payments through GST PMT 8 are:

- All the tax liabilities under reverse charge and every other liabilities

- All the tax amounts paid whether it is reverse charge or any other liability

- All the adjustments for any negative liability of tax whether it is reverse charge or any other liability

- All the tax liabilities paid through Input Tax Credit

- All the tax liabilities paid in cash

Inclusions in Payments of Self Assessment Liabilities

Form GST PMT 8 is also used to pay all the self assessed liabilities calculated by the assessee. The payment related to such liabilities will be settled in the first two months of all the quarters. The Inclusions in Payments of Self Assessment Liabilities will be

- Tax liability in the cases of reverse charge

- Tax liability in the cases other than that of reverse charge

Claims Related to the Eligible ITC

The assessee will be allowed a claim for only that ITC for which he is eligible through the form GST PMT 8. The claims arising from form GST PMT 8 will be automatically considered under GST RET 2 (Sahaj Form)

Settlement of Tax Liabilities Arising for the Quarter

All the tax liabilities arising can be settled through electronic cash ledger or electronic credit ledger accordingly. The amounts of tax liabilities and ITC will be assessed through self assessment only. All the adjustments of ITC and tax liability will only be made during the filing of quarterly returns.

Treatment of Interest Charged on ITC

Section 50 of the CGST act, 2017 determines the interest rate to be charged on the assessee for claiming the amount of ITC more than his actual eligibility. The late payments of tax can also attract some interest as a penalty.

Compulsory Declarations

All the assessees who have opted to file a quarterly return of GST are required to pay such taxes to the government every month even if no supplies are made for any specifi month of the quarter.

Important Aspects to File GST PMT-08

- PMT 08 forms are applicable to all the returns monthly, quarterly and Normal

- The form is used instead of GSTR 3B

- In case of quarterly filing of returns, the taxpayer has to make the monthly payment depending on his supplies within that month

- Even if there are no supplies in the month, the form has to be filled monthly by the taxpayer

- Only eligible taxpayers can claim ITC with the help of this form

- As per the clause of section 50 of the Act, interest rates will be charged if more ITC is claimed or short liability is mentioned. However, a taxpayer has to pay a penalty for late payment as per the rates mentioned in the clause of Section 50

- This is for the quarterly filers, self-assessment tax will be paid for the initial two months of the quarter and these amounts should be registered in GST RET 1 form

- The credit of the tax paid within the early two months of the quarter will be accessible while you are filing the return

- Such liabilities can either be sorted out of the balance in electronic credit ledger or electronic cash ledger, whatever is suitable at the moment

- Income tax credit or any other tax liability served by the taxpayer will be rested on self-inspection for the adjustment made in the major return of the quarter