Income tax is a mandatory return to be filed by every taxpayer once a year and here we will gain some basic as well as important insight into the Income tax-related question with the help of relevant frequently asked questions on income tax returns. We will go through the FAQs with an easy and meaningful understanding of each question which will further make the viewers get all the details on the tax-related compliance followed by the taxpayer.

I reside in my ancestral home which is owned by my father. Is it possible for me to pay rent to him to avail of HRA tax exemption?

An employer seeking an exemption over House Rent Allowance (HRA) asked experts, “I recently changed jobs and currently, I’m working in an MNC in Hyderabad. My salary includes Rs 40,000 per month as HRA (House Rent Allowance) and Rs. 1 lakh as a basic salary. I live with my parents in the ancestral home my father owns. I understand I can make some parts of HRA tax-free. Please explain what the rules are”.

Rajiv Bajaj, Chairman & MD of BajajCapital Ltd., offered valuable insights to salaried individuals facing the decision of whether to adopt the new tax regime or continue with the old one. As an MNC employee in Hyderabad, one individual inquired about the possibility of making some of their House Rent Allowance (HRA) tax-free, given that they live with their parents in an ancestral home owned by their father.

Bajaj advises that before making any decision, it is crucial to assess the pros and cons of each option thoughtfully. Shifting to the new regime would exclude you from any deduction or exemption on the HRA component, rendering the entire HRA amount received from the employer fully taxable.

For those who prefer to stick with the old regime, claiming HRA relief might not be straightforward if they are not currently paying rent. In such cases, the HRA component of their salary may already be fully taxable, as there are no rental expenses to be claimed.

However, Bajaj points out a potential solution for those wishing to avail of HRA benefits under the old tax regime. By paying reasonable rent to their father and obtaining valid rent receipts as evidence, they can claim the HRA exemption. This approach allows them to enjoy tax-saving benefits while living in their ancestral home.

How it works: You start paying a reasonable amount of payment as rent to your father, and you receive rent receipts. Receipts are evidence of the rental expenses. So, your employer will claim the HRA exemption, if you submit the receipts to the employer.

It is important to note that under this arrangement, the rental income received by the father will be added to his taxable income. As a result, the father must disclose this rental income while filing his Income Tax Return, and the tax will be levied on his overall taxable income and relevant tax slabs.

Before implementing this strategy, Bajaj advised you to have open and transparent communication with your father. Both parties must fully understand the implications of including the rental income in the father’s tax return and ensure it aligns with their respective financial goals.

In conclusion, the decision to shift to the new tax regime or continue with the old one indicates to consider it carefully, particularly regarding HRA deductions and exemptions. If an individual chooses to remain under the old regime and wants to avail of HRA benefits, paying reasonable rent to the homeowner (in this case, the father) and maintaining proper rent receipts, they can be benefitted reducing tax liabilities.

Nevertheless, it is crucial to assess the tax implications for both the individual and the homeowner to make informed decisions before deciding on any settlement.

What are the Ways to File Income Tax Returns Online?

An Income Tax Return (ITR) is a statutory form in a specified format with the particulars of annual income earned and tax liabilities paid on it by a person in a financial year. In short, an ITR is a reporting, of income & tax liabilities, by a person to the income tax department. Different Income tax return Forms have been prescribed for different kinds of income and their status which means depending on the nature & status of the income, a taxpayer chooses as to which ITR form he needs to download and file.

What are the Different Ways of Filing an ITR?

The different ways of filing an ITR are as follows:

- Furnishing a paper return

- Furnishing an electronic return with a digital signature

- Electronically furnishing/transmitting the data in the return with EVC (Electronic Verification Code)

- Electronically furnishing/transmitting the data in the return followed by submission of return verification in Form ITR-V.

It is to be noted that if the taxpayer is filing the returns in the way in point (iv) without a digital signature, then he shall have to take two printed copies of Form ITR-V. One copy of ITR-V will need to be duly signed by the taxpayer, and sent to “Income-tax Department – CPC, Post Bag No. 1, Electronic City Post Office, Bangalore-560100 (Karnataka) within the specified time frame i.e. 30 days) through an ordinary post or speed post. Another copy shall be retained by the taxpayer and kept for the record.

How Can We Check the Status of Our Income Tax Returns?

The status of the income tax return can be checked easily in two easy ways. First is by using acknowledgement number without login credentials and second is with login credentials.

Steps to be Followed in the Former Method- Step1. Click on “Check the ITR Status

- Step2. Make sure you are redirected to a new page

- Step3. Fill your PAN number, ITR acknowledgement number and the captcha code.

- Step4. Click “Submit”.

- Step1. Login to the e-filing website.

- Step 2. Click the option “View Returns / Forms” present on the dashboard.e

- Step 3. Select income tax returns and assessment year from the dropdown menu and submit.

Now, the status of your ITR will be displayed on the screen whether it is just verified or it has been processed.

FAQs on Income Tax Returns Filing

Q.1 What are the Ways to File an Income Tax Returns Online?

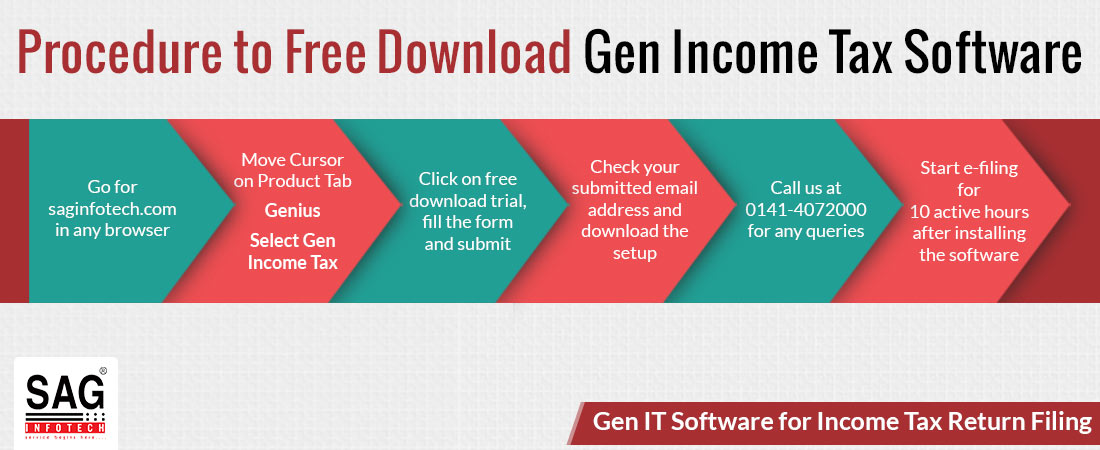

Income Tax Return can be e-filed online with the income tax software provided by the Central Board of Direct Taxes. This is a JSON-based secure software which is available for free. ITR can also be e-filed using paid software of the third party like Gen Income Tax E-filing Software, Karvy; which are experts in taxation & accounting software development. This software is government-certified and is capable of performing all the operations executed by the Government utility such as auto calculating the Income Tax as per the prevailing tax rate, uploading the ITR on the official website of Income Tax department and so on.

Q.2 How an Excess Tax Paid by a Taxpayer is Refunded?

Taxpayer can claim the excess tax as refund by filing an ITR. Income Tax department refunds the excess tax to the taxpayer by crediting the amount in the taxpayer’s bank account via ECS transfer

Q.3 What are the Advantages of Filing an ITR?

Filing of return is a statutory obligation which should be duly executed as it not only keeps in good books of government but also makes you a contributor in the national development. Besides, an income-tax return act as evidence of your creditworthiness before banks and other financial institutions and so facilitates you with easy availing of loans. It also helps you carry forward the losses and claim the tax return when an excess tax has been paid.

Q.4 What are the Steps to Electronically File an Income Tax Return?

An Income Tax Return can be filed electronically on the e-filing portal developed by Income-tax Department for the easy & glitch-free e-filing of ITRs. The taxpayers can e-file an ITR by logging www.incometaxindiaefiling.gov.in. Besides, third-party software like Gen IT software for filing of ITR you can also use.

Steps to e-file an ITR

- Log on to the portal (www.incometaxindiaefiling.gov.in).

- Download the relevant ITR form.

- Enter details from Form 16.

- Compute all appropriate tax details such as tax payable, pay tax etc.

- Confirm the furnished details and submit the return.

- Digital sign the file.

- Receive confirmation from ITR verification

- E-verify your Return through Demat account number, Bank account number, etc.

Q.5 Do We Need to Attach any Documents with the Income Tax Return?

No, a taxpayer need not attach any documents such as TDS certificates, investment proof, etc with the Income Tax Return whether e-filed or filed manually. However, such documents should be kept safely by the taxpayer, so that it can be presented readily before the tax authorities whenever needed under circumstances of inquiry, assessment, etc.

At the same time, it should be noted that the taxpayers who needs to file an audit report u/s 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW or to give a notice u/s 11(2)(a) shall e-file such audit reports or notice on or before the deadline of filing the ITR.

Q.6 What is e-filing Utility Provided by the Income-tax Department?

A free e-filing utility has been provided by the Income-tax Department. The software is in JSON & excel and facilitates easy and online filling and filing of ITR. The e-filing utility provided by Department is easy, user-friendly and also displays instructions on how to use it. The utility is available for free download on the website – www.incometaxindiaefiling.gov.in

Q.7 Is it Mandatory to File an Income Tax Return?

Yes, filing an ITR is mandatory. Government of India (GOI) has made the e-filing of income tax returns (ITR) mandatory for all the assessees who are earning an annual Income above INR 2.5 Lakhs under the old regime and income above INR 3 Lakhs in new regime.

Read Also: Free Download Demo of Income Tax Return Filing Software

Q.8 What are the Advantages of Income Tax Return Filing?

ITR reflects the taxes paid by an assessee on his annual income in a given FY. In some cases, when the tax paid by the assessee exceeds his actual tax liability then he shall become eligible for tax refunds claims which can be availed only when you are an ITR filer. Many other advantages of filing tax returns are:

- Easy loan approval

- Bolster your creditworthiness for future loans

- Easy availment of Presumptive Taxation Scheme

- Refund of excess taxes paid

- Carry forward of Losses

- Depreciation claim

- Defends from prosecution, interest, penalties & embarrassments.

- Convenient Foreign VISA Stamping

Q.9 How is e-filing Different from E-payment?

E-payment refers to the process of electronic payment of tax like payment through net banking or using banks’s debit/credit card. Whereas e-filing refers to the process of electronically or online furnishing of Income Tax Return. A taxpayer may integrate the two processes and execute his tax-related liabilities easily and rapidly.

Q.10 What are the Advantages of Filing an ITR Electronically?

Advantages of e-filing are: It is less time consuming, cost-effective and effortless. On can file an ITR online

Q.11 Do I Need to File an ITR for a FY in which I have not Generated Any Income?

Yes, you need to file an ITR before the due dates if you have incurred any loss in a financial year and you want to carry forward it to the subsequent year for its adjustment against the income of the subsequent year(s).

Q.12 Can a Return be Revised if I Find any Mistakes Later in the ITR Filed by Me?

A return can be revised and a Revised return can be e- filed u/s 139(5) if an assessee encounters any fault, omission or any incorrect statement in the return already furnished by him.

Note: If the return is filed manually or in paper format initially, then it cannot be revised electronically or in online mode.

Q.13 What is the Time Limit within Which an ITR Can be Revised?

An ITR can be revised within prescribed time limit i.e. before the end of the Assessment Year

before the completion of the assessment; whichever is earlier.

Super helpful post! Cleared up so many doubts I had about ITR filing — especially around deductions and deadlines. Thanks for simplifying it!

I changed by Job in July 2023 and my EPF with the old company was under recognized trust. My last working date in old company was 8th July 2023 and I joined the new organization on 10th July 2023 who were maintaining EPF account with EPFO.

I requested for my PF transfer on March 14, 2024 through Form 13 on online EPFO portal and also sent signed hard copy of Form 13 to them in March 24.

The old company however made the transfer in July 2024 only and they have shown the whole interest earned in FY 23-24 ( including employee , voluntary and employer contribution ) after July 8th as taxable. They are saying that since request for transfer has came late , they have shown the whole interest after 8th July 23 as taxable in Form 16.

Can I claim the interest as non – taxable during ITR filing. What does the income tax rule say about it

Refer the income tax rule.

I wanted to have clarification on following points:-

(i) As per rules, the family pension granted in name of minor children will be credited in account of his guardian. Kindly intimate, in such case, whether the family pension amount will be treated as income of that guardian and income tax to be paid accordingly or it will be treated as income of that minor child.

(ii) under section 57(iia), the Family Pension is taxable after allowing a deduction of 1/3rd of the uncommuted pension received or Rs.15000/-. Kindly intimate, whether this deduction is applicable per month or yearly.

i) In case of minor income is taxable in hands of guardian.

(ii) Under section 57(iia) deduction is applicable yearly.

Hi, I am a salaried person with tax deducted at source by my employer. I fall in 30% tax bracket. I have gifted my wife (who is homemaker, no tax liability) with INR 5,00,000/- which she invested (in her name) in Bank FDs of tenure 15days. After 15 days, the FD matured and INR 833/- was paid as interest. After that, she invested 5,00,833/- (principal + interest) in 5 year National Saving Certificate (NSC) in her name. As per clubbing of income, I am liable to pay tax on 833/- . My query is: does the interest from NSC in name of my wife will also be clubbed with my income? Kindly clarify.

I have salary income of 1.2 lacs and f&o loss of 9500 with f&o turnover of 2 lacs, AM i liable for audit ?

also can i file itr-4 instead of itr-3 declaring 6% profits of turnover even if i am having a loss ?

F&O Business is considered as a normal business so you have file itr -3 and for liable for audit please check condition 44ab because it is a normal business

If your business income is below 2.50 Lakhs and turnover is below 25 Lakhs than there is no need to maintain books of accounts and not liable to audit.

Form 26AS shows TDS as 13067.7 while AIS & pre-filled ITR form shows same TDS as 13069.

Should the return be filed with 13069 or 13067(decimal not allowed) or 13068(rounding off to next digit)?

Kindly respond at the earliest

Please file the Return with TDS of Rs 13068.

I am a salaried person. can I get the standerd deduction of Rs 50000/ in new rigim of income tax filing.

Standard Deduction in case of New Regime is allowed from A.Y. 2024-25

I use to file my ITR U/S 44AD for last 3 years as my business turnover was less then even 1CR but in the last F/Y 22-23 in filed it under 44AA due to some Miscommunication but still My turnover was less then 1CR as no audit or account maintenance was needed

But now Onwards in the year 23-24 and future now again I want to file under section 44AD as my turnover is still less then 1CR and no audit or account is maintained

If you opt out of Section 44AD then you can’t opt for 44AD again for 5 years.

We have sold our old house and I have been reported for SFT in this year’s (i.e. FY 2019-20) Form 24AS. Also, I have made a few payments towards purchasing a new Flat which started in 2018 and will complete in 2021.

Under these circumstances, in which year’s (this year or next year) ITR should I inform about the selling and purchasing?

I have been reported for SFT in this year’s Form 24AS. Can I mention the payment received in next year’s ITR? Will 1 year be allowed by CBDT?